Original title: What if $MELANIA was never launched?

Original author: 0xFinish, member of 0xTrack

Original compilation: ChatGPT

Editor’s note: The author reviews the birth of PumpFun, the halving of Bitcoin, the differences between 2021 and today’s scams, and how to adapt to the new market cycle, and reminds investors to pay attention to limited liquidity in the current market environment., have a clear selling strategy and follow the narrative in market rotation to avoid excessive FOMO. At the same time, always keep some profits in stablecoins and continue to accumulate long-term high-quality assets like BTC.

The following is the original content (the original content has been compiled for ease of reading and understanding):

This cycle has been very difficult and worse than any previous cycle. Many people even call it the “crime cycle” because the growing number of “leek cutting” and Rug projects is worrying.

The purpose of this article is to look back on the past and try to predict what will happen next for those of us who just want to succeed.

The birth of PumpFun

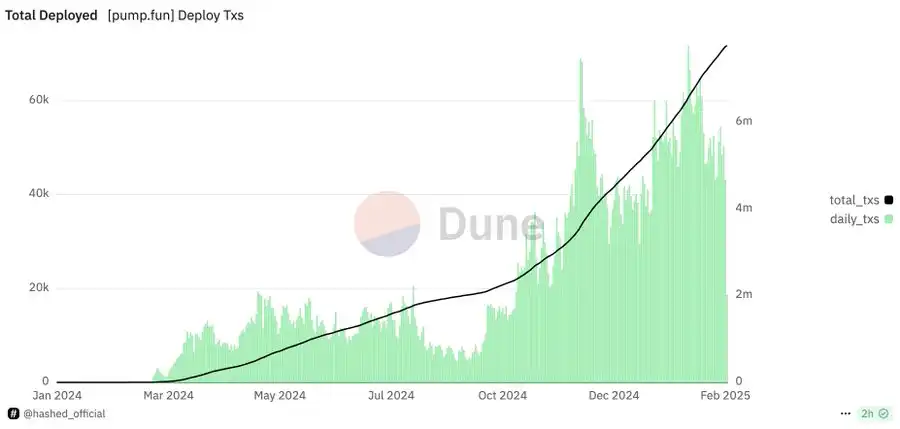

On January 19, 2024, PumpFun was born, and the face of meme coins has changed forever. Everyone gets the opportunity to launch a token, regardless of their age, occupation or nationality.

The popularity was not high at that time, but PumpFun began to gradually exert its strength in March 2024. The first projects to appear were $MICHI and $FWOG. Anyone can launch a meme coin in seconds, a phenomenon that changes the entire market.

As more and more tokens emerge, PumpFun has become a fair distribution platform, and no insiders are cutting the leeks. Although it may seem attractive, the withdrawal cost is huge.

Since its launch, PumpFun has earned more than $2.86 million SOL, or approximately $577 million. It may be one of the most successful start-ups of all time.

The liquidity was permanently withdrawn and collected by PumpFun’s developers. But I think that’s an important reason that makes this cycle special. We will discuss further later.

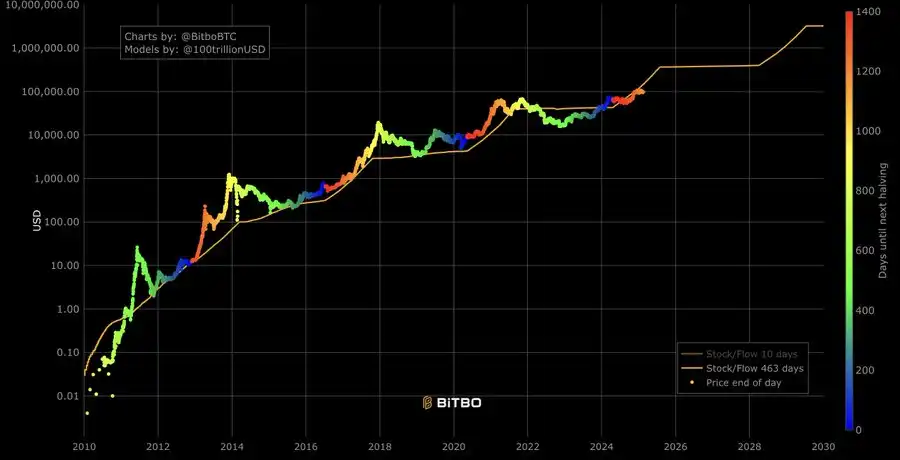

Bitcoin halving

Then comes an important moment in the current cycle. On April 20, 2024, the Bitcoin mining reward dropped from 6.25 BTC to 3.125 BTC. When the first ETF was approved on January 10, 2024, many people thought it might be a “news selling” event, but in fact we saw a new ATH.

ETF + halving is the strongest bullish combination for BTC as many people have been waiting for institutional liquidity to start injecting into the market. And that’s what happened in the end. Fidelity, BlackRock and MicroStrategy are buying every day, injecting liquidity into the market.

This gives people hope. They thought this bull market would be similar to the previous one, but this time, everything was different.

The market is always against the public, which means that if retail investors are bullish, the market is likely to fall, and vice versa. Maybe that’s what happened here, and we’re about to find out.

Your expectations are the problem

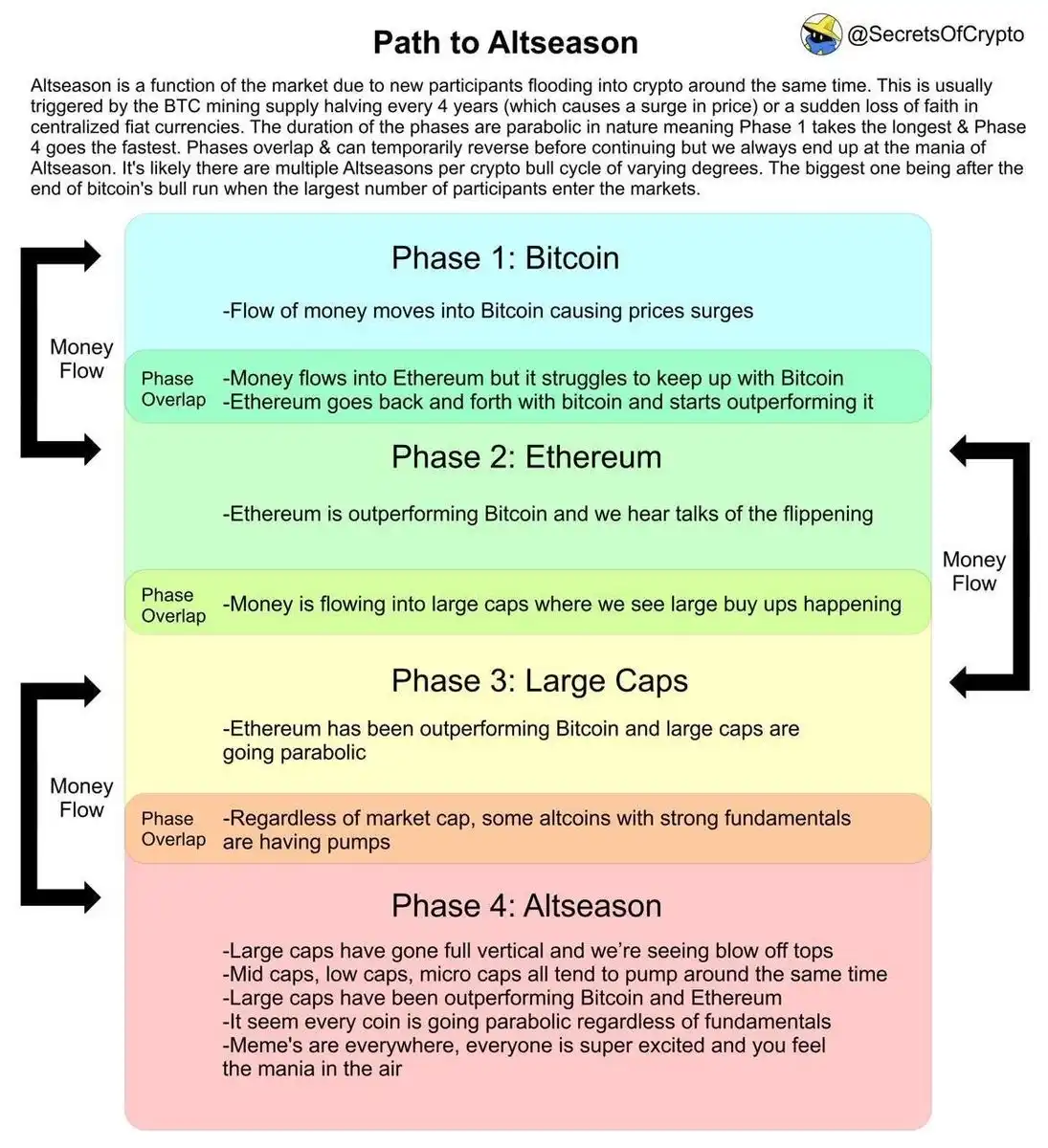

Looking back at the 2017 and 2021 cycles, the situation is very similar. Making money is not difficult and does not require any special knowledge. At that time, there were 10-20 mainstream coins that everyone knew about, and everyone was constantly accumulating.

First, BTC rises, and then ETH follows up. As a Beta variety of the cycle, the return rate is usually higher. Then we will shift from ETH to other mainstream currencies and then to some small currencies.

This is why many people decided to skip the BTC phase in 2024 and invest directly in ETH or other altcoins. The logic is simple. If ETH can increase by 5 times and larger altcoins can increase by 10 times, why should we wait for a return of 2-3 times on BTC?

This logic is very straightforward, however,”Volkswagen” did not consider that this cycle might be different. The number of projects, tokens, and meme coins is 100 times that of the previous one. Everyone has purchased familiar tokens such as $DOT,$ATOM,$ADA, etc., waiting for a 10-fold return as promised.

As a result, when liquidity began to flow into altcoins, too many new projects were created, leaving old projects behind.

The scams in 2021 are different from now

I just saw @Overdose_AI put forward an effective point and decided to join it here. Back in 2021, the “leek cutting” scammers are very creative. As long as they are not too greedy, almost everyone can jump ship.

· Terra $LUNA is controlled by Do Kwon

· FTX is controlled by Sam Fried

· 3AC invested for a long time before the crash

· Alameda promotes different narratives and manipulates markets

Fraud at that time was relatively difficult and required a certain IQ. Now, people are just using big names, celebrities, and even rulers of great powers to promote their garbage projects.

People are used to gambling, so FOMO entered $TRUMP and $MELANIA and decided to make up for the losses through $CAR or $LIBRA. As a result, it lost all its money.

I know 10 to 15 great traders who have invested $LIBRA through DCA and seized the opportunity to wait for a pullback, while insiders have made more than $100 million on them.

It’s time to adapt

It’s time to understand that cycles are never exactly the same and that altcoins are not just Beta versions of BTC or ETH, they are a completely different market segment that brings more risks and more opportunities.

You can’t continue to go long $DOT or $ATOM just because BTC has hit a new high, because this will work in 2021.

Make no mistake, I remain bullish on BTC and believe it will remain one of the best compound interest assets for the next 10 to 20 years, but the return will be similar to stocks and no longer an easy 200% annual growth.

The conclusions you need to remember during this cycle

1. Holding money and waiting for it to rise is a fool’s job. If you don’t sell at the right time, you’re finished.@ MustStopMurad keeps telling you to hold coins, and almost all of his meme coins have fallen 80%-90% since ATH.

2. You need to have a clear selling strategy. I know this may sound harsh, but that’s the way the market is, and you have to determine when to exit before you make a trade.

3. Rotating narrative, we have recently experienced crazy market rotations from meme coins to AI Agents to $TRUMP. If you don’t keep up at any time, you can almost guarantee that most of your gains will be wiped out. Always follow the market narrative and remember that liquidity is limited.

4. “In time” is better than “in advance”. Don’t overthink and find the right time to enter, but don’t wait too anxiously.

5. Always transfer a portion of your profits into stablecoins. No matter how much you believe in a particular agreement, continuing to accumulate BTC is still better than most stock or real estate opportunities.

To be honest, I don’t know whether we will go down or up next. I currently have plans on both sides. If the market falls, I will continue to buy more BTC and $ETH.

If the market goes up, I have enough altcoins to avoid FOMO, and I know I can make money by trading and help my followers.

I hope this cycle is not over yet, and the current consolidation of BTC will determine our trend in the next 2-3 months.

“Original link”