Solana’s DEX landscape is shifting towards greater efficiency and deeper concentration of liquidity.

Solana’s DEX landscape is shifting towards greater efficiency and deeper concentration of liquidity.

Written by: vik0nchain, researcher at CyberCapital

Compiled by: Luffy, Foresight News

From the fourth quarter of 2024 to the beginning of 2025, Solana’s DeFi ecosystem competition landscape will gradually emerge, mainly reflected in the rise of aggregators, user experience (UX) abstraction, major integrations, and evolving token economy standards. Although these changes were not obvious at first, recent data has clearly demonstrated the impact, highlighting changes in liquidity redistribution, expense generation and market share.

This analysis provides an in-depth analysis of the liquidity positioning of Solana-based major decentralized exchanges (DEX)-Raydium, Jupiter, Orca and Meteora-focusing on their advantages, disadvantages and potential investment impact relative to existing and emerging competitors.

Investment analysis framework

Optimistic outlook for Raydium (RAY): Deep liquidity and repurchase advantages

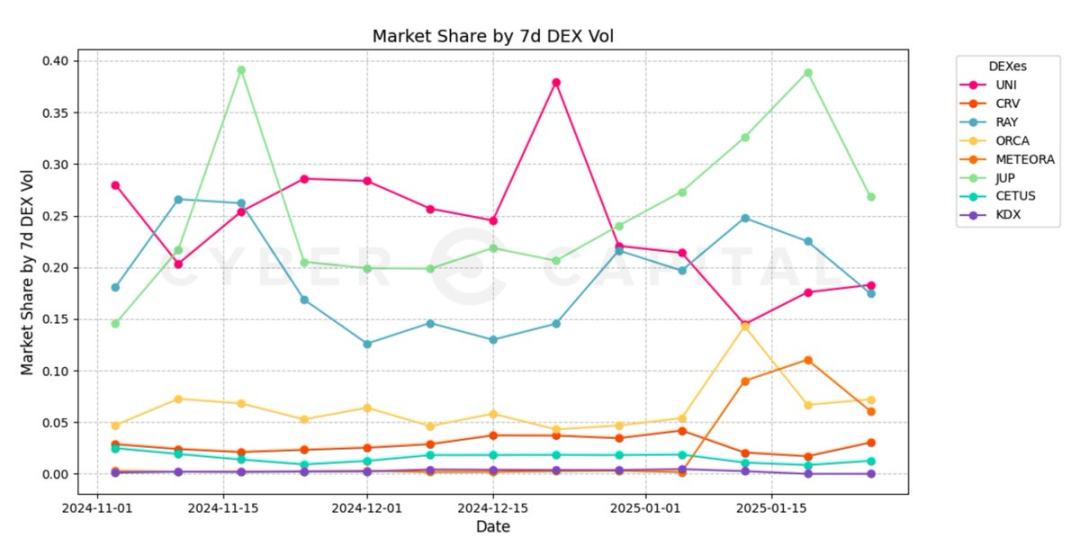

- Dominance of liquidity and volume: Raydium remains the most liquid and frequently used decentralized exchange in the Solana ecosystem. More than 55% of transactions routed through Jupiter are settled on Raydium. In addition, Raydium holds a market leading position among all blockchain decentralized exchanges along with and sometimes even surpassing Uniswap, with its fully diluted valuation (FDV) and market value only about one-third of Uniswap.

- Raydium/Uniswap fully diluted valuation ratio: US$28.72828346 million/US$91.02379018 million = 31.5%

- Raydium/Uniswap Market to Market Ratio: US$15.05604427 million/US$5465824531 million = 27.5%

- Pump.fun integration: Key partnerships, including the integration with Pump.fun, have increased transaction volume and protocol stickiness due to the migration of all new Meme pools to Raydium.

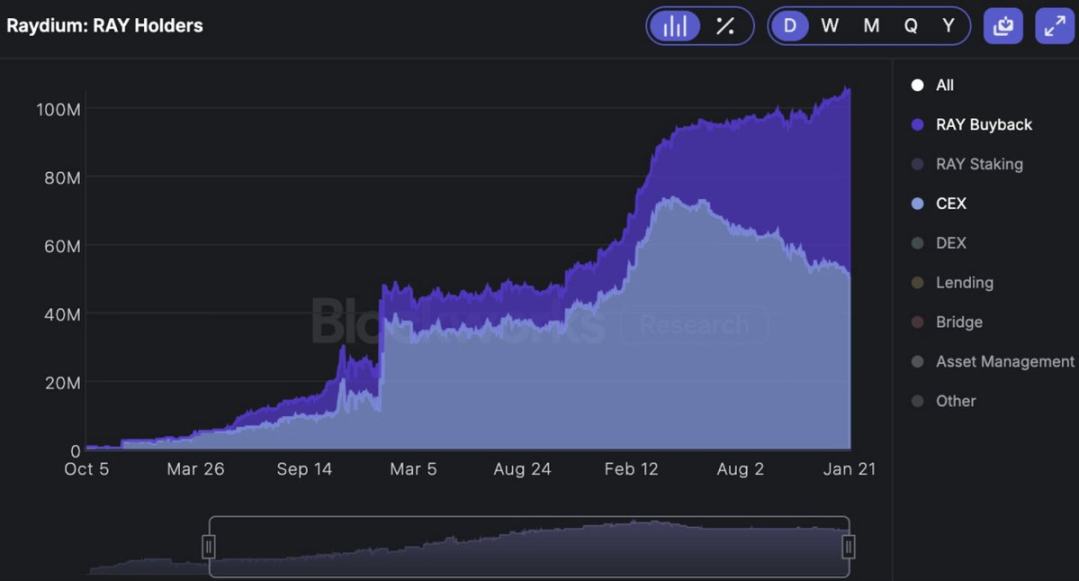

- Token repurchase: Raydium’s 12% fee repurchase program has bought back more than 10% of total supply of tokens, significantly reducing selling pressure. It is worth noting that the amount of Raydium repurchases significantly exceeds the amount held on centralized exchanges.

Jupiter (JUP) is optimistic: market-leading aggregator

- Liquidity aggregation advantages: Jupiter plays a key role as Solana’s dominant aggregator.

- Acquisition of Moonshot: The acquisition of Moonshot allows Jupiter to integrate deposit/withdrawal channels within its decentralized exchange, improving competitiveness by simplifying the user experience.

- Unlocking pressure: Jupiter faces a 127% supply increase due to token unlocking, which poses a medium-term inflation risk. Despite the recent announcement of a repurchase mechanism, the internally estimated annual repurchase rate is 2.4%. Although this provides some support for the token economy, it has limited role in competition with Raydium.

- Business model: Since aggregator fees are charged extra on top of the underlying protocol fees, the aggregator model faces difficulties in terms of low fees.

- Lack of competitors: Jupiter, the first aggregator on Solana, lacks strong competitors.

Meteora’s outlook is optimistic: The rising liquidity aggregator

- Aggregated liquidity efficiency: Unlike independent decentralized exchanges, aggregators like Meteora inherently have lower downside risk and more stable capital efficiency.

- Token issuance catalyst: The successful issuance of Meteora tokens may change liquidity preferences and provide long-term support for its market positioning. Unlike industry LP leader Kamino, MET points are not publicly displayed on the user interface. In addition, there have been no official announcements about airdrops since the MET points system was first announced more than a year ago. Although liquidity providers can reap higher returns elsewhere in the ecosystem, such as lulo.fi, market positioning and airdrop expectations may be the main drivers for liquidity providers.

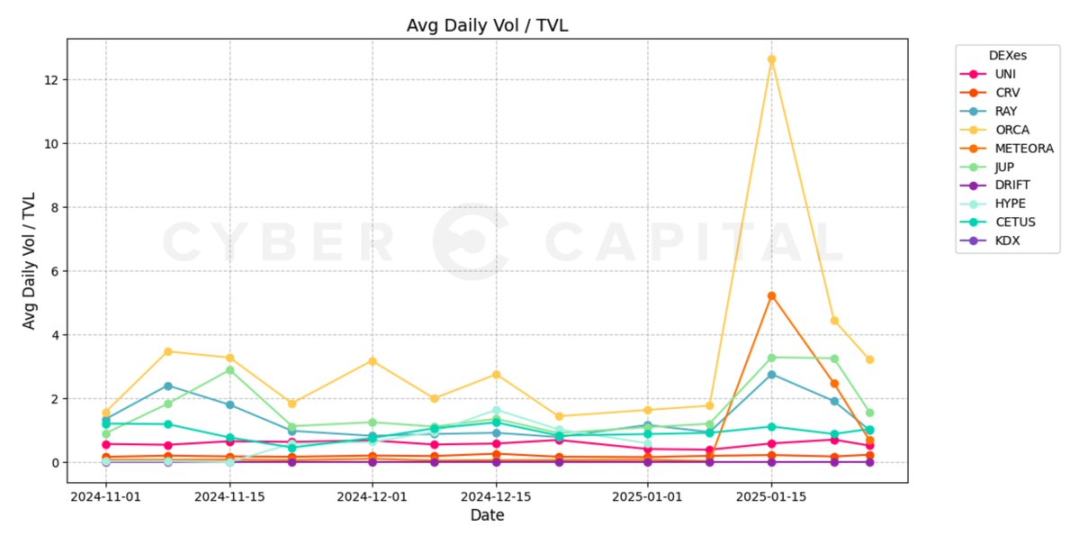

- Total lockdown value (TVL) retention: Meteora has developed through major events such as Pengu airdrops and the launch of Trump and Melania-related Memecoin. Although the volume/total locked value (Vol/TVL) ratio of many trading pairs increased due to temporary demand during the launch of Memecoin, Meteora’s total locked value continued to rise after the event, showing a good Retention rate.

- Integrated development: Virtuals migrated to Solana in the first quarter of 2024 and announced integration with the Meteora liquidity pool.

Orca’s pessimistic outlook: insufficient liquidity retention

- Insufficient depth of liquidity: Although extremely efficient, Orca’s pool size is significantly smaller than Raydium, resulting in a higher slip point for large transactions.

- Market positioning issues: Jupiter’s routing mechanism prioritizes more liquid trading platforms, making emerging low-liquid decentralized exchanges and liquidity pools unattractive.

- The emergence of Meteora as a liquidity aggregator further limits the competitive viability of non-dominant decentralized exchanges in routing frameworks, as they are routed only if the slip point cost is below Meteora’s fee premium, which is extremely rare in addition to surging market demand.

- Limited liquidity provider incentives: Orca lacks a strong liquidity mining strategy, resulting in low long-term liquidity provider Retention rate.

- Inefficient capital allocation: Unlike Meteora, Orca has not yet implemented automated revenue optimization and needs to manually manage LP, making the user experience more cumbersome.

- Not optimistic about liquidity trends: The upcoming Meteora token may completely lure liquidity providers away from Orca, making their situation even more difficult.

- Insufficient integration: The failure to reach a partnership with Pump.fun in early 2024 and the recent missed partnership with Virtuals highlights its competitive disadvantage in obtaining order flows for emerging retail-driven applications. Without an imminent catalyst to reverse this trend, liquidity migration may continue.

- These factors prevented Orca from retaining the additional users it gained during peak network demand.

Key catalysts and risks

Catalysts to pay attention to

- Comparison of RAY repurchase and centralized exchange holdings: The repurchase speed of RAY now exceeds the total amount of RAY held on centralized exchanges, strengthening the scarcity of tokens.

- Growth trend in total locked position value: The continued dominance of Raydium, Jupiter and Meteora demonstrates the sustainability of long-term liquidity. Under high-pressure market conditions, the sticky performance of emerging agreements deserves attention and cannot be ignored.

- Partnership: Just as Pumpfun’s integration brings significant liquidity to Raydium, the integration of Meteora and Virtuals may also have a similar effect. Given the impact of partnerships of this size on liquidity and total lockdown value, partnerships with lesser-known participants have attracted much attention.

- Meteora’s token issuance: This event may mark a turning point in the allocation of liquidity on Solana’s decentralized exchange.

- Expenses to market value ratio: Orca has been extremely efficient in months when demand is strong, but its lack of liquidity retention impedes long-term competitiveness. JUP, on the other hand, faces the opposite situation and is limited by its business model. Compared to the latest “hot project” Hyperliquid, Raydium incurred tenfold fees at a fully diluted valuation of one-eighth.

risk

- Inflationary pressure on JUP: Despite Jupiter’s solid aggregator status, its large supply of tokens could cause short-term price pressures.

- Orca’s decline in market share: If the trend of migration of liquidity providers continues, Orca may face continued liquidity losses.

- Meteora airdrop and token economy execution risks: Despite strong early growth in total lockdown value, its token economy and incentive structure remain untested.

Conclusions and investment outlook

Solana’s decentralized exchange landscape is shifting towards greater efficiency and deeper concentration of liquidity. Raydium’s excellent liquidity positioning, proactive repurchase mechanism and market dominance make it a decentralized exchange with great investment confidence. Jupiter’s aggregator role remains crucial and provides a barrier to competition, but dilution of the token supply poses resistance in the short term. Orca was once a competitive player, but faced severe challenges in liquidity retention and capital efficiency, becoming an increasingly fragile asset, demonstrating missed key integrations and difficulty competing head-on with mature players. Meteora is expected to rise after the successful launch of its upcoming tokens. According to our current theory, investment positions on decentralized exchanges should be concentrated among leading decentralized exchanges, decentralized exchange aggregators, and liquidity aggregators in a given ecosystem, and emerging participants who meet catalyst criteria can also hold small positions.