WEGO! A new think tank in the era of multipolarity helps China companies win the business war at sea

Global power has entered an epic cycle

Wen| Juchao Hou Tian

Electric power competitions outside China are crowded with Silicon Valley technology leaders.

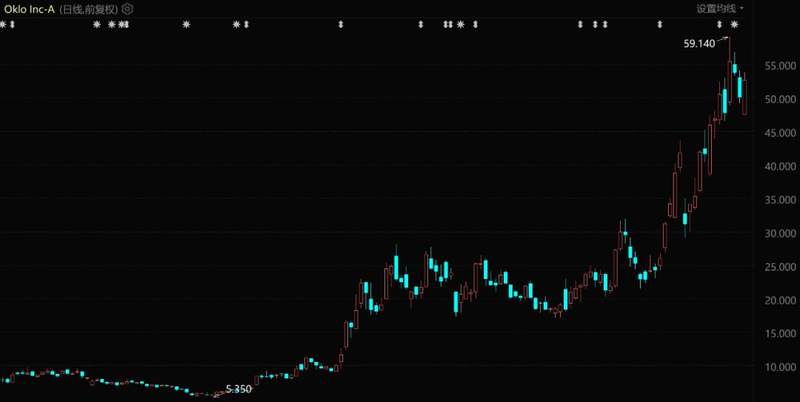

Sam Ultraman is a typical representative of them. He is a co-founder of OpenAI and an investor and chairman of nuclear fission startup OKLO. The company went public on May 11 last year, and its increase in the past five months was nearly 900%. It is one of the listed companies with the largest increases in the U.S. stock market.

Oklo Stock Price Performance (July 2024 to Present)

In addition to Ultraman, there are also top figures in the American technology and investment community such as Bill Gates, Jeff Bezos, Peter Teal, Larry Ellison and Wood.

It is said that a ChatGPT Q & A consumes almost 10 times the power of a traditional Google search. The global wave of artificial intelligence infrastructure construction is in full swing, causing technology giants to increase their investment in power.

Huang Renxun’s speech surprised the outside world even more. He pointed out that Nvidia helps improve computing efficiency and reduce energy consumption, and if computing speeds did not accelerate, we might need 14 planets, 3 galaxies, and 4 suns to fuel all of this. rdquo;

All these discussions only focus on the power supply level, which is the supply side of energy. Subsequent power grids, transmission and distribution, as well as power equipment such as generators and transformers can be added together to form a complete power system. New energy sources such as nuclear energy, wind power, and photovoltaics also require a series of supporting facilities such as uranium fuel, nuclear power equipment, and energy storage.

At present, the power grid infrastructure of European and American countries is dilapidated. Many power grid lines are in disrepair. Basically all transformers in the United States rely on imports. It can be said that all countries in the world except China will have to make up for the debts they owed in the past in terms of electricity investment in the future. The investment required is completely huge.

Driven by the construction of artificial intelligence, a historic power cycle has begun.

This article is an in-depth research article from the Juchao WEGO Research Institute. You are welcome to pay attention to the “WEGO Research Institute” on multiple platforms to understand new global business trends in the era of multipolarity.

01 Tightening Spell

It may not be technology, but energy, that constrains the development of AGI. More than one technology tycoon has expressed such concerns.

Ultraman once judged that artificial intelligence requires energy breakthroughs in the future, because the electricity consumed by artificial intelligence will far exceed people’s expectations. Musk clearly pointed out that the lack of cores is followed by the lack of electricity, and next year (2025) electricity will not be able to meet the needs of all chips.” rdquo;

Every question and answer given by generative artificial intelligence, even the data center, computing power support and the power required by the chip industry behind it are extremely huge. Data shows that ChatGPT currently responds to approximately 200 million requests every day and consumes more than 500,000 kilowatt-hours of electricity, which is equivalent to 17,000 times the electricity consumption of American households.

In the training process, according to calculations by Guosheng Securities, a single training of GPT-3 costs US$1.4 million, and the training costs of some larger LLMs (Big Language Models) range from US$2 million to US$12 million. What many people don’t know is that 60% of this is electricity bills.

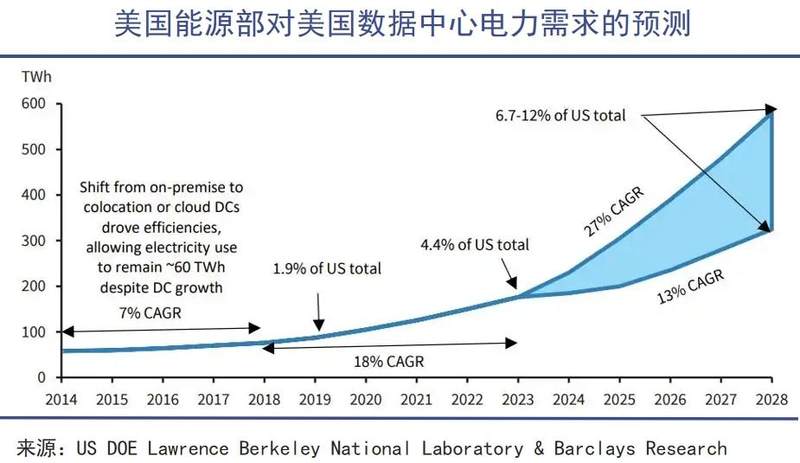

Data centers are also a huge electricity-swallowing behemoth. For example, Amazon’s large data center consumes the electricity of a medium-sized city every year. A report from the U.S. Department of Energy shows that the country’s data center electricity consumption will increase from 58 TWh in 2014 to 176 TWh in 2023, accounting for 4.4% of the country’s electricity consumption. It is expected to surge to 325-580 TWh by 2028, accounting for 6.7%-12% of total electricity consumption in the United States.

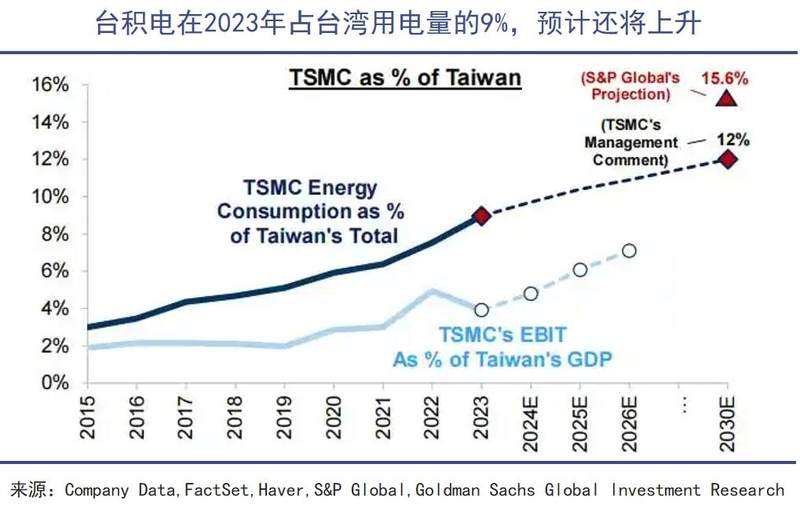

In the core supply chain of the AI industry, chip manufacturing is also a major power consumer. In 2023, TSMC, the chip OEM overlord, will consume 9% of China Taiwan’s electricity, accounting for 16% of its industrial sector demand alone.

Standard & Poor’s predicts that by 2030, TSMC’s electricity consumption will account for 15.6% of Taiwan’s total electricity consumption. Under optimistic circumstances, this company will use 23.7% of Taiwan’s total electricity consumption. A company accounts for more than 20% of an area’s electricity, which is a very rare situation in human commercial history.

At present, general AI is only in the early stages of industry development. It is foreseeable that more super large models like DeepSeek and ChatGPT will emerge around the world in the future. The construction of computing power centers in China and the United States is still growing rapidly. With the large-scale popularization of AI products, it will be difficult to estimate how much power demand will grow in the long term.

At present, global power supply relies too much on traditional fossil energy, which is costly and does not meet the demands of the times for low-carbon transformation. Renewable energy such as photovoltaics and wind power are not stable enough, so nuclear power, which is the most cost-effective, has become a bet target for technology giants.

In particular, SMR (Small Modular Nuclear Reactor) with short construction cycle, low cost, higher safety factor, and stronger address adaptability is regarded by AI companies as the most ideal development direction.

In the United States, investing in SMR can receive government subsidies, which is more cost-effective than investing in large nuclear power plants. Data from the U.S. Department of Energy shows that the power cost of the SMR project is about US$180/MWh, which can be reduced to about US$100/MWh after subsidies, which is lower than that of wind and solar power generation.

Since October last year, Silicon Valley giants have been hoarding nuclear power:

First, Microsoft teamed up with Constellation Energy to spend US$1.6 billion to restart the No. 1 Reactor of the Three Mile Island Nuclear Power Plant. The goal is to start delivering power to Microsoft’s data center in 2028;

Since then, Google has purchased power from seven reactors from nuclear power startup Kairos power in one go, totaling 500WMh (500,000 kWh);

Amazon followed suit with three agreements, investing $500 million, to join hands with Dominion Energy to develop an SMR project, fund Energy Northwest’s four advanced SMRs, and build a data center next to Talen Energy’s nuclear facility in Pennsylvania;

Oracle boss Larry Ellison announced he would design a nuclear power data center that would be powered by three small nuclear reactors and generate more than 1000 megawatts of electricity.

However, despite frequent actions by major technology companies, the output of these planned small nuclear power plants is still a drop in the bucket compared with their total power consumption. To resolve the global power crisis, a global super power investment is still needed.

02 Dammed lake

Faced with the wave of energy scale upgrades, European and American countries and large companies have formulated ambitious new energy development plans, but backward power grids and electrical equipment are becoming huge constraints to this change.

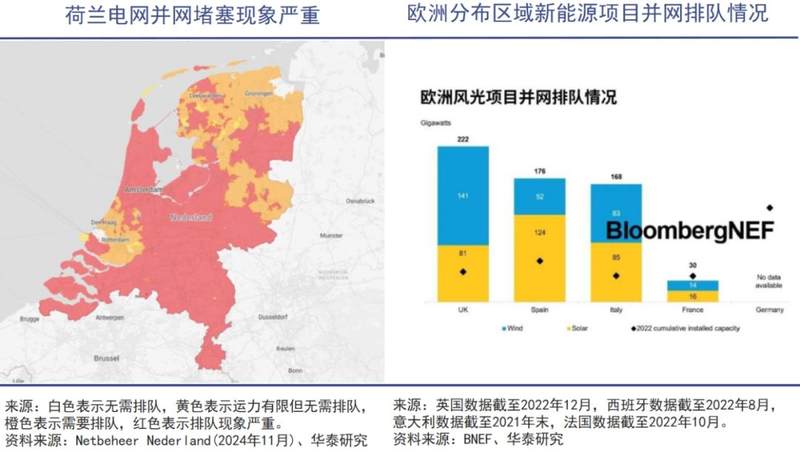

In 2021, the British government promised to achieve 100% clean electricity by 2035, but with huge amounts of money invested, various wind and solar storage projects are in full swing. But the British eventually discovered that the electricity simply could not be connected to the Internet in time.

The old power grid system allows these new energy production capacity to be idle in power plants. Some wind and solar power needs to wait as long as 10 to 15 years before it can be connected to the power grid. National Grid estimates that by 2030, five times as many high-voltage transmission lines will need to be installed as it has been in the past 30 years.

European and American countries also share the same experience as Britain. According to BNEF statistics, as of the end of 2022, the photovoltaic and wind power capacity waiting to be connected to the grid in Britain, France, Italy and Spain is as high as 596GW, and the average waiting time for new energy projects from application to connection to the power grid is as long as 3-7 years.

Most of the high-voltage power grids in Europe were built between 1950 and 1980, and some power grids had a service life of more than 70 years; most of the American power systems and transformers were built in the 1950s and 70s, 70% of which have been in operation for more than 25 years, and 60% of circuit breakers have been in operation for more than 30 years, while the design life of transformers is generally 35-40 years.

It has become an objective fact that many power grids in overseas countries have already reached or are approaching retirement age. If it is not replaced and upgraded in time, it is a high probability that the newly launched Fengguang nuclear power will fall into a useless place.

The transformation of the power grid is urgent. To this end, the U.S. Department of Energy (DOE) has launched the GRIP program, which is expected to invest US$10.5 billion in five years to promote power grid transformation; the European Union has launched the European Power Grid Action and plans to add an additional 584 billion euros by 2030. Investment; National Grid of the United Kingdom announced an investment of 60 billion pounds in the next five fiscal years to renovate network infrastructure, an amount that nearly doubled from the previous five years.

Nowadays, these huge investments have been truly reflected in the performance and stock prices of electrical companies. The electrical giants that once performed slightly mediocre have risen as much as AI star stocks.

Although General Electric (GE) is in its infancy, after the disintegration of its business empire, GE Vernova, which was split, performed eye-catching. Since its independent listing in April last year, its share price has been rising all the way, and so far the increase has exceeded 165%. In 2024, GE Vernova earned net profit of US$1.552 billion, a year-on-year increase of 454.34%.

Siemens Energy, which was born out of Siemens, has seen its share price surge 331% in the past year. Grid updates have made it an AI shadow stock in Europe. Its backlog of orders currently reaches a record 123 billion euros, and even if the new factory in the United States has not yet been completed, production capacity in the next two years has been snapped up. It can be seen that downstream demand is strong.

Established electrical manufacturers are also old trees and new flowers. Hitachi’s share price has risen 67.96% in the past year, while Schneider Electric and ABB have also risen 42.66% and 40.69%.

Just as industrialization and urbanization have driven the power grid, AI has brought power investment into a new era. Scott, CEO of GE Vernova, made it clear: We are now in the initial stage of the (electricity) investment super cycle.” rdquo;

03 inseparable

Elon Musk once asserted in an interview that there would be a shortage of transformers in the United States:

“The parallel development of electric vehicles and AI, both of which require electricity and transformers, I think this is creating a huge demand for power equipment and power generation. rdquo;

A complete power system not only contains an abundant power supply, but also requires a smooth and orderly power grid and supporting transformers, meters, energy storage and intelligent control centers and other units.

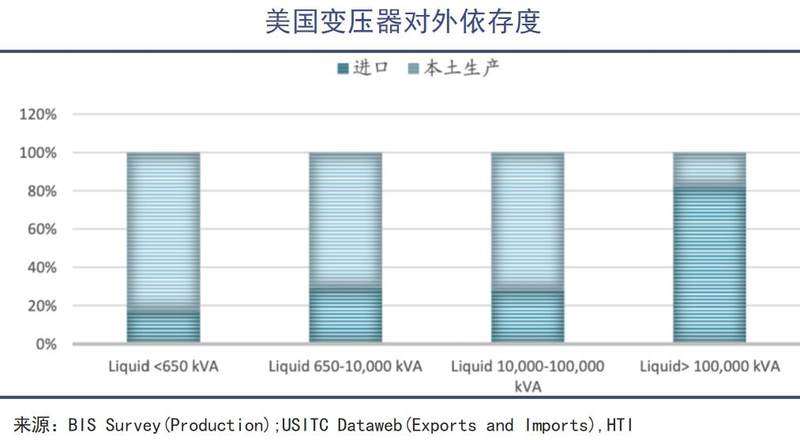

The fact is consistent with Musk’s statement that transformers have become a core component that constrains U.S. power upgrades. Just like lithography machines are to China’s chip industry, due to the lack of key material oriented silicon steel, 80% of power transformers in the United States now rely on imports.

In 1930, American N.P. Goss first discovered oriented silicon steel in the laboratory and applied it. But to this day, this material has seriously dragged down the transformation of the United States ‘power grid and may even affect the historical process of AI.

Grained silicon steel, also known as cold-rolled transformer steel, is an indispensable ferrosilicon alloy used in transformers (iron cores), accounting for one-quarter of the cost of the entire transformer. Grain-oriented silicon steel is mainly concentrated in China, Japan and South Korea, and the United States has limited domestic production capacity.

In the past five years, the total value of transformer imports in the United States has been rising. In 2023, a total of approximately US$5.8 billion were purchased from abroad, an increase of 48.7%. In the first 11 months of 2024, the import value of transformers reached US$7.32 billion, a year-on-year increase of 41.16%, a record high.

Based on the advantages of high transportation efficiency and low loss, UHV has become a common trend in global power grid transformation. The transformer is like a magician who freely adjusts the voltage. Electricity is output from the generator and is boosted to a very high voltage (161kV to 765kV) through a large transformer to achieve efficient long-distance transmission. It is then reduced to 15- 34.5 kV, and then further reduced to 240V through a smaller transformer to meet the needs of corporate and residential users.

Due to the rise in the prices of oriented silicon steel and copper, coupled with the obstruction of shipping, the expansion of several major manufacturers has fallen short of demand growth, and the balance of supply and demand has rapidly reversed. Transformer prices have risen rapidly by 60%-70% between 2020 and 2023, and there are signs of continuing to rise. At present, the U.S. transformer delivery cycle is extended to 50 weeks to 150 weeks, and in extreme cases it can take as long as 5 years.

Although my country is a major producer of transformers, at a time when trade barriers are on the rise, the United States mainly imports from Mexico, South Korea, Brazil, Canada and other countries. Most of its products come from Hitachi, GEVernova, Siemens Energy, Esjebe, Hyosung Heavy Industries (South Korea) and Hyundai Electric.

It should be noted that China only accounts for about 8% of transformers exported to the United States. Therefore, the claim that China is blocking U.S. power equipment does not hold true. Power grid equipment basically follows market competition, which is different from the situation where high-end chips are subject to technology and trade monopoly.

Of course, transformers are only a microcosm of the power upgrade dilemma in Europe and the United States, including smart meters, relays, capacitors, inductors, inverters, generators, etc. Coupled with the intelligent and digital upgrade of the power grid, European and American countries have to do there is still a lot, and all the current pressures are paying for the decisions made to de-industrialize over the past few decades.

03 Written at the end

“Artificial intelligence is both physical and material, and consists of natural resources, fuel, manpower, infrastructure, logistics, history and classification, all of which come at a cost. rdquo;

Sociologist Kate Crawford wrote in “Beyond Technology: Artificial Intelligence in Social Connectivity” that theoretically connects seemingly virtual artificial intelligence with the traditional material world.

Crawford believes that more attention should be paid to the power change behind it, and AI is gradually recognized by more people as a petroleum resource in the new century. But at the same time, the old European and American energy systems are not ready for such historic changes. Over the long history, these monopoly enterprises have not been ahead of market demand.

In the power investment cycle, China, the United States and Europe belong to different narrative lines.

As people’s daily electricity consumption, production electricity, the Internet and artificial intelligence continues to increase, the basic fossil energy power system will eventually lag far behind the growth of actual needs of human society. From a longer historical perspective, the reshaping of the global energy system by the AI explosion may be just the beginning.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.