Laopu Gold quickly paved a “golden road”, but it also exposed more hidden worries.

Crazy stock price, crazy scalpers, how long can Lao Pu gold go crazy?

Photo source: Visual China

Blue Whale News, February 21 (Reporter Wang Hanyi)At 23 o’clock in the evening on February 20, a news popped up from a gold purchasing group of nearly 500 people in Laopu suddenly posted a message that Beijing SKP and Shanghai Yuyuan Store both officially announced a price increase on February 25, and the purchase restriction order will take effect tonight! rdquo;。

The news was like a depth bomb, instantly exploding the group that had been silent for several days.

Someone was secretly happy: Fortunately, I took advantage of the event and the excitement was not in vain.” rdquo; Some people were saddened: I was critical, and everything I wanted to buy before was out of stock. Where else can I buy it now?& rdquo;

“I have long said that I will increase the price, but it is not groundless. I have been a veteran purchasing agent for many years.& rdquo; Senior purchasing agent Xiaoyang immediately released a new purchasing rule in the group. From now on, all styles will be limited to one piece, and the stock will be purchased at a discount of 16%. There is no bargaining, and Beijing can pick it up. rdquo; During the Valentine’s Day event that has just passed on February 14, her purchasing price was 12% off.

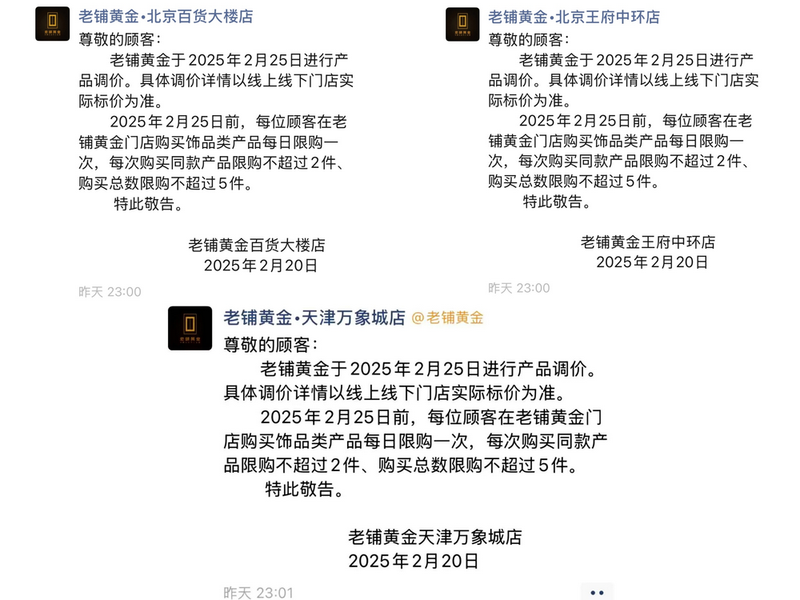

Before everyone could stop, Laopu Gold Beijing Department Store, Wangfujing Zhonghuan Store, and Tianjin Vientiane City Store also simultaneously issued the same price adjustment and purchase restriction notices in the corporate WeChat circle of friends.

Photo source: Interception from Laopu Gold Enterprise Micro

In the early morning of February 21, live video of queuing at SKP stores in Beijing was thrown into Group chats: the winding line outside the glass window was a hundred meters long, with people curled up in folding chairs wrapped in down jackets, and the light of the mobile phone screen reflected anxious faces.

“It rose 10% last September, and this time it was at least 15%!& rdquo; If you don’t hoard now, you’ll lose blood in the future! rdquo; Purchasing scalper Brother Jin sent three 60-second voice messages in succession, and the background sound was a purchase restriction reminder broadcast by the mall. At this time, there were less than 96 hours left before the price increase took effect, and everyone’s nerves were all tense.

On the other hand, the carnival in the capital market is also unfolding simultaneously: the share price of Laopu Gold (6181.HK) surged 20.84% in a single day on February 21, with the highest share price reaching HK$566/share. At the close, the stock price closed at HK$548.5 per share, and the market value exceeded HK$92.3 billion, leaving Chow Tai Fook far behind.

Photo source: Cut from straight flush

This group of scalpers walking on the edge of the rules will not know that every gram of premium gold they compete for is adding fuel and salary to this capital feast of new Chinese luxury-style luxury.

Narrative reconstruction from hard gold currency to cultural luxury goods

In 2025, when gold prices continue to rise, Laopu Gold’s share price and product prices have soared, becoming the dual focus of the capital market and the consumer market.

Behind the excitement is the scarcity game carefully designed by Laopu Gold: fixed price adjustments twice a year create a sense of urgency, and combined with hunger marketing that restricts 5 pieces per day, the consumer psychology is turned from price comparison to belief in buying.

Just as the magic formula disclosed in its financial report, ancient craftsmanship + luxury positioning = a stable gross profit margin of 41%, this is far more capital narrative than Chow Tai Fook’s gross profit margin of 31.4%.

Blue Whale journalists found during on-the-spot research at SKP stores in Beijing that the popularity of Laopu gold has reached an amazing level. Some consumers are willing to queue for 6 to 7 hours, and some even drive across cities in the early morning just to snap up what they want. Some consumers regard it as a cultural investment and status symbol. In their eyes, Laopu gold is no longer just a piece of jewelry.

People queuing up at the golden gate of SKP Laopu in Beijing Photo by Wang Hanyi, a journalist from Blue Whale

“Laopu Gold’s core competitiveness lies in its unique brand positioning.& rdquo; A senior brand positioning expert analyzed the Blue Whale News reporter and said that by combining gold with intangible cultural heritage craftsmanship and national trend aesthetics, Laopu has separated its products from the value-preserving tool attributes of traditional gold jewelry, and instead shaped them into a Chinese-style old money symbol with both cultural value and luxury attributes.

For example, its products such as the Cross King Kong Pestle, Diamond Calabash, Dragon and Phoenix Sachet attract consumers with ancient craftsmanship and auspicious meaning. At the same time, the store’s location is based on Cartier and Van Cleef and Arpels, providing Evian mineral water and Godi Van Chocolate’s high-end services strengthen the image of Hermès in the gold industry.

Since its listing in June 2024, Laopu Gold’s share price has increased more than 10 times, and its market value has exceeded HK$90 billion. The unit price per gram of the product is as high as 1,000 – 1,462 yuan, and the premium far exceeds the industry average. This phenomenon is not only the result of fluctuations in the gold market, but also reflects the complex interweaving of brand strategies, consumption trends and capital logic.

According to the prospectus, in the past three years, the number of loyal members of Laopu Gold has grown steadily, reaching 97,800, 126,600 and 202,600 respectively. The purchasing power of these members cannot be underestimated and have become an important pillar of brand revenue.

In 2023, about 65% of Laopu Gold’s revenue will come from products with a unit price of 10,000 – 50,000 yuan, while about 19% of its revenue will come from high-end products with a unit price of 50,000 – 250,000 yuan. Among the 97,800 loyal members, the core group that spends 1-5 times a year contributes 72% of revenue.

What is even more amazing is that those super VIP members who consume more than 30 times a year have per capita annual consumption exceeding one million, becoming the backbone of the brand’s high-end market.

In order to further enhance the member experience, Laopu Gold introduced the unique black room concept in the luxury goods industry and created an exclusive exhibition hall with a unique Ming Dynasty study style for VIP customers.

Here, customers can not only enjoy top-notch treasures such as the 640,000 yuan Tiliang Golden Pot and the 870,000 yuan gold Yue King Goujian Sword, but also enjoy the fragrant tea in the golden cup and enjoy the ultimate luxurious shopping experience.

Judging from financial data, Laopu Gold’s gross profit margin will stabilize at around 40% in the first half of 2024, far exceeding its peers. The price increase directly promoted the 148% year-on-year growth in revenue.

On the evening of February 20, Laopu Gold released a positive profit forecast for the full year of 2024. It is expected to achieve a net profit of approximately 1.4 billion yuan to 1.5 billion yuan for the full year of 2024, an increase of approximately 236%-260%.

Crazy old shop scalpers, hidden worries for growth

Obviously, structural changes in the consumer market are a major driving force for the rise of Laopu Gold.

On the one hand, under inflationary pressure and geographical uncertainty, the safe-haven nature of gold has been strengthened, and demand for gold investment has surged. In the fourth quarter of 2024, the price of gold rose by more than 11%, pushing consumers to shift from self-pleasing consumption to dual demand for value preservation + aesthetics.

On the other hand, young consumers have increased their recognition of Chinese aesthetics. The ancient craftsmanship of Laopu gold and traditional cultural symbols, such as Ping ‘an buckles and golden gourds, just fit this trend, and even attract former international luxury brand users to turn to local high-end brands.

In addition, the enthusiasm in the capital market has also provided confidence for the price increase of Laopu Gold. The launch of equity incentive plans such as awarding 10% H shares to the core team has also released management’s confidence in long-term strategy.

However, under the invisible ice, hidden worries still exist.

The spear of ancient craftsmanship, which was once a core competitiveness, is no longer exclusive to the old shop. Data shows that the market share of Laopu Gold’s ancient craftsmanship has plummeted from 14% in 2017 to 1.3% in 2022.

Directly opposite the Laopu Gold Store on the first floor of SKP in Beijing, there is a store called Yue King Ancient Law Gold. The Yuewang brand was founded in 1901 and was recognized as a time-honored Chinese brand by the Ministry of Commerce. The brand clerk told Blue Whale News that their production craftsmanship is no different from that of old shop gold, and they even use a one-price model to sell them.

Beijing SKP Yue King Ancient Law Gold Counter Photo by Wang Hanyi, journalist of Blue Whale

At the same time, competitors such as Chow Tai Fook and Lao Fengxiang have also launched ancient gold ornaments similar to Laopu gold, which are regarded as equal replacement products, further intensifying market competition.

What is even more worrying is that this intangible cultural heritage craft is facing a serious inheritance crisis. It has been thousands of years since the ancient gold-making techniques have been passed down to this day, but not many young people today are willing to engage in this industry.

Gong Zhankun, the inheritor of the ancient legal system, said in an interview with “China Craftsmen”: Young people are relatively impetuous nowadays and want to make quick money, but inheriting this skill requires time and patience. Each process takes a year or two or even two to three years to be proficient. It takes about ten years to cultivate a person who can truly complete a work independently. rdquo;

According to Meng Qingguo, the inheritor of filigree inlay technology, there are less than 200 filigree inlay practitioners across the country, of which only 50 are top craftsmen.

Or it was based on this that Laopu Gold chose to outsource the production of some products to processors. According to the prospectus, in 2021, 2022 and 2023, outsourcing processing fees will be approximately RMB 17.2 million, 15.2 million and 42.1 million respectively, accounting for 2.3%, 2.0% and 2.3% of the total sales cost for the year respectively. Outsourced production accounted for 36%, 32% and 41% of total production respectively.

More than 40% of products rely on outsourcing production, resulting in frequent consumer complaints about scratches, dropped drills and other problems. Blue Whale News reporter found that many consumers posted on Xiaohongshu to tell their experiences, and the comment area was full of pictures and comments. ldquo; The physical store is warm and there are flaws that cannot be seen. I suggest that everyone use a magnifying glass to inspect carefully on the spot. Consumers who knew about it later had heated discussions in the comment area.

An investment banker bluntly said: If quality control is unstable, the brand image may be affected, which in turn affects consumers ‘purchasing decisions. rdquo;

What is more noteworthy is that scalper ecology is a derivative of this game: from the queuing commission when the Hong Kong store opened in 2024 to the current speculation of purchasing numbers to 500 yuan/piece, the gray industrial chain has been deeply embedded in the brand growth flywheel.

Laopu Gold’s commission rebate policy was originally a means to encourage sales, but it was also exploited by scalpers. According to a senior old shop gold buyer, old shop gold has a high commission rebate to sales personnel who sell more, which is equivalent to a first-level agent. Two 5-gram gold coins will be given if sales exceed 500,000, and 20-gram gold bars will be given if sales exceed 1 million.& rdquo;

During the event, the Laopu Gold Store was reduced to a scalpers ‘den. According to on-site observations by Blue Whale News reporters, the number of scalpers in the store far exceeds that of ordinary customers. They hold mobile phones and skillfully stand in front of the display cabinets to communicate with online customers via video.

“It is said that the purchase limit is limited for 20 minutes, and some scalpers even stay in the store for more than an hour, blatantly completing the transaction. rdquo; Zhao Zhao told Blue Whale News that she queued for nearly 7 hours that day before successfully entering the store. The eight-treasure compass I bought was a hot seller. It took a long time to hone the counter before giving one. But who knew that as soon as he came out, he heard that the scalpers team next to him got 5. Was it because they had too many people?” rdquo;

Zhao Zhao’s instinct told her that the cabinet sister seems to prefer to leave the hot money to scalpers rather than individual customers. rdquo;

(At the request of interviewees, characters such as Xiao Yang, Jin Ge, and Zhao in the article are pseudonyms)