Author: Joshua Jake, founder of fomored news

Compiled by: Ashley, BlockBeats

Editor’s note: Ondo Finance launched the Layer 1 public chain Ondo Chain to promote RWA tokenization and DeFi integration. The chain uses license verifiers, built-in oracle machines and cross-chain bridges to enhance compliance and security. With the launch of institutional finance, demand for $ONDO tokens may increase significantly, which is worthy of attention.

The following is the original content (the original content has been compiled for ease of reading and understanding):

$ONDO has the potential to rank among the top ten altcoins.

With the launch of Ondo Chain, the practicality and demand of $ONDO will be further enhanced.

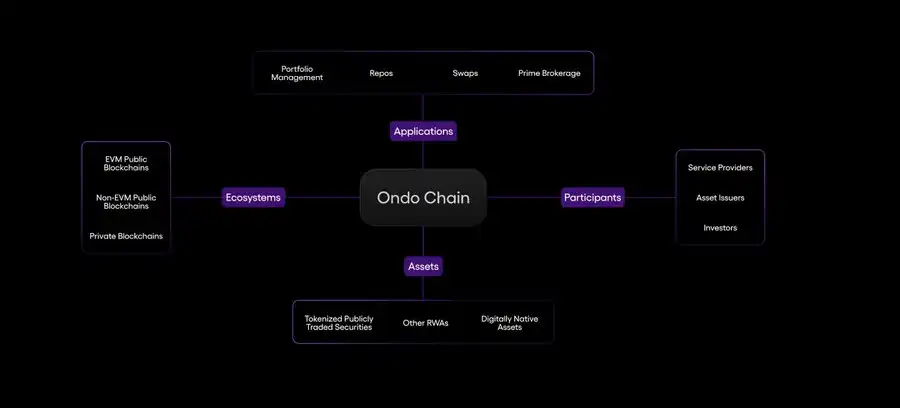

Ondo Chain: Layer 1 public chain in institutional financial markets

Ondo Finance officially launches Ondo Chain, a Layer 1 PoS public chain that aims to introduce institutional financial markets to Onchain.

The project is committed to integrating the transparency and accessibility of the public chain while meeting the compliance and security required by traditional finance.

RWA tokenization: Native support for real-world assets

Ondo Chain supports RWA tokenization, such as those issued by Ondo GM. These assets are seamlessly integrated into the blockchain ecosystem and can be used in applications such as network security, oracle and cross-chain bridges.

Verifiers will continue to verify the mortgaged assets of these tokens, enhancing market trust and reliability.

Verifier Mechanism: Institutional Security and Fairness

Ondo Chain uses a Permitted Validators mechanism to ensure network integrity and meet organization-level standards.

These verifiers are subject to continuous monitoring to prevent malicious behavior, creating a fair and safe environment for institutions with extremely high transaction standards.

These validators will be operated by selected financial institutions to seamlessly connect Ondo Chain with the traditional financial system, reducing transaction delays and providing more asset and liquidity support.

Built-in oracle: real-time synchronization of Offchain key data

Ondo Chain introduces Enshrined Oracles (built-in oracle), which allows validators to publish key Offchain data (including asset prices, interest rates, etc.) to Onchain.

This mechanism ensures the accuracy, credibility and real-time nature of data on the chain and reduces the risks of information manipulation and transaction errors.

Ondo Bridge: Secure cross-chain asset transfer

The blockchain also integrates Ondo Bridge to support secure cross-chain token transfer and messaging. Primary security is provided by Ondo Chain Verifier through a decentralized authentication network to enhance the security and reliability of cross-chain interactions.

The verifier will automatically verify with the custodian or broker dealer to ensure that all RWA tokens are supported by sufficient off-chain assets, thereby improving transparency, reducing fraud risks, and enhancing market confidence.

Although verifiers are permission-based, Ondo Chain is still open to all developers, allowing anyone to issue tokens, build apps, or participate in the ecosystem as a user and investor.

User identification and rights management is one of the core functions of Ondo Chain, which enables appropriate access control at the smart contract level.

DeFi Ecosystem: RWA’s application in lending, mortgage and other fields

Developers can natively support RWA DeFi applications on Ondo Chain, making these assets available for lending, pledge and other scenarios, further expanding their practicality in the DeFi ecosystem.

The launch of Ondo Chain is a milestone in the integration of traditional financial assets and blockchain. It solves many obstacles to existing infrastructure and paves the way for a more open, efficient and inclusive financial system.

Impact on $ONDO

As a native token of the Ondo ecosystem,$ONDO will play a key role in network operations, governance and transaction fees.

As Ondo Chain’s adoption rate increases in RWA tokenization and DeFi development, demand for $ONDO tokens may also increase significantly, which will have a positive impact on their value.

In addition, the integration of RWA and the strengthening of compliance and security may attract institutional investors to participate, further consolidating $ONDO’s position in the market.

“Original link”