① Medical beauty and skin care businesses such as dermatology and beauty have become the driving force.

② In the China market, L’Oréal is not only affected by shrinking tourism retail demand, but also faces the impact of many national trendy beauty brands.

“Science and Technology Innovation Board Daily”, February 8 (Reporter Yang Ming Intern Reporter Li Jiayi) In the early morning of February 7, L’Oréal Group announced its full-year and fourth-quarter results in 2024.

The financial report shows that L’Oréal Group’s performance in 2024 hit a new high, with sales reaching 43.48 billion euros (approximately RMB 329.19 billion), a year-on-year increase of 5.6%.

However, North Asia, which was once the group’s second largest market for many years, has fallen into the dilemma of slowing growth. In its financial report, L’Oréal Group attributed this to the first negative growth in the China market, which dragged down overall performance growth.

Accelerate the layout of medical beauty + skin care fields

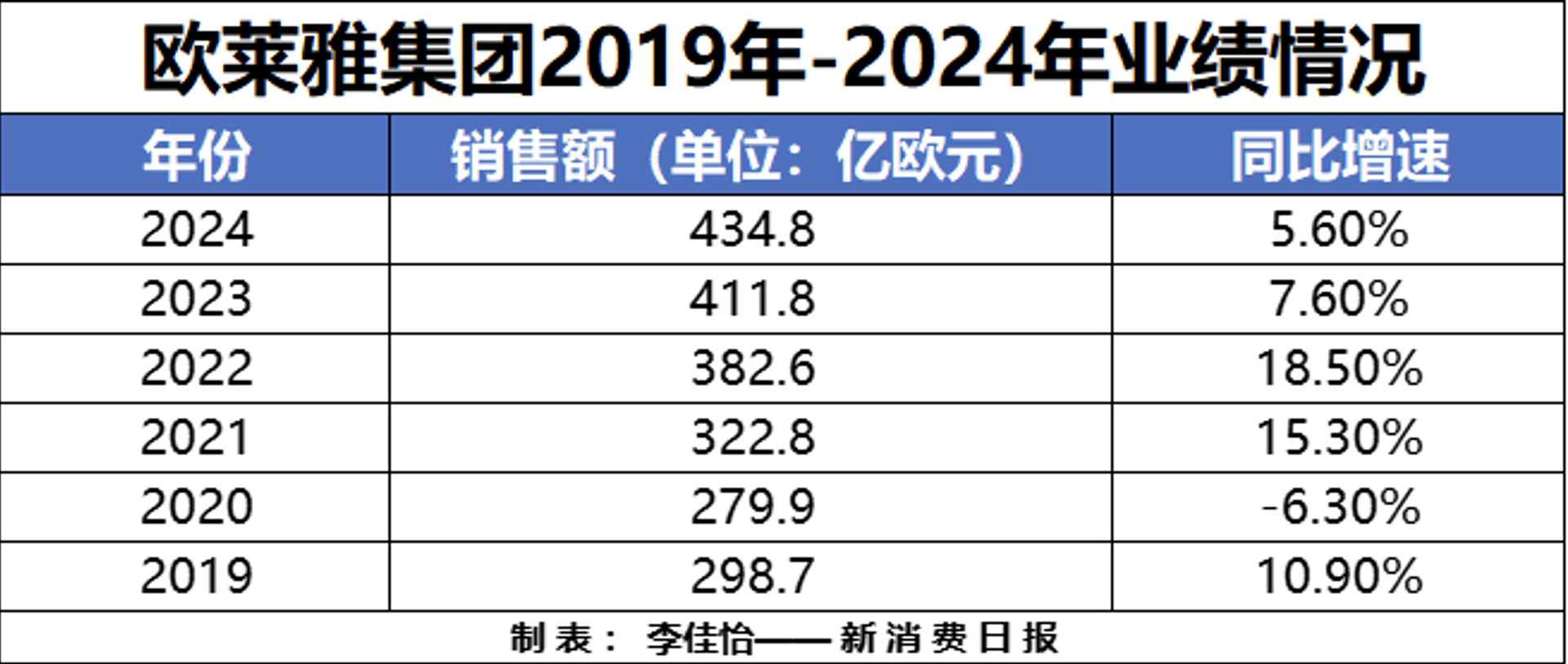

The reporter reviewed L’Oréal Group’s financial data over the past six years and found that although the group’s performance growth rate has slowed down in recent years, it has reversed the decline in performance since 2021 and maintained steady growth in sales and net profit for five consecutive years.

According to the latest financial report, L’Oréal Group once again set a new record for performance, setting sales of 43.48 billion euros (approximately RMB 329.226 billion), a year-on-year increase of 5.6%, and operating profit reached 8.688 billion euros (approximately RMB 65.784 billion yuan), up 6.7% year-on-year.

Financial report data shows that in 2024, L’Oréal Group’s four major business units will achieve year-on-year growth. Among them, the Dermatology and Beauty Department achieved outstanding results, becoming the fastest-growing sector of the four major departments with a year-on-year growth rate of 9.8%, contributing sales of 7.027 billion euros (approximately RMB 53.241 billion) to the group.

With the increase in consumer skin care demand, scientifically oriented and precise skin care have gradually become new pursuits of consumers, and scientific skin care has become another traffic depression for beauty brands to accelerate their deployment. According to data from Euromonitor Euromonitor Information Consulting, it is estimated that by 2030, the market size of China’s dermatology-grade skin care products will be close to 130 billion yuan, accounting for 22.9% of the overall skin care product market. It is the fastest-growing segment in the beauty and skin care industry.

L’Oréal Group also noticed the growth space for scientific skin care and accelerated its layout. At the beginning of 2023, L’Oréal officially renamed the L Oréal Active Cosmetics business unit to L Oréal Dermatological Beauty business unit. In addition, many of L’Oréal’s investments in 2024 are directed directly into the fields of medical beauty and dermatology.

In August 2024, L’Oréal announced the acquisition of a 10% stake in Galderma, which has been deeply involved in the field of dermatology and beauty for more than 40 years; on December 7, L’Oréal Dermatology and Beauty Division announced that it had invested in China’s medical beauty chain “Yanshu Medical Beauty.”

At the end of 2024, L’Oréal announced the acquisition of Gowoonsesang Cosmetics Co., a subsidiary of Swiss retail group Migros. Ltd。According to industry insiders, L’Oréal’s acquisition is based on the company’s Korean skin care brand Dr. G. Terellus, founded in 2003 by dermatologist Gun Young Ahn.

Ma Lan, vice president and general manager of the Dermatology and Beauty Division of L’Oréal (China), also said: “Consumers are increasingly interested and demand for medical beauty. Under the broad market prospects and professional and standardized market demand, the L’Oréal Dermatology and Beauty Division will develop in a more innovative, professional and trustworthy direction.”

Growth in North Asia slows down, and the China market has negative growth for the first time in nearly ten years

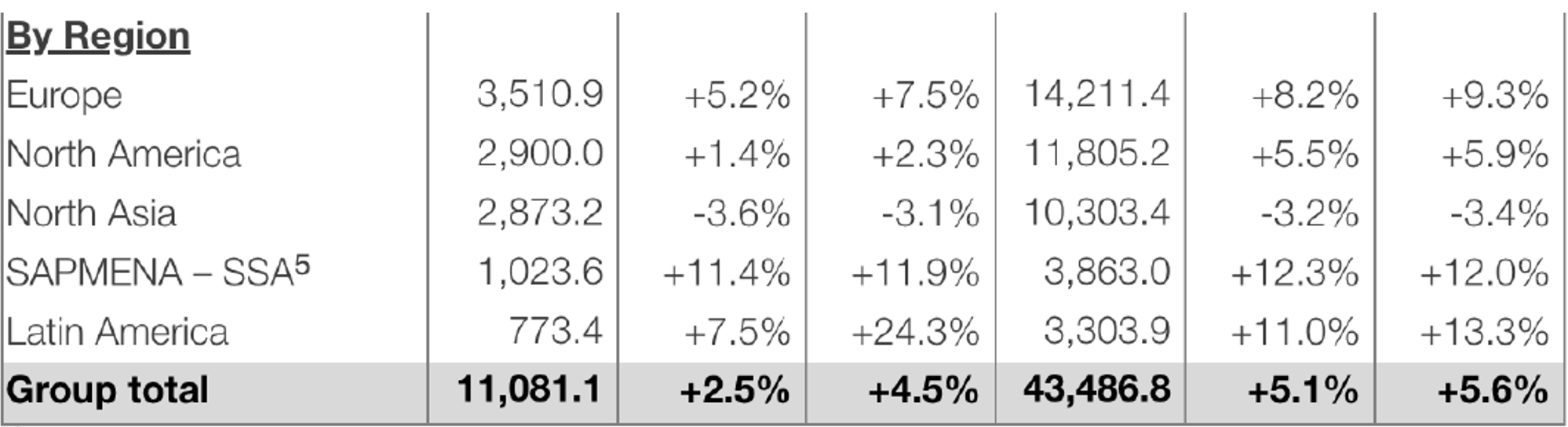

From a regional perspective, in 2024, L’Oréal’s sales in Europe, North America, Latin America and emerging markets SAPMENA-SSA (South Asia-Pacific, Middle East, North Africa, and Sub-Saharan Africa) achieved growth, with year-on-year increases of 8.2%, 5.5%, 11.0%, and 12.3%.

It is worth noting that North Asia, including China, has become the only region among the five major regional markets to experience negative growth, with sales of approximately 10.303 billion euros (approximately RMB 78.061 billion), a year-on-year decrease of 3.2%.

In this regard, L’Oréal Group explained in its financial report that the slowdown in growth in North Asia was mainly due to negative growth in the beauty market in the mainland of China, ushering in a rare single-digit decline, which was closely related to the weak tourism retail.

At present, 2024 is the only decline year for L’Oréal Group in the China market in the past 13 years. The root cause is that in addition to the official statement that it is facing the pressure of shrinking sales in the tourism retail channel, the strong rise of China’s domestic beauty brands in recent years is also an important reason why L’Oréal Group has suffered from Waterloo in the Chinese market.

In the China market, especially in the e-commerce field, the market share of domestic brands is gradually expanding. During the Double 11 activity cycle,

The domestic beauty brand “Peléal” has overtaken many foreign brands and become the sales champion on many platforms such as Tmall. L’Oréal Group’s brand “L’Oréal Paris”, which often ranks first, has to face the dilemma of declining rankings in the Top 5 lists of Tmall (second) and Jingdong (second) and Douyin (third).

However, L’Oréal Group is still optimistic about the China market. CEO Nicolas Hieronimus pointed out in an interview that although the era of rapid development in the China market with annual growth of 30% is over, growth of 4% to 5% can still be regarded as a positive expectation.

At the same time, Nicolas Hieronimus also stressed that although sales data in early 2025 and during the Spring Festival in China indicate that the market is stabilizing, the company does not believe that the China market will see a significant recovery this year.