① The giants have launched AI one after another, and the organization pointed out that the dawn of domestic computing power demand has arrived. In terms of the secondary market, Ziguang shares, Cambrian, Lulu, Invik, etc. closed at daily limit on Friday.

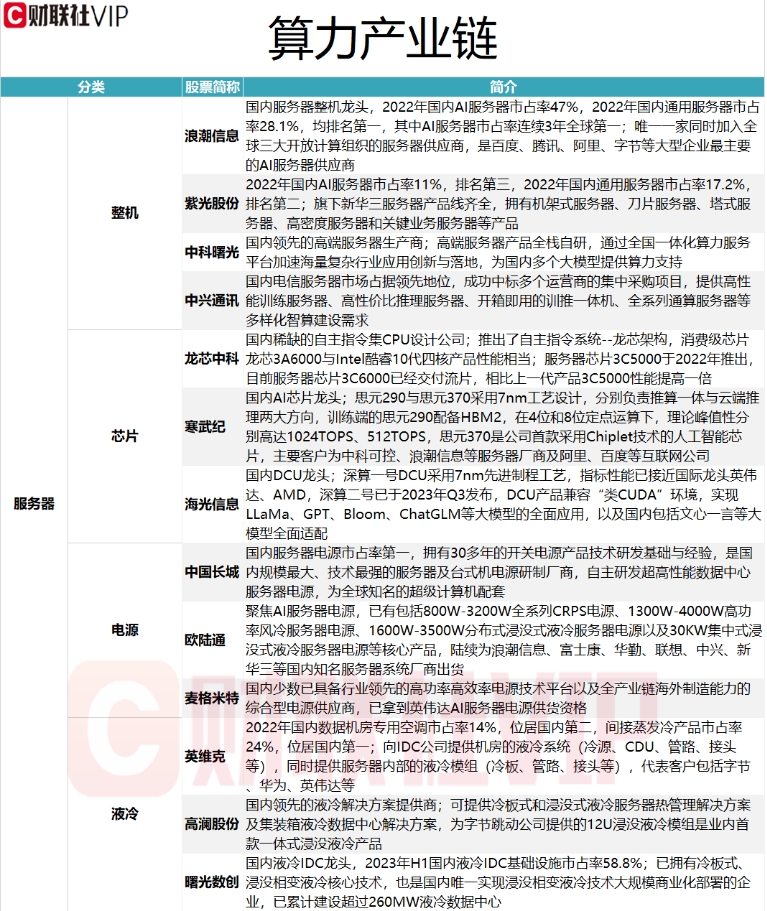

② Sort out the list of A-share listed companies with the highest market share in the server segment of the computing power industry chain (attached table).

Recently, major domestic and foreign manufacturers have maintained rapid upgrades and iterations of large AI models, and their model capabilities have been rapidly improved. The explosion of applications has driven the demand for computing infrastructure. Institutions expect that various technologies will be in 2025.The giants will still maintain a high capital expenditure intensity。On the news front, Alibaba Group CEO Wu Yongming said in a phone conference with analysts thatInfrastructure investment in cloud and AI in the next three years is expected to exceed the total of the past decade。Guosheng Securities analyst Song Jiaji and others pointed out in a research report on December 25, 2024 thatThe dawn of domestic computing power demand has arrived。Two years since the outbreak of AI, overseas countries have opened up the business cycle of AI through early accumulation of computing power and model construction. This means that for domestic Internet giants,The prerequisites for large-scale deployment of AI services are already in place。It is recommended to focus on the core targets of the four major links: computing power, communication power, manufacturing power, and infrastructure capabilities.

According to the previous review of the VIP Invitational Treasure·Data column of Cailian, servers in the computing power industry chain includeComplete machine, chip, power supply, liquid coolingand other links (see the figure below for details). In terms of the secondary market, among the above industry segments,Ziguang Shares, Cambrian (20%), Haiguang Information, Lulutong (20%), Invik, Shuguang Digital Innovation, etc. closed at daily limit or rose more than 10% on Friday。

Among them,Ziguang shares will have a domestic AI server market share of 11% in 2022, ranking third。Ziguang Co., Ltd. stated on the interactive platform on February 21 that recently, the company’s subsidiariesXinhua III officially released the Lingxi Cube large model all-in-one machine (DeepSeek version), this product includes two series: exclusive version and enabled version, with a total of 12 products in six major models.DeepSeek large models covering scales from 14B to 671B。Su Yi, an analyst at Zhongtai Securities, pointed out in a research report on January 4 that Ziguang Co., Ltd. is a leading provider of new generation cloud computing infrastructure construction and industry smart application services.The acquisition of Xinhua III significantly improves performance。Relying on computing power and connecting “dual cornerstones” full-stack capabilities, the company deeply cultivates customer digitalization scenarios, promotes breakthroughs in private domain large models in vertical industries, and accelerates the implementation of AIGC’s overall solutions in smart computing centers.AIGC application development shows good growth momentum。

Cambrian domestic AI chip leaderThe company’s Siyuan 290 and Siyuan 370 adopt a 7nm process design and are responsible for two major directions: calculation integration and cloud reasoning respectively.The main customers are server manufacturers such as Zhongke Controllable and Inspur Information, and Internet companies such as Alibaba and Baidu。Huang Chen, a researcher at First Shanghai Securities, pointed out in a research report on February 10 thatCambrian is a leading enterprise in the field of smart computing chips in China, can provide complete cloud-edge serialized smart chips and basic development software suite products, with the characteristics of cloud-edge integration, software and hardware collaboration, training and reasoning integration, and a unified ecosystem. The company’s products include cloud smart chips, accelerator cards and training complete machines, edge smart chips and accelerator cards, terminal intelligent processor IP, etc. Since its establishment,The company has been deeply involved in the field of dedicated AI chipsDuring development, a large number of processor instruction set and microarchitecture innovations have been carried out, and the developer suite and developer ecosystem have been continuously iteratively improved, makingThe company has grown into a core supplier of domestic smart computing chips。

Haiguang Information, the only domestic company that produces x86 chips, is the leader of domestic DCU, its Shenjian No. 1 DCU adopts 7nm advanced process technology, and its performance indicators are close to that of international leaders Nvidia and AMD; Shenjian No. 2 will be released in Q3 2023. DCU products are compatible with “CUDA-like” environments, enabling comprehensive application of large models such as LLaMa, GPT, Bloom, and ChatGLM, andDomestic models including Wenxinyiyan are fully adapted。Haiguang Information stated on the interactive platform on February 19 thatThe company’s deep computing series of products are progressing smoothly。Shanghai Securities analyst Liu Jingzhao pointed out in a research report on February 21 that Haiguang Information is the domestic leader in high-end processors.Years of accumulation have reached the period of heavy performance。Under the two situations of linear changes in the proportion of domestic chips and increased penetration rate over the past 27 years,The company’s X86 server CPU revenue increased by 279.5% in 27 years compared with 24 years, the increase is considerable.

Focus on AI server power supplyEurolink closed at 20CM on Friday and hit a record highOver time,The cumulative largest increase since the September 2024 low is 316%。Eurocom has core products including 1600W-3500W distributed immersion liquid-cooled server power supplies, and has successively providedInspur Information, Foxconn, Huaqin, Lenovo, ZTE, Xinhua IIIand other well-known domestic server system manufacturers shipped. Eurocom said in a research announcement released on February 21 that in terms of high-power server power supply products and solutions,The company has launched 3300W-5500W titanium and ultra-titanium GPU server power supplies, submerged liquid-cooled server power supplies and rack power solutions and other core products. Among them, the company has also launched a rack-mounted power supply solution that complies with the Open Computing Organization (OCP) Third Generation Open Cabinet (ORV3) specification. In terms of production capacity layout,The company deploys production capacity globallyto meet the needs of different markets and customers. Currently, domestic production bases include Shenzhen, Dongguan, Ganzhou, and Suzhou; overseas production bases include Vietnam and Mexico.

China’s leading supplier of precision temperature control and energy-saving equipmentInvik closed at a record high on FridayOver time,The cumulative largest increase since the September 2024 low is 148%。Invik will have a market share of dedicated air conditioners for data rooms in 2022, ranking second in China.; The market share of indirect evaporative cold products is 24%, ranking first in the country。Provide IDC with liquid cooling systems (cold source, CDU, pipes, connectors, etc.) for computer rooms, and also provide liquid cooling modules (cold plate, pipes, connectors, etc.) inside servers.Representative customers include Byte Huawei, Nvidia, etc.。Invik said on the interactive platform on February 6 that the company’s computer room temperature control and energy-saving products are provided directly or through system integrators to data center owners, IDC operators, large Internet companies, and communication operators. Over the years, the company has providedTencent, Alibaba, Qinhuai Data, IWC Data, Dataport, China Mobile, China Telecom, China UnicomLarge data centers such as users provide a large number of efficient and energy-saving refrigeration products and systems.

The “little giant” leader in data center immersion phase change liquid cooling technologyShuguang Digital Innovation’s 2023 H1 domestic liquid-cooled IDC infrastructure market share is 58.8%。It has the core technologies of cold plate and immersion phase change liquid cooling, and has built more than 260MW of liquid cooling data centers. When Dawning Digital Technology accepted an institutional survey on December 3, 2024, it stated that the company isThe only domestic large-scale commercial deployment of immersion phase change liquid cooling technologyEnterprises, companiesControlling shareholder Zhongke ShuguangIt is the server manufacturer with the largest market share in the domestic high-performance computing field. Immersion phase change liquid cooling technology is highly customized, and most of it is currently used in high-density data centers. Therefore, related transactions have accounted for a high proportion of the company in the past few years. With the rise of AI and artificial intelligence, the demand for the construction of smart computing centers is growing rapidly and the country’s requirements for PUE indicators are becoming more stringent.The penetration rate of liquid cooling technology is expected to increase rapidly。