A more rational grab for Hong Kong stocks pricing power.

Capital from the south seized the pricing power of Hong Kong stocks, and the “dividend + technology” two-line attack

Photo source: Visual China

Blue Whale News, February 28 (Reporter Ao Yulian)This week, Hong Kong stocks fluctuated widely at their highs in recent years, and the battle for pricing power of Hong Kong stocks four years ago was once again heard.

In January 2021, there was a net purchase of HK$310 billion in southbound funds led by public offerings. At that time, Huachuang Securities made a statement at a telephone strategy meeting: Go across Xiangjiang and seize pricing power.” rdquo;

Judging from the rear-view mirror, this competition for pricing power ended with funds from the south locked up. Funds entered the market at a high level. The following month, the Hang Seng Index fell sharply and pulled back for three years.

In February 2025, the argument that funds went south to compete for the pricing power of Hong Kong stocks resurfaced. The net inflow of funds to the south reached HK$152.8 billion, the second highest in a month. Four years later, southbound funds seized the pricing power of Hong Kong stocks in a more rational way.

Go all the way south to sweep Hong Kong stocks

Funds poured south into Hong Kong stocks.

On the last trading day of February, Hong Kong stocks closed with a big negative line, and the Hang Seng Technology Index fell more than 5%. However, southbound funds adjusted fearlessly, and inflows surged sharply at the end of the day, with a net inflow of HK$11.9 billion that day.

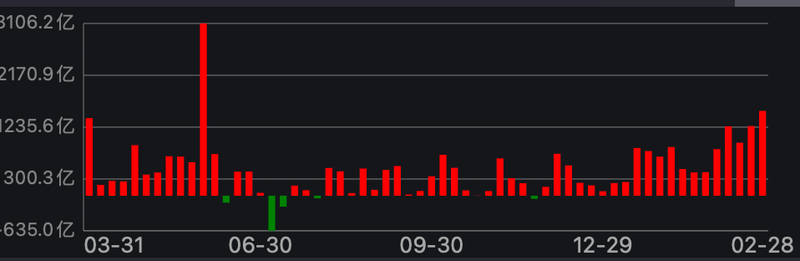

In February, the net inflow of funds to the south reached HK$152.8 billion, the second highest in history, second only to the epic purchase of over HK$300 billion in January 2021. At the same time, net inflows to the south have also been achieved for 20 consecutive months.

Among them, after the market improved in October 2024, the net flow rate was stable and fast. In the past three months, the cumulative inflow has been HK$0.38 trillion, accounting for 1/10 of the total inflow since interconnection in 2014 (HK$3.97 trillion).

Capital inflows to the south since 2020 (monthly) Source: Wind

Go all the way south to grab Hong Kong stocks. Net inflow is an indicator. What makes the market shout for Hong Kong stocks to be priced southward is also the turnover. After the third quarter of 2024, Hong Kong stocks are now turning point. Southbound accounts for the total turnover of Hong Kong stocks, breaking through the key point of 50% many times.

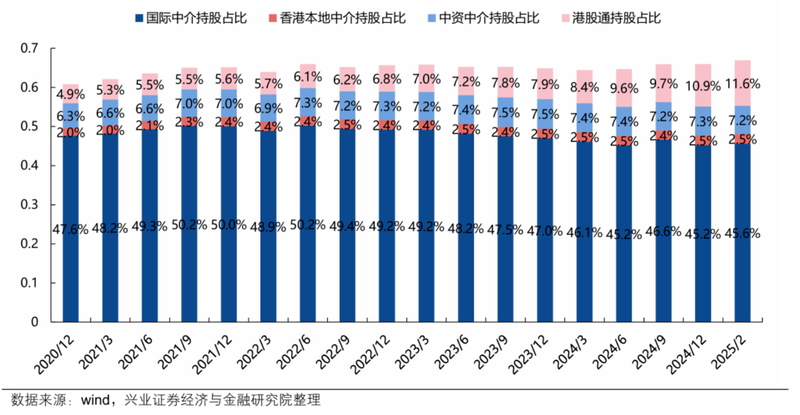

In the Hong Kong stock market, the power of international funds is of great importance. However, in the past two years, the voice of southbound funds in Hong Kong stocks has gradually increased. According to the Industrial Securities Research Report, as of February 21, the proportion of southbound funds in the total market value of Hong Kong stocks was 11.6%. At the end of 2020, this proportion was only 4.9%. At the same time, the shareholding of international intermediaries fell by 2 percentage points to 45.6%.

Who is going south? What assets to buy from the south?

Shanghai-Shenzhen-Hong Kong Stock Connect has a threshold of 500,000 yuan for opening, and most of the funds going south are mainly institutions. Judging from the listing announcements and frequent placards of insurance funds, the industry generally believes that insurance funds are big buyers.

In terms of specific targets, we will mainly buy high dividends in 2024 and quickly switch to technology this year.

In 2024, the net inflow of funds to the south will be HK$807.9 billion, a record high. Funds mainly flow to high-dividend assets such as three barrels of oil, four major banks, and coal utilities. In terms of the number of shares, the top five stocks that received the most net purchases throughout the year, and the four were bank H shares: Bank of China (net purchase of 13.2 billion shares), China Construction Bank (net purchase of 6.8 billion shares), Industrial and Commercial Bank of China (net purchase of 6.6 billion shares), China Tower (net purchase of 5.8 billion shares), and Agricultural Bank of China (net purchase of 6.3 billion shares).

Among them, insurance capital is a big buyer of high-dividend assets. Taking Ping An as an example, in December 2024 alone, it raised its holdings of China Merchants Bank H shares, ICBC H shares, Postal Savings H shares, etc.

In the most recent quarter, the net inflow to the south was HK$0.38 trillion, and funds began to significantly shift to AI and other technology sectors. The top three net inflow industries are: information technology (net purchase of 98.3 billion yuan), finance (net purchase of 83.3 billion yuan), and optional consumption (net purchase of 61.4 billion yuan). The top three net inflows of individual stocks were Alibaba, Tencent Holdings, and SMIC, with net purchases of 61.2 billion yuan, 44.8 billion yuan, and 21.4 billion yuan respectively.

A more rational grab for Hong Kong stocks pricing power

The last time funds from the south seized pricing power was in the second half of 2020 and early 2021.

At that time, public funds exploded, A-shares were already at a relatively high valuation, and Hong Kong stocks with low value carried part of the incremental funds. The main sector for fundraising is called the New Economy Sector, which is actually the current Hong Kong stock Internet, Tencent, Meituan, Xiaomi, etc. According to statistics from CICC, in 2020, nearly two-thirds of the capital from the south flowed into the new economic sector.

It is precisely because of the single concept of concentrated inflow that the market describes this as a Hong Kong stock branch after the public offering of A shares. In January 2021, the net purchase of funds from the south was HK$300 billion, a year-on-year increase of 9 times.

The peak of the carnival became the starting point of the collapse. The following month, after the Hang Seng Index surged to 31183 points, the group stocks fell sharply, and those funds that clamored to seize power were eventually trapped on the top of the mountain. Since then, Hong Kong stocks have embarked on a three-year long correction.

Looking back at this southward seizure of power, it is more like a summer thunderstorm: fierce, but fleeting. In July of the same year, a net outflow of funds from the south was HK$63.5 billion, setting a record for net outflow in a single month. Under the short-term game, floating losses turned into real losses.

Hong Kong stocks have been falling for nearly four consecutive years since 2021. Southbound funds have been bargain-hunting, buying 379 billion yuan, 335.8 billion yuan, 289.4 billion yuan, and 744 billion yuan respectively. The flow of funds has not been as wide as before, and the overall trend is stable. Based on the net inflow of HK$278.3 billion in the first two months of 2025, an inflow of HK$800 billion is expected for the whole year.

In terms of investment direction, funds used to gather together the new economic sector to warm up, but now it is arranged at both ends of technology and dividends.

Wind data shows that in the past year, the financial sector has the largest net purchase of funds from the south, reaching 236.2 billion yuan, followed by the information technology sector, reaching 181.6 billion yuan. The former has stable high-dividend assets and builds a solid defense line; the latter is a growth sector. It has great flexibility and opens up the imagination.

As of now, the stocks with the largest market value held by Southbound Capital are: Tencent (holding HK$0.51 trillion), China Mobile (holding HK$0.23 trillion), and Xiaomi Group-W (holding HK$0.21 trillion)