After several years of development, Morpho has gradually become one of the best options for managing spare money and improving capital leverage.

Author: A Xiaohai

background

Morpho is one of my favorite projects in this cycle (it just recognizes the value of the agreement, not recommends buying coins). The code is praised for its simplicity and simplicity. It combines the elements of change management/traditional fund management, making it convenient for living money management and for people who need leverage needs.

Address: app.morpho.org/

We already talked about the safety of the project in the previous issue. If you want to earn a stable interest,Then based on your assets, find a Vault with high interest rates, deposit it, and the income is settled in seconds, and you can withdraw it at any time.

Today’s issue is mainly to let you figure out where your funds are going while you deposit, what key points you should pay attention to in the Vault you deposit, how your APY comes from and how to improve it (if you are interested).

INFO

There are some words used in the middle, but because the translation is different, I will keep the proper nouns in English to ensure that the meaning is correct.

basic mechanism

First of all, after Morhpo’s revision, the home page is clearly divided into Earn / Borrow, clearly define the needs of both users.

some concepts

Before starting, there are some concepts to understand first

-

Vault: Traditional loan agreements are classified by currency. When supplying, what currency you deposit and what the interest is, it is more like a bank. What is deposited in Morpho is a concept vault, which can be roughly understood as a certain type of fund, with an independent fund manager running a vault that helps you manage your funds.

AAVE

-

Curator: The administrator of the Vault is roughly understood as a fund manager. The person or organization that manages the Vault is the representative of risk control and strength. The main person who formulates the implementation strategy of APY.

-

Collateral: Collateral: Vault gets everyone’s money and goes out to lend it to earn interest. What is the collateral that is collected? This will be described in detail below.

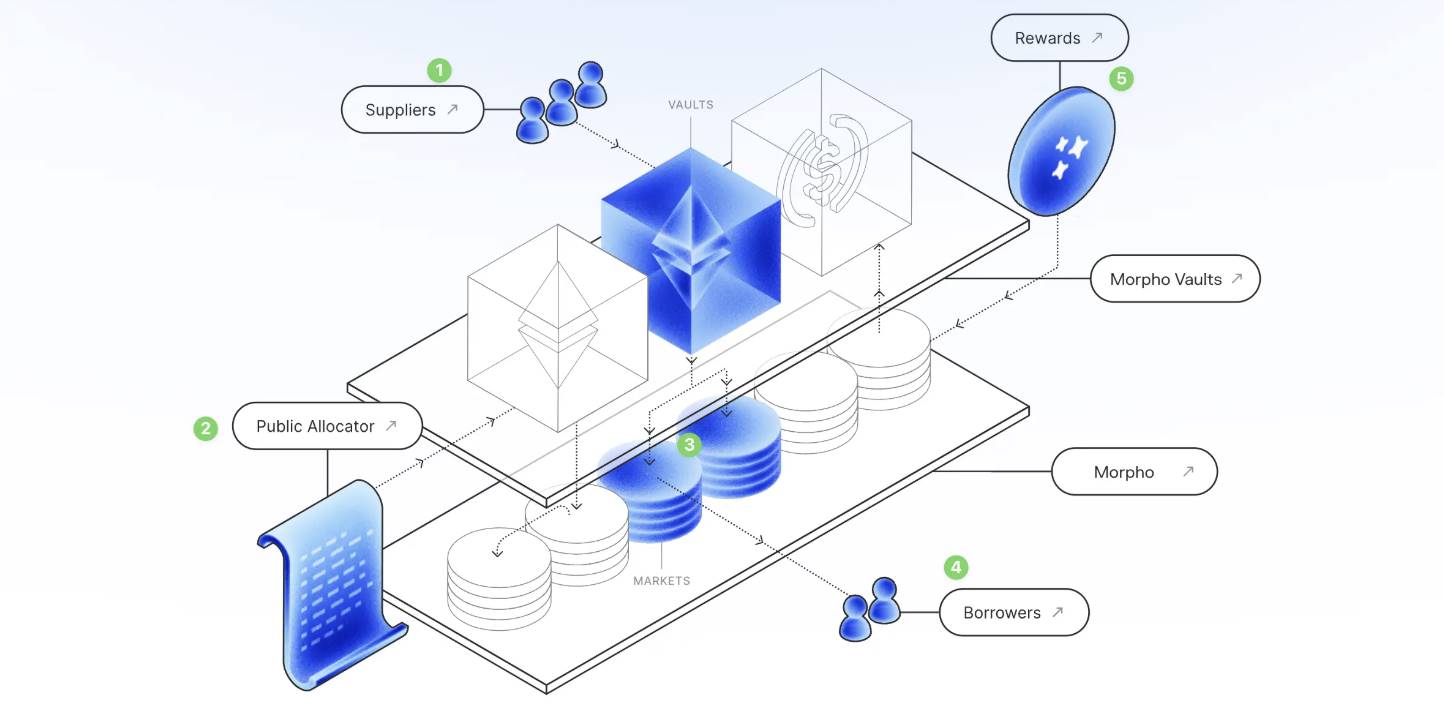

Revenue transfer mechanism

In the loan agreement, the borrower (Supplier), the interest ultimately comes from the borrower (Borrower), and Morpho is no exception. It is important to recognize this. Different from traditional loan agreements, you used to hand over the money to the agreement, and the agreement served as a matchmaker; here you handed over the money to the agreement. The agreement ensured the safety of the funds and then handed it to a fund, which helped you manage and lend. The relationship is simplified as follows. This is the picture on the front page of Morpho’s official document. If you look at it for a few seconds, you will understand the core of the entire agreement:

-

Supplier (Depositor), holding ETH / USDC and other assets, and depositing them into Morpho Vault from Earn

-

Through Public Allocator, an audited smart contract, Curator has secure access to funds

-

Vault allocates funds to the corresponding Market (full name Borrow Market, borrowing market)

-

Borrower mortgages assets from Borrow Market, lends money, and pays interest

-

Then the Reward mechanism allocates interest, etc., to the Market and vault

If you don’t understand, read it several times.

What distinguishes Morpho from traditional lending is:

-

In addition, the risk fluctuations of traditional lending of a single asset may affect the entire agreement. For example, an accident on one asset may lead to other bad debts, while Morpho is isolated from each other (an accident in Vault A does not affect the safety of Vault B).

Understand Earn and Borrow

You can understand it from an example.

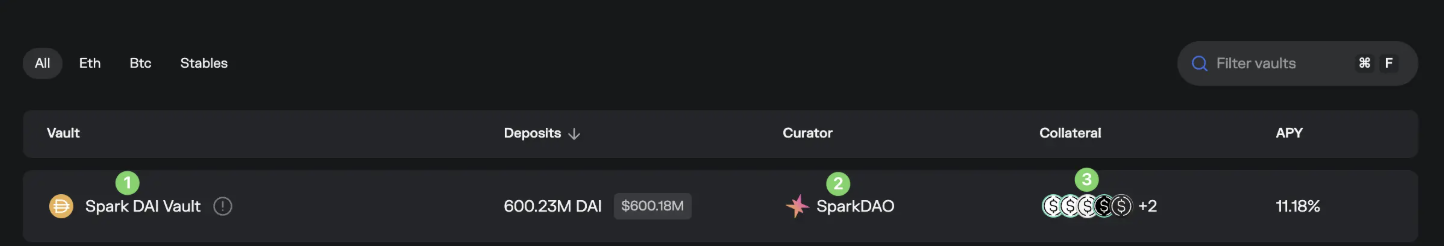

Interpretation of Earn parameters

https://app.morpho.org/ethereum/earn

First of all, Earn faces users who have spare money and want to earn interest, which is also the demand of most people. The vaults shown in this list are all officially whitelisted. In fact, anyone can create a Vault (Permissionless). You and your friends can create one if they are happy. The safety, use and transparency of funds are guaranteed by the bottom layer of Morpho, so you don’t have to worry about misappropriation. and vaults that are not whitelisted will not be displayed and searched on this homepage.

Let’s take MEV Capital Usual USDC Vault as an example and look at each parameter one by one. If you are not familiar with it, it is recommended to slow down.

-

USDC

-

MEV Capital: The Curator (administrator) of this Vault is generally a variety of institutions. You can search the qualifications, history, fund management scale, etc. of the corresponding institutions to better understand their risk management capabilities

-

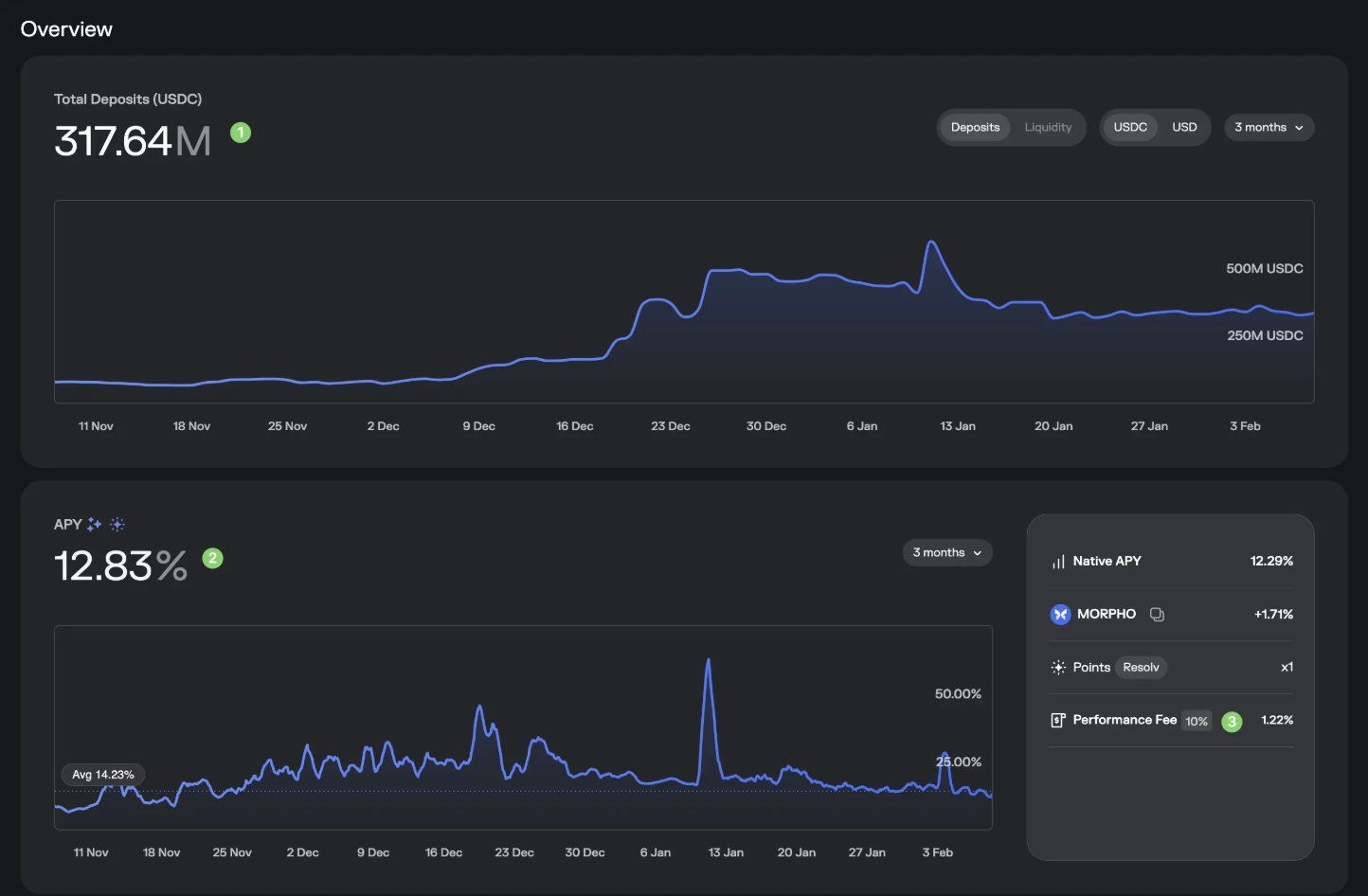

Total Deposits: How much money is currently deposited in this Vault? Here is 318M USDC

-

Liquidity: Residual liquidity, similar to bank reserves, is withdrawn from the balance here by those who want to withdraw money. This is 63M, which means that if you have saved 100M before, you can’t get away in one step. The following will talk about how the Morpho mechanism solves this problem.

-

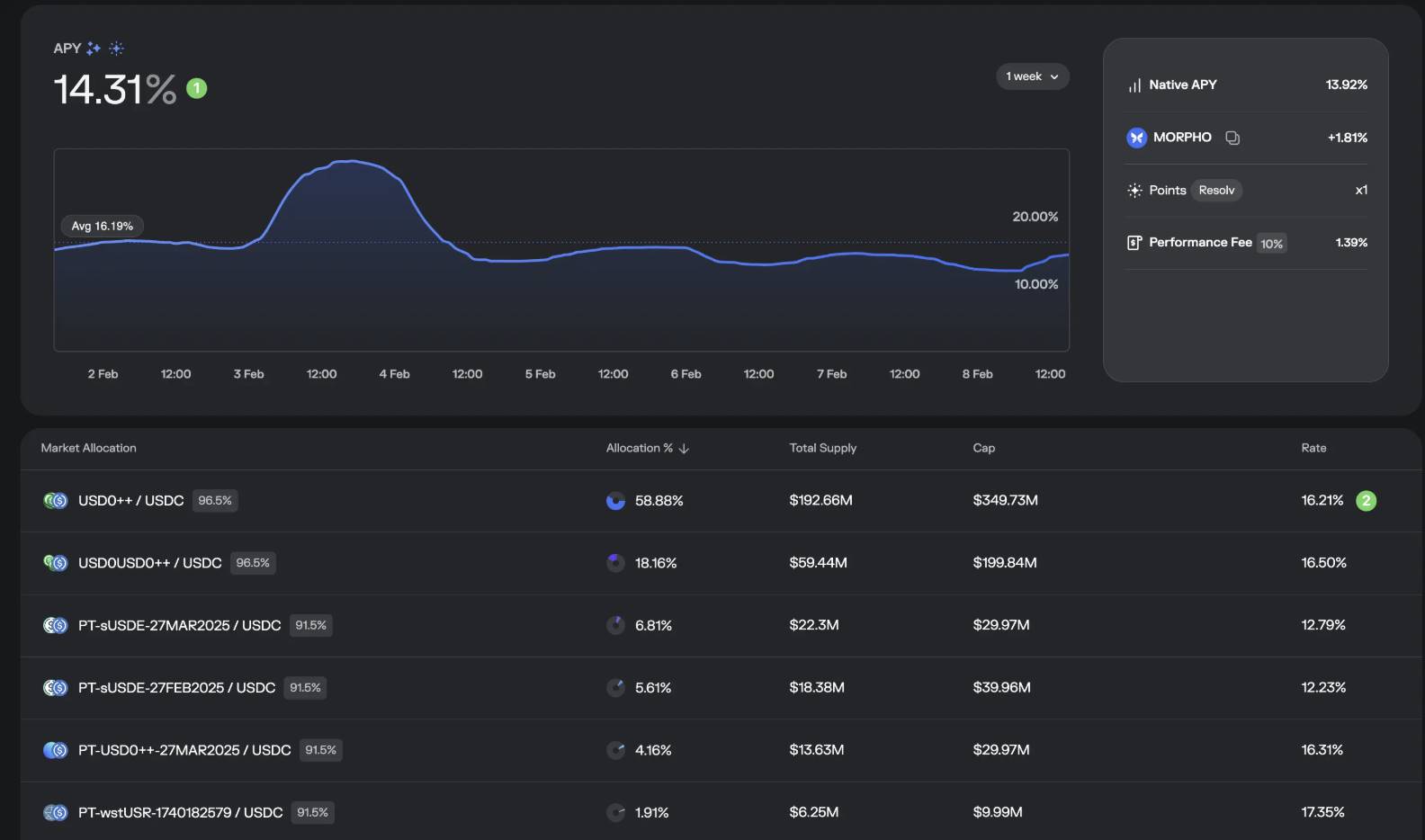

APY: The parameter that most people care about most. generally by Native APY + $Morpho token subsidy- Performance feeComposition, there may be other parameters. For example, these displays also include 1 points for Resolv projects, which may be exchanged for Resolv rewards one day.

-

Personal asset-related: How much money you have in your wallet, how much you deposit, and how much you expect to earn in a month/year.

Continue to look down on Overview

-

The first is the basic trend of deposited funds. You can switch views. If it drops rapidly, it means that risks may be growing. Pay attention to observing and protecting yourself.

-

Secondly, the basic trend of APY, where views can be switched

-

Performance Fee: APY Here is an indicator worthy of special attention. This is the performance fee of the Vault fund manager. It is extracted from your income. Here is 10%, which represents 10% of your income. It belongs to Vault Management. According to the current APY conversion, it is 1.22% discount.

Then look down on Market allocation

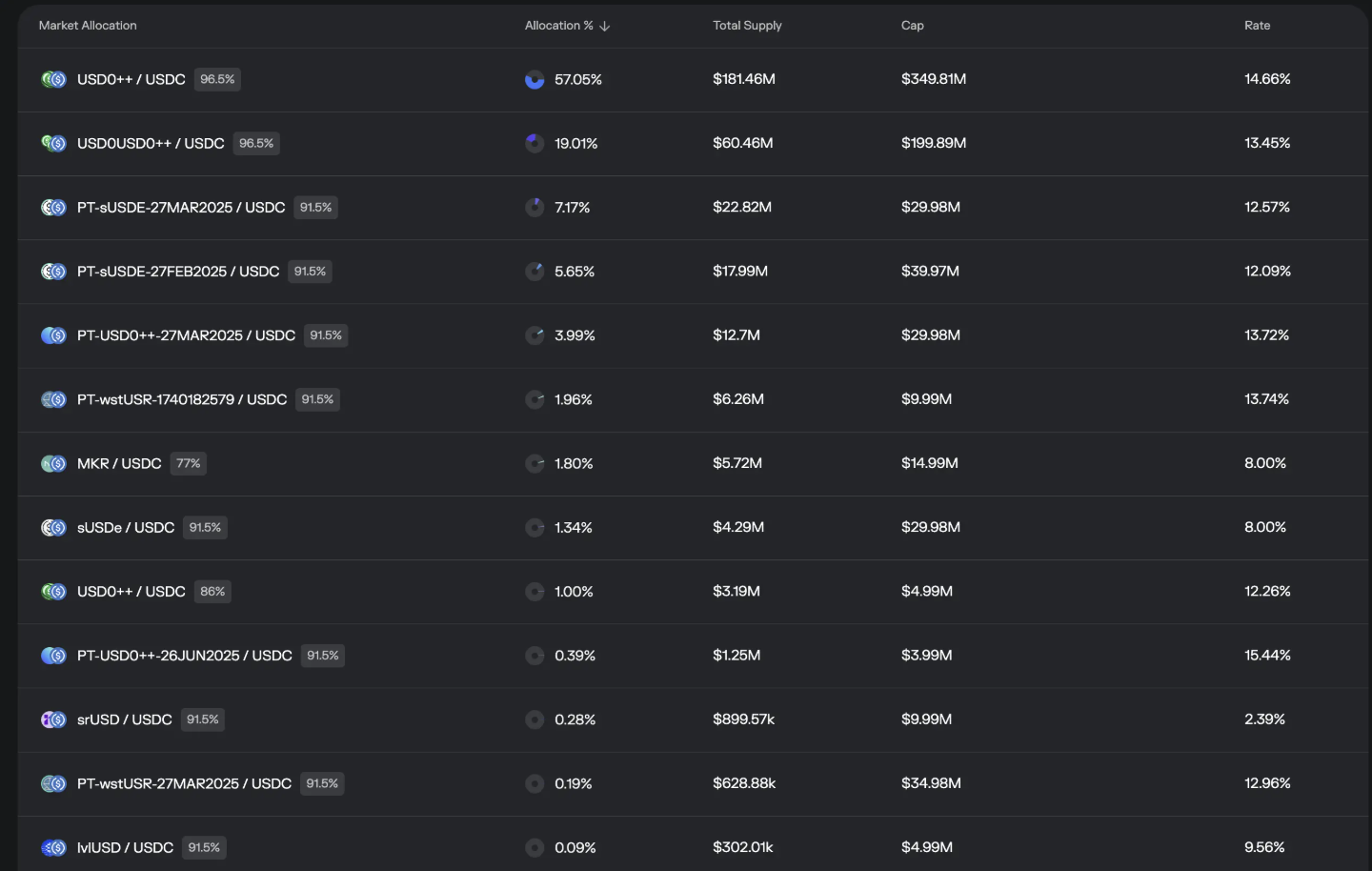

It is publicly shown here that the money you deposit is used to lend out those loans, which is your source of income. This is the attraction of decentralized funds, open and real-time.

As shown in the figure, let’s look at the first line. 57.05% of this Vault is in the USD0 ++ / USDC Market. This Market allows users to mortgage USD0 ++ to lend USDC, and the maximum margin interest rate is 96.5%. A total of 181.46M was supplied to it, the strategic upper limit was 349.81M, and the APY on the latest day was 14.66%.

Other markets have the same interpretation. At this time, you may wonder whether this part is the core source of risk for Vault, that is, what should we do if the collateral recovered by Vault becomes worthless? Indeed, this is the biggest source of risk for Morpho, not from the agreement itself, but from collateral.

Some time ago, USD0 ++ was unanchored. Although no actual financial damage occurred, panic spread, making the money that many people had saved unable to be withdrawn in a short period of time. Later, it was rescued after changing administrators actively injecting liquidity and changing markets.

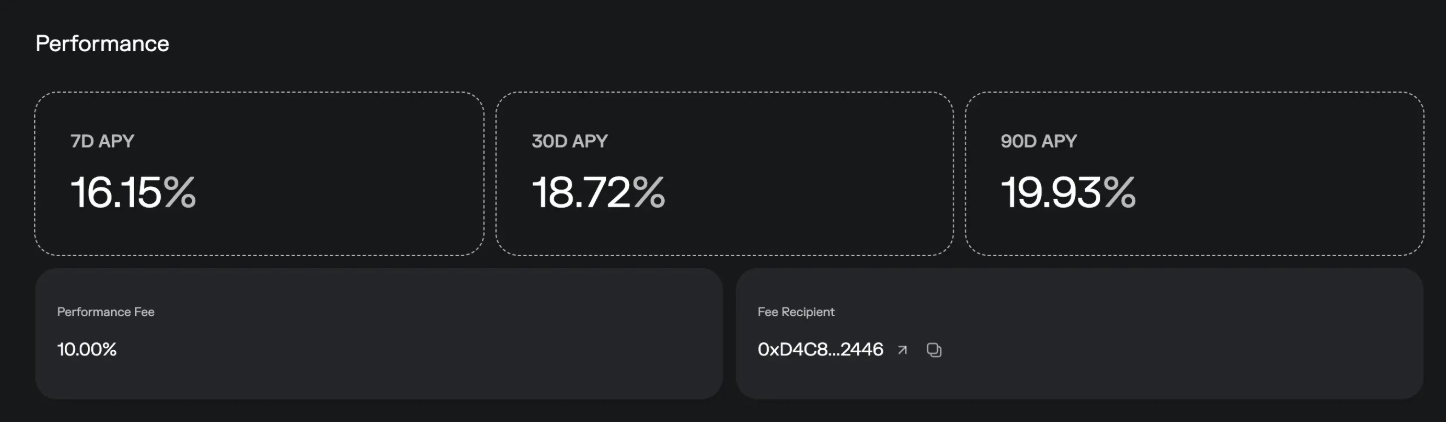

Then I saw Performance

There is nothing to talk about, but past performance and the collection address of performance fees.

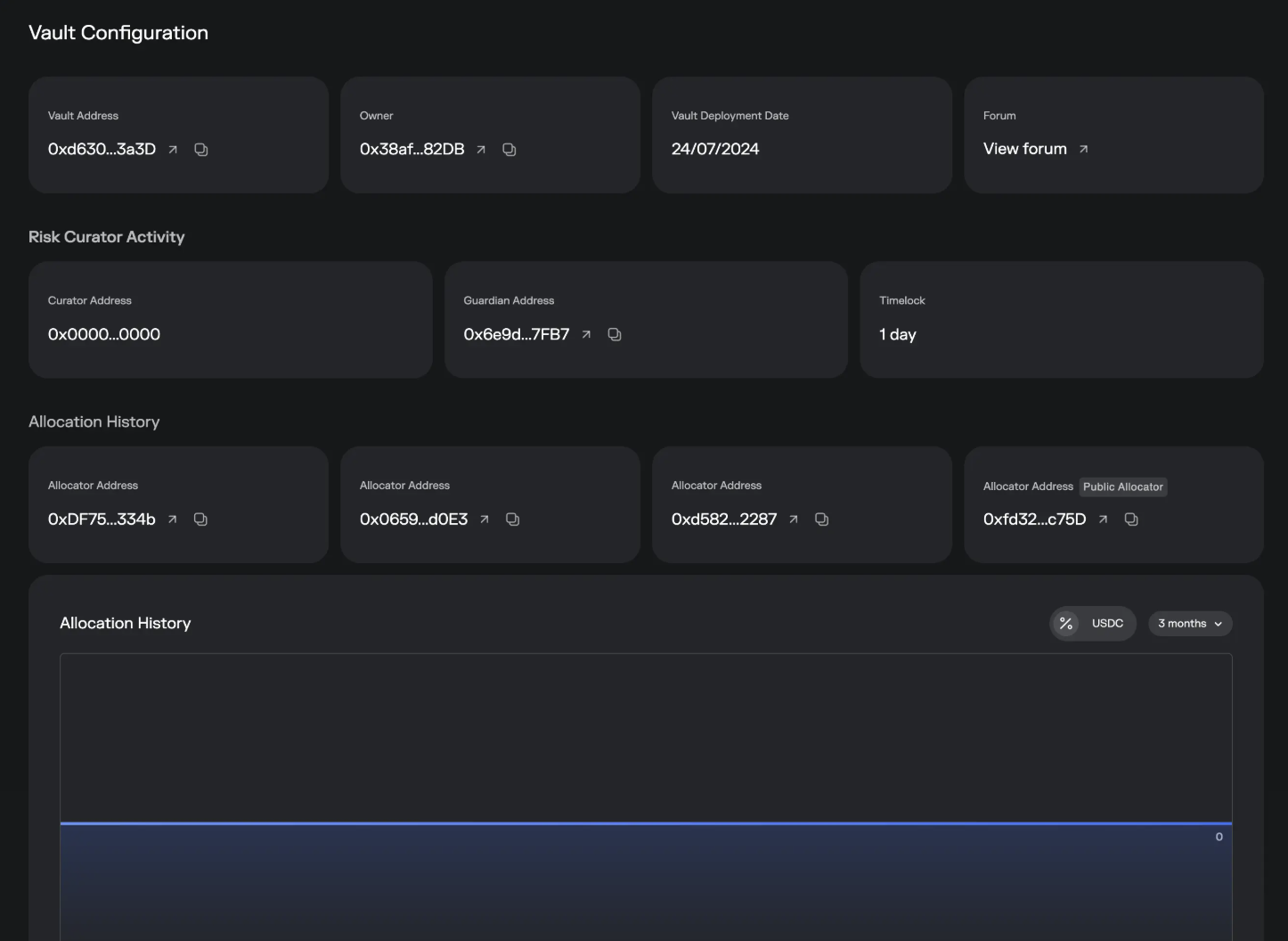

See Vault Configuration

Most of this part is transparency reporting information. For example, Guardian Address is used to monitor and disauthorize some risky operations of the Vault. www.gushiio.comlock is the shortest time you must wait when facing core changes. This time is the response time given to the market, Curator, and Guardian.

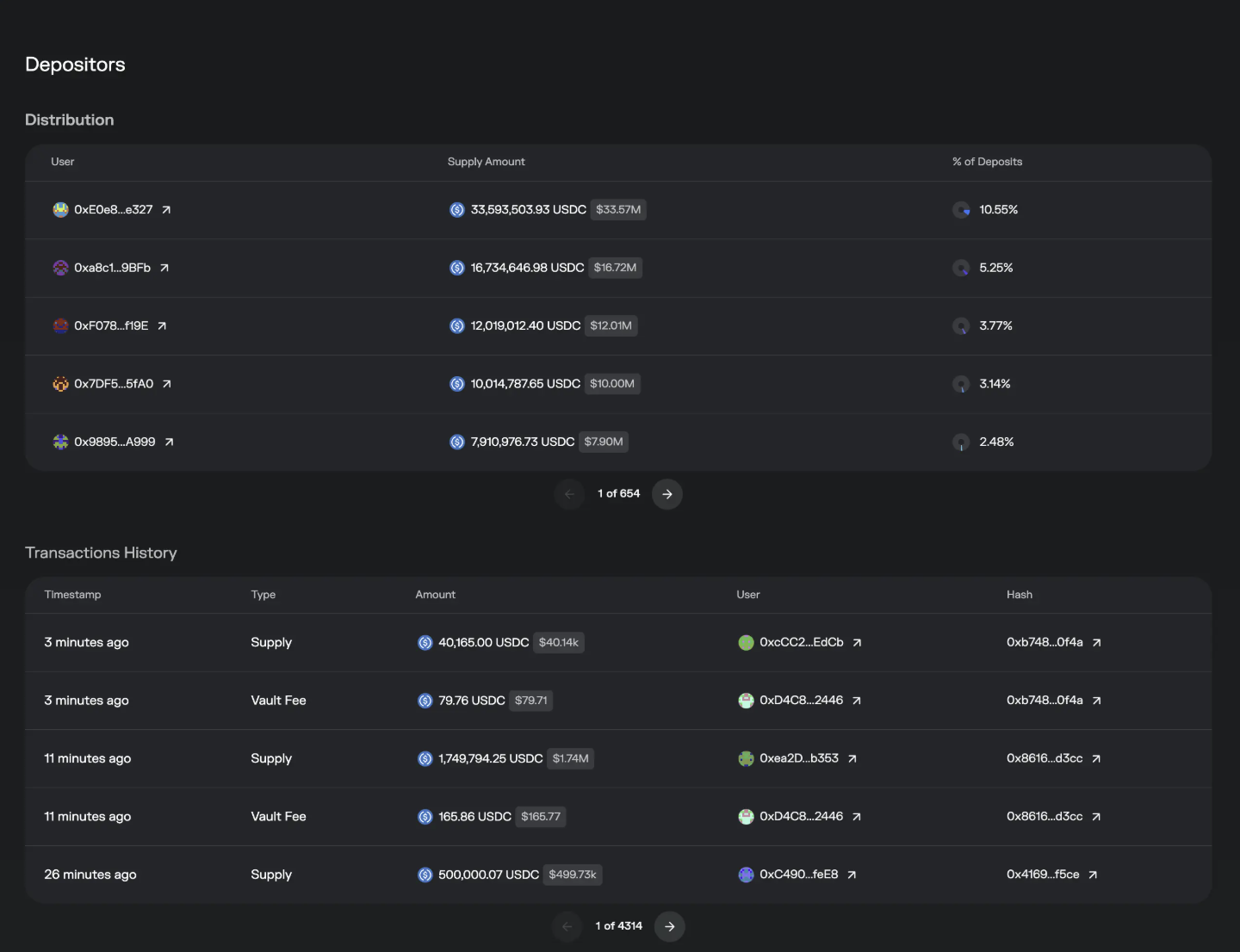

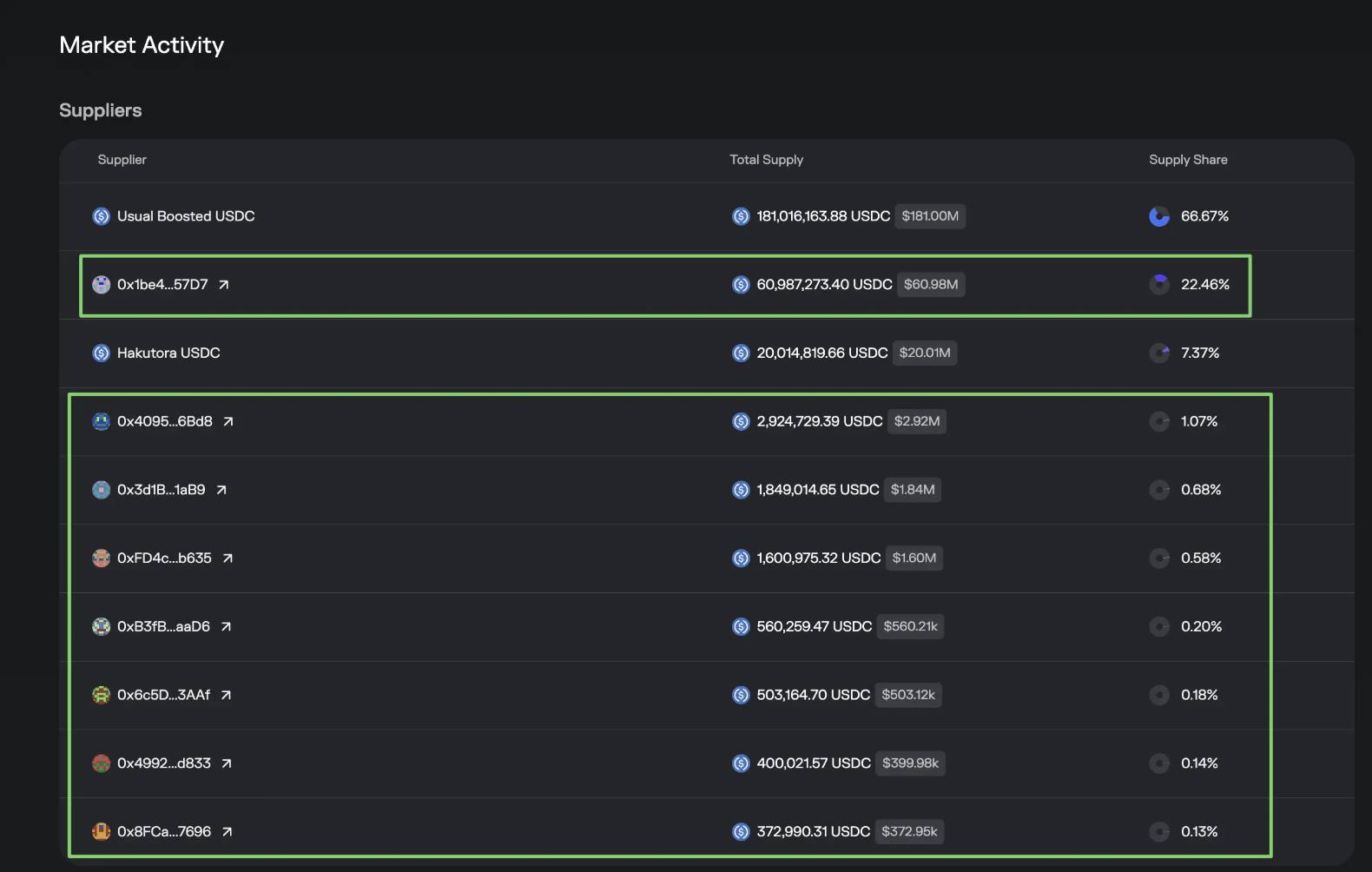

See Depositors

-

Distribution: How much money each user saves and what proportion it accounts for? Big households come first.

-

Transactions History: Here is everyone’s access dynamics. Careful friends will find that for every Supply / Withdraw transaction in the diagram, there will be a Vault Fee transaction at the same time. The mechanism here is: every time the user operates on the Vault, he will help Curator extract the performance fees he has earned from Morpho. This is also one of the reasons why gas directly interacting with Morpho is quite expensive.😂

That’s all Earn’s parameters.

Interpretation of Borrow Parameters

https://app.morpho.org/ethereum/borrow

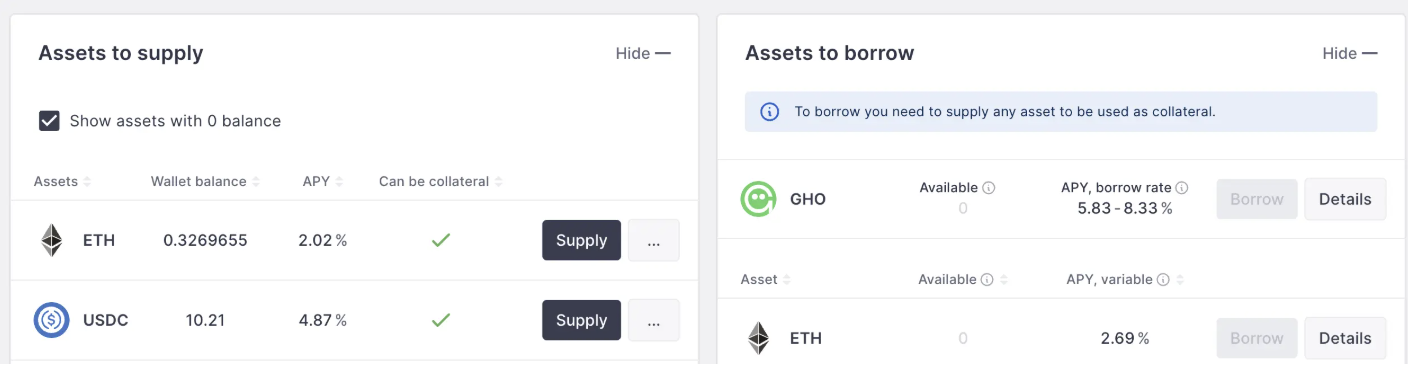

The pools in Borrow, which we call Markets, are generally provided to people who have revolving loans or other borrowing needs.

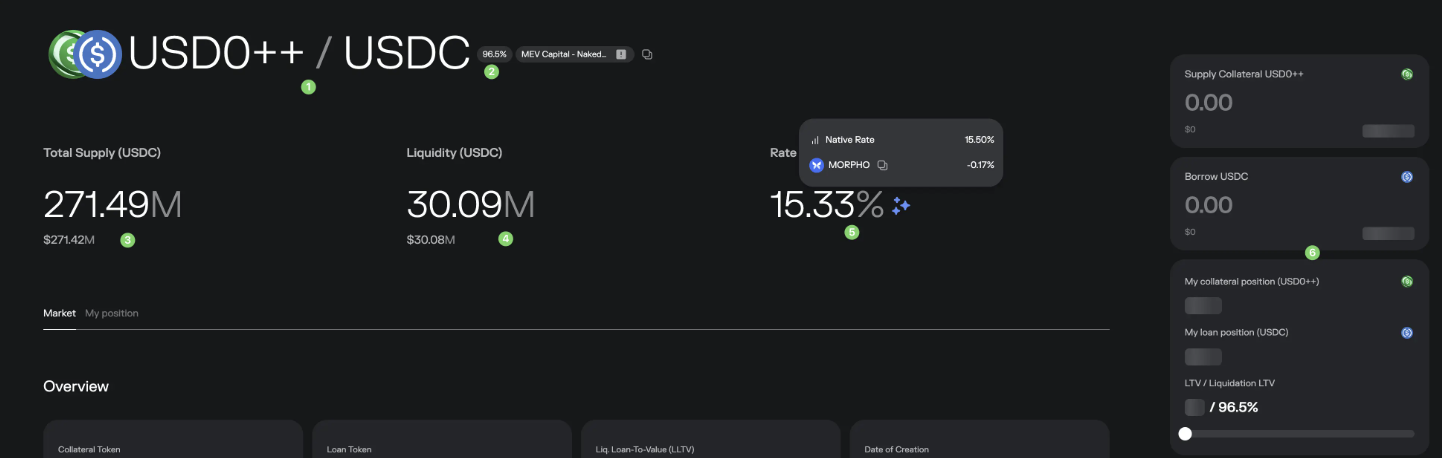

Let’s take USD0 ++ / USDC as an example

The first title is to support mortgage USD0 ++ and lend USDC

-

96.5%: LLTV, we will talk about it in detail below

-

Total Supply: How much money does this Market receive from Supply

-

Liquidity: How much money can I borrow from this Market?

-

Rate: The interest that the borrower needs to pay is 15.5%, of which there is a 0.17%$Morpho subsidy, so it is actually lower.

-

Your position information: How much is mortgaged, how much is borrowed, and how much is LLTV? If you are not familiar with LLTV, you will never get close to the target value, and automatic clearing will be triggered when it arrives.

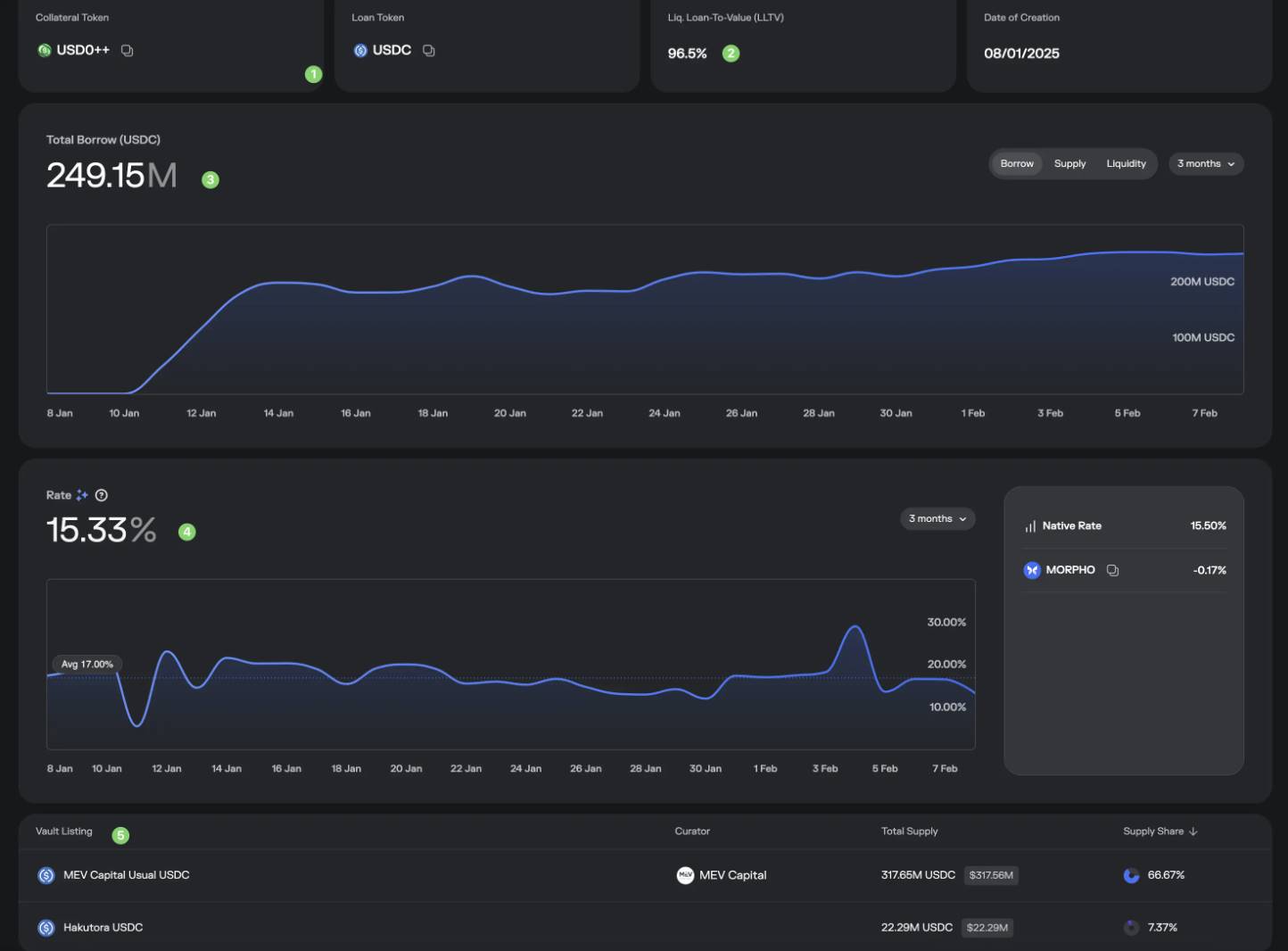

Looking at Overview

-

The first is collateral and loan assets, which we talked about earlier here.

-

Liq. Loan-To-Value (LLTV): Simple understanding is the clearing line, when your Value of borrowed funds/value of collateral = 96.5%At that time, your collateral may be liquidated. In order to protect the safety of collateral, first try not to let your loan amount approach this value. You must monitor the prices of collateral and loan tokens. Secondly, you must pay attention to the oracle structure of this Market (how the prices of the two are determined). I will also talk about it below.

-

Trend of loan amount

-

The trend of borrowing interest rates, and the calculation method on the right

-

What vault funds are received by this Market? At the same time, you will also find that the Supply Shares of these two vaults in the graph add up to less than 100%. This is because there are also some individual investors who supply, but not counting Vaults, so it is not shown here, but shown below.

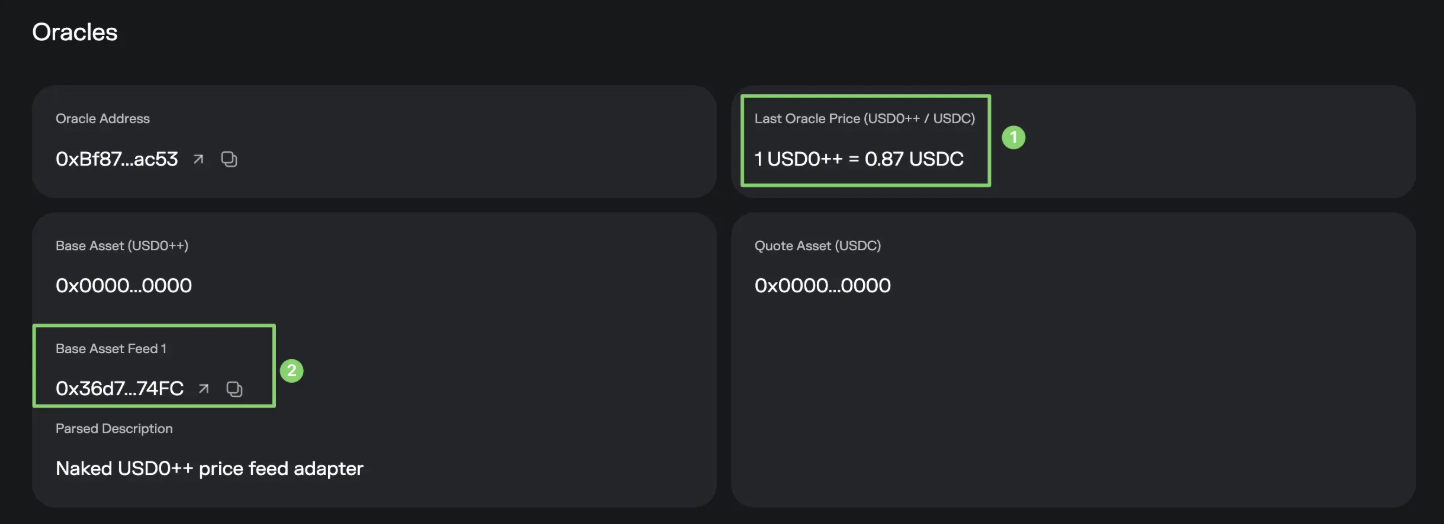

Looking at the Oracles Oracle again, this part is more complicated. If you have the conditions, you can consult an engineer or AI.

Here explains the price determination mechanism of collateral. Most of them are contracts, which are difficult for ordinary people to understand, but AI can be used, for example:

1ˇ tells you that the last price was 1 USD0++ = 0.87 USDC

The contract in 2ˇtells us how the price of USD0 ++ is defined (ask AI). It says that the FloorPrice is fixed from the contract of USD0 ++. Anyone familiar with the USD0 ++ project knows that its FloorPrice price is currently written to a dead 0.87, which also means that this price is currently fixed and will not change due to changes in market prices.

The oracle situation in each Market is different, some are fluctuating, and some increase linearly.

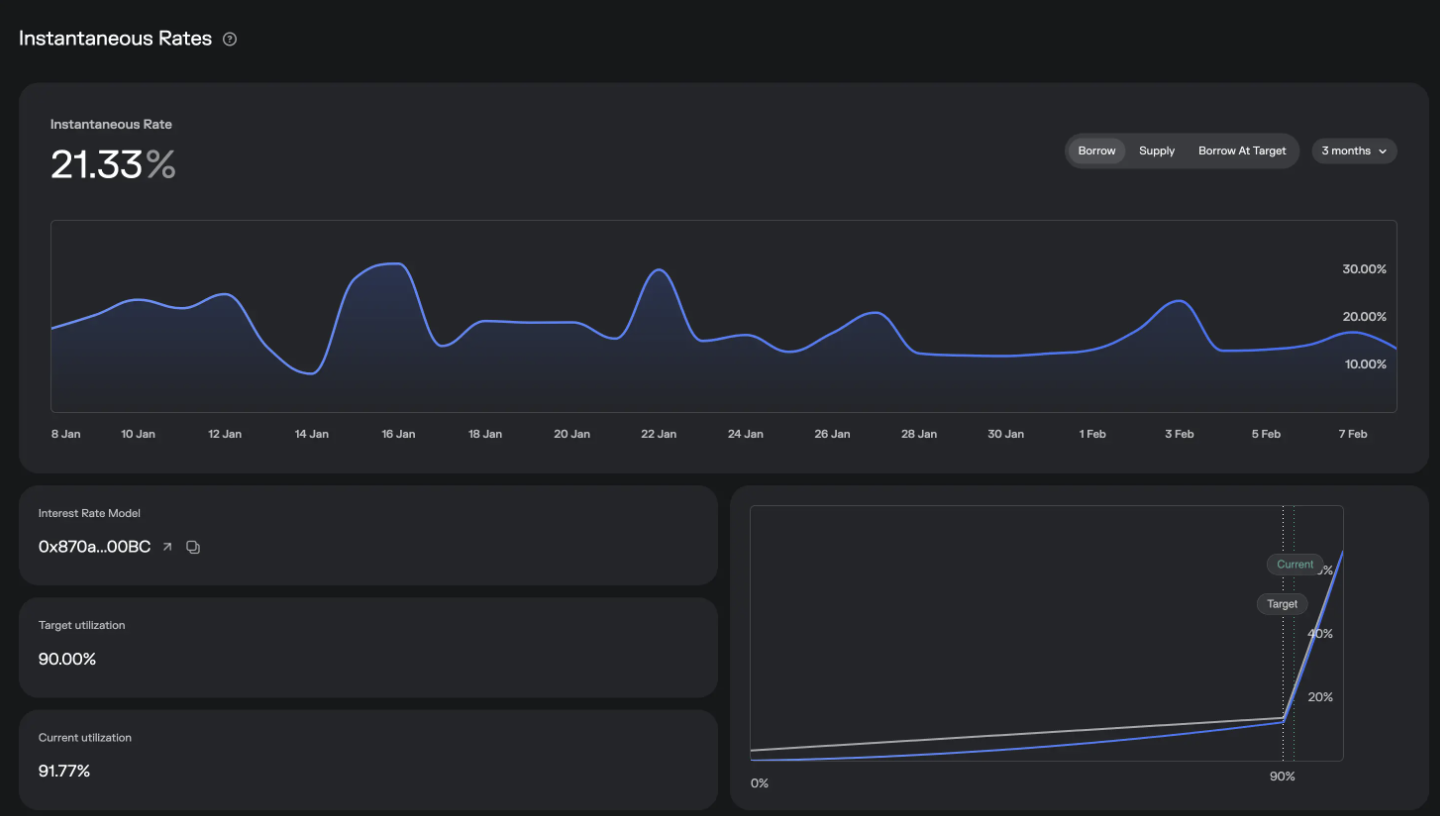

Let’s look at the Instant Rates rate, this partvery important。

First of all, we can see the real-time borrowing, supply interest rates, and trends. Then the important parameter is the Target utilization, which is currently 90%, and the Current utilization is 91.77%. The calculation of utilization is:Money loaned out/money supplied, simple mathematics tells us:The more you lend out, or the less you Supply, the more utilization will increase.

In the graph in the lower right corner, the gray line is the borrowing interest rate and the blue line is the supply interest rate. 90% is a dividing point. When the utilization rate exceeds 90%, the borrowing interest rate will soar. This mechanism protects our original problem: what if I quit if the liquidity of the Vault mentioned in Earn is not enough? Explain with an example:

Suppose a Vault takes out money to lend, supplies supplies to a Borrow Market, and the remaining liquidity on hand is only 50M, and a large household wants to withdraw 100M. What should I do?

Assuming that a large household withdraws the 50M first, the liquidity in the Vault pool will be lost, and the capital supply of Borrow Market will decrease, utilization will increase, and the borrowing interest rate will increase, forcing the borrower to repay the money; at the same time, the Vault APY will be improved, attracting external people to Supply; the borrower will repay the money, and the new person will deposit, and continue to provide funds for the large household to withdraw. In this cycle, a new balance will finally be reached.

Through this interest rate control mechanism, interest rate stability is ensured and large-scale withdrawal demand is also guaranteed.

Looking at Liquidation again, there is not much content here

One is Liq. Penalty (liquidation penalty)

The other is graph, from right to left, when the price of collateral falls, how many assets will be at liquidation risk. You can see by sliding the mouse.

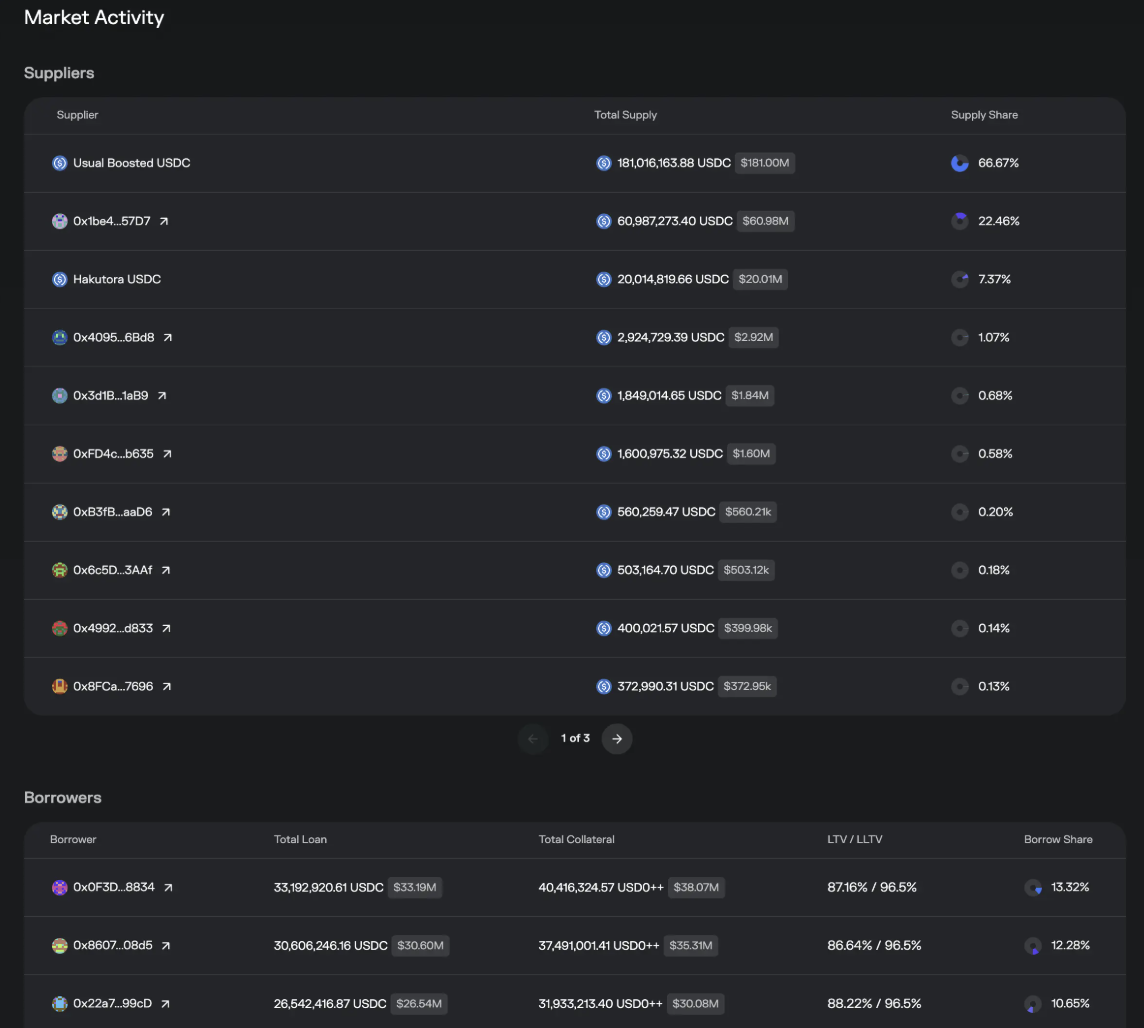

Look at Market Activity Market dynamics

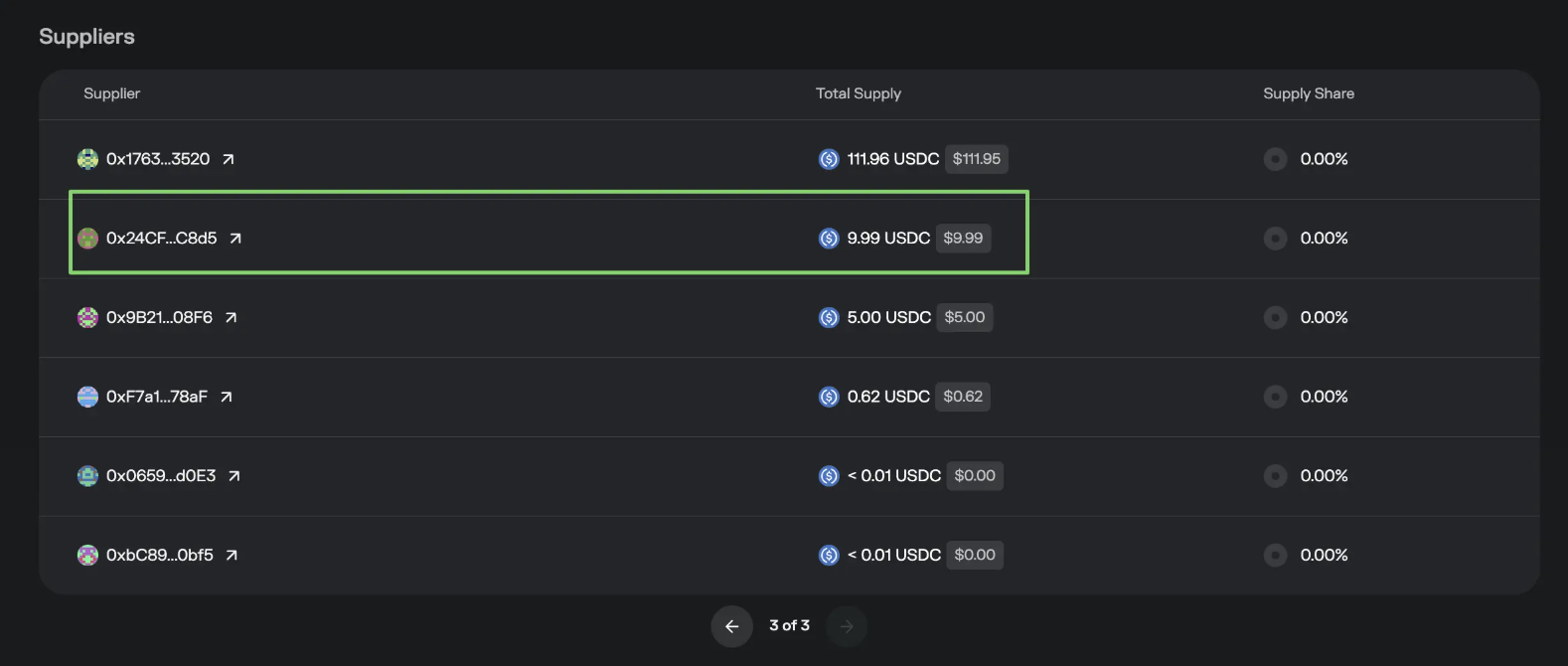

Here we can see from Suppliers that in addition to Vault, there are also some personal addresses (such as 0x1be4… 57D7), have provided funds into this Vault. In the advanced section below, we can look at why this personal address does this and how to operate it.

The Borrower list is just as the name suggests, who borrowed money and how much borrowed.

The last warning section

Here is a reminder of the possible risks in this Market. For example, we mentioned above that the price of this USD0 ++ is written in a fixed manner, and there is a reminder here. Not all markets have this reminder. Of course, having this reminder does not mean that it is very dangerous. Without this reminder does not mean that it is 100% safe and respects the market.

That is the interpretation of all parameters in the Borrow section.

By this point, you should have a deeper understanding of Morpho’s agreement. If you don’t understand it yet, read it again, my friend.

Extended question: If a risk actually occurs, can I ask Morpho to compensate? The answer is no. (Mature Crypto surfers already know)

Morpho_Terms_of_Use.pdf

Advanced operations: Achieve maximum yield + bypass performance fees

When talking about Borrow Market, we know that most of the Market’s liquidity is provided by Vault, and Vault’s money is provided by users. In the figure below, we find that some individual users supply directly to the Market (call it direct plug).

This is due to Morpho’s unlicensed model. Anyone can become a Supplier of the Market, and so can you.

The benefits of this are:

-

You can eat up the income of Supply, as shown in the figure below. Because Vault has lent money in multiple pools, the income of 1 ˇ is averaged. If we find the one with the highest APY in 2 ˇ and put it in directly, will it be possible to increase the yield?️️

-

The second advantage is that since the direct plug bypasses the Vault, the performance fee is waived, and the revenue can be increased by another 1-2%

There are also disadvantages to doing this:

-

When the Market is at risk and Liquidity is not enough, you cannot withdraw your funds immediately.

-

You need to monitor the volatility risk of collateral yourself, and a good fund manager will help you monitor early withdrawals (such as OneKey Hakutora USDC), which is the reason for performance fees. Of course, there are Valut that collects performance fees but does not have many risk control measures

The following are the instructions for friends in need.

WARNING

Be sure to use a small amount, such as 1 USDC, for the first time, and use a new wallet to prevent you from having any conflicts with other operations and ensure that Withdraw is successfully used for a large amount. The following operations are all contract interactions. Any operational errors/contract information updates/ Market differences may cause the funds to never be recovered. Operate carefully. We are not responsible for any results here. We are only for learning reference and bear the risks at your own risk.

Take this USD0 ++ / USDCMarket as an example. Other Martkets can be changed accordingly. What we need to Supply is loan Token, which is USDC.

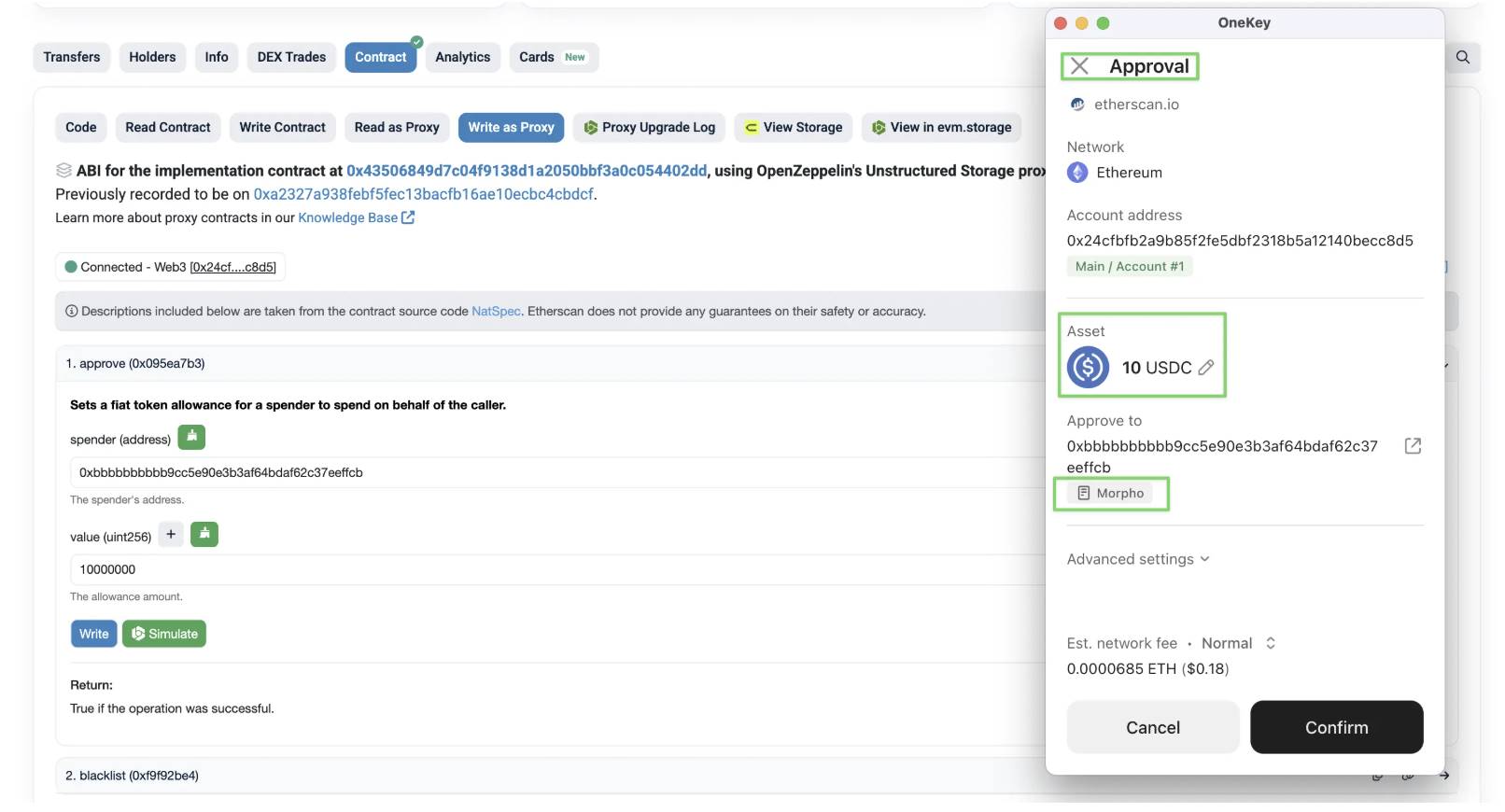

The first step is to authorize Morpho by USDC

Go to the USDC contract first:

https://etherscan.io/token/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48#writeProxyContract

Select writeProxyContract and Connect to Web3

Find the Approve function

spender 0xbbbb 9cc5e90e3b3af64bdaf62c37eeffcb This is the Morpho contract

value is the number of USDC * 1000000

Click Write to ensure that the wallet simulation results are consistent with expectations

In the second step, we went to the USD0 ++ / USDCMarket and collected the following parameters:

LoanToken: 0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48 CollateralToken: 0x35D8949372D46B7a3D5A56006AE77B215fc69bC0 Oracle Address: 0xBf877B424bE6d06cA4755aF2c677120eC71cac53 Interest Rate Model (irm): 0x870aC11D48B15DB9a138Cf899d20F13F79Ba00BC LLTV: 965000000000000000 code

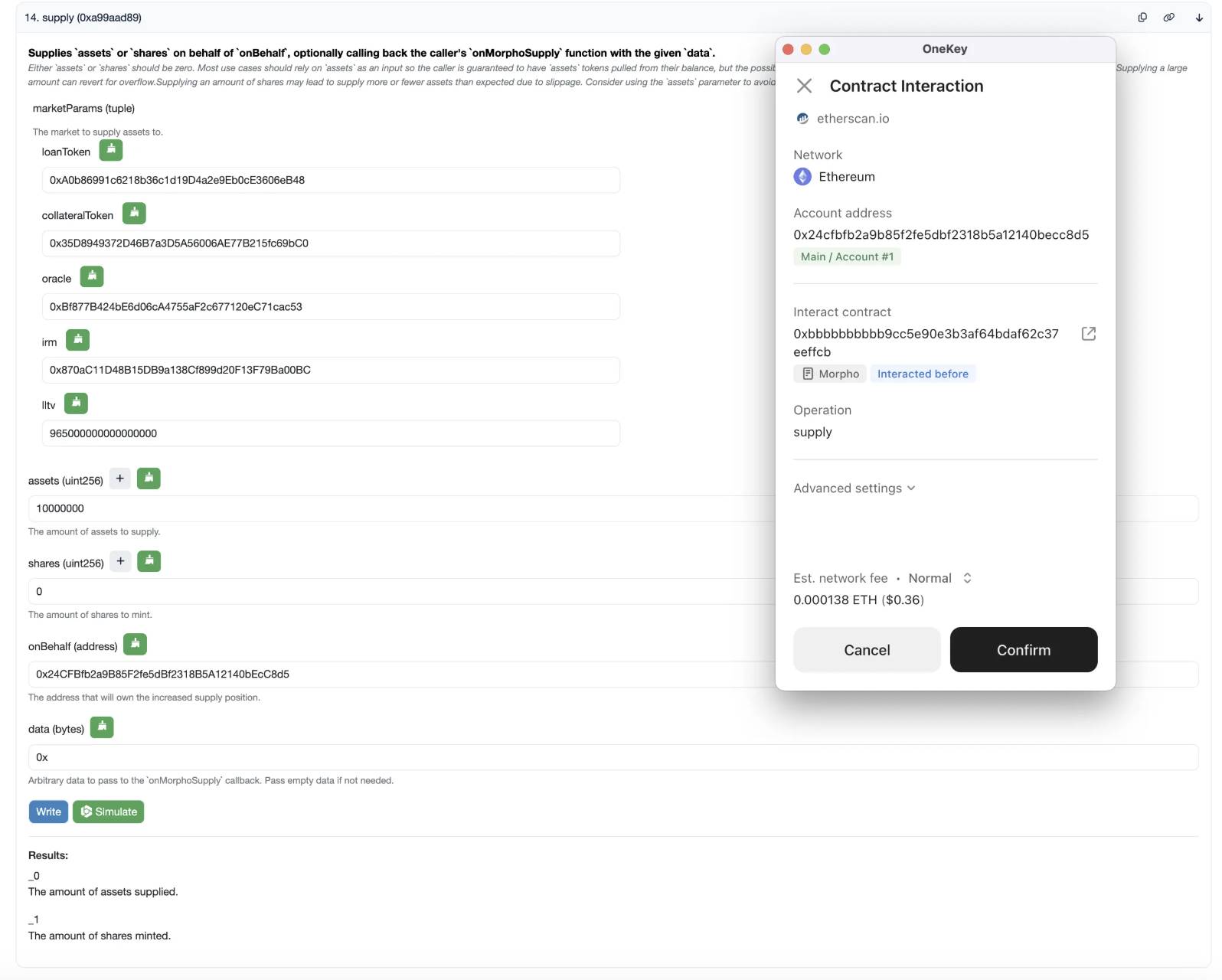

The third step comes to the Morpho contract

Select Contract – WriteContract and Connect to Web3

Fill in the corresponding parameters for the first few in turn, and the following ones

How much USDC is stored in Assets, the same USDC Amount * 1,000,000

Fill in 0 for shares

onBehalf Your wallet address

Fill in 0x for data

Click Write to ensure that the wallet simulation results are consistent with expectations

After a while, you will be able to find your amount and address in the Market’s Supplier. There is a drawback to this practice, that is, you cannot see your funds in the Position on the web page. You can only see them in the position of Makret, but $Morpho rewards are given normally.

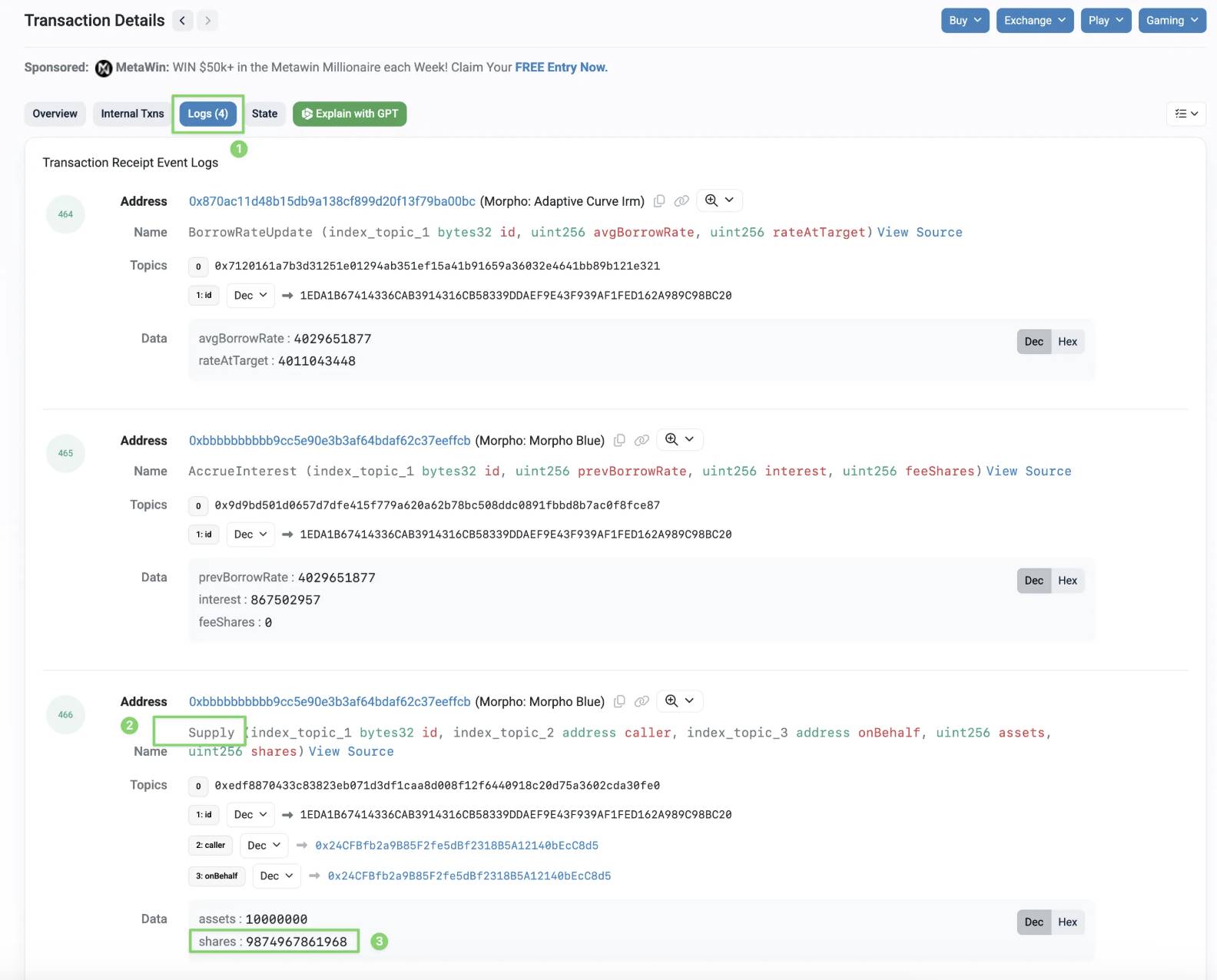

The fourth step is to prepare for withdrawal. Open the transaction you just deposited on the blockchain browser, select log, and find the Supply event. The shares parameter below indicates how many shares have been deposited and is used when withdrawing money.

Parameter 3 in the figure

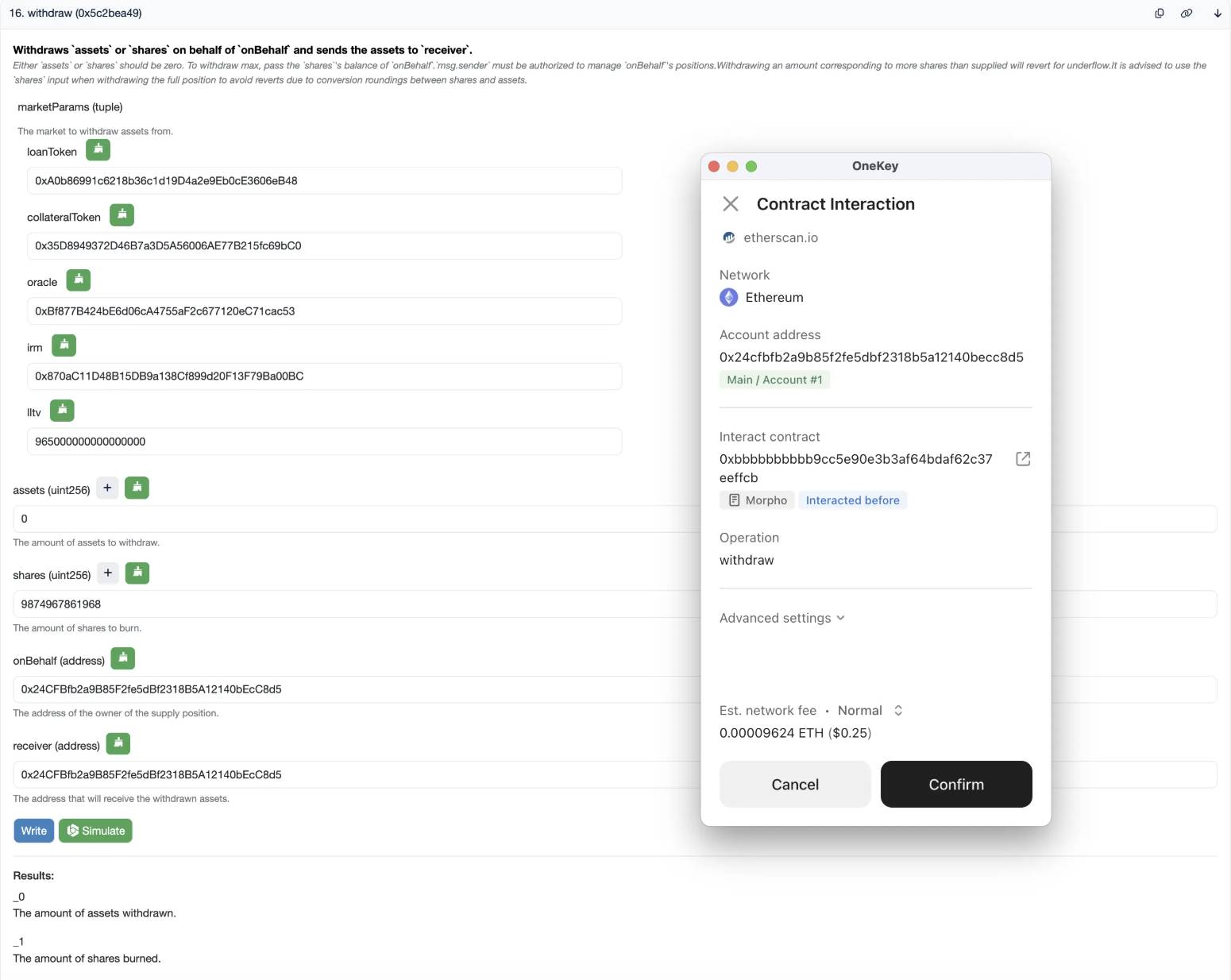

Step 5, withdraw money and come to the Morpho contract

Select Contract – WriteContract and Connect to Web3

Fill in the corresponding parameters for the first few in turn, and the following ones

Enter 0 for Assets

shares fill in the numbers found in step 4

onBehalf /The address where you deposit the money

Receiver, the address where you collect the money

Fill in 0x for data

Click Write to ensure that the wallet simulation results are consistent with expectations

If nothing goes wrong, the deposit and withdrawal will be completed.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern