If idle funds participate, there may be a small surprise for the value of points.

Author: Ice Frog

Babylon, as the leader of re-pledge tracks, has registered a foundation account tonight, implying that TGE is imminent. Here is an in-depth analysis of Babylon’s project and the participation value of airdrops.

1. Basic overview of the project: The team is strong and the investment lineup is luxurious

1.1 founding team

The project founding team has a strong academic background. Although there are many Chinese faces in the team configuration, the main functional managers are mostly overseas people. A brief introduction to its main founding team and core management.

David Tse (co-founder): With a top academic background, he is a member of the National Academy of Engineering and a professor at the University of Chicago and Stanford University.

Mingchao (Fisher) Yu (CTO and Co-Founder): Previously served as a lecturer at the Australian National University and later served as senior research engineer and chief engineer at Dolby Labs

Dong Xinshu (Chief Strategy Officer): Co-founder of RockX and Zilliqa, and technical partner of well-known VC IOSG Ventures

Sankha Banerjee (Chief Protocol Economist): Graduated from MIT and worked at Nibiru.

Spyros Kekos (Community Leader): Previously served as Community Leader for exchange Gate.io.

In addition to the above-mentioned personnel, if you look at the configuration of the project management team in detail, you can see that most of the core personnel have at least 3-5 years of relevant experience in the position, or have worked in well-known projects or exchanges. Experience, this aspect reflects that the entire Babylon management team has rich experience in blockchain, which will also make the operation of the entire project more mature and in line with industry development.

In addition, as an academician, David Tse’s senior academic background also gives the outside world sufficient confidence in his technical strength. At the same time, many core teams have investment backgrounds, which also means that the project has sufficient channels in terms of investment resources. This is also directly reflected in its investment and financing situation.

1.2 Investment and financing

Judging from the financing rounds, Babylon has gone through a whole year from the seed to the A round, but the financing speed and amount before the A round was launched on the main network increased rapidly. This shows that in the early development stage, the project still made more careful efforts to the test network. Invest, and on this basis, the next round of financing began. The final round of financing in May 2024 will reach 70 million, with a total financing scale of 96 million US dollars. In terms of financing scale, it is very considerable.

In terms of the investment team, the project investment team is very luxurious and has a diverse investment background.

As the figure above shows, in addition to the traditional top VC funds Paradigm and Polychain, the exchanges directly include first-tier firms such as Binance and OKX.

In terms of individual investors, there are well-known people such as Ajit Tripathi (former financial technology partner of Consensus Sys), Ryan Fang (former co-founder of Ankr), and Jia Yaoqi (founder of AltLayer).

It can be seen that the financing background is truly luxurious, including almost all types and backgrounds of investment funds, which also means that the project’s various resources are very sufficient.

To sum up, the project attaches great importance to the team’s experience and technical reserves, and at the same time, the configuration is very comprehensive. It belongs to a team setting that holds high standards but is not divorced from reality, which ensures the sustainability of the project’s operations and subsequent long-term development. From the perspective of financing, VCs with various backgrounds have given the project a comprehensive boost in various resources, which not only indicates that the funds are optimistic about the track where the project is located, but also indicates that the project has high growth space in the future.

2. Project advantages: Give full play to the security advantages of POW to make BTC flow

There have been many analyses on the analysis of re-pledge and Babylon. In summary, there are actually several consensus points on Babylon, which is also the main advantage of the project.

1. Focus on activating idle assets in the BTC network and promoting the prosperity of the BTC ecosystem

BTC is BTC, and cryptocurrency is cryptocurrency. As BTC, which accounts for more than half of the assets of the entire currency circle, how to make BTC assets flow and operate has always been a major problem.

BTC’s Holder has always been a difficult task for security reasons to get BTC to move from its wallet account. After all, under the custody model, the asset losses caused by the disclosure of private keys are a model that no BTC Holder can bear or accept. They would rather lie down and eat the dust than take the slightest risk, especially because the BTC main network itself is incomplete, and there is no way to use smart contracts to safely cross-chain like Ethereum. Therefore, under the influence of this inherent perception and the BTC network’s own flaws, the asset value of BTC and its utilization rate have always been highly disproportionate.

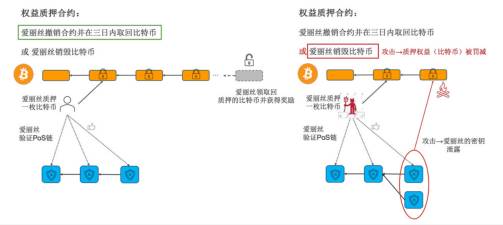

Based on this pain point, Babylon has created a set of self-custody pledge agreements that do not require trust. In layman’s terms, under this plan, users ‘assets are under their own control to achieve secure Staking. In this process, what is behind this pledge is the security of computing power under the POW mechanism on BTC to enhance the security of many other POS chains, so as to benefit multiple parties. To achieve the above, Babylon has its own unique technology, which is one reason why it is widely recognized in the market.

2. Bitcoin timestamp and pledge agreement are the two pillars of technology establishment

For POS chains, especially those that adopt Byzantine fault-tolerant mechanisms, most of them require 2/3 of the vote to confirm the block. Although most POS chains use forfeiture measures to avoid fork attacks, if there is no additional source of trust, this kind of attack is almost impossible to avoid.

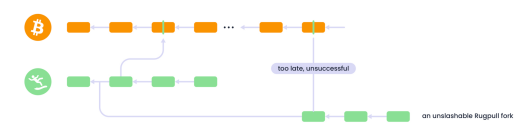

Therefore, some POS chains bind security to stakeholders, which leads to a long time for de-pledge. Based on this situation, Babylon’s main solution is to migrate the block checkpoint of the entire POS chain to the Bitcoin network. Due to the POW feature, if an attacker chooses to fork to attack, it will have a later timestamp in the Bitcoin chain. In this way, remote attacks can be effectively avoided through Bitcoin timestamps.

A more vivid metaphor is: the timestamp of the Bitcoin network is a game recording system, where all the completion times of a player are recorded. If a player wants to tamper with his completion time, the Bitcoin network will find that the arrival time is wrong and will refuse; if you forcibly tamper, you will have to create a longer fork than the Bitcoin network, which is almost impossible to achieve in terms of cost. Another benefit brought by this technology is that it can greatly shorten the time for releasing pledges on the POS chain and at the same time have greater resistance to censorship.

In terms of the specific pledge agreement, the project adopts remote equity pledge. The so-called remote equity pledge means locking the pledged bitcoins in a contract on the Bitcoin chain. When the pledger violates the PoS chain agreement, the bitcoins pledged by the violator will be fined on the Bitcoin chain. The main implementation technology is implemented through Bitcoin covenant emulation, which is mainly based on technical improvements under the Bitcoin UTXO characteristics. The specific technical details will not be expanded, but follow the path given by the official website. You can mainly refer to the following path.

Like the above path, specific rules based on Bitcoin Covenant technology can ensure the unbinding of the entire Bitcoin pledge and the execution of penalty reductions.

3. Empowering Cosmos ecological security across BTC and many other EVM chains

To a certain extent, Babylon does not belong to the pledge of equity of cryptographic assets, and is different from Eigenlayer’s feature-layer network to ensure security. It is closer to an innovative use case of the cross-chain equity pledge protocol. In fact, the entire empowerment of the POS chain does not rely on Bitcoin assets, but on the POW computing mechanism of the Bitcoin network.

Since Babylon’s cross-chain communication technology and security sharing all come from Cosmos, and the project’s own innovation in security sharing using the BTC network has greatly promoted the Cosmos ecosystem. For the Cosmos chain, it will also actively embrace Babylon’s innovation. The security sharing brings benefits to the entire ecosystem.

3. Development prospects: The potential scale is promising, but there are also many challenges

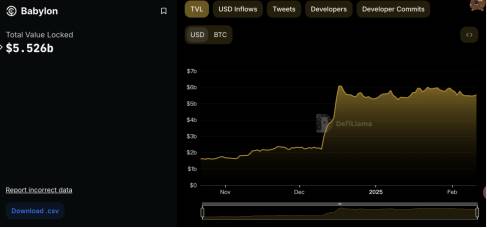

Babylon is currently the largest re-pledge in the BTC ecosystem. The current locked position value exceeds US$5.5 billion, with a total of 5.6w BTC being pledged. Currently, compared with the total amount of 21 million BTC, the overall participation rate is only 0.26%. Even if the participation rate reaches 1%, the overall TVL still has more than 4 times room for growth. There is indeed a large room for improvement from the entire ceiling scale. This may also be the reason why many investors are willing to provide high financing.

From another negative perspective, Babylon faces many challenges or growth difficulties. Whether it is the recognition of the POS chain or the participation of the BTC holder, it requires continuous education costs and habit development. Especially for large BTC households, their participation will be more cautious.

In addition, a key that needs to be considered is that after Bitcoin ETFs and listed companies began to accumulate Bitcoin reserves, Bitcoin in the market gradually began to transfer to institutions and large households. If Babylon wants to further increase its participation, how to form a more attractive solution for institutions and large households still requires continued efforts in project innovation and operation.

4. Airdrop opportunities and risk analysis: Idle funds participate, the value of points may be a small surprise

Through the previous analysis, we can see that Babylon has its own unique features, whether in terms of technology, financing or team, and also has sufficient upper limits in terms of long-term space. As the industry leader, with TGE coming soon, for many users who are air-dropping. In terms of whether it has participation value, we will do further data analysis below.

4.1 Test Network: The official clearly states that there is no incentive, but considering the zero cost, you can participate appropriately to prevent overtaking.

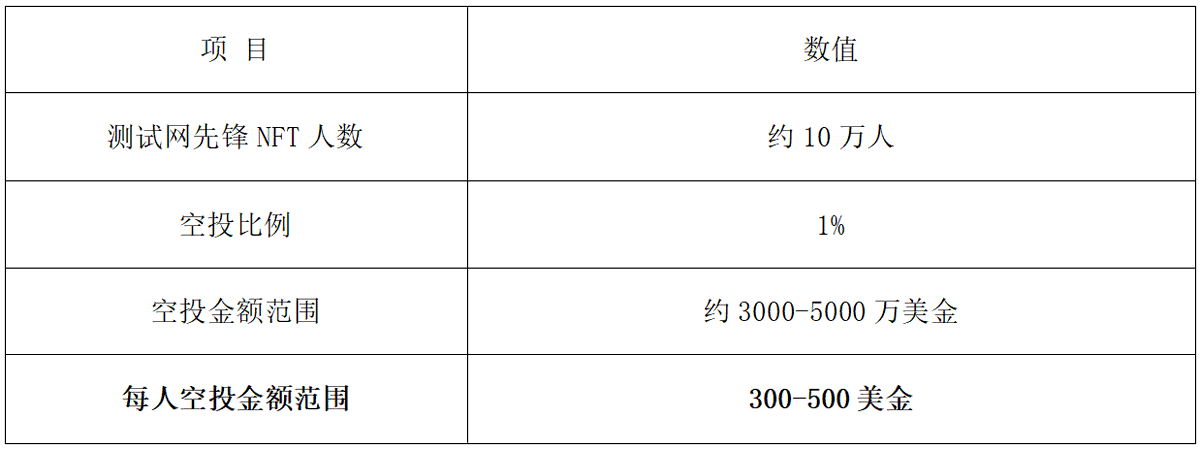

On 1 8, the project started the first stage of testing. The official files repeatedly emphasized the incentive for testing and testing. In view of the zero cost, appropriate participation can be made to prevent missing. Based on the estimated share of airdrops, if there are subsequent airdrops, the early test network may reach US$300 -500 per person.

4.2 Main network points: The annualized rate of return is still good, and you can participate if you have idle funds.

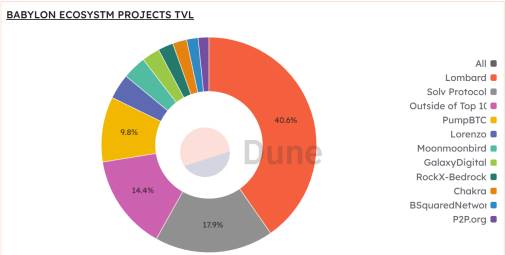

If you want to get airdrops in the past, you can only get points through related projects. Points will be exchanged for airdrops in the future. The main pledged projects include Lorenzo, Solv, etc. Lorenzo accounts for 40% of all pledged total, and it is also a project that has not been issued for large-scale financing.

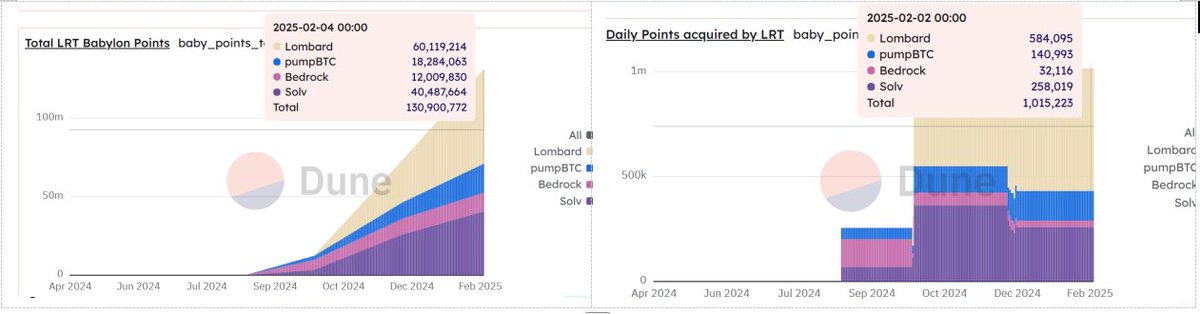

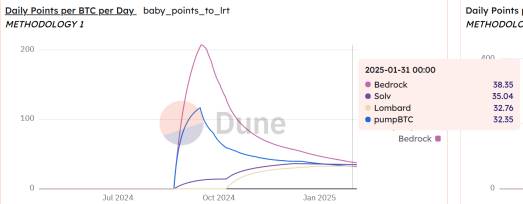

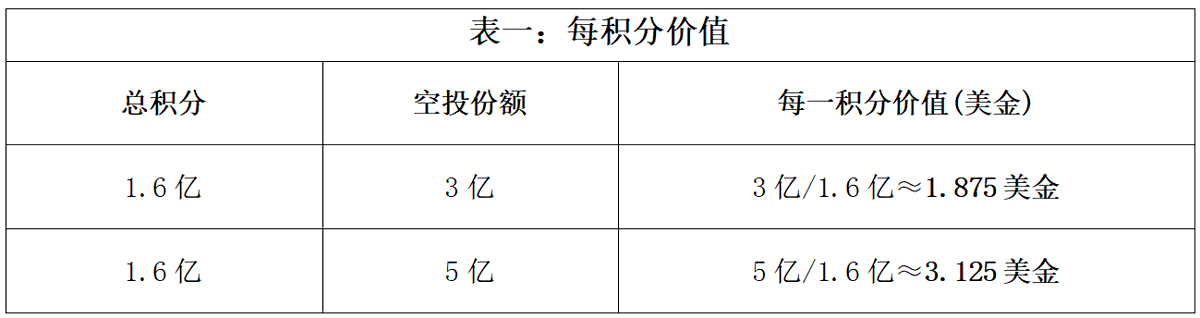

According to Dune’s board data, the current total points is about 130 million, with an increase of about 1 million points per board. Assuming TGE within one board, the final point is about 160 million.

4.3 Point value calculation

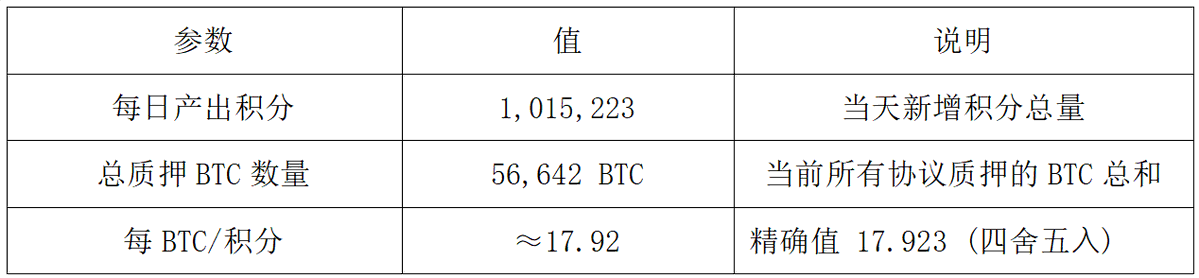

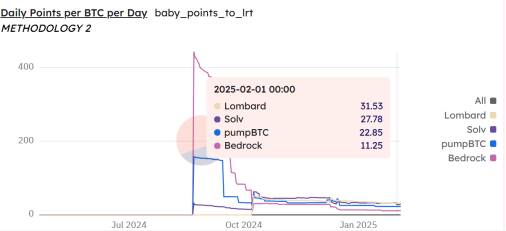

Method 1: Divide the total number of points produced per unit by the total pledge amount (approximately 17.92 per day)

Method 2: Calculate points based on the time distribution of the total supply (approximately 38.35 per day)

Distribution of total supply over time (calculated by calculating the rate between LRT’s BTC deposits and total BTC deposits, and then multiplying the rate by the Bhalon points issued that day, which are calculated by summing the token supply per coin over a period of time)

Method 3: The simple rate between the Bachron points earned by the agreement and the total BTC balance of the agreement (approximately 31.53 per day)

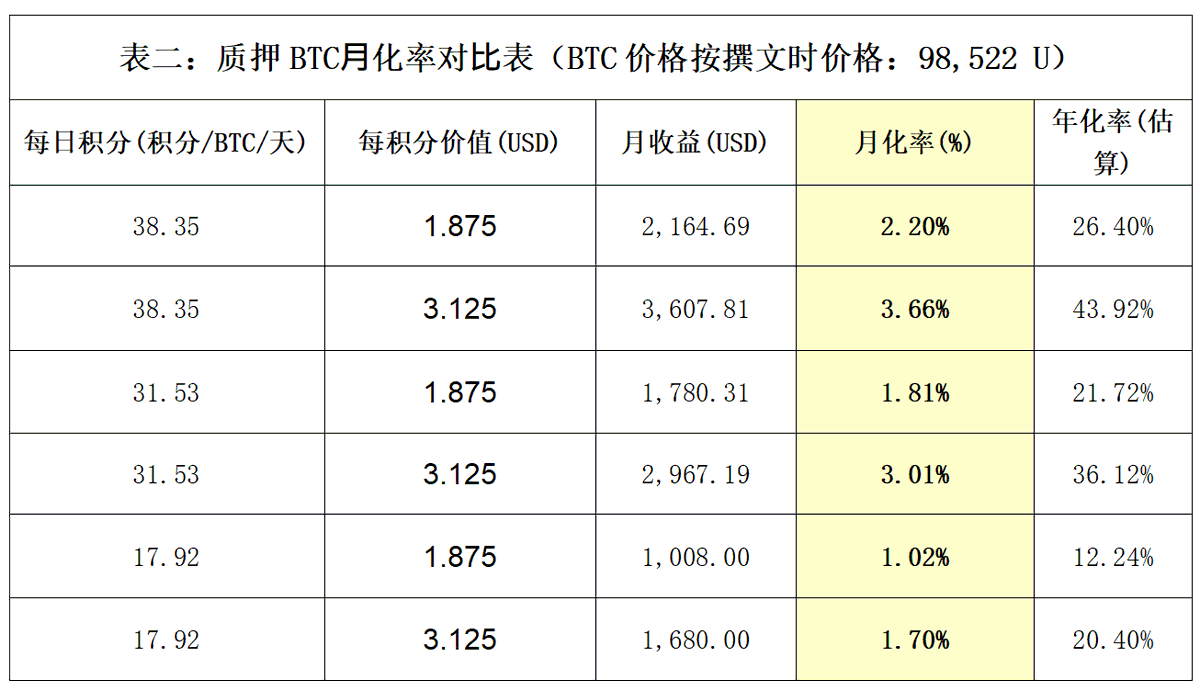

According to the above three methods, the daily output points are obtained as follows: 17.92, 38.35, and 31.53.

4.4 Comprehensive income forecast

Due to Babylon’s pledge amount and its leading position, the FDV after conservative launch is US$3 – 5 billion. There is a precedent for issuing coins in the BTC re-pledge agreement, and the Solv Protocol airdrop share is 7.65%. In order to consolidate its leading position, Babylon estimates that the airdrop share is around 10%, or US$300 million to 500 million. (Due to the poor market, this is a conservative estimate. The normal valuation should be between US$5 billion and US$10 billion)

Table 1: Value per point

Table 2: Comparison of pledge BTC redemption rate (BTC price is based on price at the time of writing: 98,522 U)

In terms of comprehensive income: By calculating that the current pledge rate is around 1.02%-3.66%, it is a good choice to have idle BTC deposits.

Main airdrop risks: The overall end time is unknown, the airdrop rules are unclear, and there are certain potential risks

In general, as a VC project with high financing, exchange fund support, and high track ceilings, both in terms of operational maturity and current advancement, it is relatively smooth and has high growth space. This laid the foundation for the high market popularity caused by the project after TGE. At the same time, it is speculated from the current limited information that participation at this stage is still cost-effective, and can be participated on demand according to your own situation.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern