Original title: A New Mindset

Original source: Glassnode

Compilation of the original text: Baishui, Golden Finance

abstract

·Bitcoin has developed into a global asset that is extremely liquid and available 24/7. This creates conditions for investors to speculate, trade and express macroeconomic views when traditional markets are closed.

·Bitcoin continues to prove itself as an emerging store of value, with cumulative net capital inflows exceeding $850 billion. It also serves as a medium of exchange for assets, processing nearly $9 billion in daily transaction volume.

·Multiple indicators of new demand remain high, but they are well below the peaks of previous cycles.

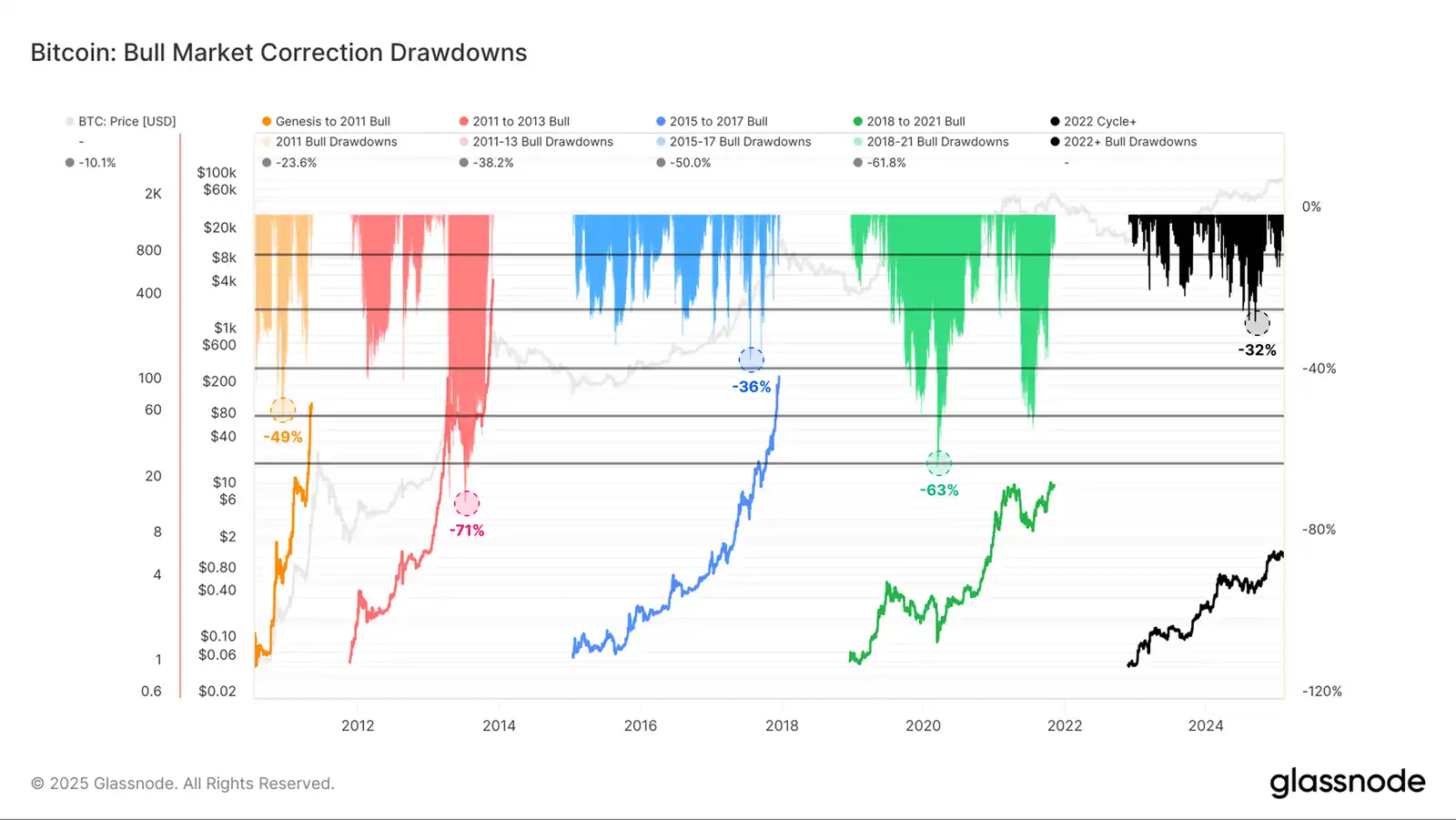

·The composition of digital asset investors is also changing, with a significant increase in the number of more mature institutional investors in the Bitcoin space. This led to a general decline in retracement, with volatility compressing over time.

test site

Since its birth in 2009, Bitcoin has developed into a highly liquid global asset and remains actively traded around the clock. Given that global events often occur outside traditional market trading hours, this makes Bitcoin one of the few assets on which investors can express their views over times such as weekends.

Bitcoin experienced a sharp decline over the weekend as market participants responded to the Trump administration’s imposition of tariffs on Mexico, Canada and China. Bitcoin and other digital assets experienced a sharp decline as other markets closed, then rebounded:

· BTC trading prices fell from $104,000 to $93,000 (-10.5%), before recovering to $102,000.

· ETH traded from $34,000 to $25,000 (-26.5%) before recovering to $28,000.

· SOL traded from $236 to $184 (-22.0%) before recovering to $217.

Bitcoin is now playing an increasingly important role on the world stage. Nation states such as the Kingdom of Bhutan are carrying out large-scale mining operations, El Salvador is promoting Bitcoin to become legal tender, and the U.S. government is considering using Bitcoin as a strategic reserve asset.

Bitcoin has now crossed the important psychological threshold of $100,000 for several weeks in a row, a feat many critics believe is impossible.

Although acceptance of Bitcoin among traditional investors is growing, Bitcoin remains a controversial and polarizing topic for many, often based on questionable claims that it lacks intrinsic value or utility.

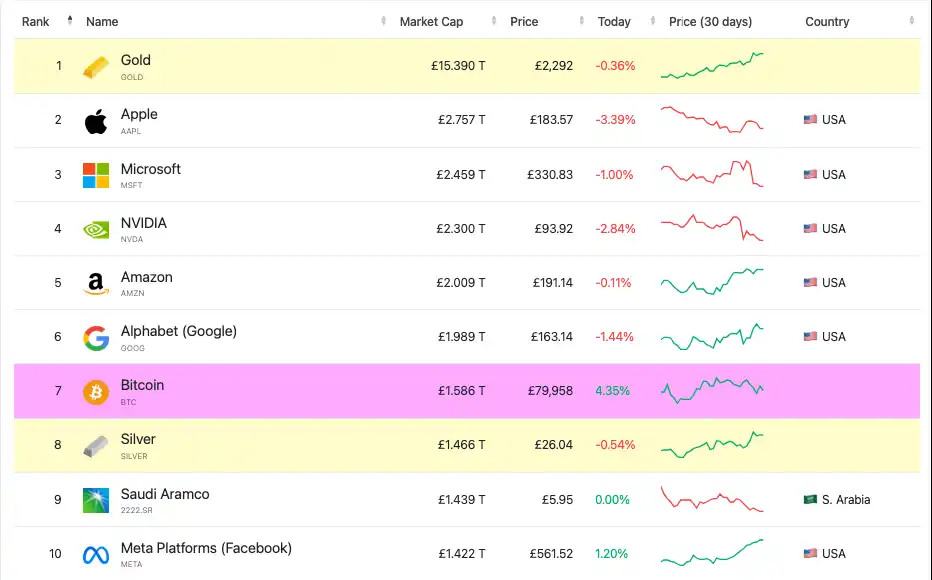

Despite this,Bitcoin has consolidated its position as one of the world’s largest assets, with a market value of US$2 trillion, ranking the world’s seventh largest asset。Significantly, this puts Bitcoin above silver ($1.8 trillion), Saudi Aramco ($1.8 trillion) and Meta ($1.7 trillion), making it increasingly difficult to ignore.

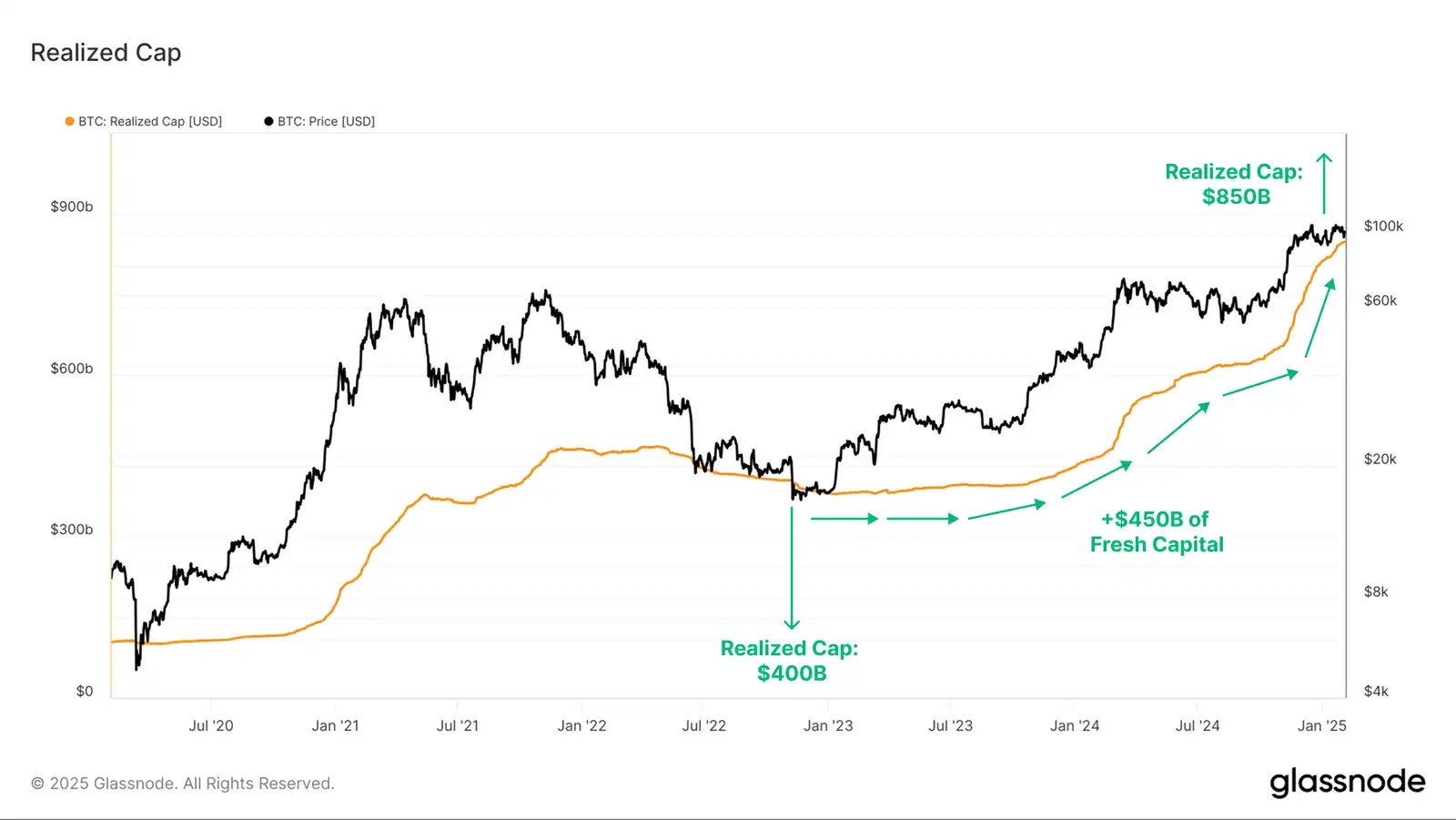

As asset valuations and weights reach such large scales, so will inertia. Chain reaction is thatBitcoin now requires significant new capital inflows to achieve continued growth in its market value。To explore this idea, we can use the realized market value indicator, which measures the cumulative net inflow of capital into digital assets.

If we use the cyclical low set in November 2022, when the realized market value was US$400 billion, Bitcoin has since absorbed approximately + US$450 billion in additional capital inflows, which is more than twice the realized market value.

This reflects that the total value of “stored” in Bitcoin is approximately US$850 billion, and each token is priced based on its price last time it was traded on-chain.

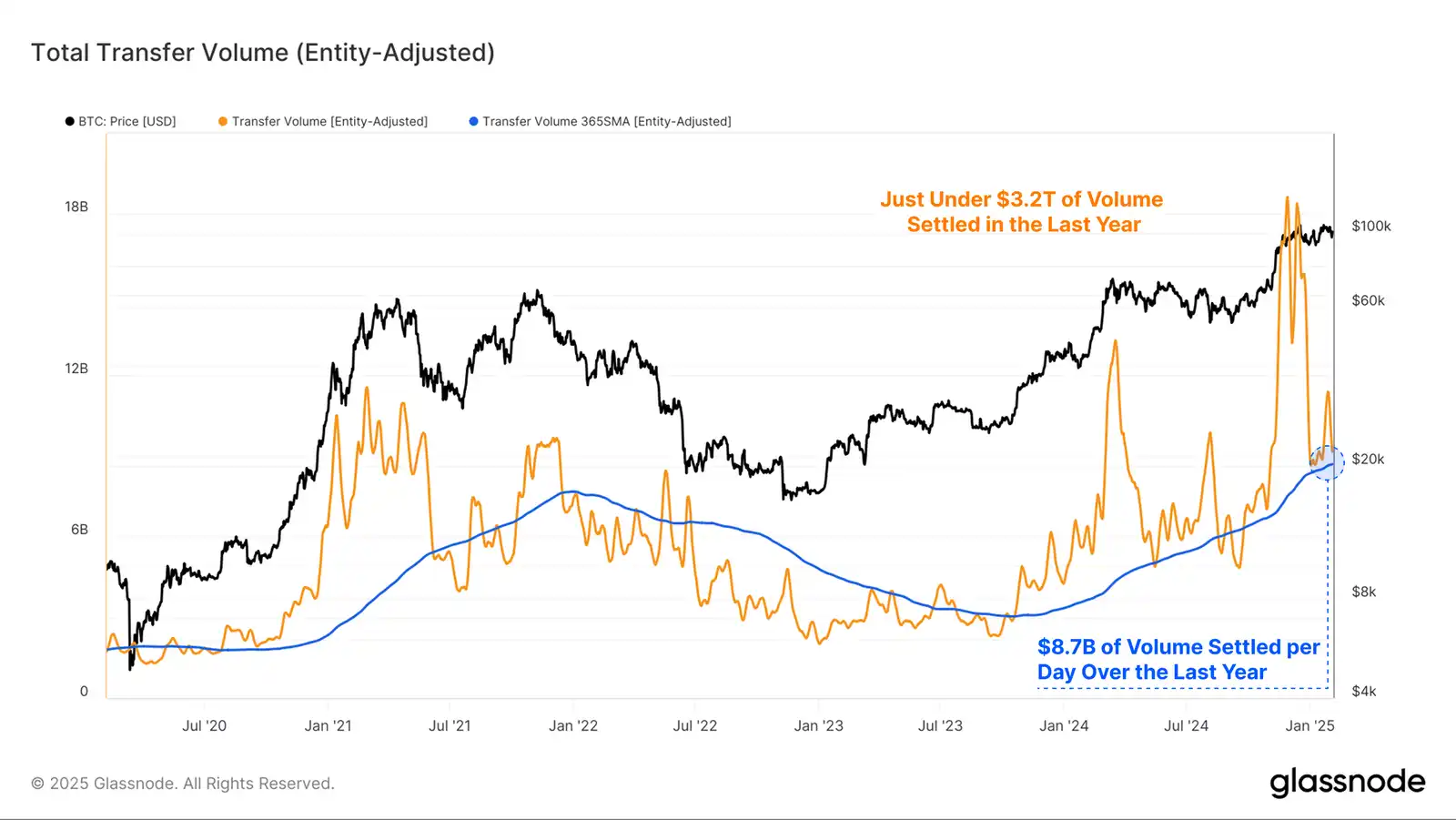

Although BTC is often seen as an emerging value store asset, the Bitcoin network can also serve as a decentralized track for BTC as a medium of exchange. The combination of nodes and miners allows any individual or entity to settle payments across borders without the interaction of a third-party intermediary.

When Glassnode’s entity adjustment heuristic was used to screen transactions, the Bitcoin network processed an average of $8.7 billion per day over the past 365 days, with the total value transferred over the past year reaching $3.2 trillion.

The actual market value and economic volume of Bitcoin’s online settlement provide empirical evidence that Bitcoin has both “value” and “utility,” challenging critics ‘assumptions that Bitcoin has neither value nor utility.

relative dominance

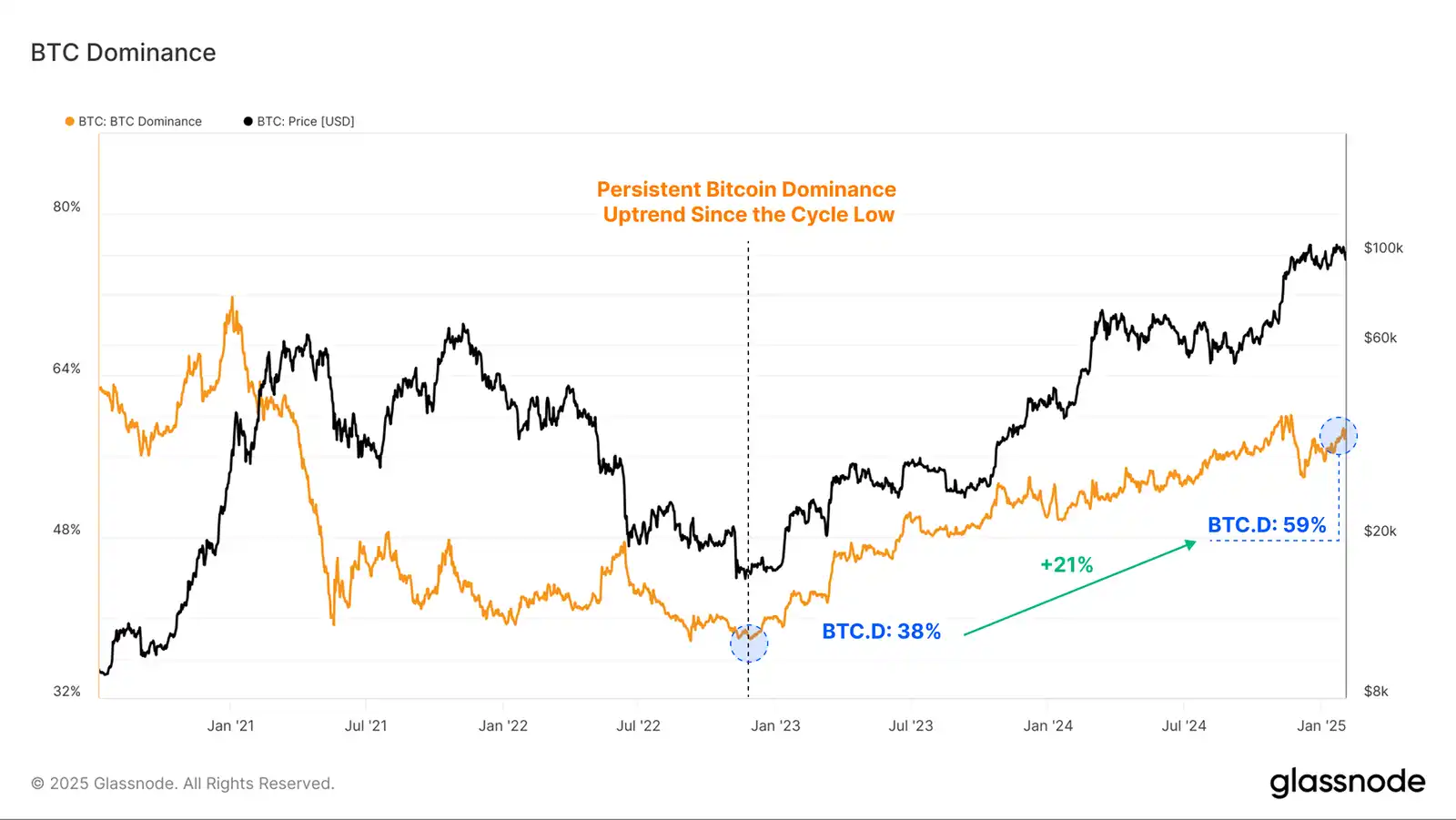

After determining the growing importance of Bitcoin as a macro asset, we can shift the focus internally and analyze its dominance relative to the broader digital asset ecosystem.

Since the FTX crash in November 2022, Bitcoin’s dominance has been on a continuous upward trend, rising from 38% to 59%. This suggests that in the digital asset space, Bitcoin’s net rotation and value accumulation take precedence over other assets.

This may be due in part to the broader access provided by U.S. spot ETFs to institutional capital. Bitcoin, as a scarce asset, has a clearer core narrative, with many people holding Bitcoin as a hedge against the devaluation of global fiat currencies.

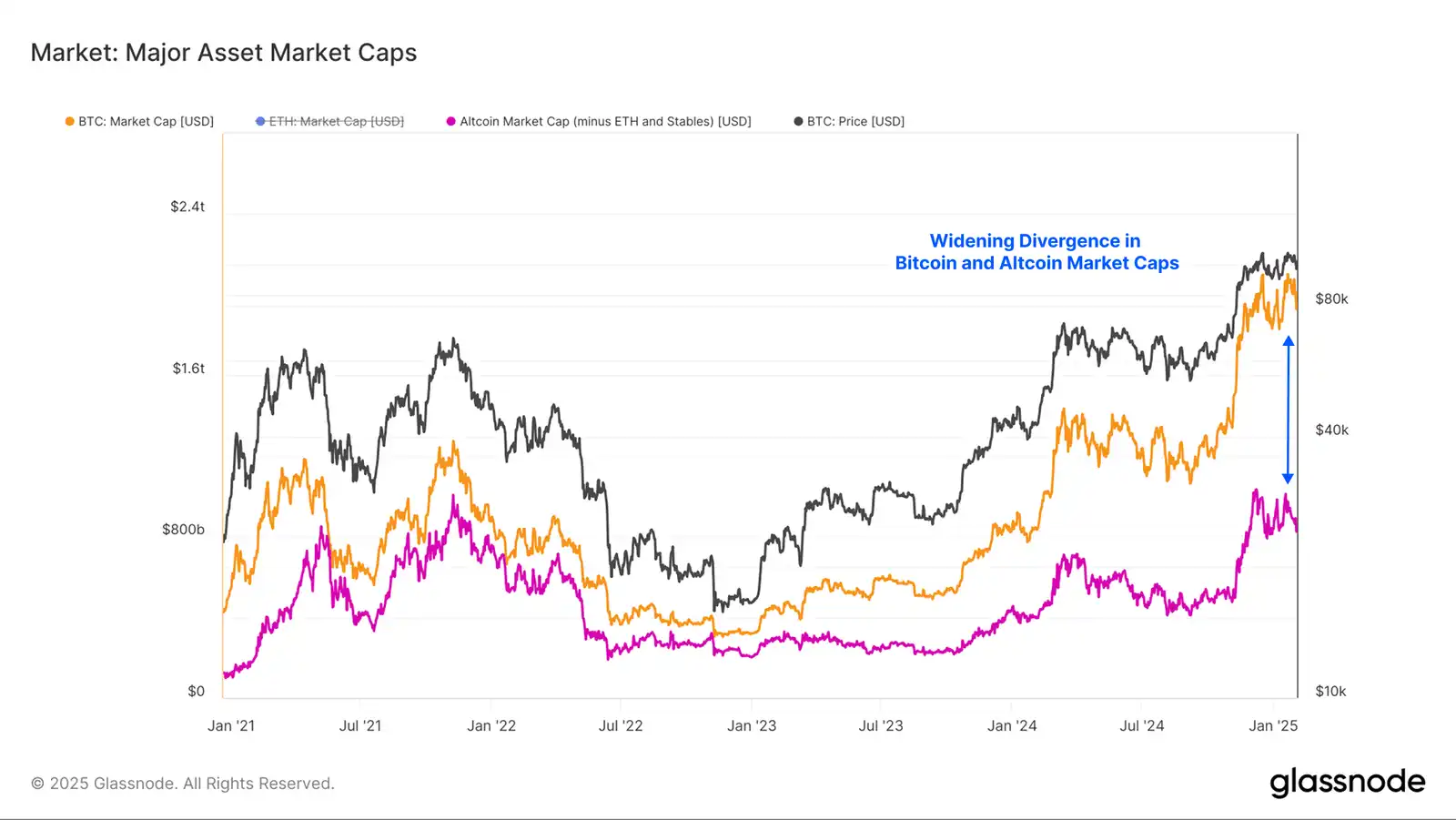

When we compare the market capitalizations of Bitcoin and various altcoins (excluding Ethereum and stablecoins), we can see that the differences in valuation are widening. Anchoring ourselves again at a 2022 low, we can compare market value growth.

·Bitcoin market value: US$363 billion and US$1.93 trillion (5.3 times)

·Market value of altcoins: US$190 billion and US$892 billion (4.7 times)

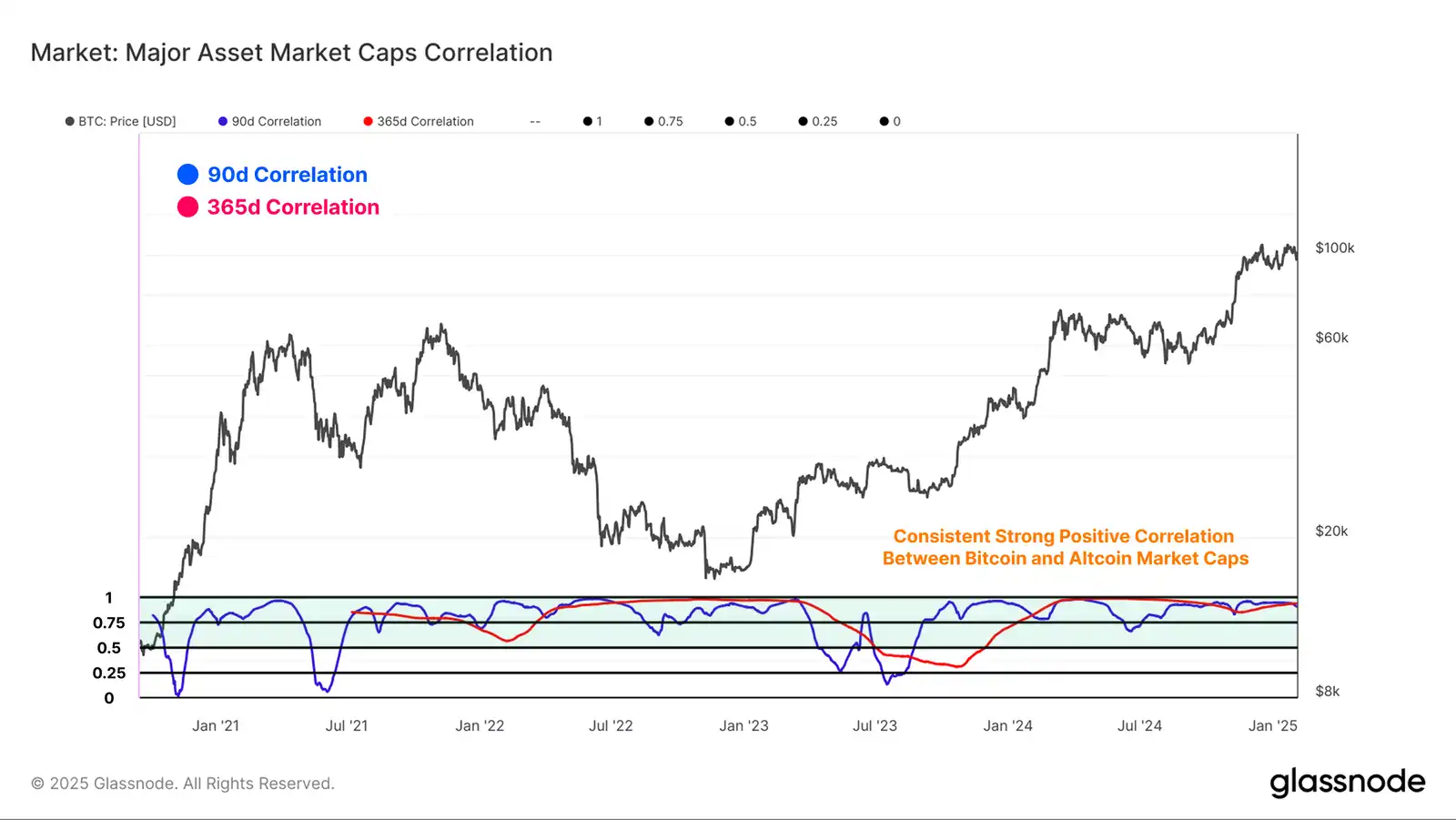

Although there are differences in the valuation sizes of bitcoin and altcoin, the correlation between the two is still strong. This suggests that the reason for this difference is not the growth rate between the two, but the huge difference in capital entering Bitcoin compared to capital entering the altcoin space.

Although Bitcoin continues to receive most of its capital from investors, it can be expected thatBitcoin’s dominance will continue to rise(A reversal in this indicator is a signal that capital is rotating in the other direction).

Where are the new needs?

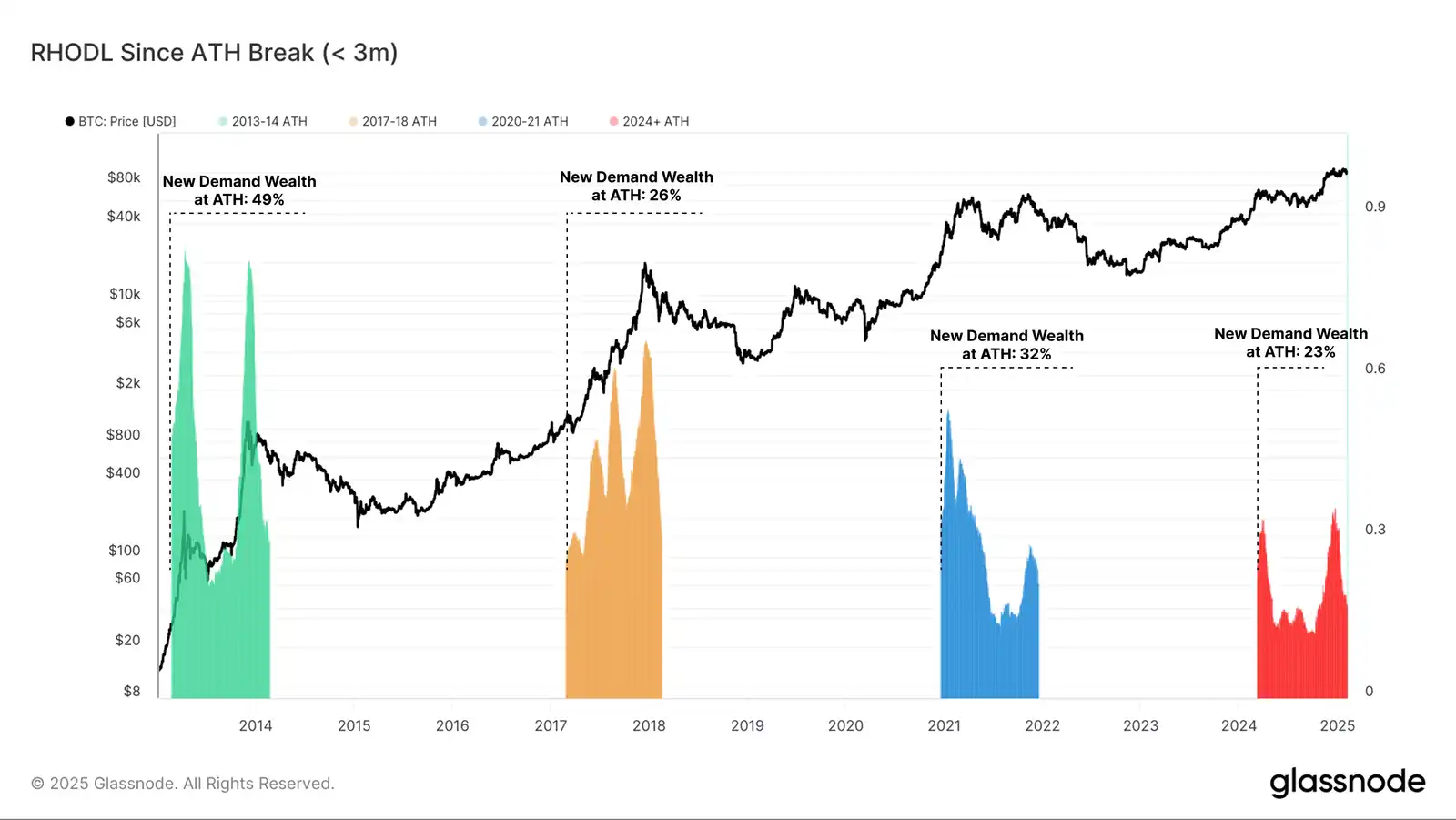

As the price of BTC breaks the $100,000 mark, people expect exposure to Bitcoin to increase significantly.We can assess this by assessing the percentage of network wealth represented by tokens purchased less than 3 months ago. The chart below plots the change in this indicator over the 12 months after breaking through the new cyclical ATH.

While the new demand in this cycle is meaningful, the wealth held by 3-month-old tokens is much lower than in previous cycles. This suggests thatThe scale of the inflow of new demand is not uniform and appears to be sudden and peak rather than continuous.

Interestingly, all previous cycles ended about a year after the first ATH breakthrough, highlighting the atypical nature of our current cycle, which first reached the new ATH in March 2024.

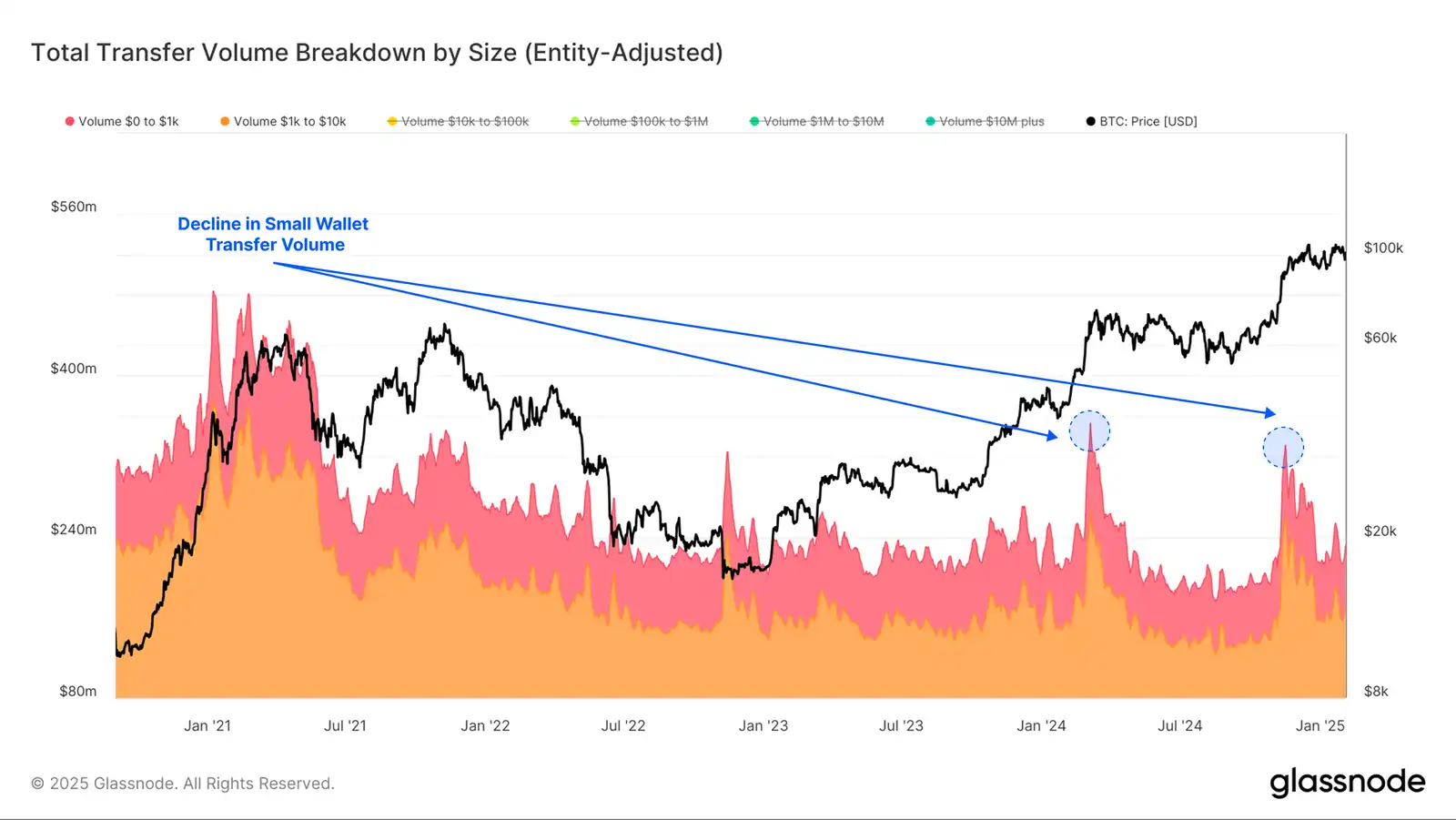

If we separate transfers in small wallets (less than $10,000), we can see a significant decline compared to the peak level in 2021. Although overall settlement volume increased significantly this cycle and Bitcoin prices also increased significantly, this remains the case.

demonstrating a New demand for BTC is mainly dominated by large entities rather than small retail entities.

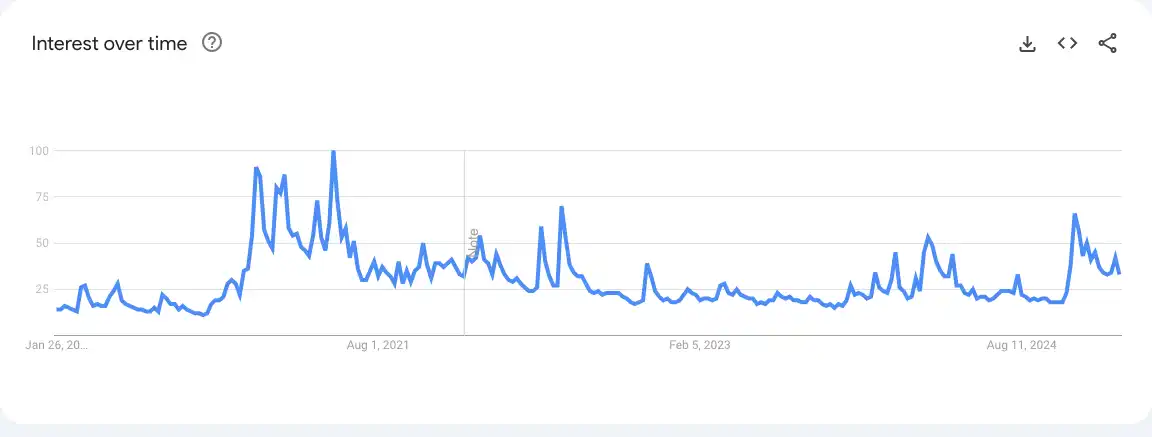

We can also use other data sets to support our arguments. Despite the many favorable factors for this asset, the search intensity has not yet reached the feverish levels seen during the 2021 bull market.

Evolving investor base

Although the structure and consensus code of the Bitcoin protocol are basically fixed, the market’s response to it is an evolving and dynamic process. The regulatory environment continues to change, and new financial instruments such as derivatives and ETF products continue to evolve around it. As the Bitcoin environment evolves, the composition of Bitcoin investors is constantly changing, which is most evident during this cycle.

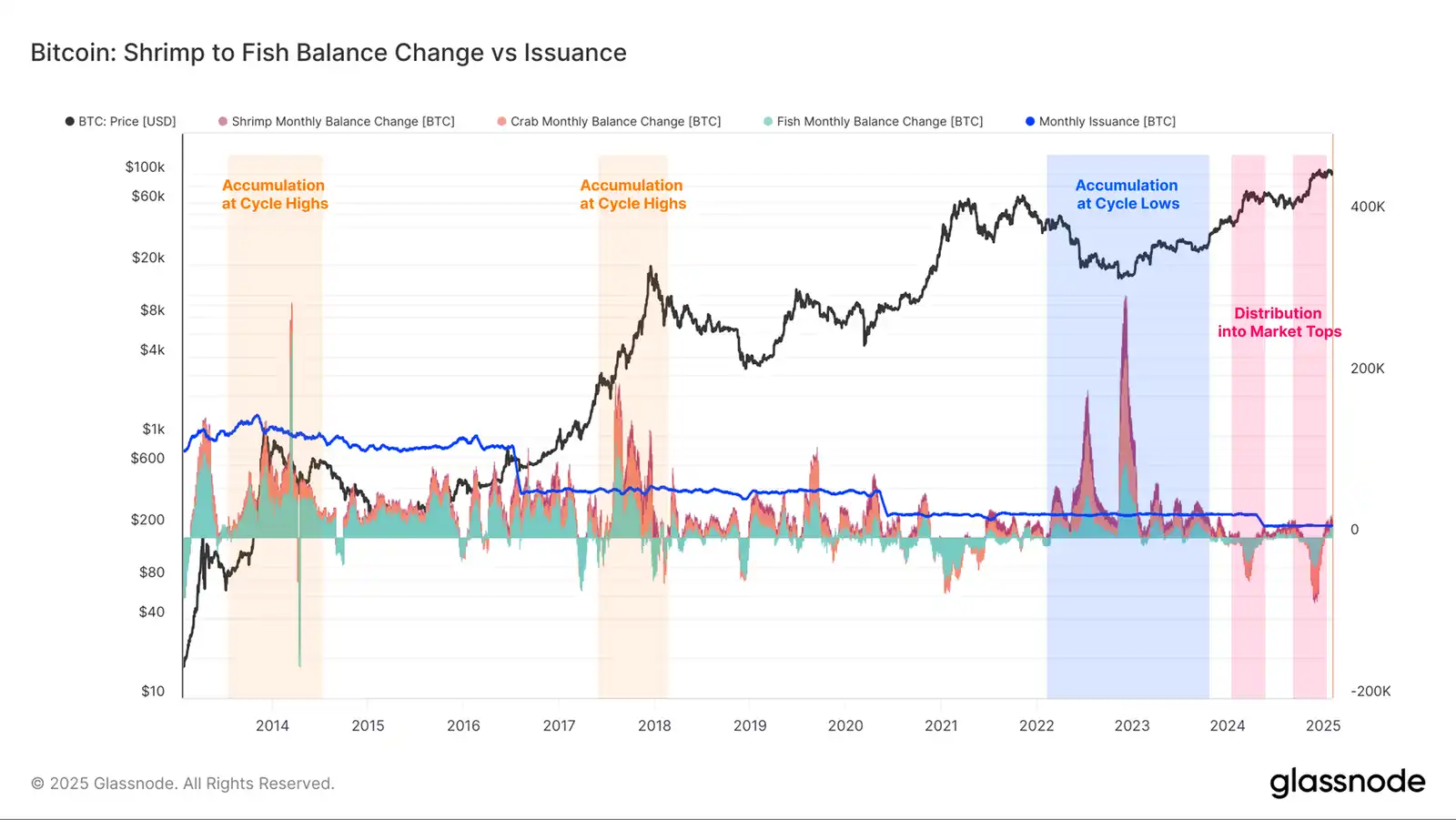

When the balances of smaller entities (retail investors holding 10 BTC) change, we have noticed significant changes in behavioral patterns in recent years.

During the bull markets of 2013 and 2017, we can identify periods of large token accumulation among these groups, which is often synonymous with “exciting top purchases.” This pattern seems to break the cycle, with smaller entities accumulating more violently during adjustments and pullbacks, and then transitioning to allocation as the market rebounds to new highs.

This suggests that even among those groups of investors that are typically considered retail investors, there is a more mature and well-educated group of investors.

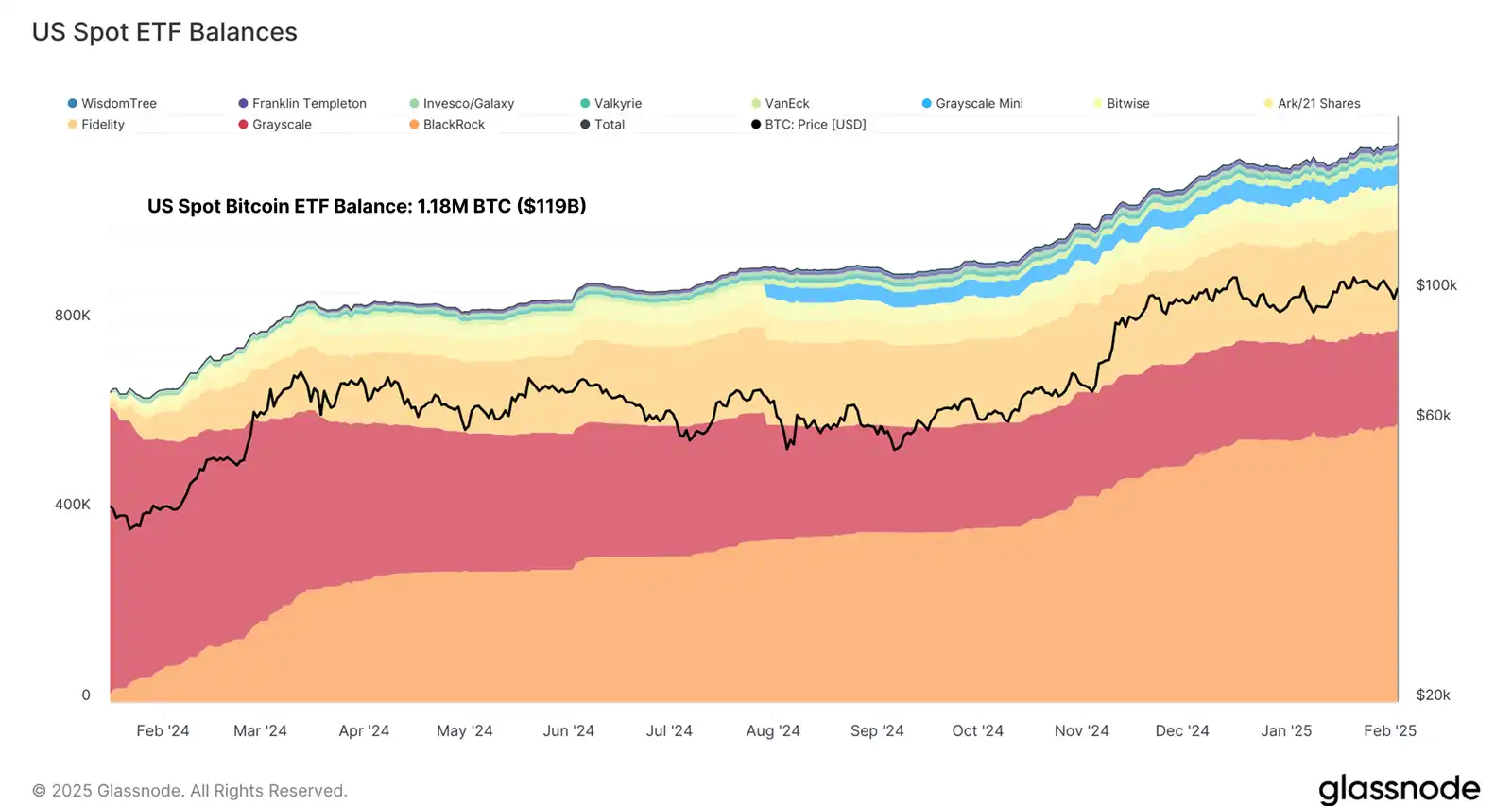

The launch of the U.S. Spot ETF Bitcoin tool also provides institutional investors with new investment channels, providing them with regulated Bitcoin investment opportunities. This has boosted potential institutional capital flows, with net inflows to ETFs exceeding US$40 billion and total asset management exceeding US$120 billion in the 12 months since launch.

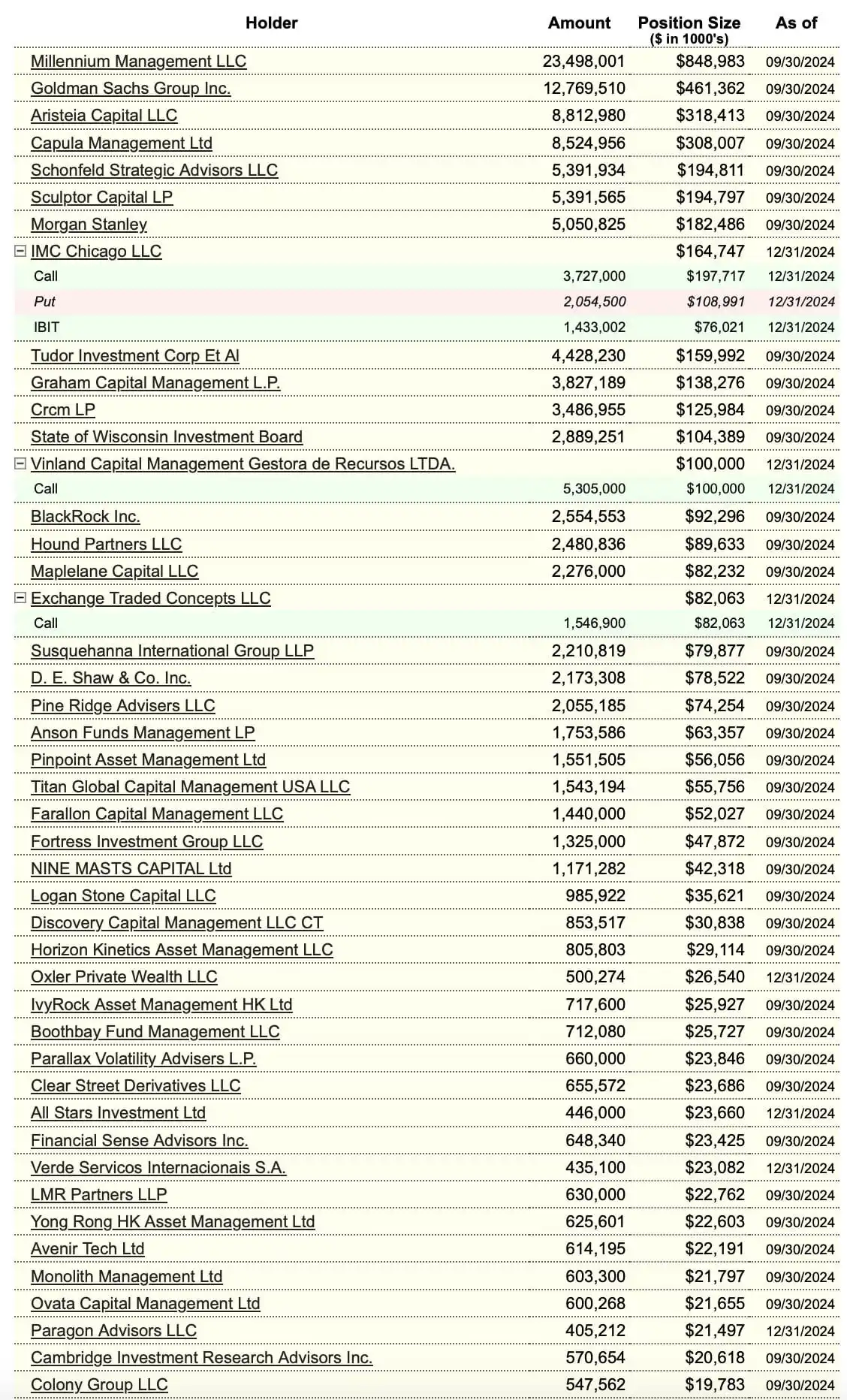

If we delve into the IBIT investor capital sheet (as described by analyst TXMC), we can clearly see signs of increased demand from institutional investors. this further provesBitcoin is attracting an increasingly mature investor base。

Controlled Downward

One of the many advantages of on-chain data is that it can help us analyze investor behavior during periods of stress, such as pullbacks and downturns.

When we assess the actual losses locked in during bull markets, our current cycle remains the most conservative. The only prominent event in which Bitcoin holders suffered significant losses was the yen arbitrage liquidation on August 5. In addition, the losses remain relatively small, indicating that the investor community is more patient, more resilient and less sensitive to prices.

This is very different from the previous cycle structure, which was characterized by multiple partial selling periods. The period from 2019 to 2022 was more turbulent and experienced several deep and serious selling events, such as the PlusToken liquidation in mid-2019, the COVID-19 sell-off in March 2020, and the massive migration of miners in mid-2021.

Bitcoin’s volatility is also in a changing state, with actual volatility at historically low levels in a bull market. Real volatility in the three-month rolling window of this cycle is usually below 50%, while in the previous two bull markets, real volatility often exceeded 80% to 100%.

This reduced volatility, coupled with a relatively calm investor base, is reflected in a more stable price structure. So far, the 2023-25 cycle has basically been a series of stepped price movements (gains followed by consolidation).

We have also seen more controllable retracements, with the current cycle experiencing the shallowest average retracement since local highs of any cycle to date.

summary

Bitcoin continues to establish its status as a global macro asset.It is always available for trading, allowing investors to express their market views at any time of the day, while its deep liquidity allows investors to execute large-scale transactions.

In response to criticism of Bitcoin’s role as a store of value and medium of exchange, the network has attracted more than $850 billion in net capital inflows while processing nearly $9 billion in daily transaction volume.These data largely dispel doubts about these claims.

Recent regulatory changes in the digital asset ecosystem have prompted changes in the investor composition, resulting in an increasing number of mature institutional investors in the Bitcoin market.This more patient, more resilient, and less price-sensitive group of investors helps reduce retracements and reduce volatility.

original link