During this period, Bitcoin once fell below US$91,000, with the lowest offer of US$90,850, a record low since mid-January.

Bitcoin fell below US$92,000, and more than 310,000 people sold positions

Blue Whale News, February 25 (Reporter Zhang Shuwei)On February 25, Beijing time, the cryptocurrency market suddenly experienced a sharp decline. Among them, Bitcoin once fell below US$91,000, and Ethereum once fell below the US$2500 mark.

CoinGlass data showed that at around 8:14 Beijing time, the price of Bitcoin fell below US$91,000, with the lowest offer of US$90,850, a record low since mid-January. As of around 9:12, Bitcoin prices rebounded to US$91,400, a 24-hour decline of 4.81%.

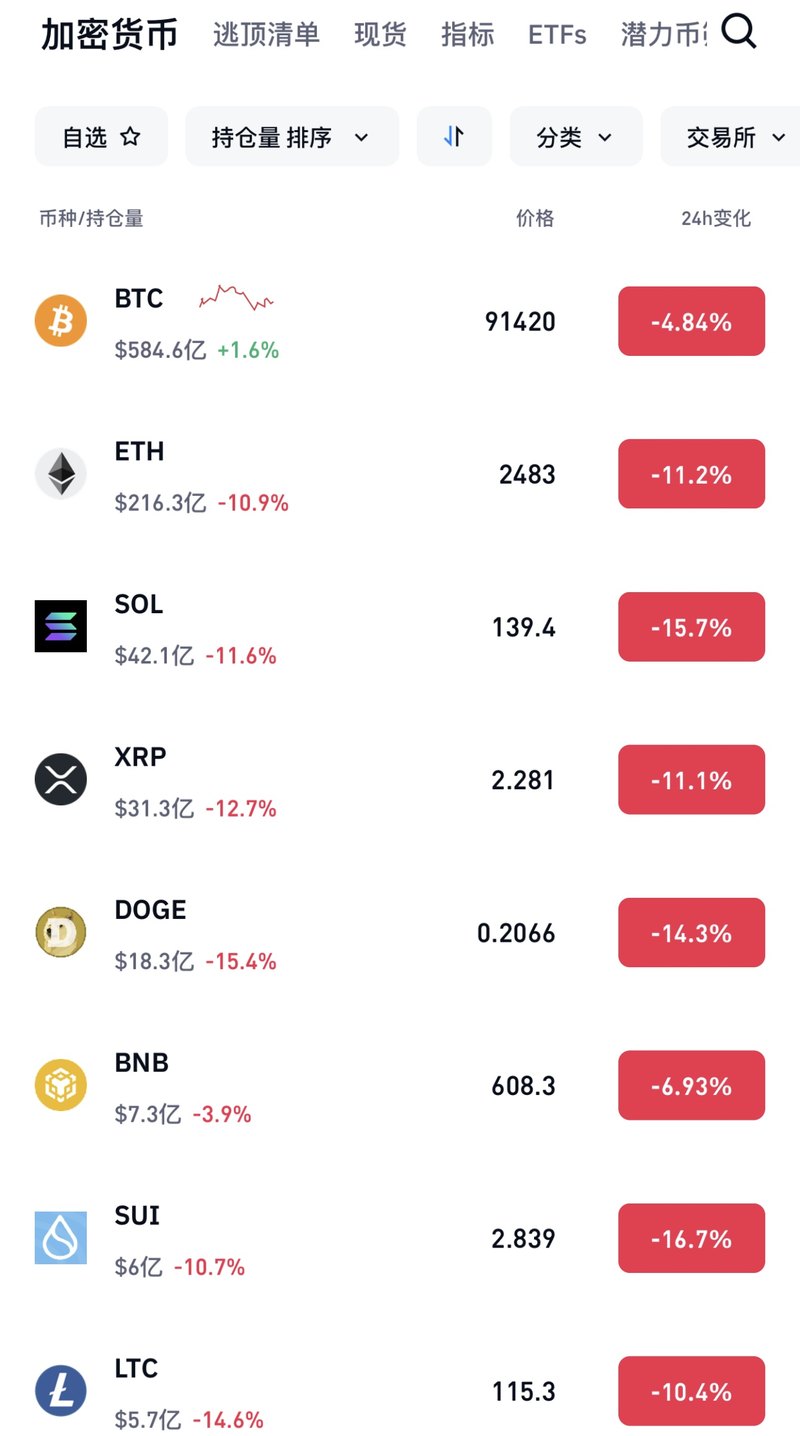

In addition to Bitcoin, Ethereum (ETH), SOL, Ripple (XRP), DOGE (DOGE), and SUI coins in the cryptocurrency market also fell significantly. Among them, as of 9:12, SUI coin fell the most, with a 24-hour decline of 16.7%; Ethereum fell below US$2500, with a 24-hour decline of 11.2%.

CoinGlass data shows that in the past 24 hours, more than 328,300 people have sold positions, with a total amount of US$961 million. Among them, the amount of multiple open positions reached US$890 million. The largest single warehouse receipt occurred in Binance-BTC, valued at US$10 million.

On the news front, on February 21, Beijing time, Bybit, the world’s second largest cryptocurrency exchange, was hacked. It is reported that hackers took advantage of platform vulnerabilities to successfully steal more than 400,000 ETH and stETH with a total value of more than 1.5 billion US dollars (approximately 10.8 billion yuan) and transferred them to unknown addresses. Affected by this, in the early morning of February 22, the cryptocurrency market collectively fell, and Bitcoin experienced multiple short-term sharp declines.

On February 24, the U.S. state of South Dakota effectively vetoed a bill to invest in Bitcoin. At the Feb. 24 meeting of the state House Commerce and Energy Committee, a majority of members present voted to postpone HB 1202 until the 41st day of the South Dakota legislative session. Because the Legislature does not last longer than 40 days, the motion effectively kills the current version of the bill, which proposes to allow state-level investment in Bitcoin. The proposed bill would amend the classification of South Dakota public funds to include up to 10% of Bitcoin investments.