Hot spots change, will opportunities come in together with hot money?

Just as the market is in a chaotic cycle of disorderly fluctuations, Sonic, formerly known as Fantom, once again re-entered the market with its old business DeFi. The main coin $S soared this week, and the overall TVL of the ecosystem also doubled in a week. Each DeFi token in the ecosystem increased by an alarming amount. The leading project $Shadow rose by more than 500% a week. The same increase occurred in almost every Sonic ecosystem in the past week. Quality projects.

The recovery of Sonic’s ecosystem is undoubtedly due to the high quality of its own DeFi ecosystem, which has brought many external increases. A large part of the popularity is also attributed to the fact that AC (Andre Cronje), the founder of Sonic’s ecological spiritual pillar, has been frantically bidding for orders and high-intensity surfing 24 hours a day. Whether it is DeFi or Meme, as long as it is a project in its own ecosystem, it is almost always answered and forwarded crazily.

During the window when Solana and BSC were in low spirits and liquidity in the chain had not yet found new exports, we took stock of some projects worthy of attention in Sonic ecology and saw how Fantom OG could participate in the Sonic ecosystem, which had been saving for three years.

DeFi

-

$SHADOW(@ShadowOnSonic)

Contract address:

0x3333b97138D4b086720b5aE8A7844b1345a33333

Current market value: US$38 million

Maximum market value: US$45 million

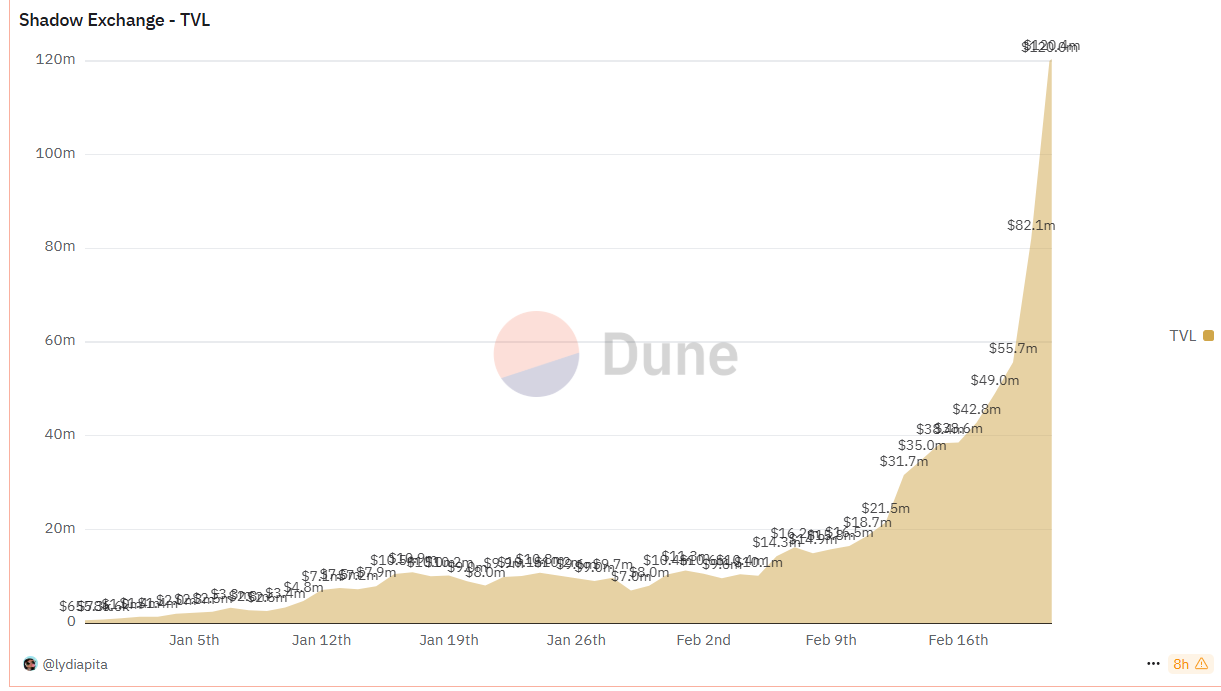

Recently, Sonic’s DeFi popularity is closely related to Shadow’s token $SHADOW. Shadow is the backbone of Sonic’s ecologyIn x(3,3) Model DEX, the innovation highlight is to make profits by traditional lockups ve(3,3)The gameplay has been transformed x(3,3)"The mutual aid model is a fine for early leave and the divided money left behind.

Users can deposit $SHADOW to obtain a pledge certificate $xSHADOW to obtain income from various agreements. At the same time, you can withdraw from the pledge at any time, except that a certain proportion of tokens (which changes according to the holding time) needs to be deducted as an early leave penalty, and the deducted tokens are distributed to the users who maintain the pledge.

This innovation has brought high pledge returns to $xSHADOW holders, and also caused Shadow’s TVL to rise sharply:

-

Beets.fi(@beets_fi)

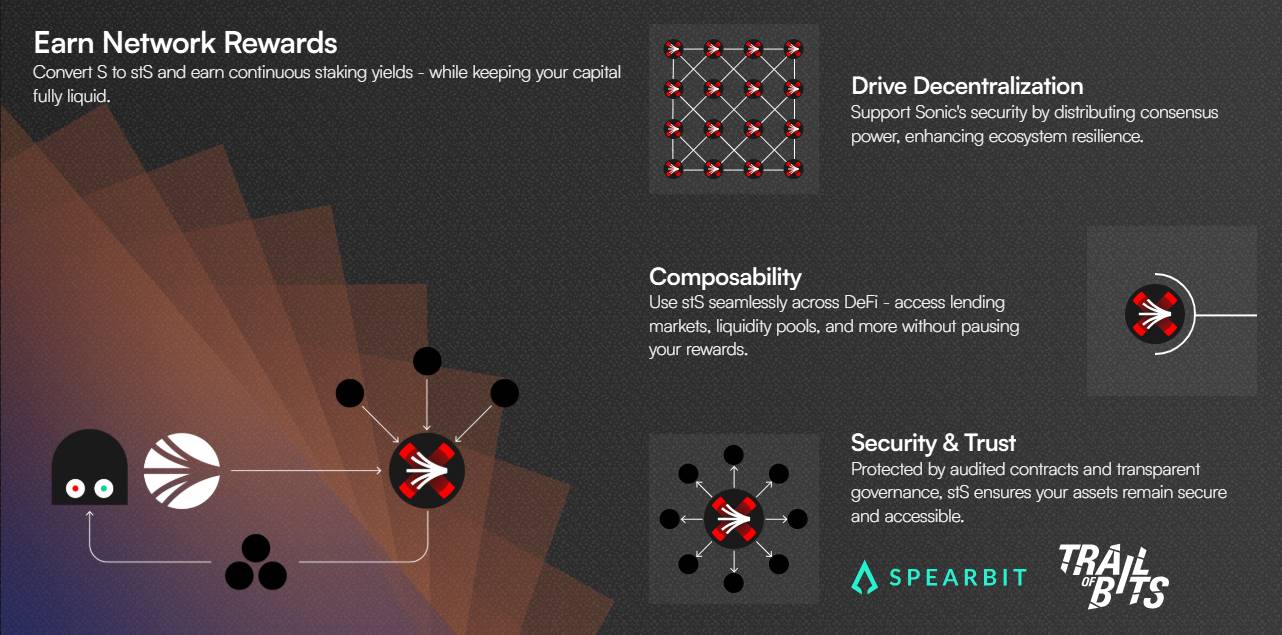

Beets.fi (Beets for short) is the LST center in the Sonic ecosystem, developed and upgraded by the Beethoven X team. As Fantom transitioned to Sonic, Beets transformed from DEX to Sonic’s core staking and mobility infrastructure projects, becoming a pillar project of Sonic’s ecosystem, suitable for users seeking stable income and long-term participation.

Users obtain the liquidity pledge certificate $stS by pledging $S, which not only retains the income of the network pledge but also maintains the liquidity of assets. The automatic compound interest mechanism designed by it allows the income to continue to accumulate. The platform uses $stS to build a matrix of multiple liquidity pools, such as the $wOS/$stS pool that works with Origin Protocol, allowing users to capture multiple benefits while maintaining $S exposure.

-

$EGGS (@eggsonsonic)

Contract address:

0xf26Ff70573ddc8a90Bd7865AF8d7d70B8Ff019bC

Current market value: US$12.7 million

Maximum market value: US$13.7 million

Eggs Finance (referred to as Eggs) is a leveraged income agreement on Sonic’s ecosystem. It combines a leveraged income tool with Sonic’s native token $S to create a capital circulation system within the ecosystem. The goal is for $S holders to amplify gains while retaining positions.

The operating mechanism of Eggs Finance can be summarized in terms of casting, leverage, and revenue cycle:

Users can pledge $S to Eggs Finance to create a derivative token $EGGS, which is pegged to $S but has leveraged properties. Foundry costs increase with participation time, early user costs are low, and part of the $S paid by later users will be returned to early participants, forming a revenue cycle similar to Ponzi. After that, users can borrow more $S using $EGGS as collateral and put it into other pools (such as ShadowOnSonic or Beets) to earn high returns. Someone on X mentioned that the short-term annualized yield of the $EGGS/$S pool was once as high as 1800%.

Currently, Eggs Finance has been included in DeFi Llama, and transactions are mainly conducted on Sonic’s DEX.

MEME Project

On February 7, Sonic officially held the Meme Mania Competition. From February 7 to March 8, 2025, a total of 8 Sonic Ecological Memecoin projects were selected as winners. The top 125 holders of the eight winning Memecoin received a total prize pool of 1 million $OS tokens (a liquidity pledge certificate of the Sonic Ecosystem).

Meme Mania event pageThe currently top 8 Memecoins are listed:

-

$GOGLZ (@GOGLZ_SONIC)

Contract address:

0x9FDBC3F8ABC05FA8F3AD3C17D2F806C1230C4564

24H trading volume: US$8 million

Current market value: US$15 million

Maximum market value: US$20.7 million

-

$THC (@TinHat_Cat)

Contract address:

0x17Af1Df44444AB9091622e4Aa66dB5BB34E51aD5

24HTrading volume: US$1 million

Current market value: US$7.5 million

Maximum market value: US$9.5 million

-

$fSONIC (@fantomsonicinu)

Contract address:

0x05e31a691405d06708A355C029599c12d5da8b28

24H trading volume: US$664,000

Current market value: US$1.61 million

Maximum market value: US$1.97 million

-

$Indi (@indi_sonic)

Contract address:

0x4EEC869d847A6d13b0F6D1733C5DEC0d1E741B4f

24H trading volume: US$378,000

Current market value: US$4.53 million

-

$HEDGY (@hedgycoin)

Contract address:

0x6fB9897896Fe5D05025Eb43306675727887D0B7c

24H trading volume: US$500,000

Current market value: US$2.9 million

Maximum market value: US$3.6 million

-

$TYSG (@tysonicgodd)

Contract address:

0x56192E94434c4fd3278b4Fa53039293fB00DE3DB

24H trading volume: US$210,000

Current market value: US$977,000

Maximum market value: US$4 million

-

$FROQ (@FROQ_SONIC)

Contract address:

0x131F5AE1CBfEFe8EFbDf93dA23fa4d39F14a817c

24H trading volume: US$450,000

Current market value: US$1.42 million

Maximum market value: US$2.2 million

-

$SDOG (@sDOG_SONIC)

Contract address:

0x50Bc6e1DfF8039A4b967c1BF507ba5eA13fa18B6

24H trading volume: US$243,000

Current market value: US$857,000

Maximum market value: US$1.4 million

Note: The price of Meme tokens fluctuates violently and carries high risks. Investors should fully assess the risks and participate cautiously. This article only carries out information transfer and sharing based on market hotspots. The author and the platform do not guarantee the integrity and accuracy of the article content. At the same time, this article does not have any investment suggestions.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern