Behind the financial management of people, brokers make more money in money funds (margin products) than investors.

Monetary fund yields hover low, management fee ratios are high and difficult to reduce, and brokerage managers are “looking ugly”

Blue Whale News, February 14 (Reporter Ao Yulian)Investors earn 0.7%, managers earn 0.9%, and brokers ‘money funds have not been able to align their rates with public offerings, which makes the already meager returns worse.

Market interest rates continue to decline, and the earnings of monetary funds collectively enter the first word. Wind data shows that there are a total of 370 money funds in the market, and the weighted average 7-day annualized income has dropped to 1.20%. Among them, the returns of money funds managed by securities firms are much lower than average. For 49 securities firms, the weighted 7-day average annualized value is only 0.87%.

This is mainly due to the high management fees levied by securities firms.

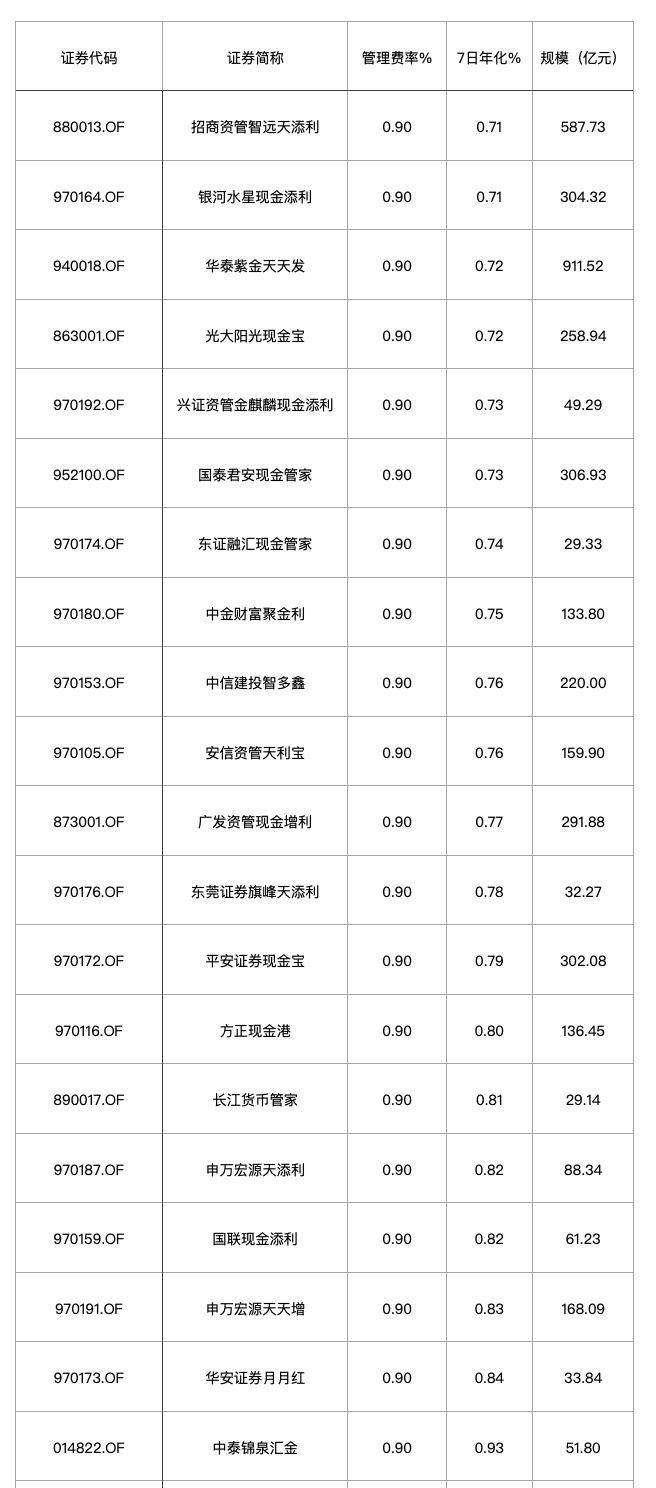

The 7-day annualization of the cargo base is the post-fee income, that is, the income after deducting management fees and custody fees. At present, the management fee rates of 49 money funds managed by securities firms range from 0.9% to 0.2%, of which 20 have management fees at a high level of 0.9%, and the scale of high rates reaches 415.7 billion yuan. Horizontal comparison, the weighted average rate of money funds for securities firms is 0.68%, while that for publicly offered money funds is only 0.25%.

20 high-rate brokerage money funds

In the face of low profits, the erosion of high rates is more obvious and silent.

Nearly half of the money funds of securities firms have reversed returns: the 7-day annualized returns of the goods base of 21 securities firms are already lower than the management fee rate. For example, China Merchants Asset Management Zhiyuantian Tianli and Galaxy Mercury Cash Tianli were annualized at the latest 7 days of 0.71%, while the management fee was both 0.9%. This means that investors earn 0.71% and managers earn 0.9%. Behind the financial management of people, managers earn more than investors.

It is more intuitive to look at the funds in hand. Huatai Zijin Tiantian Fa, the largest brokerage money fund in the market, collected management fees of 284 million yuan in the first half of 2024, earning 360 million yuan for customers. Similarly, China Merchants Asset Management Crystal charged a management fee of 176 million yuan and earned 224 million yuan for customers, which means that the profits of customers and managers are close to 60 percent.

As the revenue from goods is compressed, if the management fee is still at a high level of 0.9%, follow-up institutions may earn more than shareholders.

The predecessor of brokerage money funds was margin products, which mainly carried idle funds in stock accounts of shareholders and used them to invest in fixed-income assets and improve the utilization of funds. In fact, compared with publicly offered money funds, brokerage money funds are mainly the spare cash of shareholders in the station. The stock account is automatically transferred after signing a contract, and usually does not sell it on behalf of other three parties, saving customer maintenance fees.

In 2012, brokerage margin products were launched. Guotai Junan, Huatai and others have all entered the bureau to develop internally-developed products/in-house products, and some of them have cooperated with Internet platforms. For example, Guojin Securities and Tencent have made commission treasures. For a time, idle money management by securities firms has mushroomed.

“Prior to this, the spread between idle money investment and current interest rates was taken by the brokers themselves. In 2012, various securities firms launched margin money funds to distribute profits to shareholders. rdquo; A Tencent person who participated in the design of the commission treasure recalled to reporters that this was a good thing for securities firms to make profits.

In 2018, new regulations on asset management were introduced. Regulation requires securities firms to start public fundraising transformation of large-scale asset management products, and margin products are also on the transformation list. In November 2021, margin financing will be gradually transformed into public funds, and the investment scope of products will be stricter. For example, the corporate bonds invested should have the highest credit rating and cannot be invested in ABS. In addition, information disclosure, liquidity requirements, etc. are all close to public offerings and operate in a more transparent and standardized manner.

In fact, management fees have also changed after joining the public office. For example, Huatai Zijin Tiantianfa would collect performance remuneration before, and the fee after it is transferred to the company is fixed as management fee + custody fee.

Changing from floating to fixed does not mean changing from expensive to cheap. At present, most securities firms charge margin management like this: if the annualized rate on the 7th is higher than twice the demand deposit interest rate, 0.2%-0.3%, otherwise 0.9%. In fact, it is very simple to exceed 2 times the current interest rate. Charging 0.9% all year round is the norm. This high rate is very eye-catching among money funds.

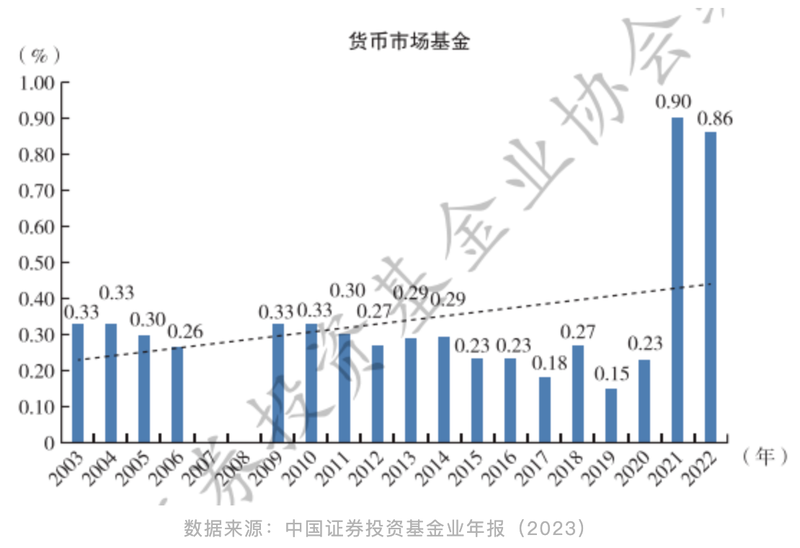

According to the annual report of the China Infrastructure Association, after the brokerage margin products were converted into monetary funds, the average carry-based rate in the entire market rose sharply: the average rate in 2020 was 0.23%, rising to 0.90% in 2021, and 0.86% in 2022.

As for the abnormally high rates of securities firms and money funds, many parties have different opinions.

As for the abnormally high rates of securities firms and money funds, many parties have different opinions.

Some brokerage asset managers said that high rates are reasonable. Broker money funds belong to margin financing. Compared with public offerings, the investment threshold is higher, the investment targets are different, and the pricing standards and positioning are different.

A reporter from a financial manager with no interests involved said that high fees are historically reasonable. Early securities firms can invest in assets such as ABS and provide higher returns than other live money management (early expected returns are between 4% and 5%), and excess returns support high pricing.

“However, managers now earn more than investors, which is very unreasonable, and fee reductions are an inevitable trend. There are two reasons: First, margin products can no longer be invested in rights-bearing assets and there is no excess support; second, securities firms ‘asset management margins have begun to participate in public transformation, and the rates should also be aligned to the public offering base. rdquo;

Although the transformation of margin products for participating companies is in line with public offerings in terms of investment scope and duration limits, the rates have not been aligned. Comprehensive reporters interviewed by multiple parties, or related to no one paying attention.

Insensitivity is the biggest feature of margin management, and it is also the marketing incision that securities firms have always had. After the stock account is signed for the first time, it can be automatically transferred in and out without interfering with other stock trading steps. In contrast to the stimulating stock trading on the floor, the presence of spare cash lying quietly in the account is not strong.

In addition, investors in brokerage margin products are closed in the station and do not have to worry about the loss of funds, and managers also lack the motivation to reduce fees in a market-oriented manner.

“Rates are easy to raise, but difficult to lower. The domestic trend is that if investors do not notice the erosion of interests, institutions will not reduce fees.& rdquo; The above-mentioned financial manager executive sighed. Today, the downward trend of monetary fund returns is certain, and no one pays attention to the improper erosion of returns by high rates.