Tencent Yuanbao anti-super bean buns

DeepSeek has been popular for a month: Tencent Yuanbao has smashed its purchase volume, kimi has plummeted, and bean buns have dropped

Wen| DataEye Research Institute

In the one month since DeepSeek exploded, the entire AI circle has undergone great changes. Various apps have connected to DeepSeek, versions have changed, and money have been spent on purchases. Embracing and competition have become the main theme of the AI circle in early 2025.

Among them, the ones that have attracted the most attention recently are Tencent Yuanbao, Byte Bean Bao and Kimi. So, what have happened to Yuanbao, Doubao and Kimi in this DeepSeek wave, and where will the future go? DataEye will combine data to bring you the latest changes in these AI assistants.

In the rankings, bean buns used to rank higher than Yuan Bao in the App Store, but now the offensive and defensive trend has reversed.

On February 22, Tencent Yuanbao surpassed Doubao and rose to second place in the Apple free list in mainland China, while DeepSeek still ranked first.

The most direct driving force for Yuanbao to overtake the top of bean buns is the recent surge in paid delivery efforts, and the indirect reason is related to changes in product ends.

Look at the release side first.

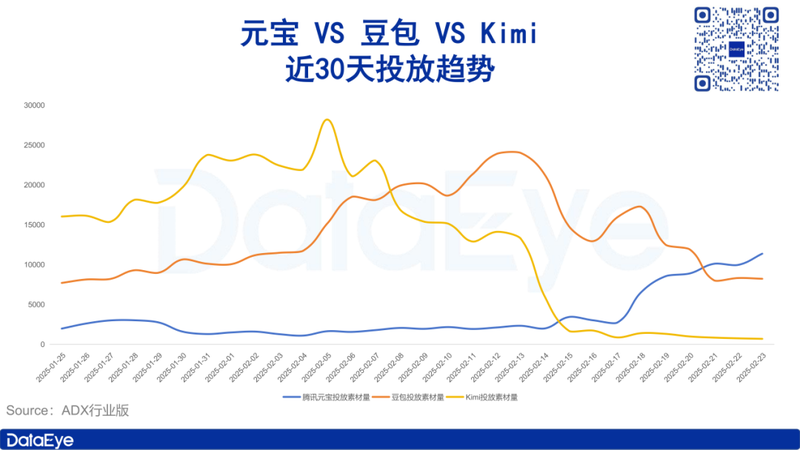

ADX data shows that before February 5, the amount of material released by Kimi, Doubao and Tencent Yuanbao was significantly stratified, and there was a large gap.

After that, the amount of material released by Kimi gradually declined, and became the lowest among the three around February 15. So far, it has maintained the daily amount of material no more than 1000 groups.

After February 5, the release intensity of bean buns first increased to a certain extent, and then dropped sharply, maintaining a similar release intensity to that in late January.

The change in Yuanbao is the most obvious. In the past, Yuanbao’s investment efforts have never been high, and Tencent has also been considered by the outside world to have vague strategies and slow actions in the field of AI models. However, on February 15, the release of Yuanbao increased slightly, and on February 18, it increased sharply. So far, the highest number of materials released in a single day has exceeded 11,000 sets, making it the first among the three.

In contrast, in the six days (2.18-2.23) in which the launch of Yuanbao has increased significantly, a total of 55,000 sets of materials have been released. In the six days before the month-on-month launch (2.9-2.14), the volume of materials has been released was 12,000 sets of materials, an increase of 345.1%.

As for the reasons for the changes in the launch intensity of the three products, DataEye Research believes that:

① Tencent Yuanbao connected DeppSeek and launched the HunyuanT1, a self-developed reasoning model. It seized the market and occupied users ‘minds by increasing its launch efforts, and promoted the HunyuanT1 model.

On February 13, the updated version of Tencent Yuanbao announced that it would connect to DeepSeek, which coincided with the slight increase in Yuanbao’s launch on February 15; on February 17, Tencent Yuanbao launched the Hunyuan T1 model, which coincided with the launch on February 18. The time point matches the surge in launch.

During this period, Tencent’s Yuanbao version was updated frequently. On February 22, the new version already supported uploading and taking photos to recognize pictures. Guided by multiple factors such as product and delivery, Yuanbao officially surpassed Doubao and became the second place in the free APP download list for Apple in mainland China.

② The release of bean buns first increased and then fell, but actually only returned to normal release status. Compared with Tencent, Doubao is not connected to DeepSeek, and even Byte’s overall attitude towards DeepSeek is very conservative. This seems to represent Byte’s confidence in his big bean bag model: Byte may believe that the big bean bag model can catch up with DeepSeek’s level in the near future.

Therefore, after DeepSeek exploded, it briefly increased the flow of beans to try to catch up, and then returned to a rational state, which is more in line with the changing trend of the flow of beans.

③Kimi reflected on his past re-launch strategy and decided to reduce the launch and focus on basic model training. Last week, media reported that Dark Side of the Moon recently decided to significantly reduce its product launch budget, including suspending the launch of multiple Android channels and cooperation with third-party advertising platforms. This is in line with Kimi’s plummeting volume of material released around February 15.

At the same time, the internal review of the Dark Side of the Moon believes that it is necessary to adhere to the basic model SOTA (State-of-the-art, the best at present), and may then retrain the basic model and seize application layer opportunities. One of the directions selected internally is DeepResearch, an agent product for the field of in-depth research.

Looking at it today, Kimi and Doubao, two past star AI applications, one was launched and the other returned to normal. On the contrary, Tencent Yuanbao, which has a smaller volume, came from behind.

So under this trend, what new changes will occur in the AI circle in the next few months? Will Doubao and Kimi make new breakthroughs in the technical level? Can Yuan Bao’s second son sit firmly? DataEye Research Institute will continue to pay attention.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.