Sales gaps are obvious and stock prices are polarized.

Qualifying for the “Top Six New Car Builders”: Xiaopeng exceeds his ideals again, and questions Jie Wei come to stall

author| Dingjiao One Jin Yu Fan

On March 1, new domestic car-building forces successively announced their February delivery report cards.

Those with good grades still hand in their papers first. Xiaopeng, Ideal, Zero Running and Xiaomi all posted their report cards that morning.

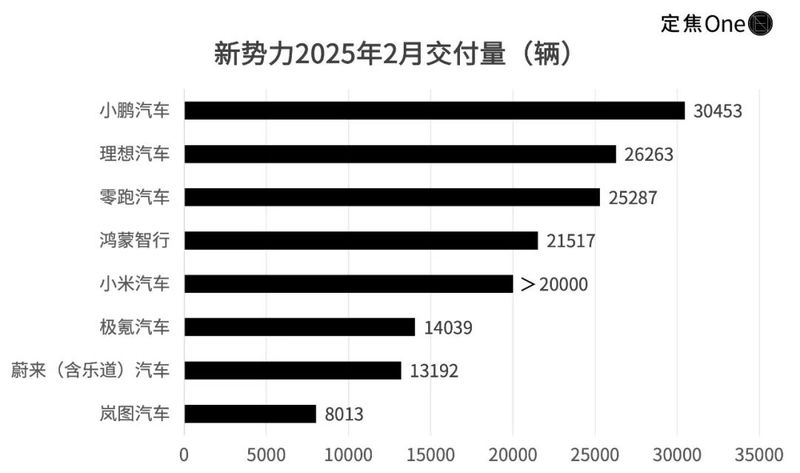

The championship battle this time is still exciting: Xiaopeng ranked first with 30453 vehicles delivered, and the former Sanhao student ideal cars delivered 26263 vehicles, ranking second. The gap between the two families has widened from 423 vehicles last month to more than 4000 vehicles.

The other two players who entered the 20,000-car club were not simple: they delivered 25287 vehicles in a silent manner. Although Xiaomi Automobile concealed the specific number, it also squeezed into the front row with a sign of more than 20,000 vehicles.

Most of the remaining new forces delayed quietly submitting their papers until the afternoon or even at night.

Gekrypton and NIO (merged with Ledao) delivered 14039 and 13192 respectively. Hongmeng Zhixing delivered 21517 vehicles in its entire series. According to 36 Krypton reports, Wenjie delivered 11315 vehicles.

The above seven brands are among those with deliveries of more than 10,000. The remaining two, Hongmeng Zhixing’s Intelligent Industry and Lantu Automobile, have delivered 9580 vehicles (according to 36 Krypton reports) and 8013 vehicles respectively.

Zhiji, which did not announce its delivery volume last month, also disclosed on March 1 that it had delivered a total of 7037 vehicles from January to February. According to China Automobile Digital Research Institute, Zhiji delivered 4237 vehicles in February.

Except for individual players, most companies ‘sales fell in February. As the first off-season of the new year, this kind of sales fluctuations actually have a warning. First, the Spring Festival holiday directly compressed the actual production and delivery cycles of car companies, and the time they can work is nearly one week less than usual; secondly, consumers piled together to buy cars and go home for the New Year before the New Year. Demand in January was consumed in advance, resulting in a sales window in February after the Spring Festival.

However, we can still observe the new forces ‘ability to recover after the holiday. This kind of rebound power hidden in the data is the key to gaining insight into the true combat effectiveness of car companies. Who is secretly working? Who showed fear again? This article will focus on analyzing six new power brands (Xiaopeng, Ideal, Zero Run, Xiaomi, Wenjie, and Weilai).

Top student: Xiaopeng is ideal, competition from different tracks

Let’s first look at the top two new forces, Xiaopeng and Ideal.

Xiaopeng is in the limelight, delivering 30453 vehicles in February, once again exceeding his ideals and taking the top spot of the new force. Last month, the two companies delivered more than 30,000 yuan, and this month turned into Xiaopeng’s one-man show in the blink of an eye.

Last month, Xiaopeng delivered only 423 more vehicles than expected, which is a small victory in production efficiency: Xiaopeng optimized the supply chain in advance, such as battery purchase agreements, and rushed to sprint production capacity before the Spring Festival holiday. However, it is ideal to extend the interest-free policy at the end of 2024 in order to write off the amount, resulting in the early release of some demand and insufficient order reserves in January.

By February, Xiaopeng’s lead gap widened to more than 4,000 vehicles. Li Yun, an investor who focuses on the new energy vehicle market, commented that it was attributed to product definition, marketing, and channel optimization.

Although Xiaopeng launched the industry’s only five-year, zero-interest, zero-down payment policy in February, which is equivalent to a maximum implicit discount of 57,000 yuan on the car price, the two cars that contribute sales, MONA M03 (100,000 yuan level) and P7+(180,000 yuan level), do not rely solely on price reductions, but on product definition.

Li Yun added that Xiaopeng has also launched low-cost models in the past, such as the G3 and P5, but the performance has not been ideal.

Tuyuan/Xiaopeng Automobile official website

To build a popular car, companies usually have two paths, either copying homework or innovating. Xiaopeng runs the two paths in parallel: first, Tesla built the P7 against the benchmark, and after 4 years of exploration, he seized a golden window period: There are no high-end smart driving for models below 200,000 yuan. Therefore, MONA M03, which is the first car for young people, was launched, and P7+ was derived from P7. Smart driving capabilities are improved and users focus more on pain points.

Xiaopeng’s two cars directly stuck in the price band of 100,000 to 200,000 yuan, pulling back sales on the cliff.

Xiaopeng was suppressed by his ideals for 28 consecutive months and finally made a comeback. However, the once ideal of winning sales is now experiencing sales pain.

Ideal delivery of 26263 vehicles in February was 30% year-on-year, but a month-on-month decline of 12%.

Last month, ideal delivery volume was halved by 49% month-on-month. On the first trading day after the delivery volume was announced, the intraday share price fell below HK$85, a drop of more than 8%. Stock prices may fluctuate again after February deliveries are announced.

Many people discuss Xiaopeng’s transcendence of ideals and may have missed the key point. In fact, the two companies do not eat at the same table: Ideal does not set foot in markets below 250,000 yuan, and relies on the L-series’s accurate home user positioning and program-adding technology to eat everything; Xiaopeng focuses on the price-performance ratio + smart driving in the market of 100,000 – 200,000. In recent years, the product line has obviously tilted towards younger people. The two annual goals for 2025, the ideal 700,000 vs Xiaopeng 350,000, are not the same size.

However, the market is indeed waiting for a reasonable explanation. The reason why there are Spring Festival holidays in January and February may not be comprehensive to judge the ideal market performance. So, March is undoubtedly a key test for ideals.

It is ideal to speed up this adjustment period: including responding to the cost performance impact of M7 and absorbing the effect of OTA 7.0 system upgrades.

Potential stocks: Zero running and going to sea, Xiaomi betting on ecology

On the new force sales list in February, Zero Run and Xiaomi can be called a pair of dark horse brothers.

At this time last year, monthly sales were still struggling with tens of thousands of vehicles, and Xiaomi cars had not yet begun to be delivered. No one could have imagined that the future waves of these two new energy car circles would become potential stocks this year.

Zero-running vehicles delivered 25287 vehicles in February, with little fluctuation from the previous month. Its brand presence is relatively low, but its sales volume ranks among the top three, forming an iron triangle of new forces with Xiaopeng and Ideal.

Zero-running has always been called a small ideal. We can see the change in sales through this combination: sales before Zero-running was about 2/3 of the ideal. In January this year, Zero-running reached the ideal 84%. In February, it is already the ideal 96%.

On the other hand, although the title of Little Ideal is ridiculous, it is also recognized. The market is opened according to the product logic of the ideal, but it is essentially a low-cost and high-quality distribution route: the domestic T03, C11, and C10 are about 20,000 yuan cheaper than BYD’s similar models (Seagull, Song plus, etc.); the C10 in the European market (starting at 36,500 euros) is 10,000 euros cheaper compared to the Model Y (47,000 – 61,000 euros)(equivalent to 75,000 yuan).

Zero runs not only know how to copy homework, but its ability to go to sea is beyond most of its peers. It has cooperated with European automobile manufacturing giant Stellantis to enter the European market and build 400+ stores.

Zhang Xiao, a practitioner in the new energy vehicle industry, said that if the goal of 500,000 units in 2025 is achieved, it is likely to sit in the top three. However, if we want to benchmark against an international giant like Tesla, we must also focus on brand building and smart driving. Work harder on reputation.

The killer of zero-running cars that do not have much sense of existence is cost performance + accurate card positioning. Xiaomi, who is good at fractional marketing, is using popular car models to support ecological valuation.

Tuyuan/Xiaomi Automobile Weibo

Xiaomi still did not announce specific delivery figures in February, only announcing more than 20,000 vehicles. In December last year, it reached 25,000 +, and in the two months of this year, despite the off-season of the Spring Festival, it was still able to hold 20,000 lines, which shows that sales are relatively stable.

Xiaomi SU7 has maintained more than 20,000 units for five consecutive months, and its total sales volume ranks first among the sales of new power models, far exceeding the second-place Xiaopeng MONA M03.

However, to meet the 300,000-year sales goal, Xiaomi cannot rely on just one car to win the world. It also has to look at the Yu7 SUV it will launch from June to July this year. The expected price range of this car is 240,000 – 330,000 yuan, 20,000 yuan higher than the SU7. If the YU7 can replicate the SU7 ‘s hit logic after it goes on sale, Xiaomi will truly break through in the car circle. The next hurdle is the transformation from cost performance to technology premium, Li Yun said.

In his view, the SU7 Ultra version released by Xiaomi at the end of February starting from 530,000 yuan is difficult to replicate the SU7 ‘s hit effect. The significance is more to increase the brand premium and pave the way for subsequent SUV models. When Lei Jun announced that he was 90% confident in the annual target of 10,000 SU7 Ultra units, it directly stimulated Xiaomi’s share price to rise in a single day, surpassing BYD and becoming the first car company in China. As of press time, Xiaomi’s market value is 1.3 trillion Hong Kong dollars.

If sales volume and stock price are matched, Xiaomi has delivered a total of 180,000 vehicles, the ideal total of 1.19 million vehicles, and NIO has delivered a total of 650,000 vehicles. There is still a big gap in Xiaomi’s sales. However, Li Yun said that the capital market is optimistic about Xiaomi Automobile’s ecological premium: Xiaomi Automobile’s gross profit margin is 17.1%, and in conjunction with its mobile phone and AIoT businesses, the company’s valuation logic has shifted from a hardware manufacturer to a technology ecosystem company, with a price-to-earnings ratio ranging from 15 times to 60 times.

Data shows that 38% of Xiaomi car owners come from Xiaomi mobile phone users, and the ecological transformation rate overtakes new forces.

Since the beginning of this year, Xiaomi’s share price has risen by more than 50%, standing out among many Hong Kong stock technology stocks, ranking only second to Alibaba in terms of growth. Now the pressure is on YU7.

Waiting to break through: Ask the world and come to a critical period

Finally, let’s look at Wenjie and Weilai. These big brothers in the new energy car circle have a sense of vision from the previous fault C position to the current difficult defense.

Last year, Wenjie relied on the M7 and M9 to steal the limelight, and even its ideals were once suppressed. A single brand contributed nearly 90% of sales to Hongmeng Zhixing Alliance, and it could be firmly in the top three on the list of new power brands. In the blink of an eye, 2025 is coming. Although the realm of inquiry still supports most of the sky in the Hong Meng Alliance, the new faces such as the intellectual realm and the enjoyment realm next door are becoming stronger and stronger.

In January and February, Wenjie did not release accurate delivery data. Hongmeng Zhixing only disclosed the delivery volume of the entire series and the delivery volume of Wenjie’s main models.

In January, 12483 Wenjie M9 units were delivered and 8443 Wenjie M7 units were delivered. In other words, the overall sales volume of Wenjie is 20,000 stalls. Li Yun analyzed that compared with the 30,000 vehicles in December 2024, the month-on-month decline was about 27%.

In February, Hongmeng Zhixing delivered 21517 vehicles in its entire series, and Wenjie M7 delivered 5204 vehicles. The M9 delivery volume was not disclosed. Based on this, Li Yun estimated that the delivery volume of the company would be between 10,000 and 15,000. According to 36 Krypton reports, a total of 11315 vehicles were delivered.

Looking at the M7 alone, it fell by 40% month-on-month in January and 38% month-on-month in February. Through Wenjie M7 to analyze Wenjie’s sales difficulties, Li Yun believes that there are two reasons: the overlapping positioning of models within Hongmeng Zhixing Alliance has led to user diversion, and the long-term lack of popular iteration in Wenjie has made it ideal for opponents to use higher cost performance or differentiated positioning to seize the market.

Both Wenjie and Hongmeng Zhixing need M8 to save the situation. Hongmeng Zhixing will challenge the sales target of 1 million vehicles this year, of which Wenjie M8 and M9 are the main forces. The M8 is scheduled to be launched around the Shanghai Auto Show, that is, at the end of April and early May. According to a late LastPost report, a modified model of the Wenjie M9 will be launched in the near future, nearly a quarter earlier than originally planned.

According to the new car application information of the Ministry of Industry and Information Technology, the size of the M8 body is close to that of the ideal L9. It is available in 5-seat and 6-seat versions. In terms of pure electric battery life, it provides two battery packs, 36-degree and 53-degree, of which the 36-degree battery pack corresponds to pure electric battery life. 161 kilometers, slightly lower than competing products of the same level. This means that the entry price of the M8 is low. According to several research reports, the price range is between 300,000 and 450,000 yuan.

Tuyuan/Wenjie Automobile’s official Weibo

Li Yun said that the M8 is the most important model in 2025, positioning itself as an SUV in the range of 300,000 – 400,000 yuan to fill the market gap between the M7 and the M9. There are not many participants in hybrid SUVs at this price, and the main competing products are the ideal L8 and L9.

As the big brother of the new force in car-building, Nilai also faces challenges.

NIO delivered a total of 13192 vehicles in February, of which 9143 vehicles were delivered by NIO brand and 4049 vehicles were delivered by Le Tao brand.

NIO is the only new force that produces two brands at a time. In January this year, it was also the only player among the top new forces whose delivery volume did not exceed 20,000.

After the delivery volume exceeded 30,000 units for the first time in December last year, NIO’s overall performance has been relatively flat, even at the bottom of the ideal weekly sales list. There are more and more dangerous voices in the market. There are also voices who believe that after the debut of the ideal pure tram i8, the one under the greatest pressure is Wei Lai.

Chen Liang, a person related to the new power company, commented that NIO is currently in a critical period of increasing sales and tackling profits.

NIO’s sales target for 2025 is 440,000 units, doubling from 220,000 units in 2024. This will have to rely on Lexo (L60 and other models) to carry the girders. It is estimated that the average monthly sales will reach 20,000 vehicles, but now it is stuck at 5,000 vehicles, which is still quite far from achieving the goal.

The next step depends on whether the fireflies, which will be launched in April, can save the game. Firefly makes a 150,000-yuan car. Although it is positioned more youthful, it is a lot of challenge to enter the BYD Dolphin market. Chen Liang said Firefly’s production capacity and pricing strategy need to be more flexible.

Among the new forces at the forefront, affected by sales, NIO’s market value has dropped from a high of 513 billion yuan in 2020, and it has even been overtaken by Xiaopeng Automobile. At present, the market value of NIO has returned to about 70 billion yuan.

Li Bin emphasized that there should be no loss in profits in 2026. If Q4 in 2025 can achieve a single quarter profit, it may become a turning point for NIO’s share price.

conclusion

At the beginning of this year, the new energy car industry staged a two-day drama. Looking at the delivery volume lists in January and February and the stock price performance of these companies, it is simply like the top players take all, the tail players struggle to survive, and there is almost no transition zone in the middle.

The first is that the sales gap is obvious. The top few have steadily delivered more than 20,000 vehicles for several months in a row, driving the new forces behind them further and further away.

Second is the polarization of stock prices. The capital market follows sales, and the stock price of top players has soared due to the rising momentum of delivery. On the other hand, the stock price is also falling with monthly sales of less than 10,000.

Looking at the essence through the data, it is still a question of whether you can make money. The gross profit margins of Ideal and Xiaomi Motors are both above 15%, while the tail players are still making money at a loss.

Based on this trend, the new car building in 2025 is destined to be a polarization and life situation. Delivery volume continues to be concentrated towards the head. The new forces at the head have capital to invest in high R & D and manufacturing costs, have greater economies of scale and technical barriers, gain greater market share and more brand trust, and further squeeze the middle and tail players. In the living space, some players may face mergers and acquisitions or reshuffle.

* At the request of interviewees, Li Yun, Chen Liang and Zhang Xiao were used as aliases in the article.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.