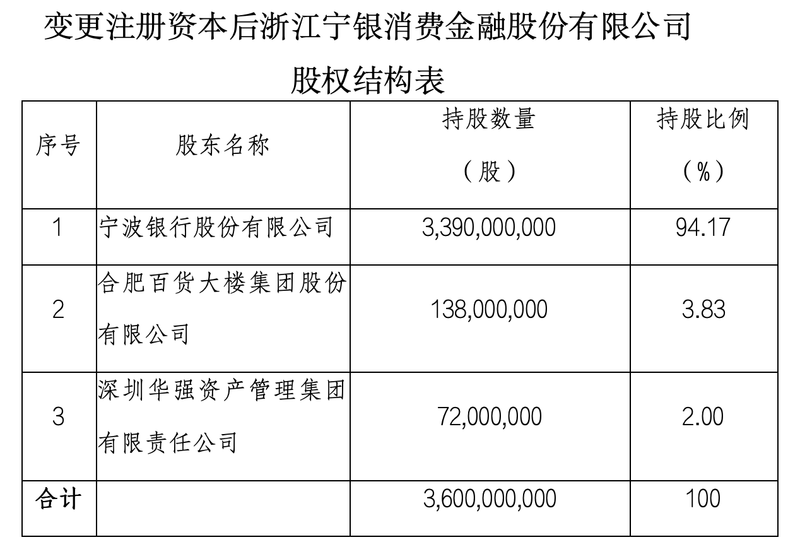

After the change in registered capital, the shareholding ratio of Ningbo Bank, the major shareholder of Ningyin Xiaojin, will increase to 94.17%, while the shareholding ratio of the other two shareholders will decrease slightly.

Ningyin Consumer Finance approved to increase capital to 3.6 billion yuan

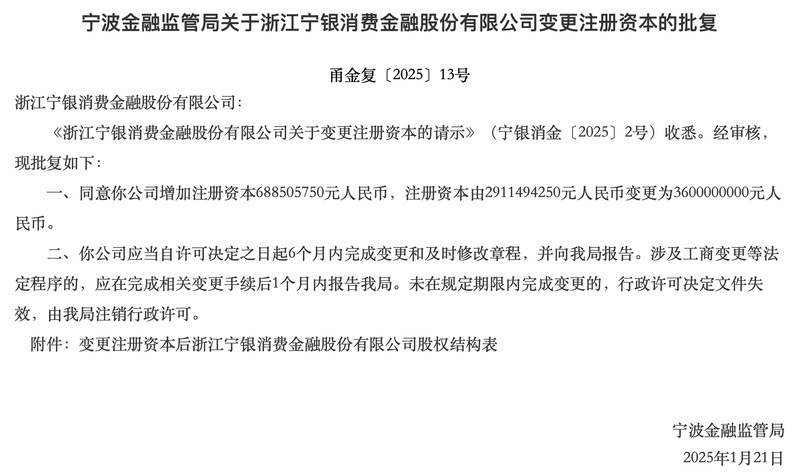

Blue Whale News, February 10 (Reporters Huang Yujie and Zhang Shuwei)Recently, the Ningbo Financial Supervision Bureau approved the change of registered capital of Zhejiang Ningyin Consumer Finance Co., Ltd.(hereinafter referred to as Ningyin Xiaojin), agreeing to increase the capital of Ningyin Xiaojin to 3.6 billion yuan. Changes to industrial and commercial information have not yet been completed.

According to the reply, the Ningbo Financial Supervision Bureau agreed to increase the registered capital of Ningyin Xiaojin by 688505750 yuan (approximately 689 million yuan), and the registered capital will be changed from 2911494250 yuan (approximately 2.911 billion yuan) to 360 million yuan (3.6 billion yuan).

After changing the registered capital, the shareholding ratio of Ningbo Bank, the major shareholder of Ningyin Xiaojin, will increase to 94.17%. The shareholding ratio of the other two shareholders, Hefei Department Store Group Co., Ltd. and Shenzhen Huaqiang Asset Management Group Co., Ltd., will be changed to 3.83%, 2%.

It is worth mentioning that the approved equity structure this time is different from previous plans. On April 9 last year, Bank of Ningbo announced that it and Ningbo City Financial Holdings Co., Ltd. planned to jointly increase capital in Ningyin Xiaojin, and expected that after the completion of this capital increase, the registered capital of Ningyin Xiaojin will increase to 4.5 billion yuan. Among them, the bank holds 75.33% of its shares, Ningbo Financial Holdings holds 20% of its shares, Hefei Department Store Group Co., Ltd. holds 3.07% of its shares, and Shenzhen Huaqiang Asset Management Group Co., Ltd. holds 1.6% of its shares.

Ningyin Xiaojin, formerly known as Huarong Consumer Finance, was established in January 2016 with an initial registered capital of 600 million yuan. In 2022, it was sold by China Huarong to Bank of Ningbo.

According to the official website of Ningyin Xiaojin, Ningyin Xiaojin currently provides a series of loan products for your loan. ldquo; Benefiting Loan is a guaranteed, pure credit loan product launched by Ningyin Xiaojin. The maximum amount is 200,000 yuan, and the annualized interest rate (simple interest) is 3.6%-14.6%. In addition, the company launched a series of white-collar financial products based on the characteristics of offline business customers, mainly for provident fund customers of employees of enterprises and institutions.

In terms of performance, in the first half of 2024, Ningyin Xiaojin achieved operating income of 1.537 billion yuan, an increase of 111.7% over the same period last year; net profit of 198 million yuan, an increase of 118.47% over the same period last year. As of the end of June 2024, the total assets of Ningyin’s consumption of gold were 53.798 billion yuan, an increase of 18.65% from the end of the previous year; the net loans and advances issued were 51.805 billion yuan, an increase of 24.31% from the end of the previous year.