Perhaps when the bubble fades and the market goes through a round of washing, the real opportunity for bargain-hunting will quietly come.

Original title: Everything before this was just noise-now the real bull cycle begins

Original author: hitesh.eth

Compiled by: Asher

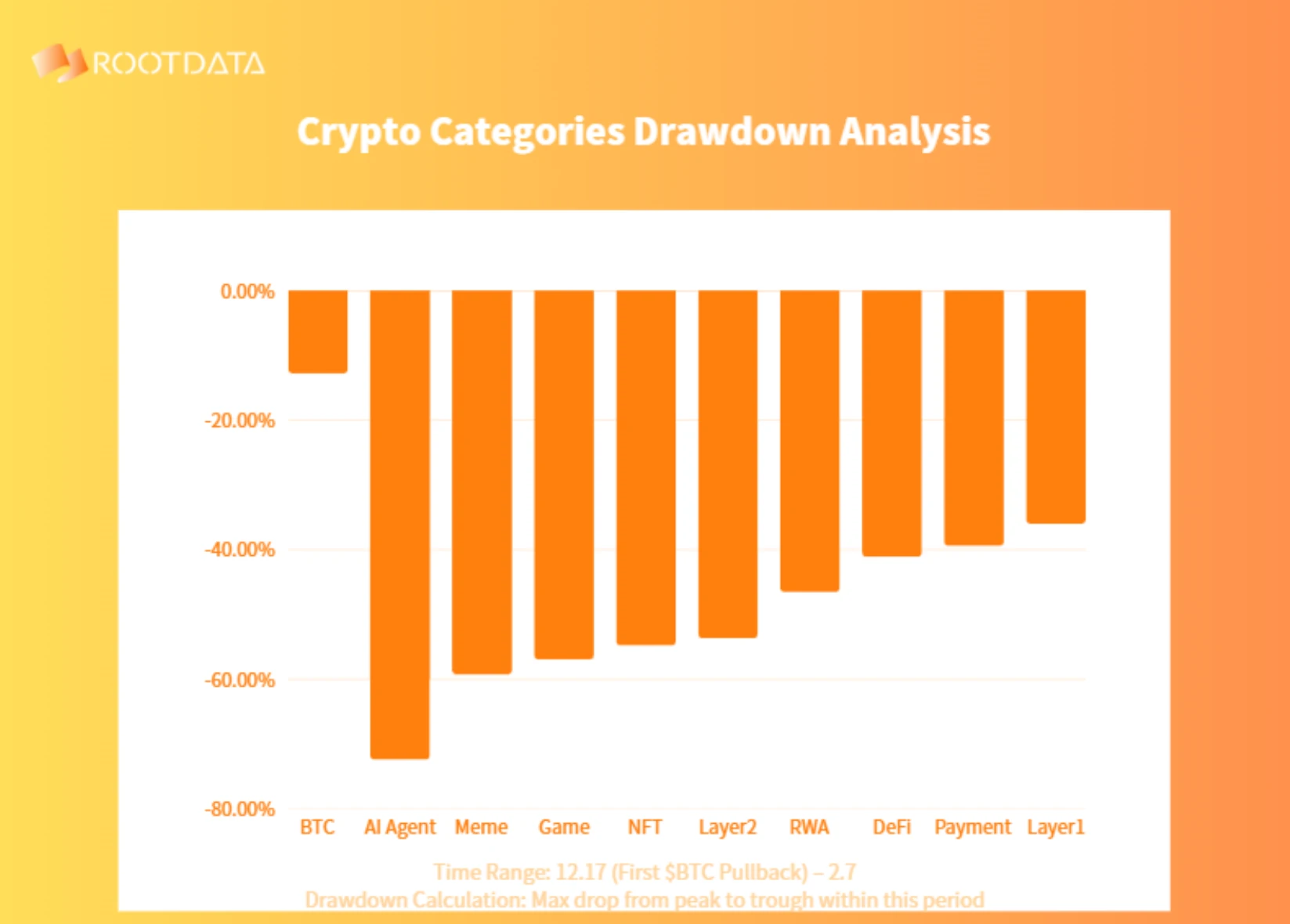

Recently, the correction in Bitcoin prices has caused altcoins in almost all sectors to experience a significant decline, and some sectors have even experienced extreme retractions. According to ROOTDATA’s data on February 8, since Bitcoin’s first correction on December 17, 2024, the AI Agent sector has experienced the largest decline, reaching 72.41%, followed by the Meme sector, with a decline of 59.24%; the GameFi sector has a decline of 56.96%; the NFT sector has a decline of 54.8%, and some other categories have retractions of more than 40%.

Data source: RootData

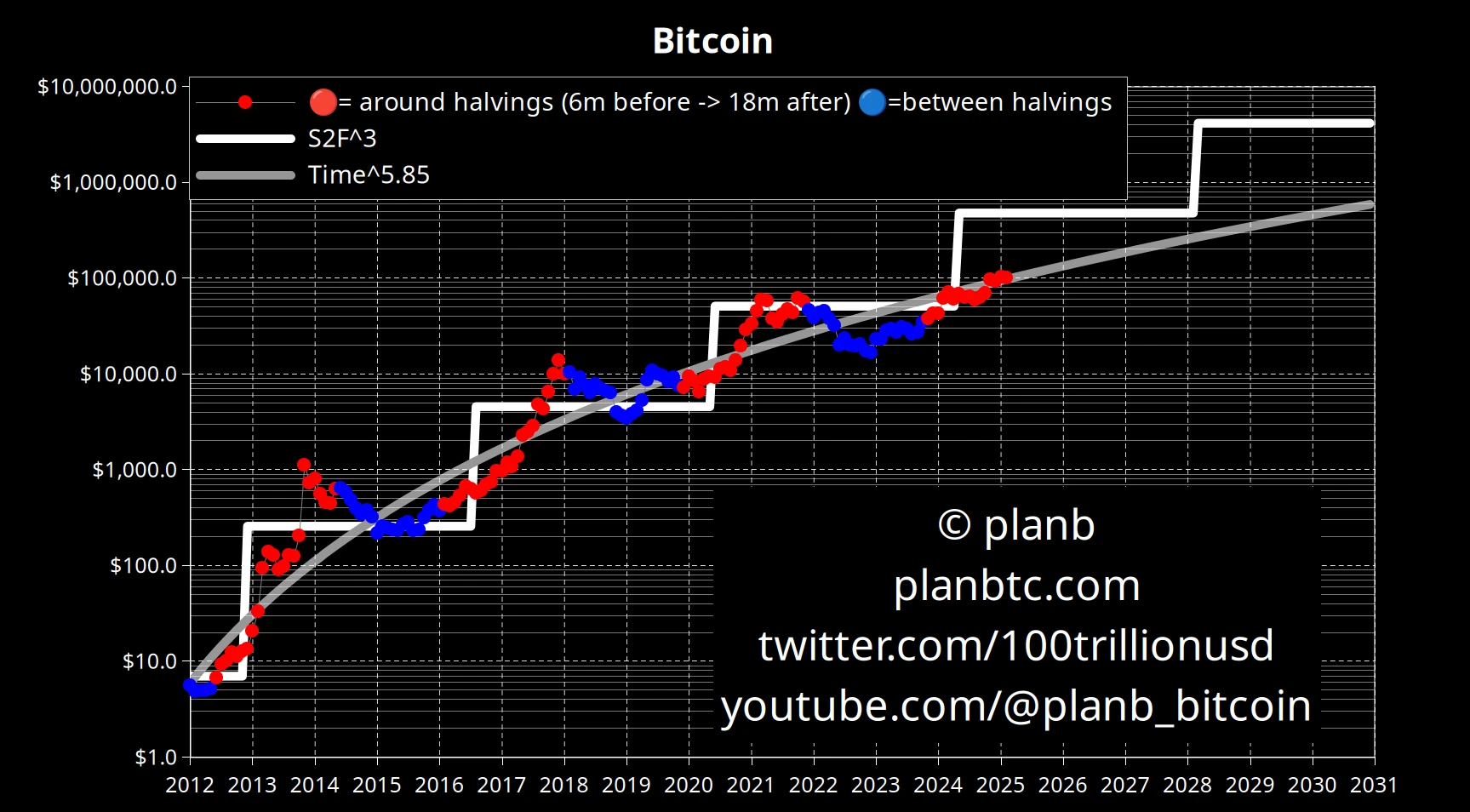

Perhaps when the bubble fades and the market goes through a round of washing, the real opportunity for bargain-hunting will quietly come. According to historical data from chart backtesting released by analyst PlanB, all Bitcoin profits appear in the red period in the chart (that is, six months before the halving to eighteen months after the halving), while the blue period in the chart is all losses. We are currently in a red period and expect the bull market to continue into October (starting in February).

PlanB vs. BTC analysis chart

In addition, from a macro environment, the real bull market cycle for encryption may just start.

In this article, hitesh.eth analyzes the vision of a crypto society and explores two paths that the crypto market may face in the future: one is anarchy full of speculation and freedom, and the other is gradually strengthened supervision and control. With the development of the market and technological advancement, these two paths will become more and more clear, and a real bull market cycle may soon begin.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Encryption was supposed to be an anarchic experiment

The birth of encryption technology is no accident. It has developed over decades, and thousands of cryptographers have promoted this process with the goal of building a truly decentralized encryption society. In a society where legal identity is no longer a requirement, everyone can remain anonymous, and governance, currency, communication, interaction and collaboration are fully driven by encryption technology without any rights restrictions.

In such a world, people are free to create markets, transactions are unfettered, wealth truly belongs to individuals, and the tax system loses control. The power institutions and the banking system have long controlled the economy and have long been mired in corruption, and carefully constructed illusions make it difficult for people to realize that they are already in a cage.

Bitcoin Awakening

The emergence of Bitcoin guides the development direction of a cryptographic anarchic society. It provides an alternative to the traditional financial system, allowing individuals to independently control wealth rather than relying on banks or governments. For the first time, money is truly decentralized, censory-resistant, transparent, and requires no permission.

In 2008, Satoshi Nakamoto released a white paper on Bitcoin, which was not only a technological breakthrough, but also a change in thinking. It shook the foundation of the centralized monetary system, exposed the shortcomings of the government and financial elite’s manipulation of fiat currencies, and marked an important step in breaking long-term economic oppression.

Subsequently, Ethereum built a complete development infrastructure, comprehensively explored application scenarios of blockchain technology, and promoted the first wave of the era of encryption and anarchy.

Everything can be token

Crypto-anarchic societies need infrastructure to support tokenization, so that everything that can be expressed in words or images can be tokenized, and liquidity markets can be built around them.

This vision was put forward as early as 1988 by cryptopunk legend Timothy May in his “Crypto-Anarchy Manifesto.” He paints a world empowered by encryption tools, where privacy, freedom and individual sovereignty are realized and no longer under the control of government and centralized power. May described how encrypted communications, anonymous transactions and decentralized systems make oppressive institutions irrelevant. The declaration became the ideological cornerstone of Bitcoin and the broader encryption movement, inspiring developers and thinkers to view cryptography as the ultimate tool for human liberation.

If we put aside price fluctuations and focus on the nature of market development, we can find that a key liquidity guidance mechanism-Bonding Curve-was unlocked last year. This mechanism can create liquidity markets for all kinds of things based on literal concepts. In the field of imaging, NFT has completed this exploration in the previous cycle. The current experimental direction is to create as many liquid markets as possible to meet the needs of different levels.

Meme coins are the market

On the surface, creating Memecoin means creating liquidity markets that seem meaningless, but the core is creating markets, assuming that some people like to speculate on “X” and provide them with the opportunity to enter the chain so that they can profit from it.

In this speculative process, people form beliefs around certain things that stem from the theories or data they use. So, in effect, we are building liquidity markets for various tokenized beliefs.

Crypto anarchy Wild West

In the state of crypto anarchy, people can trade opinions, trends, stories, articles, songs, memes, research papers, reputations, gossip, reviews, recipes, and many other things that are currently unimaginable, all of which is crazy.

As stated in the Crypto Anarchy Manifesto, sooner or later, this stage will be reached and there is now the infrastructure to support various wild liquid markets, but the current problem is that most markets are being used by powerful players who want to consolidate existing gains.

Solving the problem of fair incentive allocation in the liquidity market is to create a reputation layer for encrypting anarchy. At this level, participants can verify the reputation of creators before participating in the market, and creators can also verify their reputation before accepting users.

Two options for the future

The current encryption market is at a critical stage, and there are two paths to choose from, each path has its own advantages and disadvantages. The first path leads to more speculation and freedom, leading to an evolving state of crypto anarchy. In this state, new markets continue to emerge, wealth continues to be earned and lost in the speculative cycle, and people who can adapt and act quickly will prosper.

The second path means stronger regulation and control, leading to a regulated crypto economy. It provides stable, compliant and structured investment opportunities, dominated by institutional and traditional financial players, providing a more predictable but controlled environment. As the United States introduces encryption regulations, the difference between these two paths will become increasingly apparent. Regulated markets will focus on “cash cow” projects and Web3 businesses that generate real revenue, which will also be the starting point of the first cycle of a bull market under authoritarian control.

Crypto anarchy will continue to change rapidly on the margins. If there are 100 markets, 99 may fall, and one market will absorb liquidity from all other markets. The value of attention will increase, and those who can control this pattern will continue to win the battle. There will always be a bull market cycle somewhere in crypto anarchy, and the key is whether it can be identified and maximize the benefits from it.