① Wang Lei, a member of the Beijing City CPPCC, said that non-professionals should not use DeepSeek to stock stocks;

② Zhilian announced that the revenue generated by cooperation with Alibaba Cloud and Tencent Cloud accounted for about 1%;

③ The Nasdaq China Golden Dragon Index closed down 5.24%, and Alibaba fell more than 10%.

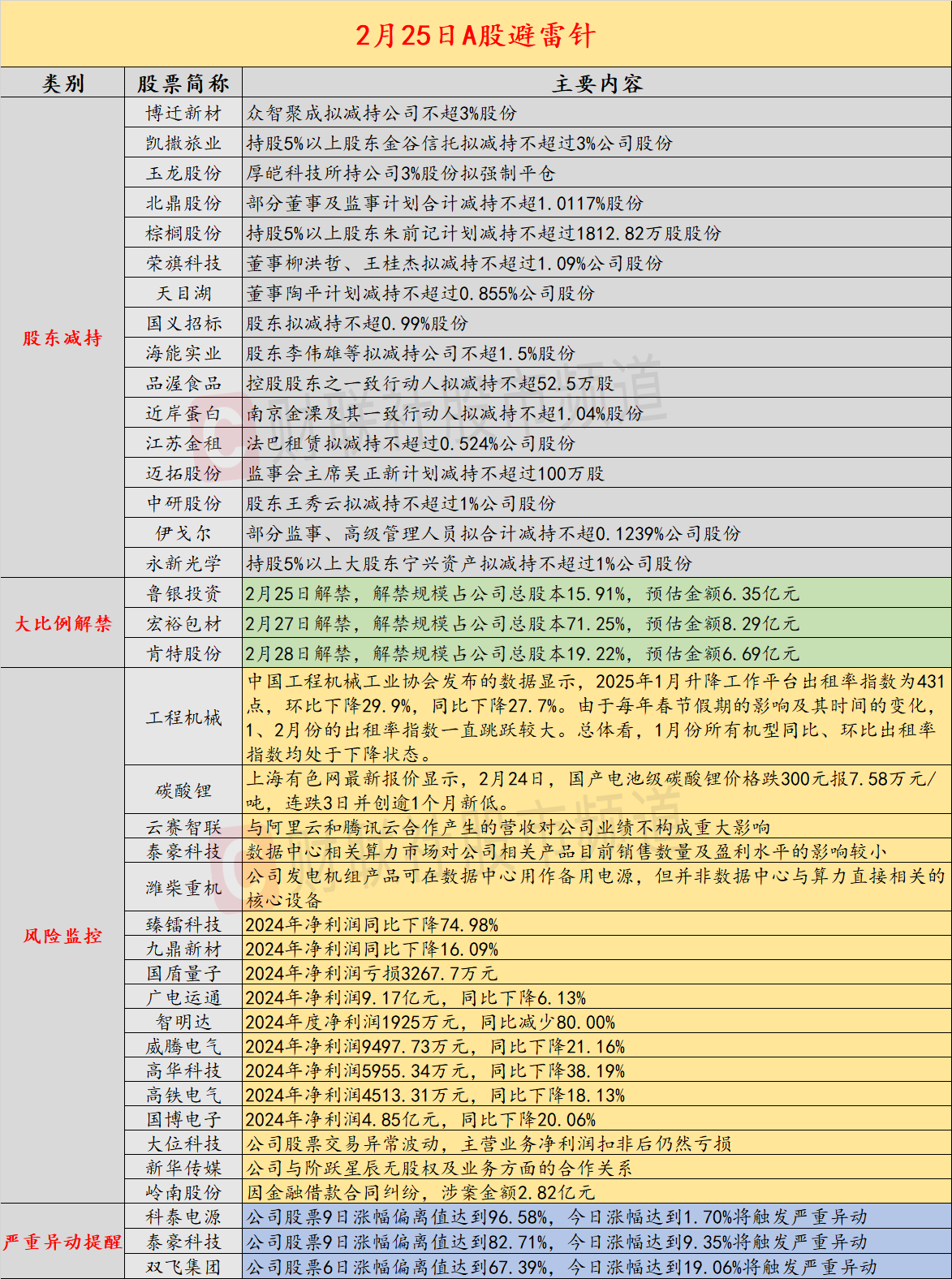

Introduction:Cailian invested in lightning rods on February 25. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) Wang Lei, a member of the Beijing Municipal Committee of the Chinese People’s Political Consultative Conference, said that non-professionals should not use DeepSeek to stock stocks;2) The price of domestic battery-grade lithium carbonate has fallen for 3 consecutive days and hit a new low for more than a month; the company’s key concerns include: 1) The 7-day 5-board cloud competition Zhilian announced that the revenue generated by cooperation with Alibaba Cloud and Tencent Cloud accounted for about 1%; 2) 4. Taihao Technology warned of risks. The data center related computing power market has little impact on the current sales volume and profitability of the company’s related products; key concerns in overseas markets include: 1) The closing trends of the three major U.S. stock indexes are divided, and most of the large technology stocks fell;2) The Nasdaq China Golden Dragon Index closed down 5.24%, and Alibaba fell more than 10%.

economic information

1. The main domestic futures contracts fell more and more, and fuel oil, glass, rapeseed meal, coke, palm oil, and coking coal fell more than 1%. In terms of increase, No. 20 rubber (NR) rose by more than 1%.

2. Wang Lei, member of the Beijing City CPPCC and chairman of Zhongke Wenge Company, said that “using DeepSeek to stock stocks” is definitely not feasible. Once DeepSeek is trained, its knowledge will be fixed. If it is not connected to the Internet, when you ask it every day, its knowledge will remain at the moment it trains its model. He cannot know the changes in today’s market, today’s industry hotspots, and some changes in some factors in today’s capital market. I don’t think this (using DeepSeek to stock stocks) is advisable. (People’s Political Consultative Conference)

3. Data released by China Construction Machinery Industry Association shows that the occupancy rate index of lifting work platforms in January 2025 was 431 points, a month-on-month decrease of 29.9% and a year-on-year decrease of 27.7%. Due to the impact of the annual Spring Festival holiday and its time changes, the occupancy index in January and February has been jumping significantly. Overall, the year-on-year and month-on-month occupancy index of all models was in a downward state in January.

4. The latest quotation from Shanghai Nonferrous Metals Network shows that on February 24, the price of domestic battery-grade lithium carbonate fell 300 yuan to 75,800 yuan/ton, falling for three consecutive days and hitting a new low of more than one month.

Company warning

1. 7 days and 5 boards cloud competition Zhilian: The revenue generated by cooperation with Alibaba Cloud and Tencent Cloud accounts for about 1%.

2 and 4 Connected Board Taihao Technology: The data center-related computing power market has little impact on the current sales volume and profitability of the company’s related products.

3. 2 Connected Board Weichai Heavy Machinery: The company’s generator set products can be used as backup power supply in the data center, but they are not core equipment directly related to computing power in the data center.

4. Boqian Xincai: Zhongzhi Jucheng plans to reduce its shareholding in the company by no more than 3%.

5. Caesar Tourism: Jingu Trust, a shareholder holding more than 5% of the shares, plans to reduce its shares of the company by no more than 3%.

6. Yulong Shares: Houai Technology plans to forcibly liquidate 3% of the company’s shares.

7. Beiding Shares: Some directors and supervisors plan to reduce their shares by no more than 1.0117%.

8. Palm Shares: Zhu Qianji, a shareholder holding more than 5% of the shares, plans to reduce his holdings by no more than 18.1282 million shares.

9. Rongqi Technology: Directors Liu Hongzhe and Wang Guijie plan to reduce their shares in the company by no more than 1.09%.

10. Tianmu Lake: Director Tao Ping plans to reduce his shareholding in the company by no more than 0.855%.

11. Guoyi Bidding: Shareholders plan to reduce their shares by no more than 0.99%.

12. Haineng Industrial: Shareholder Li Weixiong and others plan to reduce their shares in the company by no more than 1.5%.

13. Pinwo Food: The controlling shareholder, acting in concert, plans to reduce its holdings by no more than 525,000 shares.

14. Coastal protein: Nanjing Jinli and its concerted actions plan to reduce their shares by no more than 1.04%.

15. Jiangsu Golden Rental: France Leasing plans to reduce its shares by no more than 0.524%.

16. Maxtor Shares: Wu Zhengxin, Chairman of the Board of Supervisors, plans to reduce its holdings by no more than 1 million shares.

17. China Research Institute Shares: Shareholder Wang Xiuyun plans to reduce her shareholding in the company by no more than 1%.

18. Igor: Some supervisors and senior managers plan to reduce their shares in the company by no more than 0.1239%.

19. Yongxin Optics: Ningxing Assets, a major shareholder holding more than 5% of the shares, plans to reduce its shareholding by no more than 1% of the company’s shares.

20. Zhenlei Technology: Net profit in 2024 will decrease by 74.98% year-on-year.

21. Jiuding New Materials: Net profit in 2024 will decrease by 16.09% year-on-year.

22. Guodun Quantum: The net profit loss in 2024 will be 32.677 million yuan.

23. Radio and Television Express: Net profit in 2024 is 917 million yuan, a year-on-year decrease of 6.13%.

24. Zhimingda: The net profit for 2024 is 19.25 million yuan, a year-on-year decrease of 80.00%.

25. Witten Electric: Net profit in 2024 is 94.9773 million yuan, a year-on-year decrease of 21.16%.

26. Gaohua Technology: The net profit in 2024 will be 59.5534 million yuan, a year-on-year decrease of 38.19%.

27. High-speed Railway Electric: Net profit in 2024 will be 45.1331 million yuan, a year-on-year decrease of 18.13%.

28. Guobo Electronics: Net profit in 2024 will be 485 million yuan, a year-on-year decrease of 20.06%.

29. Dawei Technology: The company’s stock trading fluctuates abnormally, and the net profit from its main business is still losing money after deducting non-profit.

30.2 Connected to Xinhua Media: The company has no equity or business cooperation relationship with Step Star.

31. Lingnan Shares: Due to a financial loan contract dispute, the amount involved was 282 million yuan.

Overseas warning

1. The closing trends of the three major U.S. stock indexes were divided. The Dow rose 0.08%, the Nasdaq fell 1.21%, and the S & P 500 fell 0.49%. Most large technology stocks fell. Broadcom fell nearly 5%, Nvidia fell more than 3%, Tesla, Meta fell more than 2%, Amazon and Microsoft fell more than 1%, and Apple rose slightly. Berkshire Hathaway’s Class B shares closed up 4.2%, its best one-day performance since November. Semiconductor and hardware sectors were among the top losers, with Nano-Micro Semiconductor falling more than 8%, Micron Technology falling more than 3%, and Qualcomm, AMD and Intel falling more than 2%. Insurance, non-ferrous metals, and precious metals sectors rose. Century Aluminum rose more than 6%, Est Gold rose more than 5%, Jintian rose more than 3%, and U.S. Steel rose nearly 2%.

2. Hot Chinese stocks fell generally, with the Nasdaq China Golden Dragon Index closing down 5.24%. Upward Rongke fell more than 13%, Alibaba and Beili fell more than 10%, Futu Holdings fell more than 9%, Pianduo fell nearly 9%, Jingdong and New Oriental fell more than 7%, and iQiyi fell nearly 7%. Netease and Ideal Automobile fell more than 4%, and Baidu fell nearly 4%.

3. Russian President Vladimir Putin presided over a conference on the development of the rare earth industry. He said that developing the rare earth industry is a necessary condition for improving Russia’s competitiveness in the international market and developing the most important economic industries, and the output of rare earth products should be doubled. Before 2030, Russia should build a full industrial chain for processing rare earth resources, which is necessary for the development of the economy and defense industry. Putin also pointed out that Russia has more rare earth reserves than Ukraine, and Russia is willing to cooperate with relevant partners, including cooperation with the United States. He particularly emphasized that the possible mineral resources agreement between the United States and Ukraine has nothing to do with Russia.

4. LME metal futures closed down generally, while LME copper futures closed down US$64 to US$9494/ton. LME aluminum futures closed down US$32 to US$2656/ton. LME zinc futures closed down US$72 to US$2850/ton. LME lead closed down US$20 at US$1988/ton. LME nickel futures closed down US$72 at US$15445/ton. LME tin futures closed down US$433 to US$33244/ton.