$TRUMP was the first currency to trigger the shift, followed by $MELANIA, then a series of other rug pulls, and the last straw that crushed the market was $LIBRA.

Author: Loopify

Compiled by: Shenchao TechFlow

I was not the first to put forward this view, nor was I the one to wait until the dust settled before expressing my opinion. That would only be regarded as “hindsight.” But I still want to make a bold judgment: I think the Memecoins craze is over.

This round of Memecoins craze has basically come to an end. Existing currencies may still have a chance to return to historical highs, but it is unlikely that any new currency will be able to reach billions of dollars in market value and continue. For low-and medium-market capitalization currencies, the probability of recovery is almost 0.1%.

You can mark the critical moments that led to the imminent collapse of the Meme market: $TRUMP was the first currency to trigger the shift, then $MELANIA, then a series of other rug pulls, and the last straw that crushed the market was $LIBRA.

Large-scale scams and running errands are inevitable, just as platforms like pump.fun will appear in some form anyway.

Market volatility has been excessive, ranging from extreme rises (PvE memecoin climbs to billions of market value) to extreme scams (national gang rug operations). Most people either make money or suffer losses in the process.

There are no real currency holders

One thing is very important about Solana’s trench: It is driven entirely based on the momentum of the market. The vast majority of people who buy these tokens simply to make money because the “narrative” appeal of traditional crypto projects has disappeared. This also means that the prices of these currencies are falling faster than other currencies.

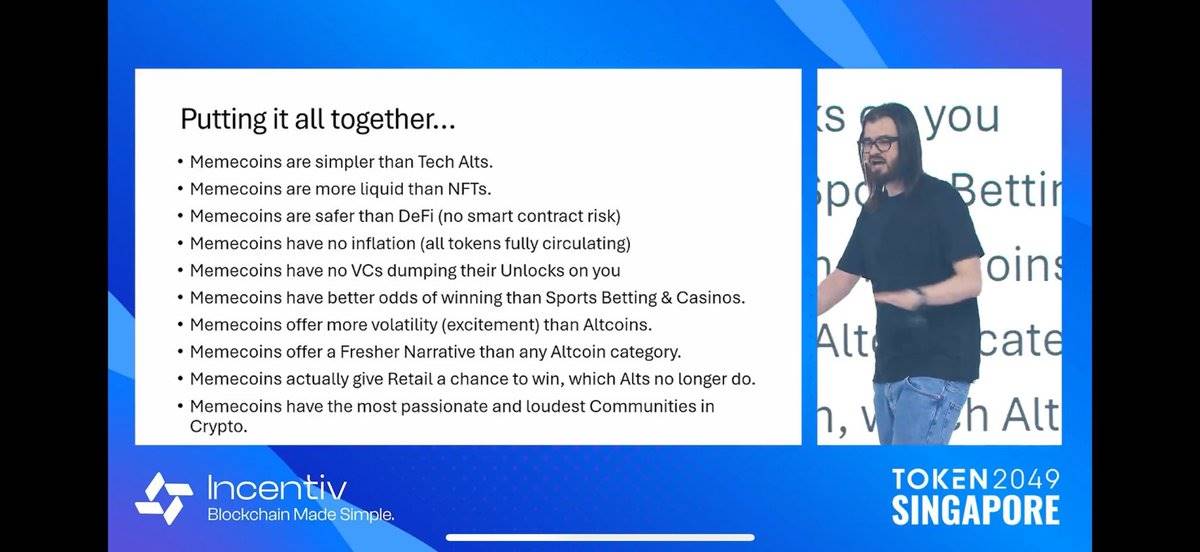

Albert Murad Einstein promotes Memecoins

The Memecoin craze is touted as the purest form of trading because it has no restrictions. This is also an important reason why they can run so crazily. However, this “purity” also brings huge drawbacks.

Once the excitement of making money wears off, the currency holders quickly leave the market, and the same group of people abandon the market completely. Unlike other cryptocurrencies, holders of other currencies often have faith in the projects themselves because they have at least some real value to support them, while Memecoins rely entirely on market sentiment and have almost no substance.

This also applies to NFT to some extent, but NFT and Memecoins are still different. Memecoins completely abandons the concept of “practicality”, and only a very few examples that break through the barrier of attention and are to some extent considered “classic” or “eternal” by the market, such as $PEPE.

This round of Memecoin craze has also spawned some relatively new phenomena, such as merchandising. In the past, people would always track wallets on the chain, but this time the influx of currencies has reached unprecedented levels. Improvements in transaction user experience (UX) and liquidity issues on Solana have also made this phenomenon more popular.

However, some people have already made hundreds of thousands of dollars through this model. They make money by attracting followers (this is not a specific person, but a common phenomenon-those who have become famous for “making a lot of money” on public wallets tend to attract large numbers of followers, and some even deliberately take advantage of this).

DEX has a follow-up function for a long time, but in the past, you couldn’t buy a small currency with a market cap of only US$10,000 at 5SOL and sell it at 10SOL 15 seconds later.

This phenomenon has led to more people following the so-called KOL into the “incinerator”(i.e. losing money), but unlike in the past, this time there has been little widespread criticism from social media because the traders have not explicitly promoted or promoted certain tokens.

Comparison with NFTs

Remember the glory of NFTs? I use this comparison because it was a hot spot in the previous cycle, just as ICOs were a trend in 2017.

Almost everyone has heard of NFTs. Not only has this trend been widely spread on the Internet, it has also attracted countless A-level celebrities to launch their own projects (although most of these projects end in running errands). Trading volume in the NFT market has reached tens of billions of dollars, and the lowest prices of various series have even reached six digits.

In that boom, OpenSea became the biggest winner, with fee revenue alone exceeding $1 billion-compared with pumpfun’s total transaction volume of only about $500 million.

However, there is one significant difference between this memecoin craze and NFTs: this time there are many protocols that benefit on a large scale.

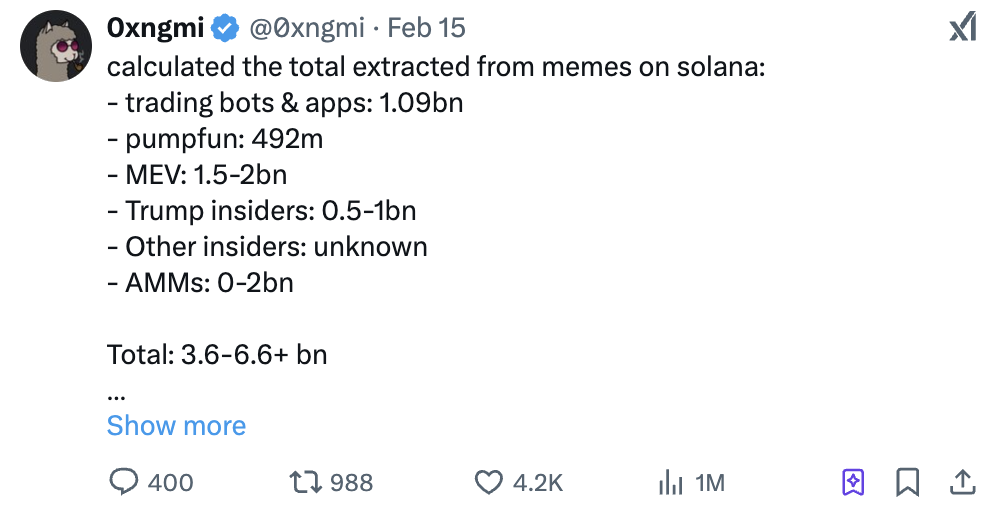

@0xngmi: The total “extracted” benefits from the memecoin craze on Solana are as follows:

- Trading robots and apps: $1.09 billion

- Pumpfun: $492 million

- Maximum extractable value (MEV): US$1.5 billion to US$2 billion

- Trump insiders: $500 million to $1 billion

- Other insiders: Unknown

- Automated market makers (AMMs): US$0 to US$2 billion

- Total: $3.6 billion to more than $6.6 billion

Even according to the lowest estimate, about US$4 billion was “extracted” from this craze, which is definitely a small amount. (After all, it’s not “early days” after one of the world’s most powerful men launched a coin that hit a market value of $70 billion in two days.)

In contrast, my rough estimate is that if market transactions, royalties and coinage income are included, the total size of NFT is slightly lower than this figure.

This shows that the craze for memecoin has surpassed the trend of the previous cycle, and its strong liquidity characteristics have made the market adjust faster.

Many members of the Solana community are sensitive to the word “extract”(so I put it in quotes) and compare it to traditional business models. But I don’t think this comparison is appropriate.

In traditional business, for example, if I buy a game, I get entertainment value from it, and the company gets revenue. This is a positive game.

You can say that many behaviors in the cryptocurrency market are zero-sum games, but the original intention of many projects is to provide some practical value.

However, pumpfun is a negative sum game that operates through a value extraction mechanism, similar to a casino, and its main function is to create tokens of no real value whose core use is simply to speculate or gamble for more profits (of course, this does not include projects that are not specifically targeted at Memecoins, such as Jup or Phantom, although these projects benefit the most from Memecoins).

What happens next?

No one really knows when this cycle will end, and this will determine the direction of the market in the short term.

Every cycle brings a new hot spot, but it could also be an evolved version of the previous trend, or a recovery (or a complete death), because people always want to find the next opportunity to increase 100 times.

Going back to the point I mentioned earlier, I think Memecoin is less likely than other trends because it has no real currency holders and no believers.

Basically, the largest currency will survive and the rest will die. If the market returns, the new currency is likely to outperform everything that exists.

You need to be prepared for this situation: survive, survive, continue to survive.

If you have exited the market before the next trend arrives or have no capital, it will be difficult for you to adapt. In such a market, adaptability is crucial. Everyone can make money in a bull market, but making money in a bear market is the real ability, and then adapting to the next bull market is another ability. (Each cycle requires a different mentality.)

Finally, I recommend an article that explores in depth why “getting rich” is only half of the process, and the other half is “keeping rich”. The article also provides some actionable suggestions:

(Tweet link)

* Note: If you think an asset has fallen by 90% and these suggestions are useless, remember that it may fall by another 90%.