Author: Invesco| Vernacular blockchain

Invesco is a leading global independent investment management company founded in 1935 and headquartered in the United States. Invesco manages assets of more than US$1.8 trillion (as of 2024), operates in more than 20 countries around the world, and has been actively deploying blockchain and

Author: Invesco| Vernacular blockchain

Invesco is a leading global independent investment management company founded in 1935 and headquartered in the United States. Invesco manages assets of more than US$1.8 trillion (as of 2024) and operates in more than 20 countries around the world. In recent years, it has actively deployed blockchain and crypto asset investments, and is committed to exploring investment opportunities in Bitcoin and other crypto assets.

This article was written by Ashley Oerth, assistant global market strategist at Invesco. In this article, Oerth discusses the strong performance of crypto assets in 2024 and believes that the crypto industry will continue to hit new highs in 2025, driven by an improved regulatory environment and friendlier policymakers.

The following is the main text:

We believe that the crypto industry will continue to hit new highs in 2025, mainly benefiting from the gradual clarity of regulatory policies and friendlier policymakers.

Positive developments after the U.S. presidential election, changing investor attitudes towards the crypto industry, and the supportive background of the market may drive the performance of crypto assets. President Trump has expressed his desire to build a strategic Bitcoin reserve and appointed policymakers to support the crypto industry.

Crypto assets will perform strongly in 2024. With the Republican Party’s victories in the House, Senate and presidential elections, Bitcoin has exceeded the $100,000 mark. As of January 31, 2025, the total market value of all crypto assets has reached $3.5 trillion. Large-cap stocks in the United States have risen 4.8% since the election, Bitcoin has risen 47.6%, and Ethereum has risen 37.4%. We expect this momentum to continue in 2025, as a series of positive news and legislative developments look likely.

In our view, crypto assets are largely influenced by the macroeconomic environment and market sentiment, which may lead to large fluctuations in their prices. Currently, the market environment and sentiment are shifting in a more favorable direction for crypto assets, including some positive developments after the U.S. election, investors ‘more friendly attitude towards the crypto industry, and the overall market due to central bank interest rate cuts and the return of the global economy to a normal growth environment. Support background, etc.

We have listed the following five prominent factors that illustrate why crypto assets are likely to continue to perform well in 2025.

01. Crypto-friendly U.S. policymakers take office

President Trump has said he will continue to roll out a series of crypto-friendly policies, including a desire to build strategic Bitcoin reserves and appointing pro-crypto policy makers in key regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). However, support for crypto assets does not come from the president alone. According to data from a group that supports the crypto industry, in the 2024 general election, a total of 294 candidates from both parties who support the crypto industry were elected to the House and Senate of the U.S. Congress.

This could mean that Trump’s policies will be very different from those of the Biden administration, which has always been hostile to crypto assets. For example, the Securities and Exchange Commission under the leadership of SEC Chairman Gary Gensler has repeatedly filed lawsuits against crypto companies, but has not clearly stated the specific framework to follow, so it has been criticized as adopting an approach of “replacing policy with enforcement.” Biden himself opposes the crypto industry and remains opposed to the 21st Century Financial Innovation and Technology Act (FIT21) despite its bipartisan support.

One of the key points of contention is SAB 121-a notice issued by the SEC in 2022 that requires publicly traded institutions to strictly follow regulations when keeping crypto assets for customers. SAB 121 requires these institutions to include crypto assets on their balance sheets, which not only triggers capital regulatory requirements, but also prevents most banks from participating in the digital asset ecosystem. Because SAB 121 requires publicly traded institutions to include crypto assets on their balance sheets, most banks lack sufficient capital or related risk management measures to support this additional burden and are therefore unable to participate in the crypto asset ecosystem.

Because banks lack effective custody solutions, many crypto investors have had to turn to alternatives that are both expensive and often unreliable. Today, SAB 121 has been abolished, opening up a new path for more large institutions to provide crypto asset custody services.

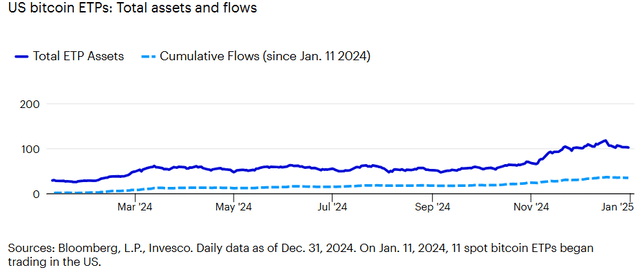

As U.S. policies change in the field of crypto assets, we expect more investors to begin to accept crypto assets, which may push the crypto market into a bull market. Since the November election, investor interest in U.S. Bitcoin CEX traded products (ETP:Exchange-Traded Products) has continued to rise.

Total asset size growth and capital inflow trend of US Bitcoin ETP since its listing on January 11, 2024

02. Investing in crypto assets has become easier

In 2024, the United States and Hong Kong launched spot Bitcoin products (ETFs), which have attracted net inflows of US$34.6 billion as of the end of 2024, according to Bloomberg data. It is expected that by 2025, more countries may allow a wider range of investors to participate in spot ETF trading. In addition, more crypto assets may also become easier to invest through ETFs. According to the latest regulatory filings from the U.S. Securities and Exchange Commission (SEC) as of the end of January, multiple ETFs already plan to start investing in other crypto assets. As more investment products are launched and more investors are attracted, we expect that the price of crypto assets may rise as a result.

03. Awareness of Bitcoin is changing

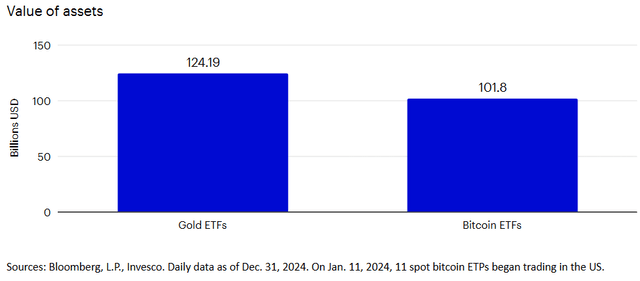

As the market value of Bitcoin continues to grow, investors ‘attitudes towards this leading crypto asset are also changing. In January 2024, the United States launched its widely accessible spot Bitcoin trading products (ETFs), marking an important milestone. The world’s largest capital market provides investors with a convenient way to easily invest in Bitcoin (which may also include Ethereum in the future). For example, as of January 11, 2024, U.S. investors have invested US$40.6 billion in the spot Bitcoin ETF, and by the end of 2024, the total assets of this product have reached US$101.8 billion. In comparison, gold ETFs have assets under management of $124.2 billion.

One year after its launch, the Bitcoin ETF’s asset size is close to the level of a U.S. gold ETF.

04. The market environment looks more favorable

Interest rate cuts in major economies such as the United States, the Eurozone, and the United Kingdom suggest that 2025 may become the “year of risk appetite” for global markets. In fact, our expectations for 2025 are more optimistic about the more cyclical areas of the market, such as stocks and Shindai. Where investors are more willing to take risks, crypto assets may see support because they are often more influenced by the macroeconomic environment.

05. Tokenization is gradually advancing

Tokenization is to record certain assets or information on the blockchain in the form of tokens, which brings many benefits to asset management and exchange. We believe that the current financial system can achieve multiple potential advantages through tokenization, such as reducing counterparty risk, accelerating payment and settlement speeds, and improving personalized customization of customers ‘investment experience.

In the past five years, the central bank’s pilot projects for tokenization of digital currencies and assets have gradually made progress, including token-based money market funds, token-based bonds and token-based market products. The British government plans to issue Token-denominated bonds for the first time in the next two years. In the euro zone, the European Central Bank is preparing to launch the digital euro, which is expected to promote the further development of Token-based applications. As this technology becomes popular, we expect that crypto assets may also benefit from it.

06. Summary: 2025 is a year worth paying attention to

Crypto assets are a highly volatile investment that may fluctuate significantly due to changes in news events. Overall, the reason why we believe that the crypto market will continue to hit new highs in 2025 is mainly due to improved regulatory transparency and friendlier policies, which have brought good news to digital assets (for example, price fluctuations in the crypto market after Trump’s election, news of Trump’s nomination of chairman of the U.S. Securities and Exchange Commission (SEC), and the U.S. decision to approve spot Bitcoin and Ethereum ETFs). We also expect that interest rate cuts in many major economies may stimulate demand for risky assets.

Note: The above views only represent the author’s personal opinions as of February 14, 2025, and cannot be regarded as investment suggestions, but are for reference only. Forward-looking statements do not guarantee future results, and the risks, uncertainties and assumptions involved may cause actual results to differ from expectations.