If we print money frantically, we may see a situation closer to the previous traditional altcoin season, but this is unlikely.

Author: Steady Dog Diary

First of all, this cycle is difficult. But the truth is, each cycle is harder than the previous cycle. You have to compete with a larger crowd, and the number of experienced participants is increasing. If you didn’t hold most of your BTC or SOL during a bear market, you probably didn’t make any money and are in trouble.

So why is this cycle so difficult?

1. post-traumatic stress disorder

We have two examples of large altcoin cycles, most of which have dropped by 90-95%, and the entire industry has been infected due to the liquidations of Luna and FTX, and prices may even fall lower than they should have. This post-traumatic stress disorder deeply affects the indigenous people of cryptocurrencies.

No one wants to hold anything for a long time because they no longer want to lose a large amount of money in their portfolio. The mood swings among participants became stronger, and everyone was constantly looking for the top of the cycle.

The psychological impact is not limited to trading behavior, but also affects the way the entire ecosystem is built and invested. Projects now face more rigorous scrutiny and the threshold of trust has multiplied. This has both positive and negative effects: while it helps filter out obvious scams, it also makes it more difficult for legitimate projects to gain attention.

2. innovation

There are more iterative innovations and infrastructure is constantly improving, but there are no 0- 1 and jaw-dropping breakthroughs like DeFi did. This makes it easier for people to argue that cryptocurrencies have not progressed, etc., and has also led to more claims that “cryptocurrencies have achieved nothing.”

The innovation landscape has shifted from revolutionary breakthroughs to gradual improvements. While this is the natural evolution of any technology, it poses challenges for narration-driven markets.

We still lack the breakthrough applications needed to bring cryptocurrency to hundreds of millions of users on the chain.

3. regulatory

The corrupt SEC caused serious damage. They have hindered the development of the industry and prevented the further development of certain industries (such as DeFi) that could have more PMF and a wider audience. They also prevent all governance tokens from passing any value to their holders, thus creating the saying that “all these tokens are useless,” which is to some extent true.

The SEC drove away the builders (see Andre Cronye’s description of how the SEC forced him to resign), prevented TradFi from interacting with the industry, and ultimately forced the industry to raise money from venture capital firms, and created a poor supply and price discovery dynamic in which all value was captured by a few.

4. Financial nihilism

All of these factors have made financial nihilism an important factor in this cycle. The “useless governance tokens” and the high FDV and low float dynamics caused by the U.S. Securities and Exchange Commission (SEC) have prompted many cryptocurrency natives to turn to memecoin search of “fairer” opportunities.

In today’s society, asset prices are soaring, legal currencies are constantly devaluing, and wages cannot keep up. It is also a fact that young people have to gamble to get rich. Therefore, memecoin lottery tickets are very attractive. Lottery tickets are always very attractive because they bring hope.

Because gambling has PMF in cryptocurrencies, and we have better technology in gambling (Solana and Pump.fun, etc.), the number of tokens issued has soared. This is because many people want to make super gambling. There is such a need.

“Trench” has always been a word in cryptocurrencies, but in this cycle it has become a widely understood term.

This nihilistic attitude is manifested in the following aspects:

- “Degenerated” culture rises and becomes mainstream

- Shorten investment periods

- Focus more on short-term transactions rather than long-term investments

- Normalization of extreme leverage and risk-taking behavior

- Hold a “don’t care” attitude towards fundamental analysis

5. Experience from the previous cycle is a hindrance

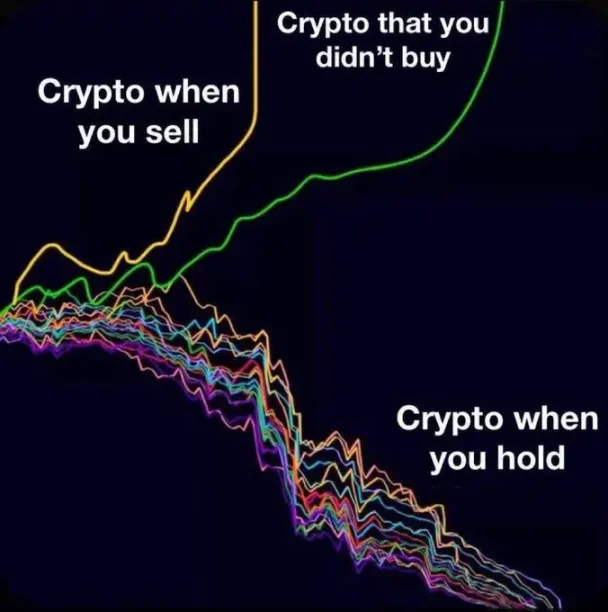

The past few cycles have taught you that you can buy some altcoins in a bear market and eventually get a return by outperforming BTC.

Few people are good traders, so this used to be the best choice for most people. Overall, there is a chance for even the worst alternatives.

This cycle is a trader’s market, and sellers are more suitable than holders. Traders even achieved the biggest gain of the cycle through HYPE airdrops.

The first hype cycle of AI Agents is an example. This may be the first time people feel that “this is something new we have been looking for.” This is still in the early stages and the long-term winner may not yet emerge.

6. BTC has new buyers, but most altcoins do not

The difference between Bitcoin and everything else has never been more obvious.

BTC unlocked TradFi’s bid. For the first time, it has an incredible new source of passive demand, and now central banks are discussing adding it to their balance sheets.

Altcoins are competing harder than ever against BTC, which makes sense because BTC has a clear goal of having a market value comparable to gold.

There are indeed no new buyers for altcoins. Some retail investors returned at new highs in BTC (but they bought XRP), but overall, traffic from new retail investors was insufficient and cryptocurrencies still had reputation issues.

7. Transformation of ETH’s role

The decline in BTC’s dominance is largely affected by the growth in ETH’s market value. Many people believe that the trigger for “altcoins” is the rise in ETH, but this heuristic has not worked so far during the cycle because ETH has performed very poorly due to fundamentals.

I still believe that fundamentals will always play a role in the long run, but you have to really understand the projects you support and how they will truly surpass BTC. There are candidates, but currently there are only a few.

Look for projects with the following characteristics:

- Clear revenue model

- Fit between actual products and markets

- Sustainable token economy

- Strong narrative to supplement the fundamentals (AI and RWA are appropriate for me)

I think that due to the deregulation of the United States, those with stronger fundamentals and PMFs can ultimately add value to their tokens, which are less risky investments. The revenue printing agreement has now been established and is working well. This is very different from the “silly” theory that previously dominated many token models.

You can choose to become a better trader, try to develop your edge and focus on doing more short-term trading, because this market does offer many consistent short-term settings. Onchain will provide larger multiples, but will also have a lower tolerance for downside risks.

For most people without clear advantages, barbell portfolios are still a viable approach. BTC and SOL (70-80%), and allocate less money to yourself for more speculative investments. Regularly rebalance to maintain these ratios.

You need to understand how much time you spend on cryptocurrency and adjust your strategy accordingly. If you’re an ordinary person with a job, competing in the trenches with Zoomer, who sits there 16 hours a day, is not going to work. This time, passively holding underperforming alternatives and waiting for your turn will not work.

Another strategy is to try to combine different areas. Have an underlying portfolio of solid assets and then consider making airdrops (it’s harder now, but lower-risk opportunities still exist), or identify emerging ecosystems and prepare early (HyperLiquid, Movement, Berachain, etc.), or focus on the selected category.

I still believe that the altcoin market will grow this year. It has been established that we are still relevant to global liquidity, but what truly surpasses BTC and SOL will be limited to a few industries and a smaller number of altcoins. The rotation speed of altcoins will continue to accelerate.

If we print money frantically, then we may see a situation closer to the previous traditional altcoin season, but I think that’s unlikely, because even in this case, most altcoins will only provide market-average returns. We will still launch some large altcoins this year, and liquidity will continue to be dispersed.