Decode the “life and death situation” of the eight major brands, the “temperature difference war” and the high-end trap in the regional market.

Shiseido’s profits are “free fall” by 73%: strategic failure in China and global brand fragmentation are in danger

Photo source: Visual China

Blue Whale News, February 11 (Reporter Wang Hanyi)On February 10, Shiseido Group released its 2024 performance report. Financial report data showed that its net sales increased slightly by 1.8% to 990.6 billion yen (approximately RMB 47.639 billion), while operating profit plummeted 73% to 7.6 billion yen (approximately RMB 365 million), setting a freezing point in nearly five years. This manifestation of increasing income but not increasing profits exposes multiple structural contradictions.

It can be said that behind this set of data is a crisis co-directed by the pseudo-recovery of Shiseido’s China market and the chronic blood loss of the global supply chain.

The downturn in tourism retail channels and rising costs are squeezed from both ends

Through the key figure of 73%, where did the root cause of the collapse in profits come from?

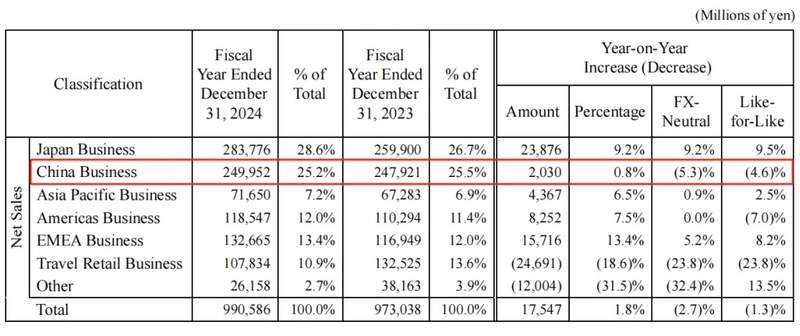

From a regional perspective, in 2024, the China market will still be the overseas bridgehead for Shiseido Group’s global business expansion, accounting for 25.2% of Shiseido Group’s annual sales.

Photo source: Intercepted from Shiseido’s financial report

Although sales in China increased slightly by 0.8% to 249.95 billion yen (approximately RMB 12.022 billion), after deducting exchange rate fluctuations, business divestitures and acquisition adjustments, the actual decline reached 5%. This means that Shiseido’s China market has increased slightly on the surface, but is actually under pressure.

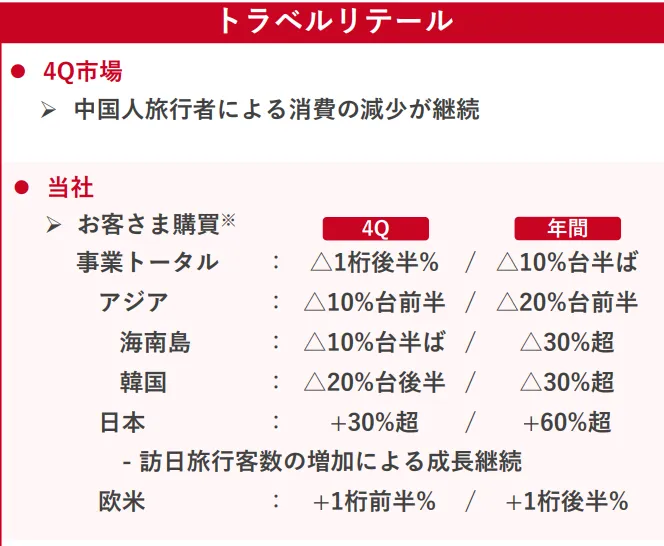

From the perspective of income channels, the avalanche collapse of tourism retail cannot be ignored. According to data disclosed in the financial report, Shiseido Group’s sales in Hainan duty-free channels shrank by 30%. Coupled with the weakness of the South Korean market, the overall tourism retail business fell 18.6% to 107.8 billion yen (approximately RMB 5.2 billion), becoming the biggest driver of shrinking profits.

Photo source: Intercepted from Shiseido’s financial report

In fact, the overall decline in tourism retail in 2024 will have an adverse impact on foreign cosmetics companies. But compared with its peers, Estee Lauder’s tourism retail sales fell only 9% during the same period. This shows that Shiseido’s business model that relies too much on duty-free purchasing is not resilient enough, especially after Hainan cracked down on duty-free purchasing, which suffered fatal injuries from the iron curtain of policies.

In addition, continuous cost expenditures and strategic investment have also squeezed profits. Recently, Shiseido Group’s official website issued a price adjustment notice stating that starting from April 17, 2025, due to rising raw material costs, Shiseido will adjust the prices of some products.

The notice shows that Shiseido’s price adjustment products include a total of 38 products in skin care, makeup, beauty tools, men’s and other categories, with most of the increases within 10%. For example, the price of Shiseido Eudermin Essence Lotion has been adjusted from 9680 yen (approximately RMB 456.33) to 9900 yen (approximately RMB 466.71).

According to data from third-party platforms such as Shenniu and Founder, rising raw material costs have forced Shiseido to increase the average price of its products by 2%-10% within two years. However, consumers are more sensitive to price increases than expected. Shiseido Tmall flagship store repurchase rate fell by 5.2%.

According to a report by Morgan Stanley, Shiseido’s strategic contraction is costly: the one-time cost of shutting down the U.S. R & D center and abolishing 15% of its European team amounted to 21 billion yen, which was criticized by analysts as having not healed the bleeding.

The Darwinian battlefield of the brand matrix”

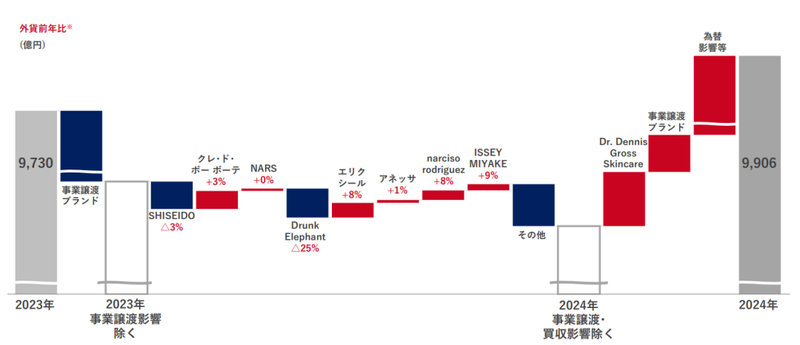

In 2024, the annual sales of Shiseido Group’s eponymous brand, Shiseido Group, will drop by 3% year-on-year, and the sales of the Drunken Elephant brand will drop by 25%. The performance of the NARS brand will be flat, the Anressa brand will increase by 1%, and the Key to Skin brand will increase by 3%. Sales of the Erissa brand will increase by 8%, Narciso Rodriguez perfume will increase by 8%, and Issey Miyake perfume will increase by 9%.

Photo source: Intercepted from Shiseido’s financial report

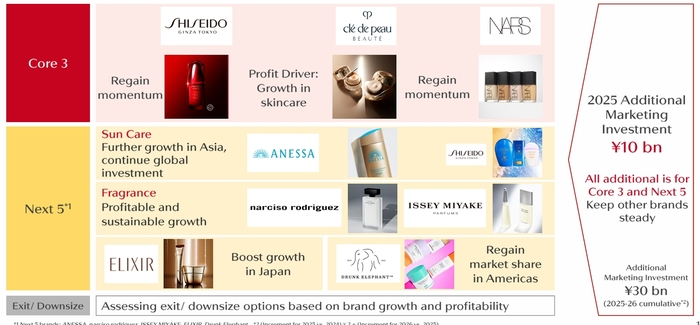

In November 2024, Shiseido Group launched a 2025-2026 action plan aimed at restoring profitability. In this financial report, this plan was highlighted.

The plan regards strengthening the brand base as one of its top priorities, focusing on core brands, maximizing gross profits, and strengthening collaborative operation systems between brands and regions to enhance brand value.

Shiseido plans to allocate 30 billion yen (approximately 1.4 billion yuan) in additional marketing expenses to eight core brands such as SHISEIDO, and divide them into two tiers: Core 3 and Next 5.

“The Core 3 brand includes SHISEIDO, Key to Skin and NARS, of which SHISEIDO and NARS are tasked with regaining growth momentum.& ldquo;Next 5 brands include Anjesa, Narciso Rodriguez Perfume, Issey Miyake Perfume, Iris and Drunken Elephant.

Kentaro Fujiwara, President and CEO of Shiseido Group, said late last year that the purpose of this mission is to enhance the status of core brands, create new loyal users, and be more efficient in market segments.

Photo source: Intercepted from Shiseido’s financial report

To put it bluntly, the survival guide of Shiseido’s eight core brands is like a cruel survival experiment of the fittest.

In the evolutionist camp, Key to Skin uses skin cell-level anti-aging technology as a spear to break through the Double Eleven. Sales surged by 28% year-on-year, and the customer unit price exceeded 1800 yuan, becoming a beacon for the group’s high-end transformation.

The main brand SHISEIDO (Shiseido) is facing the dilemma of degeneration. The aftershocks of public opinion on nuclear sewage have not subsided. The Baidu Index shows that brand searches have dropped by 41% year-on-year, and the rate of withdrawals from department stores is as high as 23%.

In such situations, Zhang Yaodong, former vice president of L’Oréal China, once pointed out that high-end brands need independent narrative space, but the group’s transfusion rescue of the main brand has actually dragged down the overall strategic rhythm.

Some beauty industry analysts also said in an interview with Blue Whale News that although Shiseido’s high-end strategy has been effective, the aging problem of the main brand has not been solved. Consumers ‘perception of Shiseido still remains at the basic skin care line, and high-end brands need to be more independent. Brand narrative to avoid diluting value.

Survival game under regional temperature differences

In 2024, Japan’s domestic market achieved a sales growth of 9.2%, with net sales for the year of 283.776 billion yen (approximately RMB 13.649 billion).

In this regard, Shiseido Group stated that it will continue to promote profitability improvements by implementing the business reform plan Mili Shif NIPPON 2025. At the same time, with the increase in the number of foreign tourists visiting Japan, Japan’s tourism retail business has achieved a steady recovery, with a year-on-year growth of more than 60%.

In other words, selection and concentration strategies based on a solid brand foundation have been successful, achieving growth in key areas.

However, it is worth noting that although the high temperatures in the local market are welcome, regional temperature differences cannot be ignored.

Behind the 9.2% sales growth in the Japanese domestic market is the support of the 15% price increase of Red Kidney Liquid Foundation, which reflects the high tolerance of local consumers for brand premiums, but this model has encountered acclimatization in the China market.

Similarly, in Europe, Shiseido Group has experienced unexpected dividends from the perfume economy. Shiseido acquires Dr. The first co-branded fragrance after Vranjes exploded on Social networks, driving a 10% growth in the European region. At the same time, it exposed the worry of insufficient innovation in the cosmetics category. NARS sales in Europe increased by only 2.3%, far behind Fenty Beauty’s 14%.

Not to mention the 12% share of the American market. The management ‘s strategy of emphasizing Asia-Pacific over America has been repeatedly condemned by shareholders.

Based on the Bain Consulting Global Beauty Report, the China market has evolved from channel dependence to mental reconstruction. If Shiseido wants to stop bleeding in China, it needs to restructure its channels. Online live broadcasts and private domain operations can be increased to reduce reliance on duty-free channels. The recovery of Double 11 in 2024 has proved online potential.

At the same time, some senior beauty industry insiders pointed out to Blue Whale News that in terms of cutting parent brand dependence, we can refer to Estee Lauder’s operation of La Mer as an independent business unit to promote CPB and Drunken Elephant to establish an independent R & D and marketing closed loop to get rid of Shiseido’s parent brand. Negative connection.

In addition, consumer trust can be rebuilt through diversification of origin.& ldquo; Shiseido needs to establish a more flexible supply chain, conduct experiments in de-Japanization of the supply chain, and disperse production risks." rdquo; The industry insider gave examples, for example, transferring part of high-end production capacity to Europe or Southeast Asia to avoid the public opinion impact of nuclear sewage. rdquo; According to Bloomberg data, this move has helped SK-II resume 8% growth in the Southeast Asian market.

Shiseido expects sales to increase 4% to 995 billion yen in 2025 and operating profit to 13.5 billion yen. If a balance cannot be found between high-end modernization and cost control, it is hard to say that its revitalization plan will not be full of challenges.