① “Exchange losses were mainly due to the 2.4% appreciation of the US dollar against the RMB. We hold approximately $1.5 billion in U.S. dollar loans.”② “The popularity of AI will accelerate the growth of hardware demand. Even if it is an indirect benefit to the company, it is still a positive development trend.”

Huahong Semiconductor’s Q4 performance meeting: Exchange losses impact profits, and AI popularization will indirectly benefit

Source: Visual China

Blue Whale News, February 13 (Reporter Zhai Zhichao)Tonight, Huahong Semiconductor Co., Ltd.(A-share abbreviation: Huahong Company, 688347; Hong Kong stock abbreviation: Huahong Semiconductor, 01347)(hereinafter referred to as the company) released its fourth quarter 2024 results report and held a performance briefing meeting.

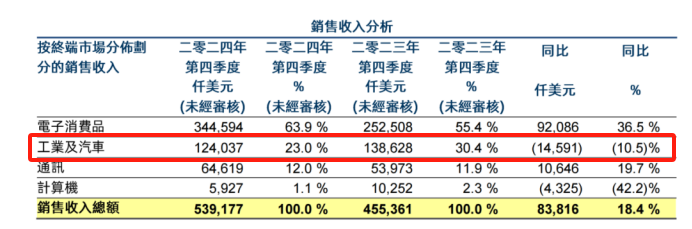

The financial report shows that in the fourth quarter of 2024, the company’s sales revenue was US$539.2 million, a year-on-year increase of 18.4%, and a month-on-month increase of 2.4%; the gross profit margin was 11.4%, a year-on-year increase of 7.4 percentage points and a month-on-month decrease of 0.8 percentage points.

In terms of terminal market distribution, consumer electronics, as the company’s largest terminal market, contributed sales revenue of US$344.6 million this quarter, accounting for 63.9% of total sales revenue, a year-on-year increase of 36.5%, mainly due to flash memory, other power management, MCUs, general purpose MOSFETs and other products. Demand has increased.

Industrial and automotive products, the second largest end market, fell, with sales revenue of US$124.0 million, a year-on-year decrease of 10.5%, mainly due to declining demand for IGBT products, partially offset by increased demand for MCUs and other power management products.

Source: Company financial report

Company management said in a telephone conference that“In the automobile and new energy markets, there is indeed inventory adjustment in 2024. We believe that the inventory adjustment has not yet been completed, so we are cautiously optimistic about 2025. Over the long term, these markets are still growing. We are strengthening research and development and launching better technology platforms to serve these markets, especially in power devices and MCUs, which are becoming increasingly widely used in the automotive market. rdquo;

However, in terms of profit, the loss attributable to owners of the parent company for the quarter was US$25.2 million, compared with the profit attributable to owners of the parent company for the same period last year and the previous quarter, which were US$35.4 million and US$44.8 million respectively. This was mainly due to foreign currency exchange losses in this quarter, while both foreign currency exchange gains in the same period last year and the previous quarter.

In this regard, the company’s management further explained that“The exchange loss was mainly due to the 2.4% appreciation of the US dollar against the RMB. We hold approximately $1.5 billion in U.S. dollar loans. We plan to convert U.S. dollar loans into RMB loans when the RMB strengthens to solve this problem. rdquo;

Looking at it over time, the company’s sales revenue in 2024 will be US$2.004 billion, a decrease of 12.3% from the previous year, mainly due to the decrease in the average selling price, which was partially offset by the increase in the number of wafers shipped; the gross profit margin was 10.2%, which was lower than the previous year. 11.1 percentage points, mainly due to the decrease in average selling price and the increase in depreciation costs.

It is noteworthy that a few days ago, SMIC’s financial report showed that its gross profit margin has also declined, and its executives even predicted that the chip industry may face a major price war in 2025. Company management said that“We are optimistic about the gross margin in the second half of 2025, especially in special technology areas.& rdquo;

Bai Peng, president and executive director of the company, said that for the company, 2024 is a year of both challenges and opportunities. The complex and changeable market demand, the recovery of the consumer sector and the rapid growth of some emerging application markets have driven the company’s image sensors, power management and other platforms to perform well, but the demand for mid-to-high-end power devices still needs to be improved. However, in the face of fierce market competition, the company’s annual average capacity utilization rate is close to 100%, ranking among global wafer foundry companies. rdquo;

It should be noted that Bai Peng took up the position of president of the new company on January 1 this year. Regarding the business strategy after taking office, especially whether it involves issues of investor concern such as cost reduction and supply chain localization, Bai Peng responded that“The company will focus more on improving efficiency and reducing costs, and the localization of equipment, materials and parts in the supply chain is indeed part of this strategy.This not only reduces costs, but also improves supply security. This move will be integrated into the company’s overall strategy, including promoting a better technology platform and improving marketing efforts. rdquo;

Looking ahead, the company expects first-quarter sales to be between approximately US$530 million and US$550 million, and expects gross margins to be between approximately 9% and 11%.“Looking at the whole year of 2025, it will still be a challenging year, but we are cautiously optimistic. rdquo; Company management added.

When talking about the AI and semiconductor markets, the company’s management said that although the company does not directly produce AI chips for advanced nodes, AI-related demand is increasing, and the company has participated in related fields such as data center construction and power management chips.The development of AI is good news for the entire semiconductor market, because not only advanced node chips are needed, but also supporting chips to support these applications. The popularity of AI will accelerate the growth of hardware demand, and even if it is an indirect benefit to the company, it is a positive development trend.。& rdquo;