Eleven tokens were issued in 3 days, with a 100% win rate and a profit of US$25,000. This may be the ideal self for countless MEME players. But the reality is that this is just one of the thousands of addresses for the industrialized RUG team.

Author: Frank, PANews

Eleven tokens were issued in 3 days, with a 100% win rate and a profit of US$25,000. This may be the ideal self for countless MEME players. But the reality is that this is just one of the thousands of addresses for the industrialized RUG team. While retail investors are still fighting for the thousandfold myth, the professional team has used robots, multi-contract signing and public opinion engines to transform the MEME track into a 24-hour harvesting machine. On-chain data shows that this type of industrial RUG operation is not an isolated case.

From the traceability of funds to the original address of the exchange to the hundreds of associated wallets derived, a dark game involving technology, capital and human greed is devouring the wallets of speculators.

A single address is US$25,000 for 3 days, and hundreds of addresses form the RUG assembly line

PANNews uses data on the chain to dissect the complete harvest link and attempts to reveal a cruel reality: when the issuance of MEME coins becomes a game of mathematical probability, and when the community consensus is forged in batches by the industrialized water army, the end of this carnival may have long been doomed.

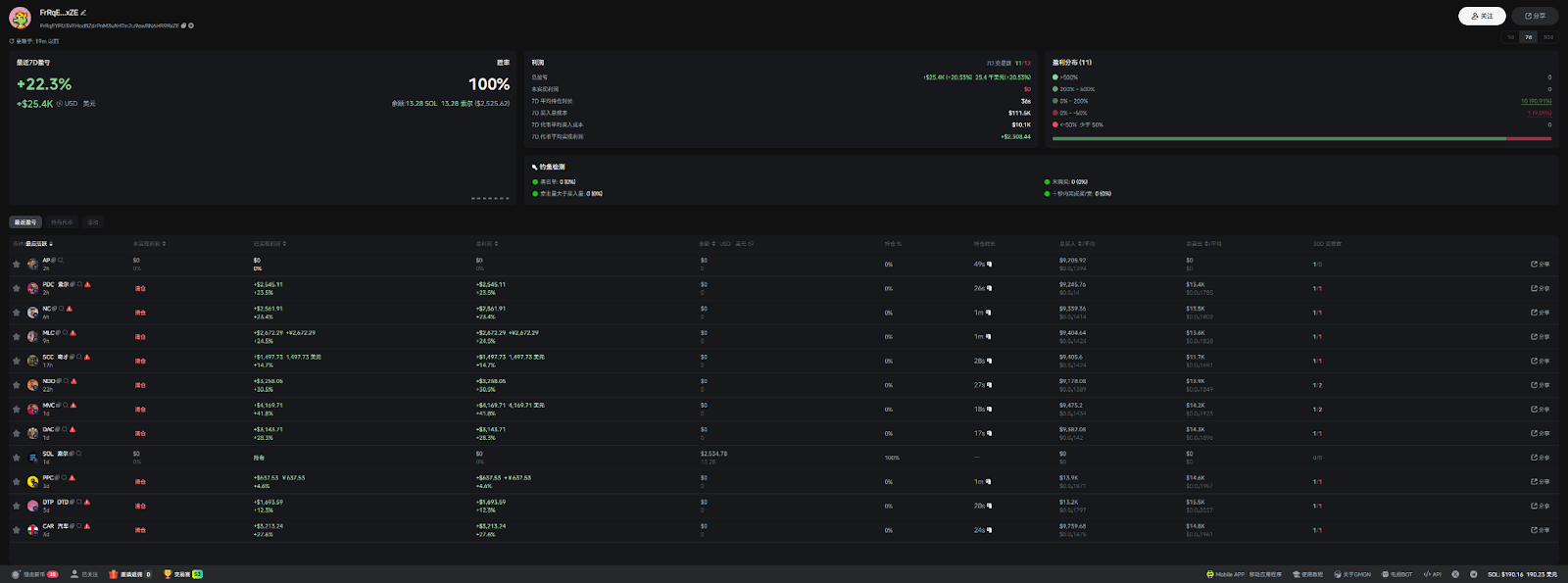

Taking this address as an example, FrRqEYFfJ 3VEHodfiZdrPNM3vAHTm2u9ewBN6HR9RxZE (hereinafter referred to as “FrRqE”) issued 11 MEMEs in the past three days, with a total profit of US$25,000 and a win rate of 100%.

How is it achieved specifically? Judging from the time of holding positions, the time interval between FrRqE buying and selling each time is only tens of seconds, and the longest time is no more than 1 minute. First of all, FrRqE will buy the token in a large amount after the market opens. The general amount is about 48 SOL. This will make other users seem to think that the token is bought by a large customer, so they will quickly follow suit. Buy, and FrRq’s position has exceeded 70%. He would then sell these tokens in one go in tens of seconds. The average yield is between 20% and 30%, and the profit per time is about 2500 US dollars.

Of course, since various monitoring tools are now very complete, when developers hold too large a proportion of positions, many skilled old players will not buy in all at once.

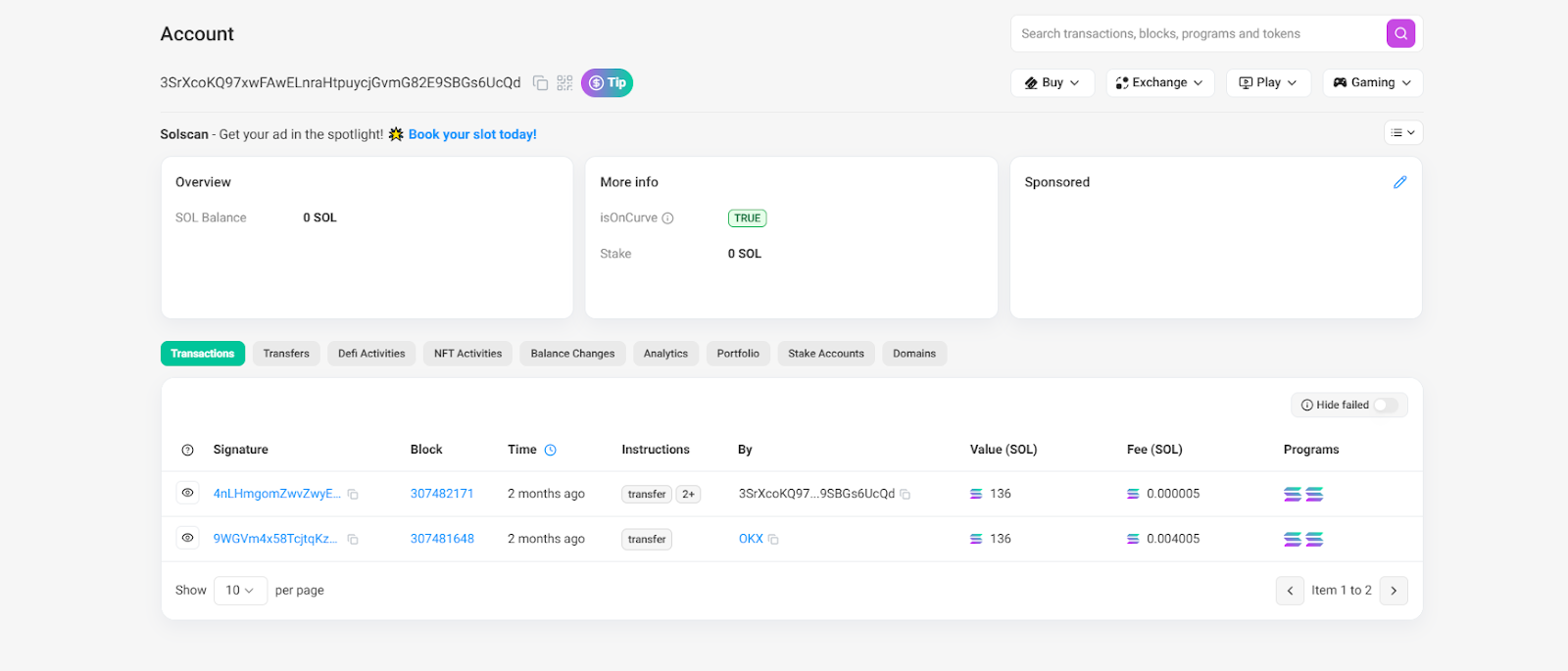

Therefore, FrRq will quickly spread these tokens to 400 wallet addresses after buying them in one fell swoop to avoid monitoring by robots on the chain. And when more and more addresses buy and the amount in the Pump pool is about to be full, FrRq will repeat the same trick, transfer all the tokens back to the same address again, and then sell them in one go., and instantly return the tokens to zero.

Judging from the operating time, this address has been conducting such activities for more than 2 months. Every time an address issues about 10 tokens, funds will be transferred to a new address to continue the next round of RUG. Currently, hundreds of RUG addresses have been derived.

Except, of course, for these actions on the chain. There is more to be done to complete the RUG DEV. For example, these tokens traded in Pump usually have dozens or hundreds of replies, and in the early stages, you can still clearly see traces of a large number of robots buying them. Users feel that this project is like a normal MEME token in terms of transaction volume and discussion level.

What is even more terrifying when you think about it is that such tokens were not found by PANNews specifically screening, but were accidentally discovered by randomly clicking on tokens on Pump.fun. For users who frequently participate in MEME investments, they should often encounter similar RUG bureaus.

The operating process of this kind of RUG bureau is not possible for ordinary users. First, professional address distribution tools and collection addresses are needed to complete flexible and unified token transfer operations. Second, tools are needed to monitor social media hotspots in real time to ensure that every token issuance must also step on the latest hotspots. Third, a large number of Pump.fun posters and social media posters are needed. For example, the X account@r999d99z was created in January 2025 and has promoted FrRqE tokens many times. There seems to be a countless connection between the two. Fourth, it is a dedicated trading robot responsible for creating momentum and sending packaged transactions. To complete the above steps, you may really need a strong technical team and operations team to achieve it.

With a Retention rate of one in 10,000, there is no place for retail investors in MEME Forest

According to dexscreener’s data, in the past six months, among the tokens issued on Pump.fun, the number of tokens with a market value of more than US$50,000 is 1987, of which the number of tokens that have been issued for more than one month is 27. There were 72 more than one day, and the remaining 1915 were released in nearly 24 hours. Six were tokens issued yesterday. Based on this proportion, a total of 49153 tokens were issued on Pump.fun on February 13, with a graduation rate of 1.23%, and a total of 606 tokens graduated. The market value ratio of tokens that can remain above US$50,000 within one day after graduation is 0.9%. Judging from the overall value, the probability that it can maintain a market value of US$50,000 one day after being launched on pump.fun is about one in ten thousand.

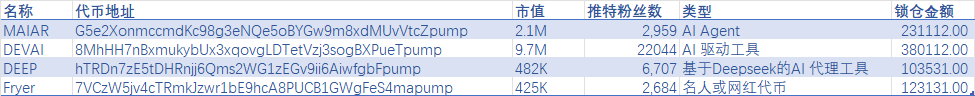

We used the six coins that survived after the issuance on February 13 as research models to see what characteristics these surviving coins have (during the observation process, the number of such data samples dropped from 6 to 4).

Looking at these four tokens, we can summarize several characteristics. First, behind these tokens are all project tokens or have clear spokespersons. Three of them are AI-related project parties, and one is a personal token issued by Internet celebrities. Among them, there are no tokens issued randomly by ordinary players.

Second, the LP lock-up ratio of these tokens is very high, basically above 95%, and the lock-up amount is more than 100,000 US dollars. Third, the number of followers on social media is more than 2000. Although several accounts have not been created for a long time, their social media scores are not low due to KOL interactions.

Overall, the era of PVP seems to have passed, and it is almost impossible for personal-issued tokens to be out of circulation or reach a high market value in this market. Many players with publishing experience may already know this. In this context, the DEVs who still choose to issue large quantities of tokens every day obviously have their own unique business experience. However, this dark forest-style gameplay is still in an unregulated environment.

As the pool is exhausted, a large number of players are reluctantly leaving the field

The MEME coin track is changing from a casino where all people look for perspective to a hunting ground for technology and main forces for ordinary retail investors. It may be difficult for users to see clearly the routines of RUG practitioners, but as the actual losses gradually expand, more and more users are reluctantly withdrawing from this dark forest.

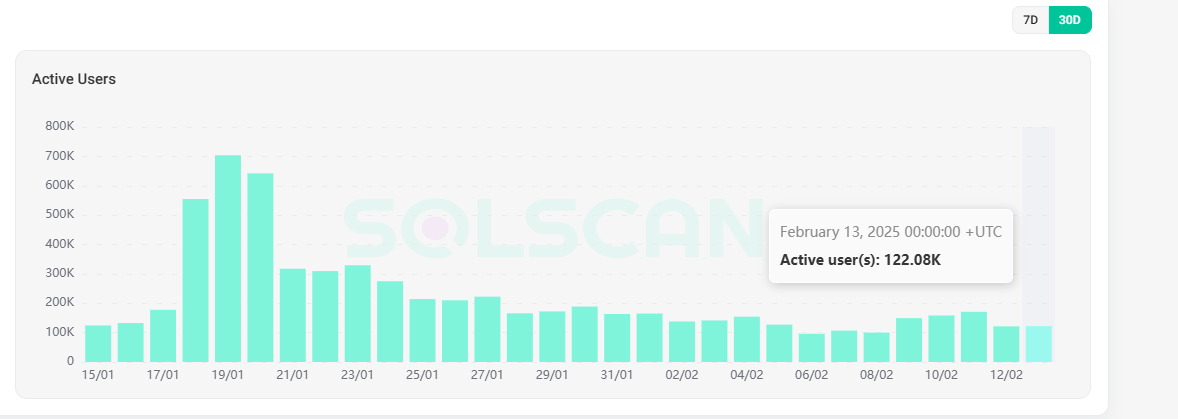

According to The Block, Pump.fun token trading volume on Solana has recently cooled down. The average daily trading volume in the past week was only US$560 million, setting a new low since Christmas 2024, and a significant drop of 82% from the single-day peak of US$3.13 billion three weeks ago.

Data on the Solana chain also shows a similar trend. In the past three months, the number of active wallets on the Solana chain reached 7.22 million on November 16, but by February 1, the number had dropped to 3.18 million. The biggest decline was more than half. However, active users of aggregators such as Meteora and Jupiter, which were popular due to the explosion of TRUMP tokens some time ago, also dropped rapidly after their popularity cooled down.

Even many KOLs, whose main business is MEME, claim that the current environment is no longer suitable for “rushing dogs”. A blogger named Laughing said: “I have completely given up betting on meme’s opening pvp. Lottery buyers will never be able to play lottery sellers.”

Paradigm researcher Arjun Balaji pointedly pointed out,”Memecoins used to be fun and pure, but the trenches of industrialization turned a harmless PvP game into a predatory game dominated by internal advantages.”

Although the market is becoming more and more severe, we may still get some inspiration from the two sides of blockchain. On the one hand, because of the unregulated blockchain, malicious DEVs are unscrupulous. On the other hand, it is precisely because of the traceability of blockchain that no matter how our opponents hide them, we can always find some clues on the chain. For players who are studying hard, they can avoid similar scams after being familiar with these malicious routines.

In addition, although Pump.fun’s token Retention rate has been as low as one in 10,000, players may also be able to directly avoid searching for a needle in a haystack at the earliest stage, but instead choose to let the bullets fly for a while, focusing on tokens that have been issued and are still “alive” for more than a day. Time seems to be becoming the most practical screening tool. For those teams who expect to issue project tokens through MEME, sincerity becomes a simple and effective narrative because of this market environment. Bad money is destroying the market, and good money will hit bad money.