It is foreseeable that after BYD, Xiaopeng and other car companies, more car companies will join this smart driving inclusive campaign. By then, the original smart driving business experience may have to change its thinking.

Who gave the pressure to the national smart driving carnival?

Blue Whale News, February 13 (Reporter Li Zhuoling)The domestic smart driving battle, which has been opened up by new forces, has become heated with the addition of traditional car giants.

Recently, Chang ‘an and BYD, two traditional car companies, held intelligent strategy press conferences one after another. Among them, intelligent driving is the highlight: Chang’ an launched an upgrade of digital and intelligent products and promoted affirmative action for intelligent driving, claiming that starting this year it will no longer develop non-intelligent new products; BYD holds high the price butcher and releases a national intelligent driving strategy, allowing intelligent driving models to directly drop to the level of 70,000 yuan.

As Chang ‘an and BYD successively expanded their skills, more players are rushing into the battle. Blue Whale News learned from many car companies that they will release plans related to smart driving in the near future. Geely Automobile told Blue Whale News that there will be heavier news in the future. A press conference is expected to be held early next month, but it has not been disseminated to the public yet. The relevant person in charge of Chery also told Blue Whale News that they can pay attention to the relevant content recently released by Chery.

After this national smart driving carnival kicks off, to whom will the pressure be transmitted first?

Photo source: Visual China

Smart driving changes from optional to standard, and business models may change

Behind the acceleration of the national smart driving trend, whether the paid business model adopted by past car companies ‘smart driving systems will be affected will attract industry attention. It is reported that the mainstream smart driving charging methods on the market were mainly divided into three types: subscription, one-time buyout, and including software and hardware costs directly in the car price.

As a pioneer in the field of intelligent driving, Tesla is the first to launch two different levels of optional packages, enhanced automatic assisted driving (EAP) and Full self-driving (FSD), based on hardware embedded + paid unlocking software., allowing consumers to choose a one-time buyout or subscription.

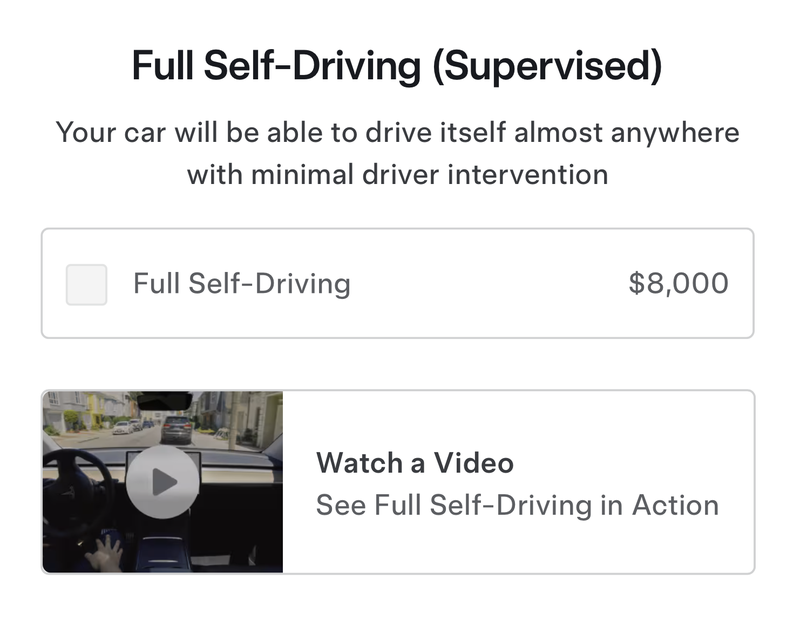

In the U.S. market, its FSD buyout price was as high as $15,000, and the monthly subscription price was $199. As of now, Blue Whale News has seen on Tesla’s official website that its FSD is priced at US$8000 (approximately RMB 58,500), and the monthly subscription fee is US$99.

Photo source: Tesla’s US official website

In the China market, when Blue Whale News inquired about smart driving charges on its official website, its online customer service stated that if the vehicle is equipped with the basic version of assisted driving functions, the price of upgrading to the enhanced version of Automatic Assisted Driving (EAP) is 32000 yuan, and the upgrade to fully autonomous driving capability (FSD) is 64000 yuan.

It is understood that its EAP currently includes all functions of the basic version of assisted driving, as well as automatic assisted navigation driving, automatic assisted lane change and automatic parking, as well as basic calling and advanced intelligent calling functions. Its FSD includes all the functions of a basic version of assisted driving and an enhanced version of automatic assisted driving, and will also be introduced to recognize and respond to traffic lights and stop signs, as well as automatic assisted driving on urban streets. In other words, the latter is also the urban navigation function (Urban NOA) that is currently being vigorously promoted by the new head-autonomous forces.

Currently, FSD is not yet open in China. According to Tesla’s timetable disclosed in September last year, FSD is expected to be launched in China in the first quarter of 2025, but it still needs to await regulatory approval. Regarding issues such as when Tesla’s FSD will enter China and whether future FSD prices will be reduced in the context of such a surge in its own brands, Tesla responded to Blue Whale News by saying that there is no news.

Turning their horizons back to the domestic independent brand camp, there are also many brands that charge high-end smart driving as a differentiated selling point, such as NIO and even Huawei’s Gankun smart driving cooperative brands.

Among them, Huawei Gankun Smart Drive has HUAWEI ADS and SE Basic Edition. Both high-end feature packs support one-time purchase, or monthly or annual purchase. HUAWEI ADS one-time purchase is 36,000 yuan (the current limited time discount is 30,000 yuan), monthly subscription is 720 yuan and annual subscription is 7200 yuan. NIO previously adopted a service subscription model that opened monthly and paid monthly. The cheapest NOP+ subscription price was 380 yuan/month.

Of course, there are also packages that include the cost of smart driving in the price of the car, but they will be differentiated in the form of smart driving version, or Max and Pro versions. There may be a difference of tens of thousands between the two versions, mainly based on Ideal, Xiaomi, etc. It is typical. Take the Ideal L6 as an example. The Max version is priced at 279,800 yuan and provides urban + high-speed intelligent driving; the Pro version is priced at 249,800 yuan and provides high-speed intelligent driving, with a difference of 30,000 yuan.

Judging from BYD’s latest national smart driving strategy, it is similar to the strategy adopted by ideals. It is reported that BYD’s Eye of the Gods includes three sets of technical solutions: Eye of the Gods A triple laser version, Eye of the Gods B laser version, and Eye of the Gods C triple laser version. ldquo; Eye of God A is mainly used for looking up, Eye of God B is mainly used for Tengshi and BYD brands, and Eye of God C is carried on BYD brand. The difference is that BYD’s three plans distinguish brands at different price points rather than the same model.

Before BYD, Xiaopeng Automobile also announced last year that the P7+ and subsequent models would no longer distinguish between Max and Pro versions, and the entire series would come standard with AI smart driving.

It is foreseeable that after BYD, Xiaopeng and other car companies, more car companies will join this smart driving inclusive campaign. By then, the original smart driving business experience may have to change its thinking.

High-level smart driving will force the supply chain to reduce costs?

It is worth noting that behind the popularity of smart driving, the industrial chain is expected to benefit first. Wang Chuanfu bluntly said that there has never been such a large demand in the smart driving industry chain. The company has joined forces with hundreds of high-quality suppliers to break through the bottleneck. He also called on suppliers to seize the opportunity, continue to expand production capacity, and jointly promote smart driving for all.

CITIC Securities Research reported that the penetration rate of domestic mid-to-high-end smart driving is expected to double in 2025, driving the domestic incremental market of 35 billion yuan. The four major links of chip, control, sensing, and connection are all expected to benefit, among which the chip and controller are more flexible and have a clear pattern. Considering that autonomous vehicle manufacturers are expected to follow the smart driving affirmative action strategy in 2026, the industry’s prosperity is expected to continue to strengthen in the past two years.

Blue Whale News learned from the smart driving chip company Horizon that Horizon has reached cooperation with more than 40 cooperative car companies and brands such as BYD, Chery, Volkswagen, Geely, Chang ‘an, Ideal, GAC, FAW, and SAIC. Among them, its latest generation The journey 6 series of on-vehicle intelligent computing solutions has won platform cooperation from more than 20 car companies and car brands, and will help more than 100 mid-to-high-end smart driving models launch this year.

According to people from Horizon pointed out to Blue Whale News, BYD Eye of God C has used its Journey 6M chip. Horizon Journey 6 series offers a total of six chips from 6B to 6P. Among them, Journey 6B faces entry-level products and is equipped with 10+TOPS computing power; Journey 6E and 6M are aimed at the mid-level smart driving market, with computing power of 80TOPs and 128TOPs respectively, which can meet the needs of high-speed NOA, lightweight Urban area NOA and memory driving respectively; the top-end product Journey 6P has computing power of 560TOPs, mainly for full-scene intelligent driving.

According to official data, BYD Eye of God C is equipped with 5 millimeter wave radars, 12 cameras, and 12 ultrasonic radars, but it is not equipped with high-cost laser radars. In terms of functions, this solution can achieve high-speed NOA, smart parking, and Urban area memory navigation. The latter is expected to be launched via OTA by the end of 2025.

Although BYD defines the Eye of God C as the most suitable high-end smart driving for the public, this statement has also sparked heated discussions. According to current industry mainstream standards, having high-speed NOA functions is not too scarce, and it can provide urban NOA Only can be regarded as high-end. Judging from this standard, a national smart driving wave may be coming soon, but high-level smart driving for all people may take some time.

It is reported that urban NOA needs to deal with long-tail scenarios such as dynamic pedestrians, complex intersections, and sudden obstacles, and its technical difficulty far exceeds that of high-speed scenarios. In this context, lidar is still one of the core sensors for high-end intelligent driving due to its three-dimensional sensing, strong anti-interference, and high ranging accuracy. nbsp;

Blue Whale News learned that BYD Eye A and B are equipped with lidar, the former has 3 lidar, and the latter has 1/2 lidar. The models equipped mainly cost more than 200,000 yuan. In December last year, BYD officially launched the no-map city pilot function nationwide, but it mainly promoted it in batches for models with relevant intelligent driving hardware foundations in the early stage such as the Looking Up U8, Tengshi Z9GT, and Tengshi N7.

Currently, the industry is also pushing the price of models equipped with lidar to lower. Recently, many car companies have announced that they will launch a 100,000-class lidar model. Among them, Chang ‘an said that its Tianshu smart driving system will be equipped with lidar in the 100,000-yuan class model in August to launch the first anti-collision function in extremely dark environments and extreme weather; Zero-Run predicts that its Zero-Run B10 pre-sold in March will take its first lidar Urban area smart driving within 150,000 yuan.

From the industry’s perspective, high-level intelligent driving will, to a certain extent, force the supply chain to reduce costs and promote the restructuring of the industrial chain. Taking lidar as an example, some industry chain people told Blue Whale News that the cost of lidar is much lower than that of many years ago. In 2017 and 2018, lidar products in the United States cost almost 80,000 US dollars, which is 100 times worse than now.” rdquo;

Under this trend, the lidar industry is experiencing a thousand-yuan machine revolution. According to media reports, the cost of mass production of Sagitar Juchuang’s lidar has dropped to less than US$500, and it is expected that the cost of some new products will drop to less than US$200 (approximately 1462 yuan) this year. Horser Technology’s next-generation lidar product ATX for Advanced Driver Assistance Systems (ADAS) is expected to sell for only half the price of the previous AT128 model.

People from Hesai Technology told Blue Whale News that we have products at different price points, targeting the needs of different car companies. Some car companies still hope to follow the high-performance route and play the safety card; others hope to buy products with a slightly lower cost.” rdquo;

“The main product supplied this year is ATX.& rdquo; The above-mentioned person from Hesai Technology revealed to Blue Whale News that the price of ATX will be about US$200.” ldquo;(Cost reduction) mainly relies on vertical integration, that is, chipization. In addition, lidar has also been used, which also plays a big role in reducing costs. rdquo; Its name.

The price reduction of laser radar is just a microcosm of the transformation of the intelligent driving industry chain. With the continuous sinking and popularization of high-end smart driving, changes in the entire chain from computing power to algorithms to data services will begin, and no one can stay out of it. How to find a balance between technological development and cost control tests all players.