Although NS has cost advantages, the ecology is not yet mature.

Author: Luke, Mars Finance

introduction

The NS token soared by 103% in just one hour, and the price exceeded 0.43 USDT. It then fell slightly and is currently at 0.38 USDT. This wave of increase has attracted widespread attention and surprised many retail investors: Why did a previously unknown blockchain domain name token suddenly become the focus of the market? This article will conduct an in-depth analysis of NS’s technical advantages and economic model, compare it with Ethereum Name Service (ENS), and finally discuss whether the blockchain domain name track has investment potential.

The surge triggered by the liquidation of the giant whale

The surge in NS was not entirely driven by the token economy model, but was triggered by the capital operation of the giant whale. This situation is quite similar to the past GameStop incident. At that time, the giant whale quickly created a short-term boom in the market through large-scale replacement and airdrop positions.

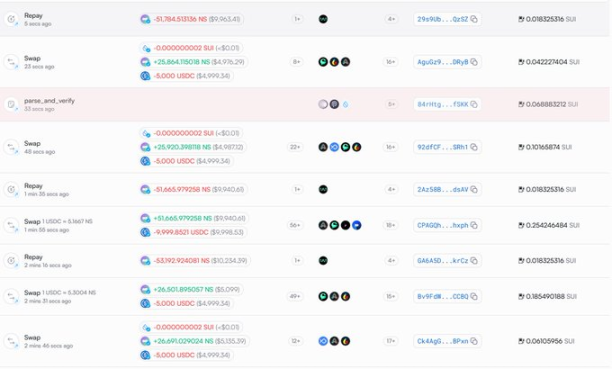

A giant whale invested funds in the Navi platform in early 2025, used NS as collateral for loans, and carried out short operations on the exchange. The giant whale first lent NS, sold short, and then used the profits to repay the loan and re-mortgaged NS, forming an endless capital operation. However, the space for such operations has gradually exhausted. If other investors start withdrawing their NS on Navi, Giant Whale’s short positions could suffer rapid liquidation.

According to online data, the surge on February 20 was caused by a giant whale or group of giant whales trying to cover short positions and repay loans by buying back 75,000 NS units per minute, which triggered sharp price fluctuations. In the process, the joint counterattack of retail investors played a role in fueling the flames, similar to the “squeeze” effect in the stock market, causing the price to soar to 0.43 USDT.

Although this situation seems to give retail investors an opportunity to make profits in the short term, it also hides greater risks. Giant Whale’s short positions and airdrops may form an unstable capital cycle in the market. If retail investors and investors withdraw their NS, Giant Whale’s short positions may be quickly liquidated, thereby exacerbating price fluctuations. Therefore, this type of market surge is both an opportunity and a bubble.

What is NS? Blockchain domain name service in Sui Ecosystem

Sui Name Service (NS) is a core technology in the Sui ecosystem that provides users with a simple and easy-to-remember blockchain address solution. In the blockchain world, long lists of addresses often cause headaches, and NS’s goal is to make these complex addresses more concise and easier to identify. For example, the address “0xd77861 e972e02 feb0927611 eb934b67a1f9 e60782 e36cdef 61f6779919 b6a8cd” on Sui may confuse you, but with NS, you can convert it to a short identifier like “@john” or “john.sui”, similar to how you create a username on social media, except that it is completely decentralized and runs on the Sui blockchain.

Developed by the Mysten Labs team, NS leverages the high-performance architecture of the Sui blockchain to provide speeds of up to 100,000 transactions per second, giving it the ability to process large numbers of transactions. Users only need to pay about 20 SUI (equivalent to a few dollars) to register a domain name, and the June 2024 V2 upgrade also adds sub-domain names, making naming more flexible, similar to “@john.family”. NS’s core mission is to provide a decentralized “domain name yellow pages” for Web3 and provide more convenient digital identity and asset management for the blockchain world.

NS vs. ENS: Rookie versus Big Brother

To understand the potential of NS, we might as well compare it with ENS, a veteran giant in the blockchain domain name field. ENS, as a core project in the Ethereum ecosystem, has firmly dominated the domain name market as early as 2021. It provides users with concise addresses like “vitalik.eth”. Relying on Ethereum’s huge ecosystem and first-mover advantage, ENS has become the most popular domain name service in the blockchain world. ENS has registered more than 2.6 million domain names so far, and the price has soared from the initial US$43 to US$85.69 in November 2021. It was then pulled back to US$6.7 (October 2023) due to the bear market, and now it has returned to the US$25 -35 range.

But ENS also faces some challenges. The most significant shortcoming is the high Gas fee, which makes the annual domain name registration cost often as high as US$5 to US$640. Short domain names are particularly expensive, often requiring 300 ETH (hundreds of thousands of dollars). In addition, due to Ethereum’s transaction speed and handling fees, the registration and use costs of ENS are relatively high for ordinary users.

Unlike ENS, NS runs on the Sui blockchain and has significant advantages. Sui is known for its high-performance transaction architecture, which can easily reach 100,000 transactions per second, which gives NS huge advantages in cost and efficiency. NS can register a domain name similar to “@john” for just a few dollars, and its Gas fee is almost negligible. Thanks to the rapid development and low-cost advantages of the Sui ecosystem, NS is likely to achieve rapid growth in emerging markets.

However, NS’s ecosystem is not as mature as ENS, and its user base and market size lag far behind ENS. Retail investors need to be patient and wait for its gradual development in the ecosystem.

Domain name track: Web3 ‘s “ID craze” has both potential and risks

Blockchain domain names are rapidly becoming one of the infrastructures of the Web3 ecosystem, similar to the Domain Name System (DNS) in the traditional Internet. It not only simplifies complex blockchain addresses, but also provides a decentralized, verifiable identity system for decentralized applications (DApps), NFTs, and digital assets. Just as.com domain names became a scarce asset of the Internet in the 1990s, blockchain domain names may become a “digital ID” in the Web3 field. As the number of Web3 users surges, the market demand for blockchain domain names will also rise.

In this area, NS and ENS represent two different competitive strategies. ENS, as a leader in the Ethereum ecosystem, has become the “big brother” of blockchain domain names with Ethereum’s strong ecosystem and first-mover advantage. It currently has more than 2.6 million domain names registered and is firmly targeted at the high-end market through its integrated wallet, DApp and NFT usage. Despite this, ENS’s high Gas fees and high registration costs are still its main shortcomings, especially for ordinary users, where domain name registration costs are high.

In contrast, NS relies on the high performance and low cost advantages of Sui blockchain to demonstrate strong competitiveness in the market. The transaction speed of the Sui blockchain is extremely fast, the cost of registering a domain name is only a few dollars, and the Gas fee is almost negligible, making it extremely attractive in emerging markets. However, NS is still in its early stages of development, and its ecosystem and user base are far behind those of ENS, so investors need to be cautious.

Overall, although the market has huge potential, speculation and regulatory changes may still pose risks to investors. Despite this, blockchain domain names are still an important cornerstone of the Web3 ecosystem. Whoever can accurately grasp market demand can make profits on this track.

Conclusion: This surge is only a temporary opportunity, and risks still exist

Although the short-term surge in NS has attracted great attention from the market, this price surge may simply be due to short-term fluctuations caused by the clearing of giant whale airdrop positions. Similar to the “squeeze effect” in the stock market, the giant whale conducts large-scale repurchase in order to cover short positions. Although it pushes up prices, this fluctuation is likely to be temporary and unsustainable. Although retail investors have achieved higher returns in the short term, the risks behind this surge cannot be ignored.

As market sentiment fluctuates and liquidity is limited, NS may face the risk of a price correction, especially when the giant whale operation ends, and market support may weaken. Therefore, despite NS’s potential in the Sui ecosystem, investors must be cautious and not be induced by short-term price fluctuations. For those investors who want to hold for the long term, they should pay close attention to the long-term development, technological progress and ecological construction of the project, rather than just relying on short-term market heat.

In the crypto market, opportunities and risks always coexist, and investors need rational judgment and risk management. The future of NS is still full of uncertainty, and this surge is only a short-lived theater in the crypto market and may not last. Therefore, retail investors are advised to remain sober when participating and avoid blindly chasing after highs to avoid falling into the risks brought by short-term bubbles.