This is less than a month since the first tens of millions of payment fine was issued during the year.

Gather payment to collect tens of millions of regulatory fines

Blue Whale News, March 3 (Reporter Huang Yujie)After Beijing Yaku Spacetime Information Exchange Technology Co., Ltd. received a fine of 11.99 million yuan in February this year, the high-pressure supervision situation in the payment industry continues to appear.

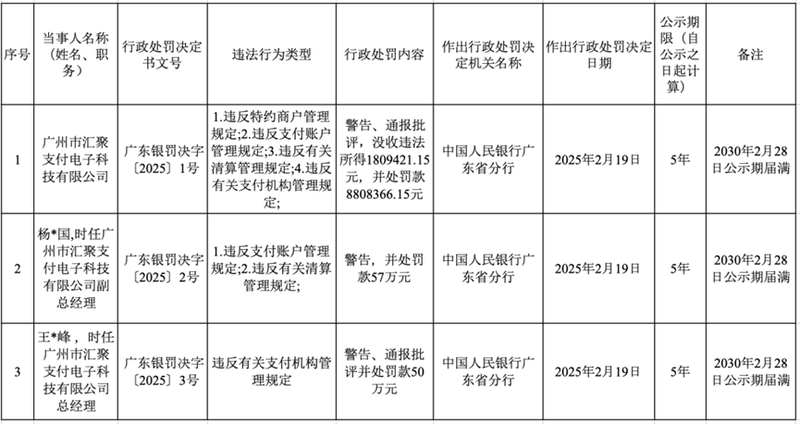

The central bank announced that Guangzhou City Gathering Payment Electronic Technology Co., Ltd.(hereinafter referred to as Gathering Payment) was fined a total of 10.61 million yuan for multiple violations. The company’s general manager and deputy general manager were also fined 500,000 yuan and 570,000 yuan. This is less than a month since the first tens of millions of payment fine was issued during the year.

According to public information, the institution involved in the matter, Jigu Payment was established in 2008 and obtained a national Internet payment license issued by the central bank in July 2014. This penalty continues the regulatory characteristics of double penalties for payment industry institutions and responsible persons in recent years. In the case of Yaku Space and Space in February this year, the relevant responsible persons were also simultaneously punished financially. According to statistics, among the large-scale fines in the payment industry that exceed 10 million yuan in recent years, inadequate implementation of the anti-money laundering system has become the main violation.

It is noteworthy that the newly revised Anti-Money Laundering Law will be officially implemented in 2025, clearly listing non-bank payment institutions as obligated institutions and requiring the establishment of an internal control system that matches the risk situation. This marks a comprehensive upgrade of the compliance requirements faced by payment institutions, including systematic rectification of customer identification, suspicious transaction monitoring and other aspects. Industry insiders pointed out that the ex post remedy model that some institutions relied on in the past has become unsustainable.

Against the background of continued tightening of supervision, the payment industry is undergoing a deep reshuffle. Data disclosed by the central bank shows that as of the end of March 2025, the total number of payment licenses nationwide has been reduced from 271 at the peak period to 172, and a total of 99 business licenses have been cancelled. Most of the institutions that have been cleared are involved in serious illegal operations. Typical cases include Deshi shares being fined 88.73 million yuan and eventually delisted for repeatedly violating liquidation management regulations.

Industry observers believe that although short-term pain is inevitable, supervision continues to clear out market violators, which is conducive to building a healthy competition ecosystem. With the withdrawal of inferior institutions, the market space for leading companies operating in compliance is expected to further expand, and the payment industry is transforming from scale expansion to high-quality development.