Shanzhai investment is more like a poker game, but with too many tables and too few players.

Author: tzedonn

Compiled by: Shenchao TechFlow

After a crazy fourth quarter, it’s time to calm down and reflect. In just three months, the market has undergone many major changes.

The situation this time is different from the past.

Everyone is looking forward to the arrival of the “shanzhai season”(the moment when the blue line exceeds the orange line), just like 2021-2022, the prices of all shanzhai will explode. However, since the launch of the Bitcoin ETF in January 2024, the gap between Bitcoin (BTC) and the TOTAL2 index (representing the total market value of copycats) has continued to widen.

In the past shanzhai season, investors have often shifted Bitcoin’s earnings to riskier assets, driving the shanzhai market to rise across the board. This phenomenon has formed a classic capital flow pattern.

But today, Bitcoin’s capital flows are completely disconnected from other cryptocurrencies, forming an independent ecosystem.

Bitcoin’s capital inflow is mainly driven by the following three aspects:

- ETF: Currently, ETF funds hold a total of 5.6% of global Bitcoin;

- Microstrategy: This company holds 2.25% of Bitcoin and is a continuous buying institution;

- Macroeconomic factors: Including interest rates, political situation (e.g., U.S. sovereign wealth funds or other countries may buy Bitcoin).

On the other hand, Bitcoin’s capital outflows mainly include:

- U.S. government: Currently holds about 1.0% of Bitcoin and says it may not sell it;

- Bitcoin miners: Due to daily operational needs, miners regularly sell some bitcoins;

- Bitcoin giant whale: These investors who hold large amounts of Bitcoin have seen their asset values rise about five-fold since the market low in 2023.

Obviously, the drivers of these capital flows are completely different from those of the shanzhai market.

Shanzhai Market: Are there enough players?

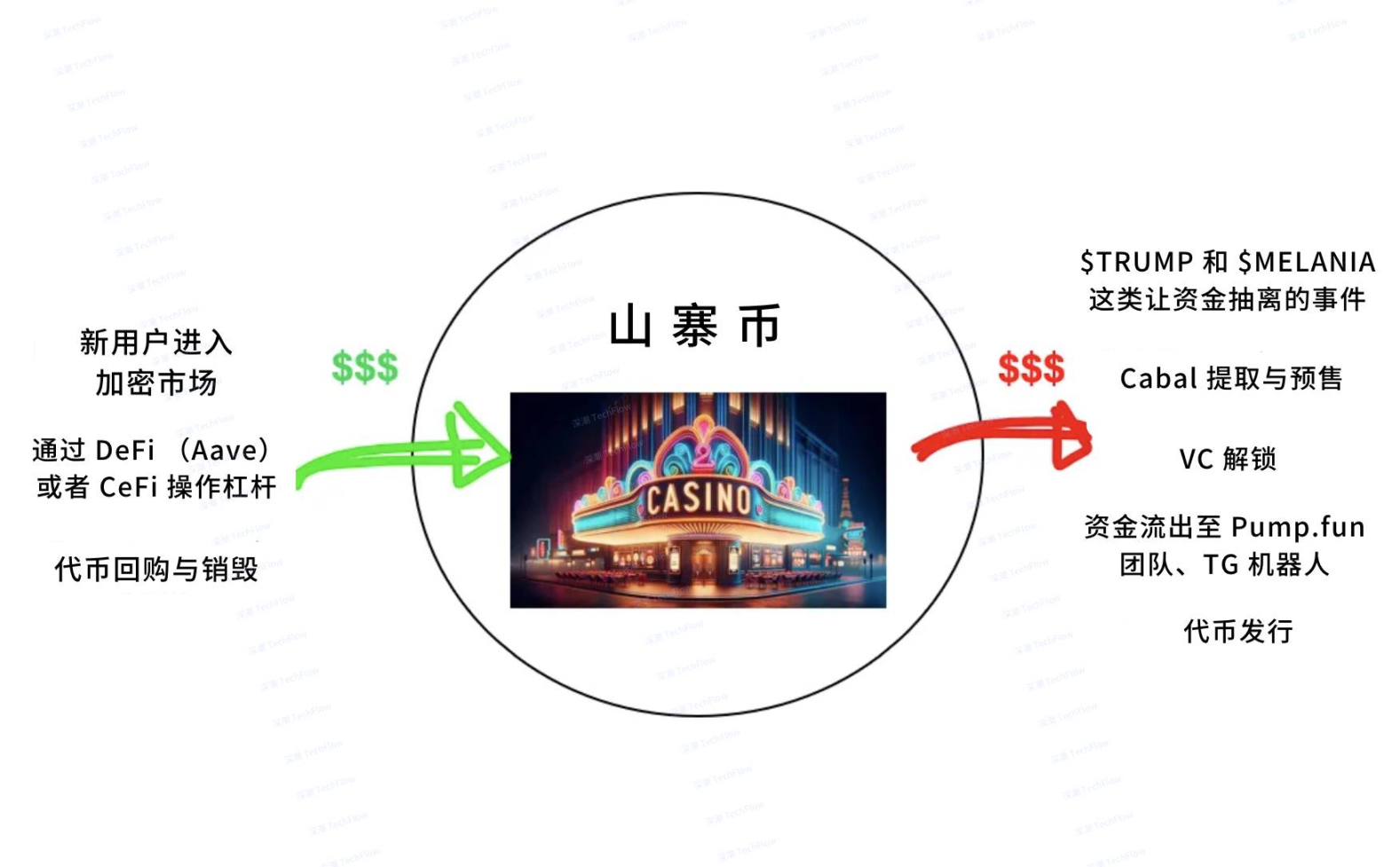

The copycat market can be compared to a casino.

Only when there is sufficient liquidity in the casino (i.e., the net inflow of funds is high) is a good time to participate. Choosing the right gambling table (i.e., investment target) is equally important.

The sources of capital inflows to the shanzhai market are as follows:

new capital inflows

For example, in 2021, a large number of retail investors entered the crypto market, bringing new funds. However, the current capital inflows through Phantom/Moonshot or TRUMP token offerings, as well as USDT/C market value growth, do not seem to be enough to support the market.

In addition, certain assets may also benefit from funding rotation. For example, some investors never invest in Meme, but may start focusing on “AI Meme” because these investments are easier to rationalize.

Leveraged funds obtained through decentralized finance (DeFi) platforms (such as Aave, Maker/Sky) or centralized finance (CeFi) platforms (such as BlockFi, Celsius). From an institutional perspective, the CeFi market now appears to be no longer active after a collapse in 2021. In the DeFi space, the IPOR index (used to track USDT/C borrowing rates) shows that the rate has dropped from about 20% in December 2023 to about 8% currently.

Token repurchase and destruction: making players ‘chips more valuable

The “buy-back and destruction” mechanism in crypto projects is similar to the card owner using revenue to increase the value of players ‘chips.

A typical example is the HYPE Insurance Fund, which bought back 14.6 million HYPEs at a price of $24 each, worth approximately $350 million.

However, most crypto projects do not achieve sufficient product-to-market fit (PMF), making it difficult to conduct buybacks of sufficient scale through revenue to significantly affect token prices (such as the JUP repurchase case).

Outflows of casino funds: Who is cashing in chips?

Large-scale capital withdrawal event

In January, there were two “once-in-a-lifetime” large-scale capital withdrawals in the market:

- Trump Incident: Funding increased from $0 to $75B, then quickly dropped to $16B;

- Melania Incident: Funding increased from $0 to $14B, then dropped to $1.5B.

These two incidents are conservatively estimated to have sucked more than $1B of liquidity from the crypto market ecosystem. In other words, if someone earns more than $10M on a trade, they are likely to transfer more than 50% of the proceeds to the over-the-counter market.

Tool-driven continuous capital withdrawals

In addition to large-scale events, some tools are also continuing to extract market funds:

- Pump.fun: Cumulative revenue reaches $520M in about 1 year;

- Photon: Cumulative income is approximately $350M;

- Bonkbot, BullX and Trojan: Cumulative revenue per tool is approximately $150M.

These tools gradually remove large amounts of funds from the market through decentralized small withdrawals.

Cabal extraction and pre-sale model

Cabal extraction and pre-sale models often mark the end of the market cycle. This is because a few people will withdraw huge amounts of money at this stage and move it to the over-the-counter market. As the cycle draws to a close, the duration of these events becomes shorter and shorter:

- Pasternak: It only lasted about 10 hours;

- Jellyjelly: lasted about 4 hours;

- Enron Pump: It only lasted 10 minutes.

This rapid outflow of funds is figuratively called the “euthanasia roller coaster” because it allows the market to experience short but sharp fluctuations.

Unlock funds for venture capital (VC)

Venture capital institutions unlock funds and convert crypto assets into U.S. dollars to return allocated investment returns (DPI) to their limited partners (LPs). For example, in the TIA project, VC extracted a large amount of money from the crypto market in this way.

the deleveraging

There are also deleveraging phenomena in the market, such as lowering the borrowing rate of USDT (TEDA). This behavior will lead to a gradual reduction of leveraged funds in the market, further affecting liquidity.

Shanzhai Choice: How to find your poker table?

In the crypto market, choosing the right investment target is the key to success. Compare this process to selecting a suitable poker table.

When the market is active (i.e., there are a large number of players participating), your potential return will be higher, but only if you choose the right token.

This investment is called a “poker game” because it is essentially a zero-sum game.

In this game, projects either:

- Failure to generate revenue or value;

- Attribute the generated value to the token.

The only possible exceptions are the following two types of projects:

- Frequently used L1 such as SOL and ETH;

- Products that can generate high-revenue, such as HYPE.

It should be noted that some investors are betting that the team can generate sustainable revenue in the future based on “fundamentals”, but in the short term, I am more pessimistic about this.

Situation in 2025: Too many tables, but too few players.

By 2025, competition in the crypto market will become more intense, and finding suitable investment targets will be more difficult than ever. This is because there are too many “poker tables”(i.e. token items) in the market at the same time.

Here are some data:

- About 50,000 new tokens are launched every day through Pump.fun;

- Since the launch of Pump.fun, more than 7 million tokens have been launched, of which about 100,000 have eventually entered the Raydium platform.

Obviously, there are not enough investors in the market to support all these token projects. Therefore, the return on investment of shanzhai shows a strong trend of differentiation.

Choosing the right investment target has become an art, and the following aspects usually need to be considered:

- The strength of the team and products;

- The narrative behind the project;

- Communication and marketing effectiveness.

Kel once wrote a wonderful article that discussed in detail how to choose copycat investment targets.

What does this mean?

Shanzhai is no longer a “high-beta bitcoin.” Investment theory in the past held that “holding copycats instead of holding bitcoin” could lead to higher returns, but this strategy may no longer be applicable today.

The importance of asset selection has increased. With the Pump.fun platform reducing the threshold for token issuance to almost zero, choosing the right copycat has become more important than ever. Capital inflows into the market can no longer drive up the price of all tokens on average.

Shanzhai investment is more like a poker game. Although it sounds pessimistic to compare copycat investment to poker games, it is indeed a true reflection of the current market. Maybe in the future I will write an article exploring the real long-term use cases of cryptocurrencies.

Have you seen the top yet? At present, the market may have peaked in stages, but the future trend remains to be seen.

When will the next shanzhai season come?

The traditional “four-year cycle” theory may have failed because the trend of altcoins is gradually separating from the influence of Bitcoin (BTC).

In the future, the market for altcoins may be triggered by some unexpected events, such as phenomenal events like “GOAT”.

In the long run, the prospects of the crypto market are still very worth looking forward to, especially under the influence of the US Sovereign Wealth Fund (US SWF), governments that support bitcoin, and the introduction of stablecoin-related bills.

The future is full of uncertainty, but it is also full of opportunities. Good luck and have fun!