The net is in outlets.

Gucci is about to fall short of luxury goods

Wen| Source Sight Anran

The dramatic Gucci House has staged ups and downs again, attracting the attention of the industry.

At 10 p.m. on February 25, Gucci’s 2025 autumn and winter show kicked off and turned into a dark green new symmetrical double G logo, marking the end of Sabato De Sarno’s Anchora Red and marking that Gucci has officially entered a director-free state.

Before Fashion Week, Gucci was obviously a little anxious in the face of a huge decline in performance.

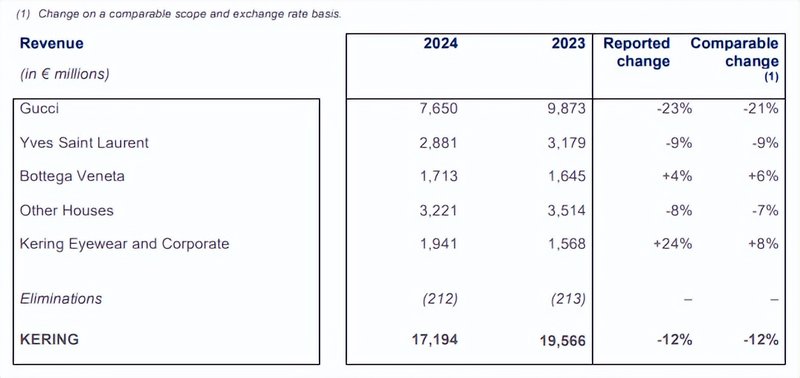

Recently, Gucci’s parent company Kaiyun Group released its 2024 financial report. According to the report, Kering’s full-year revenue fell 12% year-on-year to 17.194 billion euros; recurring operating profit fell 46% to 2.554 billion euros; parent net profit fell 62% to 1.13 billion euros.

As the group’s core brand, Gucci, which contributes nearly half of its revenue and about two-thirds of its operating profit, has its annual revenue dropped 23% to 7.650 billion euros; recurring operating profit dropped 51% year-on-year to 1.605 billion yuan.

The operating situation of other brands is also not optimistic. For example, Yves Saint Laurent’s revenue fell 9% year-on-year to 2.881 billion euros, and recurring operating profit fell 39% year-on-year to 593 million yuan; Bottega Veneta’s revenue increased by 4% year-on-year to 1.713 billion euros, and recurring operating profit fell 18% year-on-year to 255 million yuan.

Screenshot comes from the group’s financial report

Looking at its performance in recent years, Gucci’s suffering is basically the suffering brought by all in.

In terms of product design, we relied too much on Alessandro Michele’s extremely exaggerated style in the early stage, and were caught off guard by aesthetic tiredness and changing trends under the new situation.

In terms of market layout, it relies too much on the Asia-Pacific market and is more deeply influenced by fluctuations in China’s market economy and consumer behavior.

In terms of brand positioning, compared with top luxury brands such as Hermes and LV, Gucci has a lower entry threshold and is more regarded as a luxury brand for the middle class.

Against the background of the economic downturn, the domestic middle class has been deeply affected, consumer behavior has become increasingly cautious, and its loyalty to the brand has been shaken. Due to insufficient product innovation, Gucci has lost its leadership and uniqueness in the transformation of youth and has gradually slipped into the middle. Market trap.

In addition, the out-of-control volume of new products has led to the proliferation of goods in the Ole channel, causing Gucci to suffer a double blow to its brand image and performance.

While Kering was anxious about Gucci’s rebranding and rebalancing, there was market news that Prada Group, which had successfully explored rejuvenation, might acquire Versace, and Prada, which had a similar positioning, would further strengthen its power and pose a threat to Gucci.

philosophical conundrum

Gucci’s roller coaster is still diving.

In 2022, benefiting from the all-in advantage, Gucci’s sales will increase by 8% year-on-year to 10.484 billion euros, ranking among the billion-euro clubs at the level of LV, Chanel, and Hermès, setting a growth myth in the industry.

But the sequelae of all in are also fierce. After the market situation changes, Gucci’s revenue will drop by approximately 2.8 billion euros (approximately 21 billion yuan) by 2024, which is approximately equal to the size of four Miu Miu (based on the latest full-year revenue in 2023).

In the four quarters of 2024, on a comparable basis, Gucci’s revenue fell by 18%, 19%, 25%, and 24% year-on-year respectively.

Objectively speaking, Gucci’s sharp decline in performance, especially in Greater China, is related to the domestic economic downturn and shrinking consumer demand.

Fran ois Henri Pinault, CEO of Kering Group, believes that the deterioration of the real estate market and high youth unemployment have had a negative impact on consumption. rdquo;

The “2024 China Luxury Market Report” released by Bain & Company shows that sales in the mainland’s personal luxury market are expected to decline by 18%-20% in 2024. In 2024, the total global consumption of luxury goods by China consumers will fall by about 7%.

Bain & Company pointed out that lack of consumer confidence and cautious consumption are the main reasons for the market decline. VIC (high-value customers) have become more conservative in luxury consumption, more inclined to spread risk, investing spending in a wider variety of value-protected assets.

At present, compared with soft luxuries such as ready-to-wear bags, hard luxuries such as gold, silver and jewelry are more popular, which can be seen from the rebound in the latest fiscal quarter performance of hard luxury giant Lifeng Group; and gold’s status among luxury goods is becoming increasingly prominent due to its high value preservation. The popularity of gold from old domestic shops can be confirmed.

However, it is not that soft luxury is growing against the trend. In addition to top brands such as Hermès that are firmly bound to ultra-high net worth customers, for ordinary luxury brands, growth opportunities mainly depend on whether they can firmly grasp the trends of the times.

One is that The representative role of a brand that caters to conservative consumer sentiments and grasps Quiet Luxury is undoubtedly synonymous with minimalist luxury in recent years.

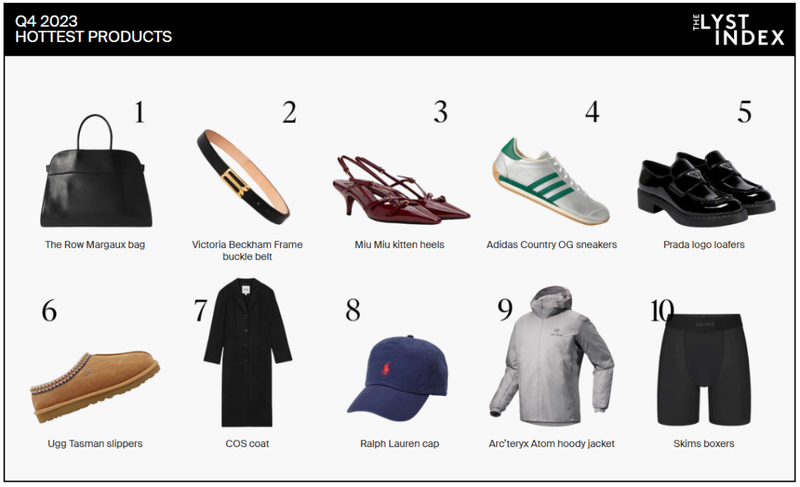

According to Lyst, searches for The Row have increased exponentially in the past few years. In the list of hot items in the fourth quarter of 2023, The Row Margaux handbags beat Miu Miu, Prada, and Ralph Lauren to be known as The New Birkin.

Screenshot from THE LYST INDE Q4 2023

According to Bloomberg News, The Row has completed its first round of financing with a valuation of US$1 billion. There are many giants behind it such as Chanel and L’Oréal. Some industry analysts estimate that The Row’s annual revenue may be between US$250 million and US$300 million, and it will still maintain an annual growth rate of 20%-30% during the epidemic.

The other is to meet the needs of breakthrough innovation and capture or even lead the preferences of young consumer groups in the new era, such as the original Miu Miu.

From January to September 2024, Miu Miu’s revenue increased by 97% to 854 million euros; in the third quarter, its revenue surged by 105%, and it has recorded 15 consecutive quarters of high growth so far, becoming a living force in Prada Group’s dual-brand attack.

In fact, Gucci has also touched the new trend boundary of minimalism.

Sabato, who joined Gucci as creative director in 2023, has stepped on the demand of consumer hotspots to a certain extent, making the previously publicized Gucci a much lower-key and simpler style.

In last year’s autumn and winter men’s collection, Gucci upgraded two classic handbags, Jackie and Bamboo. In addition, it also launched new classic collections such as Blondie and Emblem, which received many favorable reviews.

The screenshot comes from the official website of GUCCI

According to the financial report, the proportion of new products sold by Gucci will steadily increase in 2024. New products accounted for 5%, 25%, 35%, and 45% of revenue in the four quarters respectively, which has a positive impact on AUR (average selling price).

However, Sabato is not the powerful drug Gucci wants. According to Francesca Bellettini, deputy CEO of Kering Group, its success is not enough to fully compensate for the decline in sales of regular series. rdquo;

This aspect reflects that Gucci under Sabato has insufficient strength in innovation and reform. It is unable to create innovative hits and contribute breakthrough growth to curb the brand that is accelerating its downward trend under multiple unfavorable factors.

Some industry insiders believe that Sabato’s on-the-job creations are slightly dull and lack of highlights, making it difficult to stimulate more consumers ‘desire to buy; the series designs presented every season lack overall concepts and tend to be fragmented, making it difficult to concentrate on features and selling points, and the marketing effect is also weakened.

On the one hand, to get rid of the existing aesthetic fatigue of extreme complexity, and on the other hand, to let the simple style release new ideas and bring breakthrough creations, what Gucci’s new creative director has to face is a philosophical problem comparable to nothing out of nothing.

find a balance

Francesca Bellettini, deputy CEO of Kering Group, said on a conference call that what we hope to change is the appeal, fashion sense and fashion authority of the (Gucci) brand. rdquo;

Actively looking for creative muse to reshape the brand’s influence and achieve the best balance between fashion and tradition is on the one hand. On the other hand, it is equally urgent to improve Gucci’s sinking brand image through channels and realize the scarcity and popularity of luxury goods. The balance of popularity.

According to a previous report by the Wall Street Journal, due to the mismatch between order volume and actual demand in the early days of the epidemic recovery, Gucci’s inventory has accumulated, and a large number of slow-moving new products will be placed on the Ole shelves after the new products are released next season.

After Sabato took over Michele, the time for new products that failed to generate strong appeal from the counter to delivery to Ole was shortened. Some new products were priced at half in just a few months.

According to source Sight, in the second-hand market, Gucci’s price out of the counter is basically 30%-50% off, while LV bags are usually around 50%-70% off. Due to the lack of ace classic models, even popular models such as Mammon, Bacchus, and 1955 do not maintain value except for various special material series.

The Ole models that have been greatly discounted in a short period of time not only dampen consumers ‘enthusiasm for purchasing, but also continue to lower the image of luxury brands and dilute brand value.

At the 2023 fiscal year results meeting, the group’s management stated that it would enhance exclusivity in product, distribution, customer interaction and other aspects, including reducing product discounts, and plans to close some outlet discount stores as soon as 2024.

While Ole models are proliferating, Gucci’s aggressive store expansion in the early stage has also become a major drag on current development.

According to financial reports, as of December 31, 2024, Gucci directly operated 529 stores. In the mainland market of China, the number of Gucci stores ranks among the top, with more than 60 stores in all categories of boutiques alone.

In contrast, the number of stores in China such as Hermes, Dior, Prada, etc. is about 30-40.

The layout of large-scale stores is undoubtedly a heavy burden on weakening store sales, so Gucci is also looking for a new balance between scale and profitability.

Gucci offline stores in China

In 2024, Gucci will close nine stores in regional markets such as Asia Pacific, Eastern Europe and the Middle East, withdrawing from lower-sales locations to optimize its store network.

In mid-February this year, Gucci closed two stores in Shanghai Rio Department Store and New World Damaru Store in one day. So far, the number of Gucci stores in urban Shanghai has been reduced to seven. Since last year, Gucci has closed 6 stores in the China mainland market.

Throughout 2025, Kering Group plans to close about 50 stores across the group, 1/3 of which are Ole stores, to adapt to the slowing market.

In fact, in order to cope with the slowing consumer market, and at the same time add to the impact of the rise of online consumption and the increased influence of e-commerce and social media, almost all luxury brands have begun to reduce the size of physical stores.

According to statistics from Lianshang.com, since 2024, the six top luxury brands, including Hermes, Chanel, LV, Dior, Gucci and Prada, have closed 14 stores in the China mainland market.

In October last year, LV announced the closure of its store in Shenyang Zhuozhan Shopping Center; in November, Chanel announced the closure of its Henglong store in Shenyang City, which was the first time Chanel had withdrawn its store in China.

In addition, Coach’s parent company Tapestry Group will close 27 stores in 2023-2024; Versace and Michael Kors ‘parent company Cpari Group will close 65 stores in 2024 and will close 175 stores in the next two years.

According to the analysis of the Demanter Research Institute, the one-city, one-store strategy will be the direction of adjustment for all luxury brand stores in the future; the one-city, one-store, one-network model with online as the core will be the inevitable choice for all luxury brands.

Battle for defending position

The turmoil in the luxury goods world continues, and brands will fall from the cloud if they are careless.

In 2024, LVMH’s fashion and leather goods business revenue will be 41.06 billion euros. According to estimates by HSBC analysts, LV sales in 2024 may reach 21.5 billion euros, and Dior sales may reach 8.47 billion euros.

According to this data, in terms of revenue volume, Gucci slipped to the second-to-last position among the top six luxury brands. At the same time, Prada, which was originally ranked at the bottom of the list, is also secretly making efforts from brand to group, posing a certain threat to Gucci.

Typical examples such as Gucci and even the entire Kaiyun Group, revenue began to decline. In 2023, Gucci’s revenue fell 6% year-on-year to 9.87 billion euros, and Kering Group’s revenue fell 4% year-on-year to 19.57 billion euros.

Prada Group, on the other hand, bucked the trend during the cycle.

In 2023, Prada Group’s revenue increased by 17% year-on-year to 4.73 billion euros. Core brand Prada’s revenue increased by 12% year-on-year to 3.49 billion euros, and Miu Miu’s revenue rose 58% year-on-year to 650 million euros. The dark horse escaped.

On the one hand, the reforms made by Prada Group during the trough have had a profound impact on today’s development, and these practices are also of great reference significance to today’s Gucci.

2015-2016 In 2008, when Gucci welcomed Michele to open the prelude to its golden age, Prada fell into extreme anxiety.

At that time, Prada Group’s performance was stagnant, the brand was in the dilemma of over-expansion and high exposure, and the China market was also the hardest hit by recession. Everything was exactly the same as what Gucci is experiencing now.

In order to improve channel problems, Prada Group began to reduce the number of stores and stop some wholesale business.

In 2019, Prada Group Chairman Patrizio Bertelli emphasized in a conference call that his brands would stop end-of-season discount promotions at stores. Reducing discount stores and focusing on full-priced store retail have become Prada’s most important themes in recent years.

In addition, Prada Group has focused on localization and digitalization in the China market, combining new platforms such as Weixin Mini Programs with star traffic, which has a positive effect on expanding channel sales.

In the first three quarters of 2024, Prada Group’s retail sales increased by 18% year-on-year to 3.425 billion euros, accounting for 89.4% of total revenue; wholesale revenue also increased by 8.6% to 310 million euros. Group total revenue increased by 18% year-on-year to 3.83 billion euros.

While increasing the proportion of direct sales and strengthening the brand image, the Group’s profitability has also been improved.

On the other hand, the core weapon for ultimately achieving brand growth is naturally innovative design.

Take Miu Miu as an example. Although its products are also considered to lack value preservation, such a brand that is too young, too trendy, and has changed too quickly has repeatedly broken the inherent perception that luxury goods performance is positively linked to the value preservation rate. It relies on cutting-edge and unique creative design, and maintains a consistent and powerful stable output.

In the first three quarters of 2024, sales of the Miu Miu brand increased by 97.3% year-on-year to 854 million euros, and sales in the third quarter increased by 105%. In the same quarter, Gucci’s revenue fell 25% to 1.64 billion euros.

Middle-class millennials were once the main promoters of Gucci’s glory. However, after experiencing aesthetic fatigue with the brand and lack of innovation in new products, this type of consumer group has gradually been harvested by brands such as Miu Miu.

Recently, according to Bloomberg News, Prada Group is working with consultants to comprehensively evaluate the possibility of acquiring Versace. It is reported that Prada has signed an exclusive agreement to start a comprehensive review after obtaining the latest financial and sales data from Versace.

Prada Group’s desire to align with multi-brand luxury goods groups such as Kering and LVMH is clear. Its core brand Prada’s ambition to march towards Kering’s core Gucci and overtake is also growing.

The moment when the top luxury battle began to slide down from Gucci has already begun. Although there is still a certain gap between the two, judging from Prada’s growth, Gucci may not have much time left.& nbsp;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.