① China’s export container transportation market continues to recover slowly;

② Dongfang Group is suspected of major financial fraud and may involve major illegal and compulsory delisting;

③ Last Friday, the Nasdaq China Golden Dragon Index closed down 1.82%.

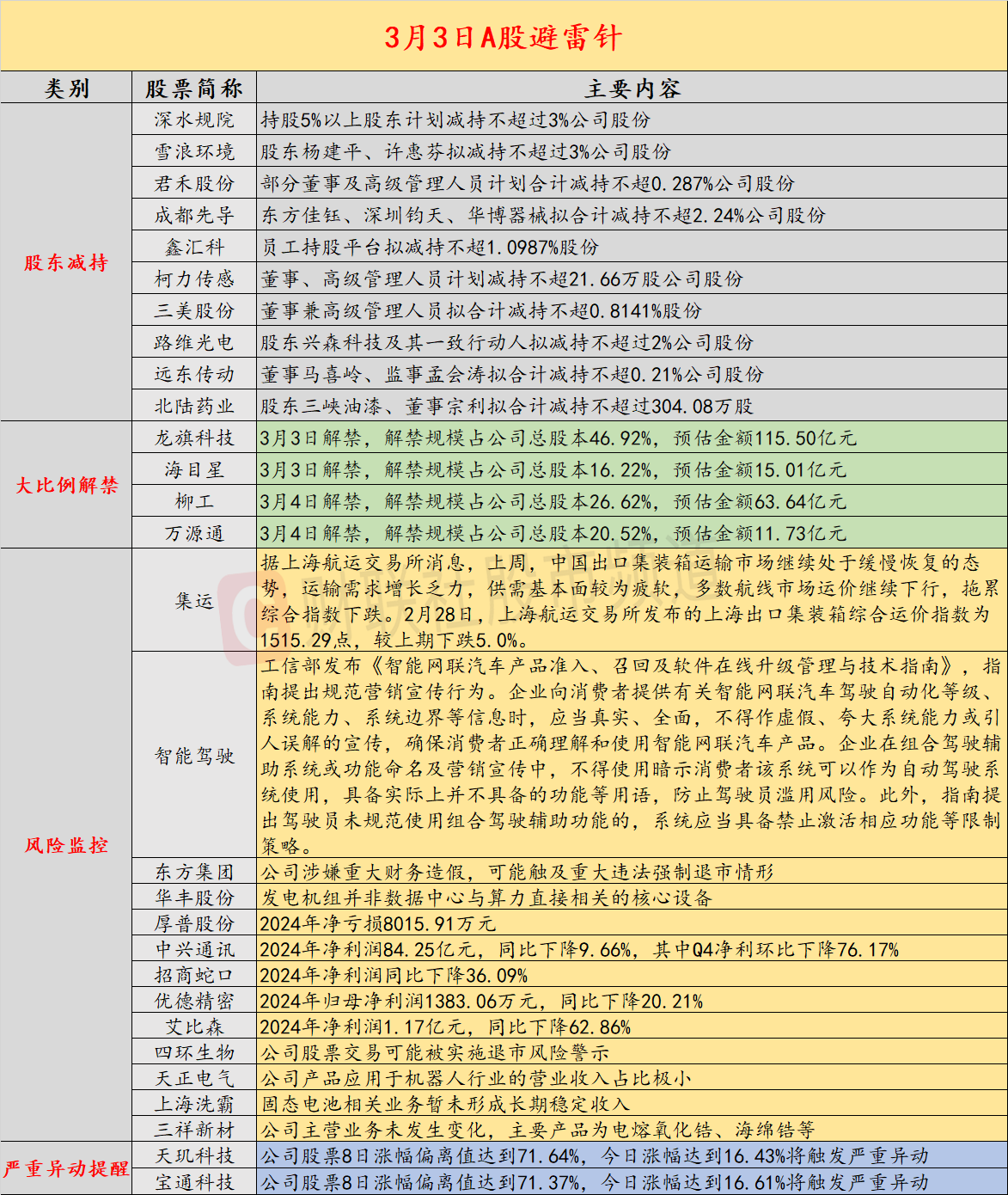

Introduction:Cailian invested in the lightning rod on March 3. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) China’s export container transportation market continues to be slowly recovering;2) the Ministry of Industry and Information Technology issued a document stating that companies must not imply that consumer combined driving assistance systems can be used as autonomous driving systems; the company’s key concerns include: 1) Dongfang Group is suspected of major financial fraud, which may involve major illegal and forced delisting; 2) 6 consecutive board Huafeng shares warned of risks that the generator set is not the core equipment directly related to computing power in the data center; key concerns in overseas markets include: 1) Last Friday, the Nasdaq China Golden Dragon Index closed down 1.82%;2) Last Friday, COMEX gold futures closed down 0.99%, and COMEX silver futures closed down 1.26%.

economic information

1. According to the Shanghai Shipping Exchange, last week, China’s export container transportation market continued to be in a slow recovery trend. Transportation demand growth was weak, supply and demand fundamentals were relatively weak, and freight rates on most route markets continued to decline, dragging down the composite index. On February 28, the Shanghai Export Container Composite Freight Index released by the Shanghai Shipping Exchange was 1,515.29 points, down 5.0% from the previous period.

2. The Ministry of Industry and Information Technology issued the “Intelligent Internet-connected Automobile Product Access, Recall and Online Software Upgrade Management and Technical Guide”, which proposes to standardize marketing and publicity behaviors. When enterprises provide consumers with information on the driving automation level, system capabilities, system boundaries, etc. of intelligent networked vehicles, they should be truthful and comprehensive, and must not make false, exaggerated system capabilities or misleading publicity to ensure that consumers correctly understand and use intelligence. Connected automotive products. In naming and marketing of combined driving assistance systems or functions, companies must not use terms such as implying that consumers can use the system as an automatic driving system and have functions that they do not actually have to prevent drivers from abusing risks. In addition, the guide states that if the driver does not use the combined driving assistance function in a standardized manner, the system should have restriction strategies such as prohibiting the activation of the corresponding function.

Company warning

1. Dongfang Group: The company is suspected of major financial fraud and may involve major illegal and compulsory delisting situations.

2. 6 Lianban Huafeng Shares: The generator set is not the core equipment directly related to computing power in the data center.

3. Deepwater Planning Institute: Shareholders holding more than 5% of the shares plan to reduce their shares of the company by no more than 3%.

4. Xuelang Environment: Shareholders Yang Jianping and Xu Huifen plan to reduce their shares in the company by no more than 3%.

5. Junhe Shares: Some directors and senior managers plan to reduce their shares in the company by no more than 0.287%.

6. Chengdu Pioneer: Dongfang Jiayu, Shenzhen Juntian and Huabo Equipment plan to reduce their shares in the company by no more than 2.24% in total.

7. Xinhuike: The employee stock ownership platform plans to reduce its shares by no more than 1.0987%.

8. Keri Sensing: Directors and senior managers plan to reduce their holdings of no more than 216,600 shares of the company.

9. Sanmei Shares: Directors and senior managers plan to reduce their shares by no more than 0.8141%.

10. Luwei Optoelectronics: Shareholder Xingsen Technology and its concerted actions plan to reduce their shares in the company by no more than 2%.

11. Far East Transmission: Director Ma Xiling and Supervisor Meng Huitao plan to reduce their shares in the company by no more than 0.21%.

12. Beilu Pharmaceutical: Shareholder Sanxia Paint and director Zong Li plan to reduce their holdings by no more than 3.0408 million shares.

13. Houpu Shares: The net loss in 2024 is 80.1591 million yuan.

14. ZTE: Net profit in 2024 will be 8.425 billion yuan, a year-on-year decrease of 9.66%, of which Q4 net profit will decrease by 76.17% month-on-month.

15. China Merchants Shekou: Net profit in 2024 will decrease by 36.09% year-on-year.

16. Youde Precision: The net profit attributable to the parent company in 2024 will be 13.8306 million yuan, a year-on-year decrease of 20.21%.

17. Abison: Net profit in 2024 will be 117 million yuan, a year-on-year decrease of 62.86%.

18. Sihuan Biotech: The company’s stock trading may be subject to delisting risk warnings.

20. 2 Connected Board Shanghai Xiba: Solid state battery-related businesses have not yet formed long-term stable income.

21, 3 days 2 boards Sanxiang New Materials: The company’s main business has not changed. The main products are electro-fused zirconia, sponge zirconium, etc.

Overseas warning

1. Most popular Chinese stocks fell last Friday, and the Nasdaq China Golden Dragon Index closed down 1.82%. Weibo fell nearly 5%, Ideal Automobile, NIO and Xiaopeng Automobile fell more than 3%, and Alibaba fell nearly 3%.

2. Last Friday, COMEX gold futures closed down 0.99% at US$2,867.3/ounce;COMEX silver futures closed down 1.26% at US$31.705/ounce.

3. Last Friday, WTI crude oil futures closed down 0.84% at US$69.76/barrel. Brent crude oil futures closed down 1.16% at US$73.18/barrel.

4. The International Cocoa Organization predicts that there will be a global oversupply of 142,000 tons of cocoa in 2024/25.

5. The U.S. merchandise trade deficit in January reached a record US$153.3 billion, much higher than the market estimate of US$116.6 billion.