With the support of the big model, an effective brand mentality and moat have not yet been established. Consumers ‘perception of AI phones is still weak, and most consumers regard AI as a “gimmick” rather than a necessary condition for replacing phones.

Ali settled Apple and made enough face for Jack Ma

Wen| New knowledge of science and technology Sakuragi

The AI phone war between Apple and Android this time turned the focus to the confrontation between big models.

Apple and Samsung, the top two mobile phone brands in the world by shipments, chose to announce their big move in the direction of AI phones almost on the same day.

First, Samsung announced that Smart Spectrum’s Agentic GLM would become the source of AI capabilities for its new mobile phone Galaxy S25. Then The Information broke the news that after nearly a year of model testing and partner exploration, Apple finally finalized its partner in the China market. Alibaba.

After the Spring Festival holiday, this trend began to accelerate. DeepSeek’s popularity has set off a wave of DeepSeek access in the domestic mobile phone camp. Huawei, Glory, OPPO, vivo and other domestic mobile phone camps officially announced access to DeepSeek. According to statistics from “New Technology Knowledge”, Xiaomi has become the only mobile phone manufacturer that has not connected to DeepSeek.

The last time large models became the focus of mobile phone manufacturers can be traced back to the Android camp. When ChatGPT was just beginning to become popular, keen domestic mobile phone manufacturers announced all in AI, and the most important manifestation was to equip their mobile phones with self-developed large models. Later, Apple announced its cooperation with openAI at the press conference, which once again attracted attention.

But what is embarrassing is that neither route seems to have undergone disruptive changes. Although mobile phone manufacturers have received help from big models, consumers ‘perception of AI phones is still weak. Surveys show that most consumers regard AI as a gimmick rather than a necessary condition for replacing phones.

It is not difficult to predict that although the cooperation between large-scale models such as Ali and DeepSeek and mobile phone manufacturers has attracted attention, it is still difficult to break the traditional curse and create a new influence. Even in general terms, whether AI applications, AI functions, or large models, they are still just selling points for mobile phone manufacturers at the moment.

The alliance between large model manufacturers and mobile phone manufacturers is, to a certain extent, more like a credit endorsement between brands. Through the alliance with mobile phone manufacturers, large model manufacturers further open up the b-end market space, while mobile phone manufacturers have adopted The blessing of large models adds weight to the sales of their own brands.

What is more entangled is that for large model manufacturers such as Ali and DeepSeek, the advancement of technology has not stopped, and the status of large model manufacturers today is far from being invincible. DeepSeek’s case also proves that as long as the technology is outstanding enough, the traffic and influence gathered in the short term will be considerable. On the contrary, incidents where Ali replaces Baidu will occur frequently.

To sum up, the curtain on this AI mobile phone competition led by big models has just begun. Technology and brand seem to become key variables. Whoever will become the ultimate winner in the AI mobile phone era seems to want to be in this competition. Lost.

The battle for definition of AI mobile phones

Today, as AI mobile phones continue to flourish, in fact, an embarrassing question still floats in the hearts of users and manufacturers, that is, what is an AI mobile phone? Big model? AI applications? APP collaboration?

Countless concepts hit us, but no one can accurately define an AI mobile phone. In 2024, at Apple’s press conference, Apple for the first time defined five capabilities, including self-expression and recreating memories, as differentiated functions of AI phones.

Specifically, expressing oneself includes writing tools and image generation. Users can modify syntax through Apple’s AI capabilities in different apps and automatically generate pictures for sharing; recreating memories includes searching for pictures and videos through voice in the image library to generate personalized photo albums; in task scheduling, Apple’s AI function can display email summaries in notifications, automatically placing high-priority items.

In terms of voice assistant Siri, Siri can understand even if the user’s voice is incoherent;Siri can also understand screen content and perform more complex tasks. For example, if a contact sends a text message saying that a music album has been released, Siri can directly recognize the content of the message and play it for the user; if a user asks Siri to find a certain photo through voice and send it to a friend, Siri can also complete it. As long as the user turns on the camera, the phone can understand the camera’s shooting and complete the instructions. For example, when shooting an event poster, Siri can directly add the specific time and place of the event to the to-do list.

To some extent, the existence of large models is precisely to support these five capabilities.

Apple’s paradigm has almost become the basis for other manufacturers to understand AI phones. From a functional point of view, the top five mobile phone manufacturers in China, OPPO, vivo, Xiaomi, Glory, and Huawei have all released self-developed AI models, and their flagship mobile phones have also simultaneously completed AI transformation.

Due to the relatively fixed needs of users, the differences in AI phones are not obvious. Similar to Apple’s five capabilities, domestic manufacturers are also closely behind. From a functional point of view, retouching, drawing, Q & A, and performing simple operations (such as setting alarm clocks, itineraries, etc.) are common applications on AI mobile phones. Form, although compared to the smart assistant era, current AI applications have not been fundamentally improved.

From the perspective of the big model, the five capabilities have not broken through circles or become popular, which makes it difficult for the big model itself to reflect greater differences. Today, whether it is OpenAI, Ali or DeepSeek, their role is only to support five capabilities, and nothing else.

Even in terms of five capabilities, mobile phone manufacturers are hardly fully mature.

During a glory live broadcast in 2024, CEO Zhao Ming staged the so-called Magic7 scene. He simply ordered three cups of Lucky Ice American style and asked for a large one. Then a magical scene appeared. Magic7 automatically opened the Meituan, searched, and then selected the coffee type, and the final frozen screen was placing an order and paying.

Urgently, Zhao Ming also used voice operation to order 2000 cups of Luckin coffee on site at a later press conference, causing the surrounding Luckin coffee to fall into chaos for a while. The quality of AI caused controversy for a time.

In a questionnaire survey conducted by foreign organization SellCell on 1000 iPhone users and 1000 Samsung mobile phone users, the results showed that 73% of Apple Intelligence users and 87% of Galaxy AI users believed that AI functions were not very valuable or added almost no value. It has no substantial help in improving the user experience.

Since it is difficult for large models to leverage AI mobile phones, why does the current cooperation between large models and mobile phone manufacturers attract greater attention in the industry?

iPhone moment is far away

This round of AI phone competition reached a peak when Apple announced its access to the Alibaba Model. But the real iPhone moment of AI phones still seems to be far away.

Judging from the experience of Europe and the United States, even if it connects to top-level models, it is difficult to leverage sales, but Apple’s options in China are actually stretched.

According to Caixin’s report, at present, China’s big model startups do not yet have the ability and experience to connect with Apple’s customers. Among the entrepreneurial team, only Intelligent AI has more than 1000 people. In October 2024, Smart Spectrum AI announced that it had reached a strategic cooperation with Samsung Electronics of China. Samsung’s first mobile phone for the China market and provided by Smart Spectrum AI with underlying AI capabilities was released on February 11.

The controversy over the cooperation between Baidu and Apple also proves to some extent that the capabilities of China’s big model still need to be accumulated. According to industry analysts, to this day, Baidu can still be called the number one group in the domestic model ecosystem with Ali.

For major manufacturers, there may be many companies that can provide basic AI model services, but there is more or less competition and game with Apple. According to reports, Tencent’s WeChat and ByteDance’s Douyin are both super apps. Both companies have differences over the 30% commission of Apple’s App Store. Apple once pressured the two companies to stop bypassing in-app store payments.

There are not many choices and many restrictions, which is the perception of the current situation of the large model team by mobile phone manufacturers.

On the other side of the coin, Apple shipments are shrinking. Apple is in urgent need of regaining the city and has established confidence in the outside world. AI mobile phones are undoubtedly the key to this competition.

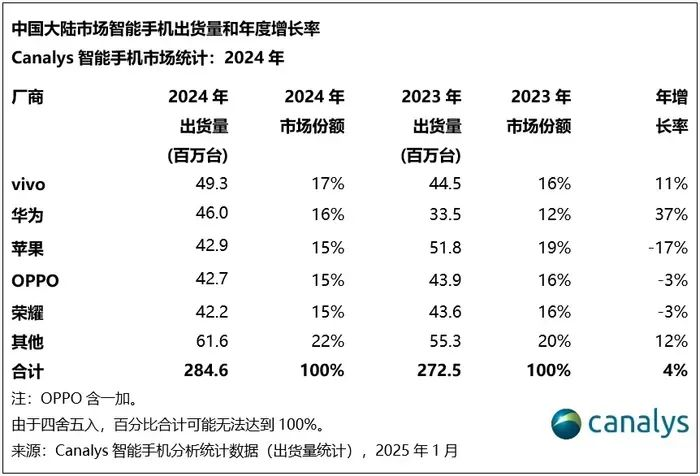

Data from market research firm Canalys shows that shipments of smartphones in China will increase by 4% year-on-year to 285 million units in 2024. Among them, Huawei’s mobile phone shipments will increase by 37% year-on-year, while Apple’s mobile phone shipments will decrease by 17% year-on-year; Ranked by shipments, vivo, Huawei, Apple, OPPO, and Glory are the top five mobile phone manufacturers in China market in 2024, with market shares of 17%, 16%, 15%, and 15% respectively. Huawei’s mobile phone market share increased by 4 percentage points compared with the previous year, while Apple dropped by 4 percentage points.

The complex relationship, the AI future that is still difficult to achieve, and constant competition among manufacturers make up the picture of this AI mobile phone competition.

Big model endorsement, not a moat

Focusing on the present, what is the value of the big model to mobile phone manufacturers?

From an event-driven perspective, Apple’s replacement of large model suppliers and DeepSeek’s sudden explosion are two important reasons why this round of AI phones has once again become the focus of the market.

But what is more intriguing is that although it is difficult for large models to directly drive mobile phone sales technically, it seems that mobile phone manufacturers are still happy to see the brand benefits brought by large models.

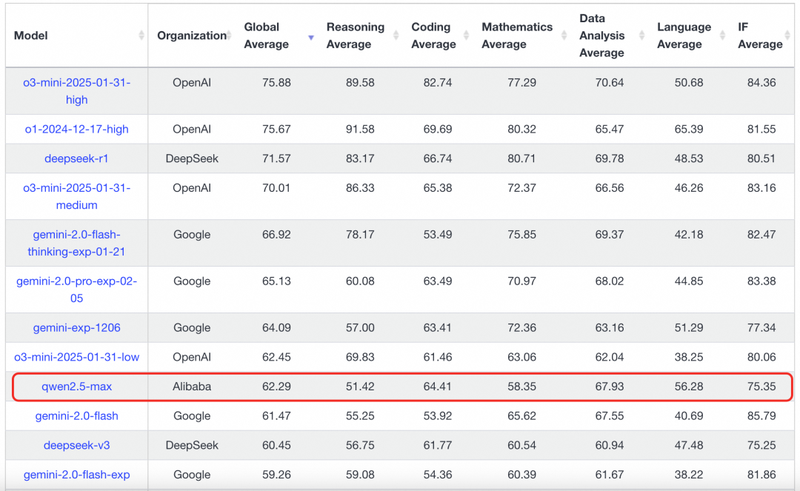

Ali’s ability to gain such trust is also inseparable from the relatively excellent performance of its big model. According to reports, on January 30, Alibaba released the Qwen 2.5-Max model. The Qwen 2.5-Max model represents the latest exploration results of the Alibaba Cloud team on the MoE model. The pre-training data exceeded 20 trillion tokens, and it almost completely surpassed DeepSeek-V3, GPT-4o and Llama-3.1- 405B in multiple benchmark tests. Slightly inferior to DeepSeek-R1, it ranks seventh in the world in the ranking of Chatbot Arena, an AI model evaluation platform, and is already among the top in the world. Especially in the single test of mathematics and programming ability, it ranks among the top in the world.

Of course, compared with mobile phone manufacturers, this kind of credit endorsement seems to be more important for large model manufacturers.

Tianfeng Overseas Securities believes that this cooperation may have a positive impact on Alibaba. On the one hand, Apple has a large iPhone user base in China. After integrating Alibaba’s AI functions, Alibaba can directly reach more high-value users and obtain important traffic entrances; on the other hand, Apple is known for its strict technical standards, and this cooperation will become an important endorsement of Alibaba’s large-model technology, thereby attracting more companies to adopt it, driving the continued acceleration of cloud business growth and the reshaping of Alibaba Cloud’s valuation.

The situation of domestic mobile phone manufacturers queuing up to access DeepSeek seems to be a concentrated reflection of the benefits of this endorsement. From the glorious early adopter version of DeepSeek, to ZTE’s full-blooded version of DeepSeek, to the first folding screen version of DeepSeek, and so on. It can be seen that mobile phone manufacturers value more about the endorsement and traffic value brought by DeepSeek.

From the perspective of brand endorsements alone, Ali and DeepSeek are almost equivalent.

Ali co-founder Cai Chongxin was the first to confirm cooperation with Apple. Apple has always been very selective. They talked with some China companies and finally chose to do business with us. They hope to use AI to enhance mobile phone functions. We are honored to work with such a great company as Apple.& rdquo;

It seems to be conveying to the public that Ali has high technical barriers and can deal with its highest value customers.

However, leading domestic manufacturers turned a deaf ear and did not follow Apple’s choice. Instead, they collectively turned to DeepSeek, using practical actions to show that the big model is to some extent just an endorsement, not the core moat.

Since it cannot drive sales in terms of functions, of course, DeepSeek, which has larger traffic and higher popularity, will be chosen.

Well, looking further, it seems that the competition for AI mobile phones backed by big models is far from reaching the end, and the choices of current mobile phone manufacturers may, to some extent, become objects of abandonment.

In the “AI Mobile Now and Future” report, independent analyst firm Canalys proposed a three-stage vision for smartphone AI: AI is a function, AI is a service, and AI is an interface. According to their observations on the China market in 2024, local top manufacturers have made significant progress in the AI as a function stage, and some manufacturers have made particularly significant progress in deep integration at the operating system platform and user interface levels.

For example, on flagship devices released this year, features such as AI elimination and AI summary have become standard features in pre-installed apps such as photos and memos. But while these independent AI features can enhance product appeal and attract consumer interest for flagship products to a certain extent, the real differentiation still depends on the next stage: AI as a service.

With AI Agent as its core concept, Canalys believes that AI-as-a-service will become the key for manufacturers to build core AI competitiveness in the next two or three years. Last year, many manufacturers launched early AI Agent functions in China, such as OPPO’s one-click query screen, vivo’s PhoneGPT and Glory’s Any Gate. However, due to the limitations of model capabilities and application ecology, these functions are still far from the ideal AI Agent vision.

What we need to be sober is that although the benefits continue to be positive and the China model is making rapid progress, it is still closer to endorsements on the application side than to the moat of mobile phone manufacturers. However, there is still a lot of room for the future for this just opening curtain, which means that today’s winners are likely to be replaced in the future. This moment is far from a moment to celebrate.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.