Wen| Watch the trend and new consumption

Data released by the National Bureau of Statistics show that from January to December 2024, the total retail sales of gold, silver and jewelry above designated size was 330 billion yuan.

The Spring Festival has always been the traditional peak season for gold consumption, and adding gold during the New Year has become the first choice for many consumers. According to data from the China Gold Association, during the Spring Festival of 2025, national gold consumption increased by 13% year-on-year.

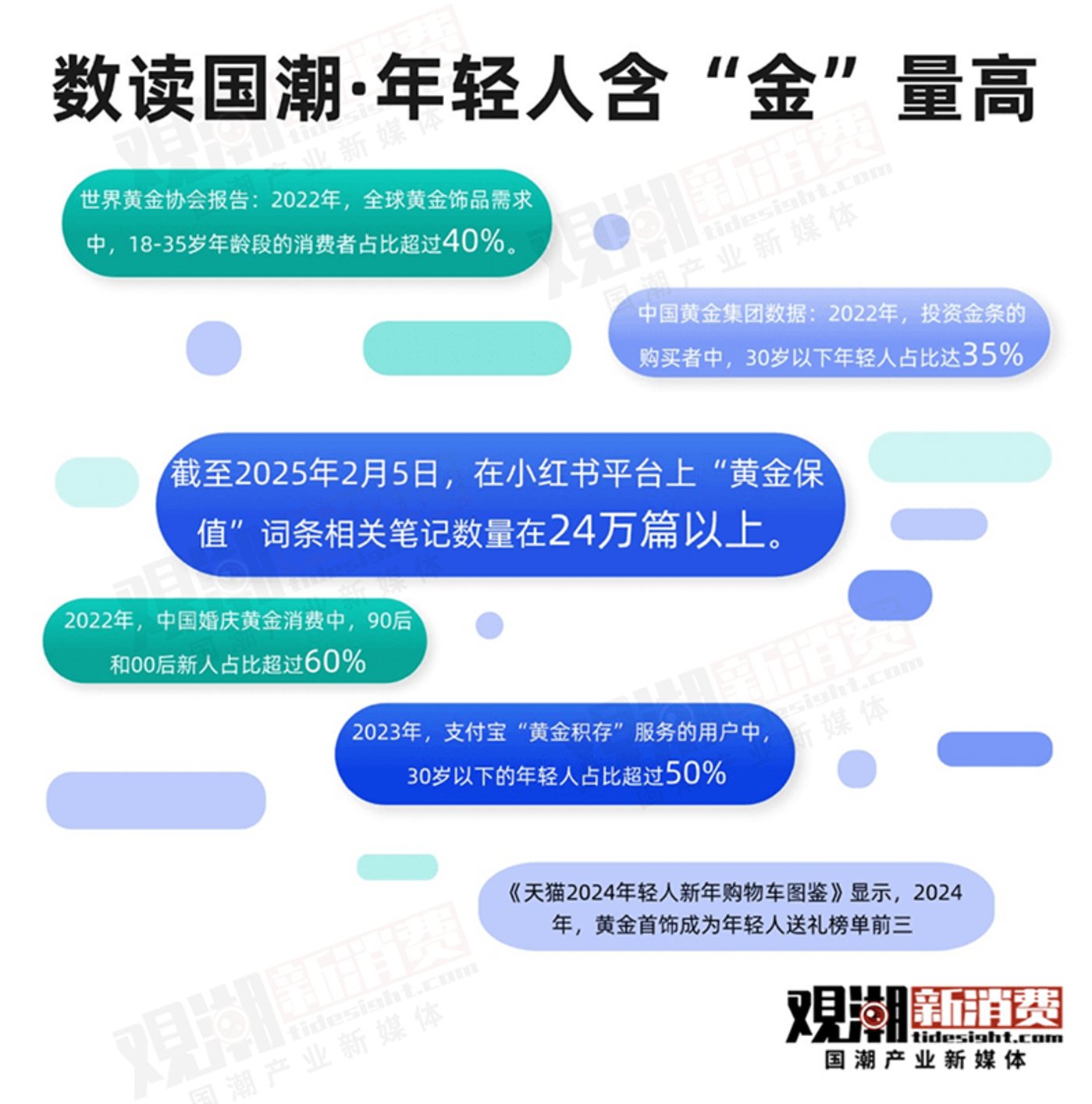

This year’s young people have also used actions to subvert the stereotype that they don’t know the fragrance of gold when they are young, and have become the main force in gold consumption! It is reported that among the people buying gold in Tmall Supermarket, the two major groups born in the 1995s and 2000s account for more than half.

When young people fall in love with buying gold, how crazy can it be?

12 years ago, China’s aunt’s grab for gold triggered global heated debate. ldquo; As much as the discussion about aunt grabbing gold back then, the love for gold now is as deep as it is!& rdquo;

Understanding aunt and becoming aunt is the common choice of this generation of young people.

On February 5, the listing prices of gold ornaments from retail brands such as Chow Tai Fook, Lao Fengxiang, and Lao Miao Gold generally exceeded 855 yuan/gram. The latest closing price of spot gold AU9999 on the Shanghai Gold Exchange was 667.75 yuan/gram. The price of gold remains high, and the rush to buy gold remains unabated.

Those who win young people win the world! In this context of consumption, how to seize the hearts of young people has become the key to breaking through and achieving sustainable development in many industries.

Trend New Consumption (ID: tidesight) This article will break down in detail. How can gold jewelry brands capture a new generation of young consumers and withstand this explosive growth in gold consumption demand that is awakened?

It is not as good as filling up emotional values

When it comes to emotional value, I have to mention Jellycat, which will become popular in 2024. The shop assistants use a play-house performance to provide consumers with unique packaged services. The emotional value that a small plush toy can provide may far exceed the product itself.

On the eve of the Spring Festival this year, the author selected a transfer bead at Chao Hongji to give it as a gift. The counter sister informed that free rope weaving services can be provided when buying transshipment beads. There are a variety of rope weaving styles for customers to choose from, and even said that they can weave any rope style they can find online.

Source of various woven ropes for Chao Hongji: Please enter the picture on Chao Hongji’s official website

It is understood that all major gold jewelry brands have now launched the free rope weaving service, and the competition among counters is also very fierce. This is mainly due to the fact that if young consumers buy satisfactory gold jewelry and rope matching, they often publish it on social media such as Xiaohongshu, and will bring new customers after being watched.

In the early days, cabinet sisters taught themselves to weave ropes by following online tutorials. Nowadays, weaving ropes has become a crucial skill in the training of gold jewelry companies. During the company’s training, it will also design corresponding combinations for different products, incorporating some fashion and popular elements and cutting-edge design concepts. For example, in the Year of the Snake in 2025, cyan and white will become the main colors.

The author also randomly asked the counters of several other gold jewelry brands. In addition to the basic rope matching, some cabinet sisters can also give more targeted and reasonable suggestions based on the wearer’s zodiac, birthday, personality, preferences and other information. The overall shopping experience is very pleasant, and I feel that the whole person will be good after wearing it. Full of luck, full of emotional value throughout the process.

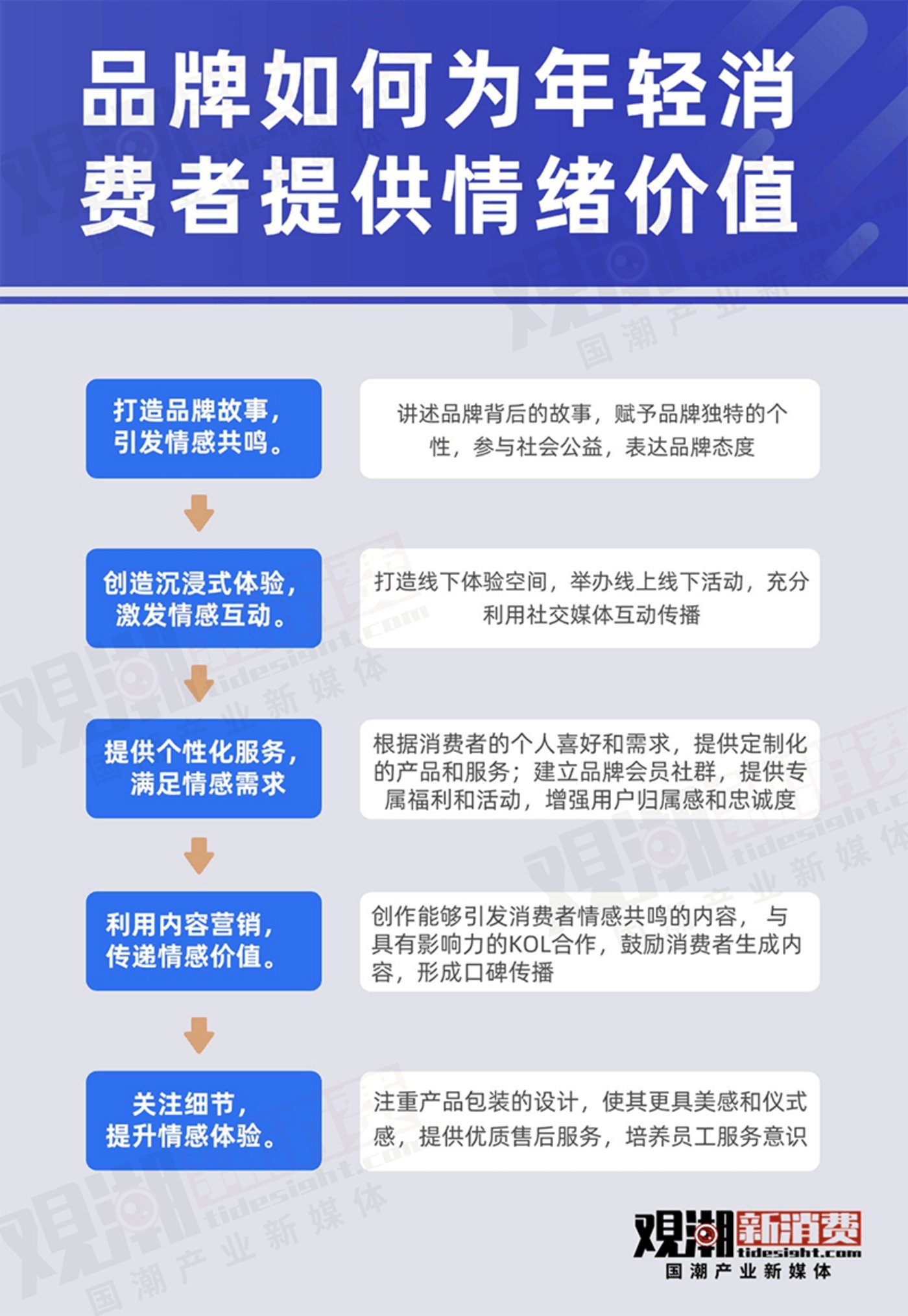

Young consumers are paying more and more attention to emotional value, and consumer brands are also meeting their emotional needs in a variety of ways.

In addition to gold consumption, new consumer brands such as Bubble Mart and Yuanqi Forest, and new tea drinks brands such as Xi Tea and Bawang Tea Ji have all grown rapidly based on meeting the new consumer needs of this generation of young people.

Young people have a high amount of gold,Reshaping the gold market pattern

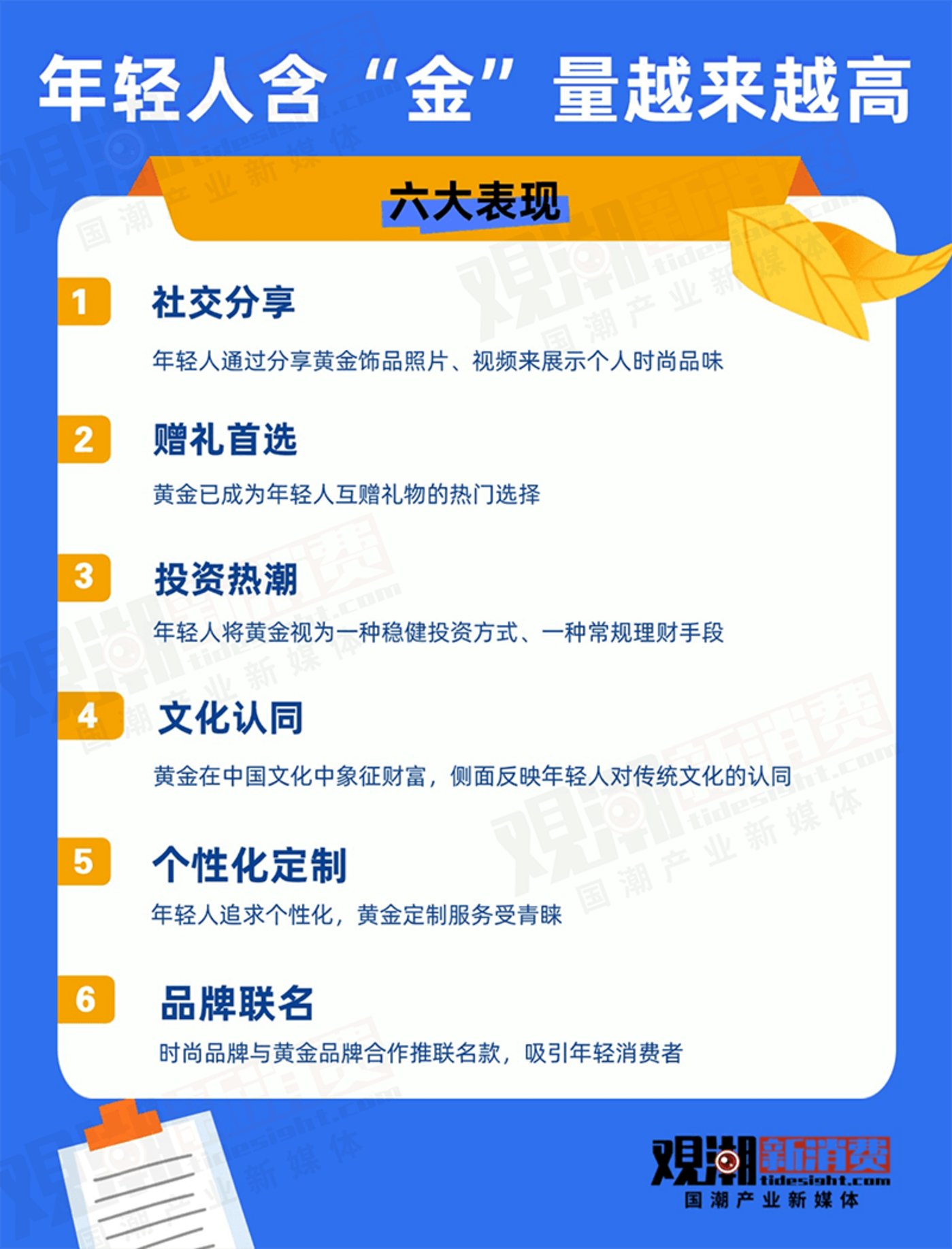

From consumer behavior, investment and financial management to fashion customization and cultural identity, young people’s enthusiasm for gold is accelerating the reshaping of the gold market.

Mothers buy gold and love to buy small gourds, peace buckles, Ruyi and various flower-shaped ornaments. Each style is full of beautiful connotations. Young people buy gold and love to buy small golden beans, national trends, ancient methods and IP co-branded jewelry, focusing on doing whatever they want.

According to the “China Jewelry Market Development Report (2019-2024)” released by the China Jewelry and Jade Jewelry Industry Association, young consumers are no longer blindly pursuing big and heavy products, but are more willing to pay for small but beautiful products. Major brands followed the trend and launched small gold ornaments such as Xiaojinzhu and Xiaojindou.

“Xiaoke Heavy Gold Jewelry has become one of the first choice gold products for young people with limited budgets due to the lowering of purchase barriers. Collecting small golden beans has also become a new financial management method for contemporary young people. On Xiaohongshu, there is a very high topic discussion. On the one hand, it can preserve and increase value when the price of gold rises; on the other hand, the process of accumulation gives young consumers a sense of pleasure and satisfaction.

Young people have unique preferences in the choice of gold jewelry. They are no longer satisfied with traditional gold styles, but are more pursuing personalized, fashionable design and products with cultural implications.

“The rise of national trends and the growing cultural confidence of the younger generation have made ancient gold jewelry that combines elements of China traditional culture popular among young people who pursue quality and culture. Ancient gold not only inherits the skills of making gold and silver utensils in ancient Chinese court, but also innovatively combines modern design concepts and precision processing technology.

The consumption of ancient gold jewelry in 2023 will be 249.39 tons, a year-on-year increase of 37.29% from 2022, accounting for 35.30% of the annual consumption of gold jewelry. The total retail revenue will be 161.867 billion yuan, a year-on-year increase of 66.38%.

In addition, some popular IP co-branded gold jewelry that combines traditional cultural elements and modern fashion elements are also popular among young people.

At the end of 2024, Zhou Dasheng released new IP cooperation projects such as the national treasure golden brocade, the extraordinary national tide safe Mount Tai, the master art jewelry da Vinci, and the master’s joint zodiac snake.

It is reported that one of Zhou Shengsheng’s new strengths for young consumer groups is to launch a joint series in cooperation with many IP sites that young people like, such as Bubble Mart, Sanrio, Harry Potter, and One Piece.

Mothers bought gold, and global gold prices rebounded against the trend; young people bought gold, which made China’s shellfish market popular.

Shuibei Market is the largest gold jewelry manufacturing, processing center and trading distribution center in China, with tens of thousands of gold jewelry companies concentrated. With the rise of Short Video platforms, a large number of overseas purchasing of shellfish have emerged, and platforms such as Douyin and Xiaohongshu have a large number of recommended content about shellfish gold, making shellfish gold widely known and increasing sales scale.

Looking forward to the development trend of the industry, Cai Zhonghua, vice president of Chaohongji Group and general manager of Chaohongji Jewelry, once used three keywords: beauty-price ratio, heart-to-price ratio, and cost-effective ratio to summarize the important considerations for young consumers to choose gold jewelry.

For gold jewelry brands, how to capture the younger generation of consumers? How to innovate in design? How to respond quickly to the market? How to meet individual needs? Solving these strategic issues requires the support of a strong supply chain system with high flexibility, efficient collaboration and rapid response capabilities.

Building a strong supply chain system not only requires a large amount of capital investment for technology research and development, equipment renewal and talent training, but also requires long-term experience accumulation and resource integration. This is also the core of well-known brands ‘ability to grow against the trend and cross the cycle.

Gold + National Trend: Creating China’s own luxury jewelry

Waiting in line for five or six hours to buy gold? Moreover, he bought a piece of gold jewelry that cost tens of thousands or even hundreds of thousands. This is the first day of SKP’s Spring Festival event in January this year, and the queue was held at SKP’s Laopu Gold Stores in Beijing, Xi’an, Chengdu and Wuchang.

Laopu Gold was established in March 2009 and is known as the Hermes of the gold world. Its success is mainly attributed to its combination of innovative design and thousand-year craftsmanship.

As the first brand to promote the concept of ancient gold, Laopu Gold relies on the three major processes of ancient casting, handmade fine gold, and handmade gold repairing, and uses various techniques such as tyre casting, filigree, inlay, chiseling, and gold repairing (among which filigree, inlaid gold, high-temperature enamel and other skills have been included in the National Intangible Cultural Heritage List), and has become a China gold luxury brand in just 16 years.

Please enter the picture description for some products of Laopu Gold

About 40% of Laopu Gold’s products have a unit price ranging from 10,000 yuan to 250,000 yuan. Jewelry such as rose windows, cross diamond pestle, and portable Buddha are very popular for their classic designs and superb craftsmanship.

Laopu Gold’s financial report showed that operating income in the first half of 2024 was 3.52 billion yuan, a year-on-year increase of 148.34%, and net profit increased by 199% to 588 million yuan; its share price also rose from HK$70 on the first day of listing to HK$396 (closing price on February 5), with a market value of HK$66.7 billion. As of the end of 2024, Laopu Gold has a total of 38 directly operated stores.

In luxury consumption, consumers often have a herd mentality and express their identity by purchasing specific brands and elements. Fashion trends are easy to spread in communities, manifested in a strong herd effect.

Take Van Cleef and Arpels as an example. In 2010, Van Cleef and Arpels fully entered the China market in the form of direct sales. Jewelry with lucky connotations such as four-leaf clovers became popular. The overall retail sales in mainland China increased rapidly from 2.1 billion yuan in 2018 to 6.9 billion yuan in 2021, a 2.3-fold increase in three years.

In recent years, it has become an indisputable fact that luxury goods have no longer been sold in China. On January 16, Richemont Group, the parent company of Cartier and Van Cleef and Arpels, released data for the third quarter of fiscal year 2025. Its sales in China fell for three consecutive quarters. The Asia-Pacific market where China is located is the only region with negative growth in Richemont Group’s sales.

On January 21, Bain & Company released the “2024 China Luxury Market Report”, showing that sales in the personal luxury goods market in mainland China are expected to fall by 18%-20% in 2024. Bruno Lannes, senior global partner at Bain & Company, said that the market cold snap has affected all luxury goods categories, with jewelry and watches performing the worst, mainly due to consumer preferences shifting to other value-preserving assets and experiential products.

Amid the sluggish overall market performance of luxury goods, Laopu gold has emerged suddenly. In addition to the unique attributes of the gold category, it is also because local gold jewelry brands can quickly and accurately seize the opportunity period of consumption change for the younger generation.

Young consumers born in the 1990s and 2000s grew up in an era when China’s comprehensive national strength was rapidly improving, and their sense of identity and pride in local culture was unprecedentedly high. They no longer blindly pursue Western trends, but turn their attention to the long-standing traditional Chinese culture.

For the younger generation, buying luxury goods is not as fulfilling as buying a luxury brand belonging to China.

Advance can attack, retreat, and defend,Young people pursue pragmatism in the new era”

During various festivals, girls on the Internet often complain about the aesthetic gifts given by straight men by boys and give them a luxury bag. The style and color they choose are indescribable, and the second-hand market is basically discounted by half. However, during the Spring Festival of 2025, the real-life version of the gold miners ‘gift that became popular on the Internet was almost delivered to the hearts of girls, with a negative review rate of 0.

If you are not sure about the style when buying gold jewelry, you must be right to give gold bars. If you don’t like it, it doesn’t matter. You can find a gold shop to make whatever style you want. Some netizens even joked that buying a diamond ring to propose may not necessarily agree, but buying a gold bar to propose may definitely agree.

According to data from China Gold Association, in the first half of 2024, national gold consumption was 523.753 tons, a year-on-year decrease of 5.61%, including 270.021 tons of gold jewelry, a year-on-year decrease of 26.68%, while 213.635 tons of gold bars and coins, a year-on-year increase of 46.02%. This data clearly shows that in the gold market, investment demand for gold bars and coins is showing strong growth.

Against the backdrop of the current unstable global economic environment, gold, as a safe-haven asset, has attracted great attention from young people to its investment attributes. Faced with large fluctuations in the stock market, uncertainty in the real estate market and potential inflationary pressure, gold has become an important choice for young people in asset allocation due to its relatively stable value.

Many young people use buying gold bars and coins as a long-term investment strategy, hoping to use gold to resist economic risks and achieve steady asset growth. For example, some young people who have just entered the workplace will regularly spend part of their savings to buy gold bars or gold coins to lay the foundation for their future wealth accumulation.

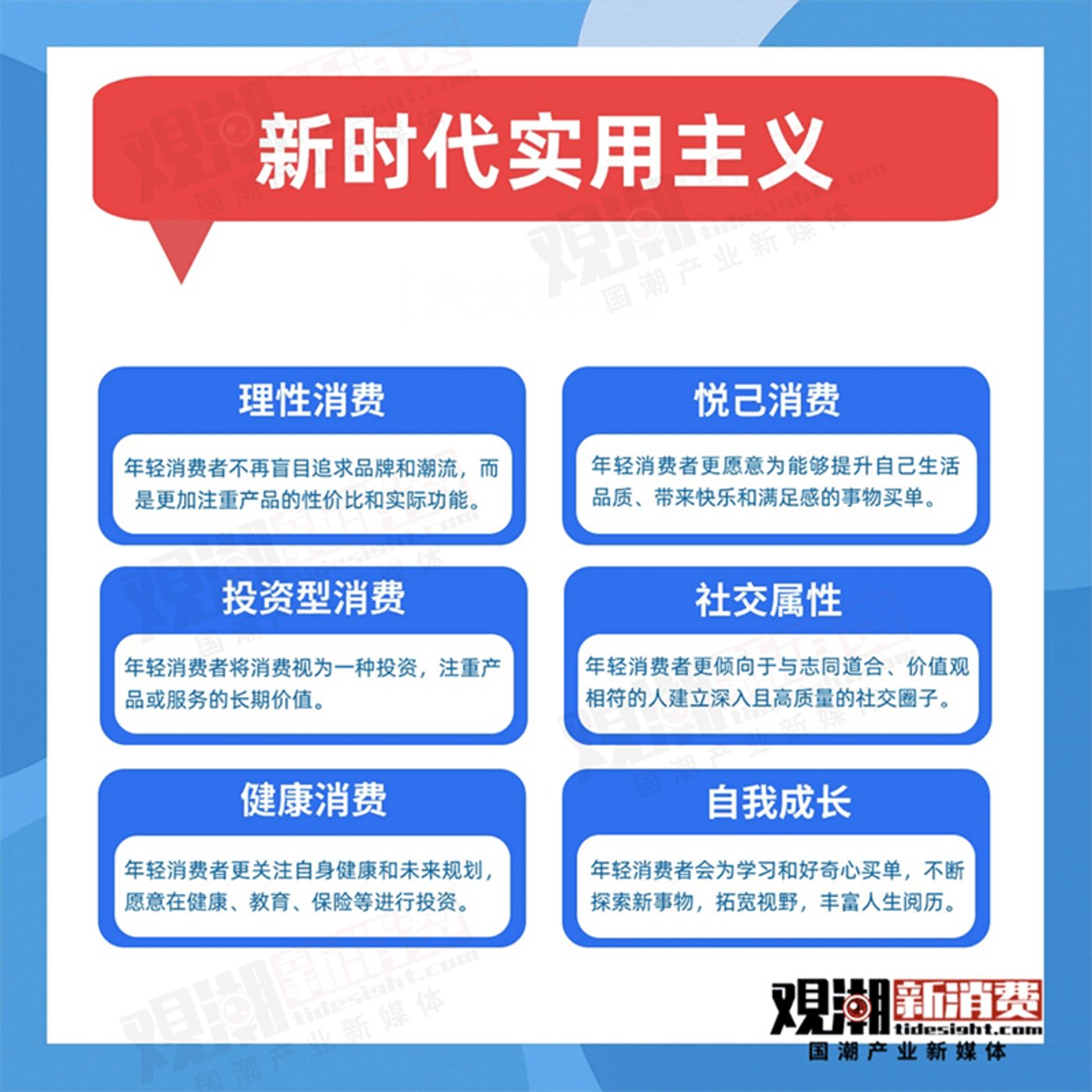

“Stereotypes such as moonlight family, squandering, and hedonism that exist in the new generation of young people are gradually changing. The new generation of consumers has its own consumption opinions.

Enterprises must not take it for granted that the new generation of consumers are just pursuing appearance. Just telling a story or selling a package can attract them. In fact, they want more. Understanding and satisfying the new generation of consumers ‘new-era pragmatism is the future of enterprises. Compulsory course.

These (as shown in the picture above) are the just-needed consumer needs for the new generation of young people, not just for food and clothing.

As the main force of consumption, young people in the future have unique consumption concepts and behavioral patterns. They pursue personalization, focus on experience, are keen on online social interactions, and are full of curiosity and desire to explore emerging things. Whoever can accurately grasp these characteristics of young people and develop products and services that meet their needs will be able to seize the opportunity and win the right to speak in the fierce market competition.