① Berkshire’s net profit attributable to shareholders in fiscal year 2024 reached US$88.995 billion, and liquidity such as cash/short-term government bonds reached a record US$334.2 billion;

② Buffett stated in his shareholder letter that Berkshire will always invest most of its shareholders ‘funds in stocks;

③ “Stock God” continues to express favorable feelings for the Japanese market and discloses that it may increase its holdings of Japanese trading companies in the future;

④94-year-old Buffett also said that he was on crutches.

Cailian News, February 22 (Editor Shi Zhengcheng)On Saturday evening, Beijing time, Berkshire Hathaway released its 2024 annual report and its annual Buffett shareholder letter.

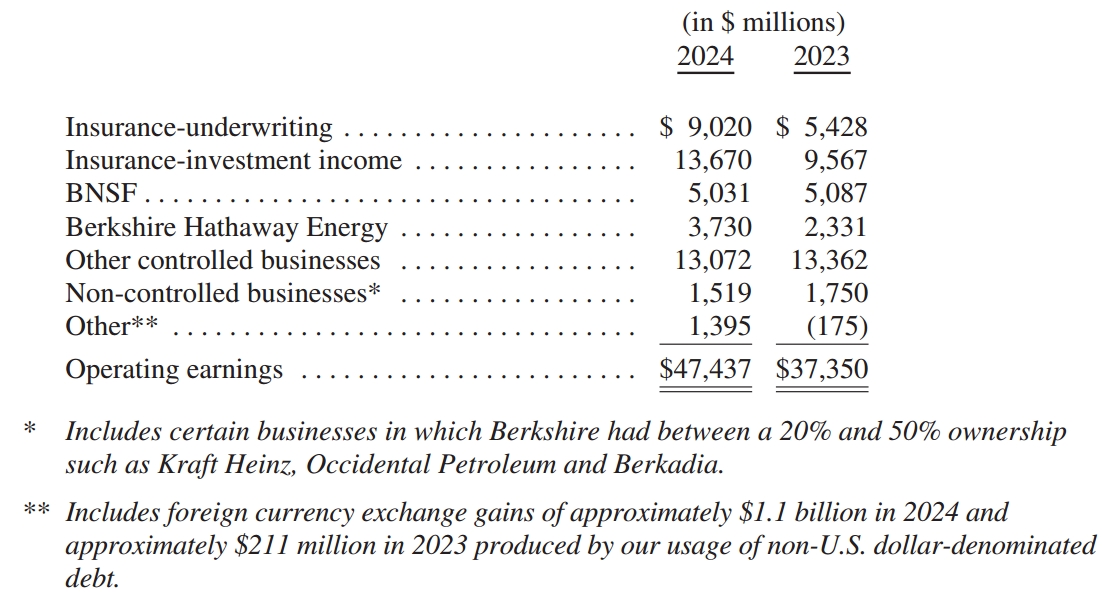

Financial reports show thatBerkshire Hathaway’s operating profit in the fourth quarter of last year reached US$14.53 billion, a year-on-year increase of 71.34%, full-year operating profit reached US$47.437 billion. Coupled with the huge floating profits of the “Stock God” in the investment market,Berkshire Hathaway’s net profit attributable to shareholders for fiscal year 2024 reached US$88.995 billion.There is no doubt that Buffett himself does not like this algorithm.

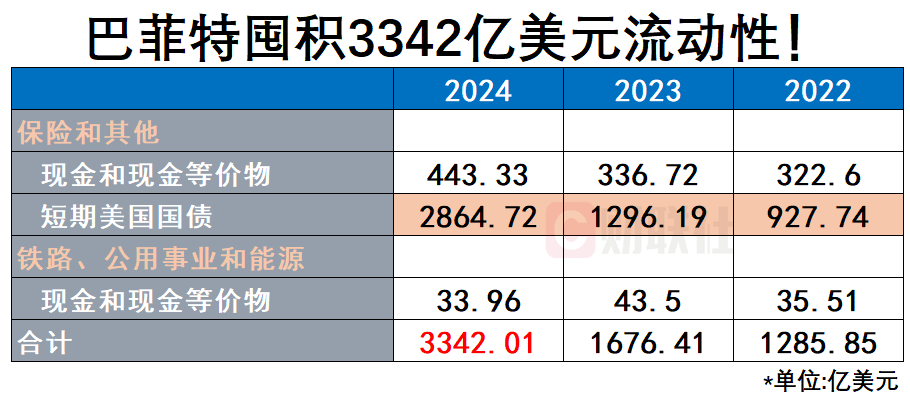

The much-watched cash level has also further improved. As of the end of last year,Berkshire’s liquidity reserves such as cash/short-term treasury bonds reached a record high of $334.2 billion.As in the third quarter of last year,Berkshire did not conduct stock buybacks in the fourth quarter of 2024, the company disclosed that it did not conduct stock buybacks in the first quarter ended February 10. This may imply that Buffett believes Berkshire’s share price is already above its intrinsic value.

Buffett commented in his shareholder letter that Berkshire’s performance in 2024 exceeded expectations, although 53% of the 189 operating companies experienced a decline in earnings. However, due to the improvement in treasury bond yields, Berkshire has significantly increased its holdings in short-term U.S. Treasury bonds, and investment income has experienced a predictable and substantial increase.

Berkshire also disclosed in its earnings report that it estimated that the wildfires that ravaged parts of Los Angeles last month would cause pre-tax losses of approximately $1.3 billion.

As an “evergreen tree in the stock market”, this time of year is also the time for Buffett to show off his long-term investment return. Berkshire A’s share price will continue to rise by 25.5% in 2024,So the annualized compound rate of return since 1965 is 19.9%, and the total rate of return since 1964 has reached a staggering 5,502,284%.Also last year, Berkshire’s market value exceeded the trillion-dollar mark for the first time.

(Berkshire Annual Chart, Source: TradingView)

The highlight of this annual report is still Buffett’s shareholder letter. It is through this annual long article that the 94-year-old “Stock God” systematically describes what he has learned about the stock market and global assets.

Buffett also joked in the letter that he is now 94 years old and it should not be too long before Greg Abel replaces him as CEO and writes his annual shareholder letter.

Aspect 1: Buffett emphasizes that he is optimistic about stocks with a lot of cash on hand

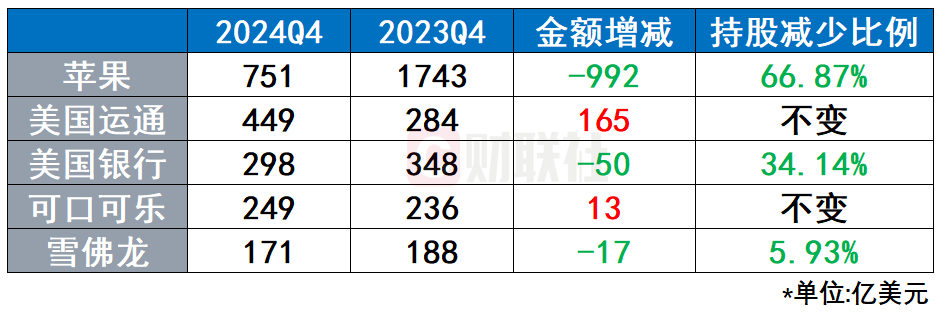

Throughout the past year, except for Western oil, which has been constantly adding positions and being “trapped”, Berkshire rarely made big purchases. On the contrary, the sharp cuts in positions of Apple and Bank of America attracted attention.

According to the 13F released last week, at the end of 2024, Berkshire’s top five stock positions will still be American Express, Apple, Bank of America, Coca-Cola and Chevron, with their proportion in the total positions falling from 79% to 71%.

(Earnings of Berkshire’s top five stock positions in 2024)👇

As of the end of last year, Berkshire’s cash level hit a new record of US$334.2 billion.

Regarding the liquidity level that has doubled in the past year, Buffett said this in his shareholder letter:

Although some commentators currently believe Berkshire’s cash position is very high, most of your money is still invested in stocks. This preference will not change. Although our ownership in tradable stocks fell from $354 billion to $272 billion last year, the value of our equity holdings in unlisted companies has increased and is still far greater than the value of our tradable investment portfolio.

He further said Berkshire shareholders can rest assured that they will always invest most of their money in stocks-mainly U.S. stocks, even though many of these companies have important international businesses. Berkshire would never prefer ownership of cash equivalent assets to owning good businesses, whether controlled or partially owned.

What is somewhat disappointing is that apart from mentioning short-term U.S. bond yields, Buffett did not explain why he wanted to hold so much cash (cash equivalents). After all, the reduction of U.S. stocks for nine consecutive quarters is probably not something that can be explained by the phrase “still prefers stocks.”

Aspect 2: Disclosure that it will increase its holdings of Japanese trading companies

As mentioned in the Financial News Agency’s Outlook, Buffett continues to talk about the Japanese stock market in shareholder letters.

Buffett said Berkshire purchased shares of Japan’s top five trading companies for the first time in July 2019. Previously, I had just looked at their financial records and was surprised at the low stock price.Berkshire’s admiration for these companies continued to grow over time.

He lamented: “These five companies increase dividends at appropriate times and buy back their own shares at reasonable times, and their executives are far less aggressive in their compensation plans than their American counterparts.”

Buffett emphasized thatShareholdings in these five companies are long-termBerkshire is committed to supporting their board of directors. At the beginning, we agreed to keep Berkshire’s stake below 10% of each company’s shares. But as we approach that limit,The five companies agreed to moderately relax the cap。Over time,The future may see a slight increase in Berkshire’s shareholding in all five companies。

As of the end of last year, Berkshire’s total investment costs in Japan’s top five trading companies (in US dollars) were US$13.8 billion, and the market value reached US$23.5 billion. It should be noted that Berkshire purchases Japanese stocks by issuing yen bonds, so it is not affected by exchange rate fluctuations.

Buffett predicts thatGreg and his successor will hold these Japanese positions for “decades”Berkshire will find other ways to work with these five companies in the future.

“Stock God” also boasted thatDividend income from Japanese investments is expected to reach approximately US$812 million in 2025, while interest costs on Japanese yen bonds are approximately US$135 million.

Aspect 3: Annual shareholders ‘meeting

Like last year, there are still only three people on the stage at this year’s Berkshire shareholders ‘meeting: Buffett, Greg Abel, and Ajit Jain, of whom Ajit Jain, who is in charge of insurance, will only attend the morning Q & A.

This year’s shareholders ‘meeting will be held on May 3, local time in Omaha. There will be official “60 Years of Berkshire” at the scene, which according to Buffett is a “relaxing history book.”

The schedule for the question and answer period has also been significantly shortened.The start of this year is slightly advanced to 8 a.m. local time, and the morning show lasts until 10:30. After a half-hour break, Buffett and Abel will start the second Q & A session that lasts until 13 p.m.

For comparison, last year’s local Q & A session started at 9:15 a.m. local time, and after about an hour’s break at noon, the afternoon session started at 13:00.

Small tidbit: Buffett is on crutches

At the end of the shareholder letter, Buffett revealed his sister Bertie (the absolute protagonist of last year’s shareholder letter!) Will be bringing their two daughters to the annual party in Omaha. Bertie is 91 years old, and the two will, as agreed, call on Sundays to discuss the “joys of old age” and compare the relative advantages of their walking sticks.

Buffett joked that for him, the use of the cane was limited to preventing falls face down.