① The United States and Russia announced preparations for a meeting between heads of state. European stocks generally rose, and the Russian stock index rose nearly 6%;

② Trump predicts: There will be news of “reciprocal tariffs” on Thursday;

③ Cai Chongxin confirmed that Ali cooperated with Apple;

④ Baidu announced that Wenxinyiyan is completely free and has launched in-depth search functions.

Cailian News, February 13 (Editor Shi Zhengcheng)Before the U.S. stock market on Thursday, under the favorable news that “the United States and Russia are expected to hold heads of state talks” and the negative news that “reciprocal tariffs will be released on Thursday”, the overall trend of the U.S. stock futures index was twisted and lacked a clear direction.

As of press time, Dow Jones index futures (2503 contract) fell 0.02%, S & P 500 index futures fell 0.08%, and Nasdaq 100 index futures rose 0.03%. The German and French indices that are being traded both rose more than 1%, and the Russian MOEX index rose nearly 6%.

(Source: Wind)

According to CCTV News on Thursday,Russian Presidential Press Secretary Peskov said that Putin and Trump have instructed the working team to start preparations for the meeting between the two sides, and the time and place of the meeting between the two sides will be announced after progress is made in future work.

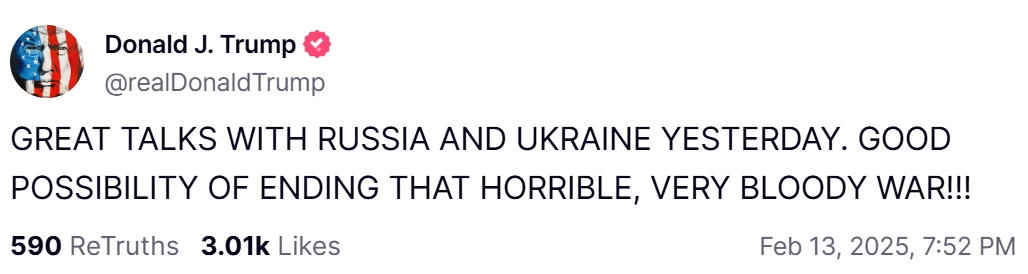

Shortly before press release, Trump boasted on social media about his phone calls with Putin and Zelensky, and saidCould end that very bad, bloody war。

(Source: Truth Social)

Susana Cruz, strategist at British investment bank Panmure Liberum, explained that a ceasefire between Russia and Ukraine could eliminate war-related costs, especially in energy, reduce uncertainty and potentially boost investment and business confidence-crucial for some of Europe’s largest economies.

Also before Thursday’s trading, Trump also announced thatThere will be news of “reciprocal tariffs” on Thursday。Affected by this, the US dollar and gold rose slightly. After yesterday’s wide fluctuations, the latest price for spot gold returned to around US$2920/ounce.

(Spot gold daily chart, source: TradingView)

For investors in China assets, the performance of China’s stocks on Thursday also attracted special attention, especially after Alibaba’s Hong Kong stocks surged and fell back last night. As of press time, Alibaba’s U.S. stocks were trading sideways, at the doorstep of the long-term pressure level of US$120.

other messages

[Cai Chongxin confirms that Ali cooperates with Apple]

At the World Government Summit in Dubai on Thursday, Alibaba co-founder and chairman of the board of directors Cai Chongxin publicly confirmed rumors of “Alibaba and Apple cooperation.”

Cai Chongxin said: “Apple is the representative of edge computing, and they need small AI that can run on the device side. To enter the China market, they need to cooperate with local AI companies in China. Apple is very strict in selecting partners and has discussed with many China companies. In the end, they chose to use Ali’s AI. Ali is also very honored to cooperate with a great company like Apple.”

[Baidu Wenxin Yiyan is fully free]

Baidu Wenxinyan announced on its official website on Thursday that it will be fully free from 0:00 on April 1. All PC and APP users can experience the latest models of the Wenxin series. From now on, Wenxinyiyan will also launch the in-depth search function.

[Unilever’s ice cream business is expected to complete the spin-off within the year and will be listed in three places including Amsterdam]

Unilever announced on Thursday that it is expected to complete the spin-off of its ice cream business within the year and make progress in key processes, including establishing a legal entity, implementing an independent operating model and preparing for the spin-off financial statements. After the spin-off, Unilever’s ice cream business will be listed in Amsterdam, London and New York. The business company will be incorporated in the Netherlands and its headquarters will remain in Amsterdam.

[Sanofi terminated an E. coli vaccine trial and lost approximately $250 million]

French pharmaceutical giant Sanofi and American counterpart Johnson and Johnson have ended development of an experimental vaccine because it failed to effectively protect against an invasive digestive tract pathogen, Escherichia coli. Sanofi said in a statement that as a result of this latest decision, the company recorded an impairment loss of approximately $250 million in its fourth quarter 2024 earnings report.

Events worthy of attention during the U.S. stock market period (Beijing time)

February 13

21:30 The number of initial jobless claims in the United States for the week from February 8, and the January PPI in the United States

February 14

Pending Indian Prime Minister Modi visits the United States and will meet with Trump