Bank of Dongguan Branch applied to the Guangzhou Arbitration Commission for a ruling that Lingnan Shares repay nearly 270 million yuan in principal and payable interest, penalty interest, compound interest, etc., totaling approximately 281.8 million yuan.

280 million yuan in debt was overdue, and Lingnan shares were applied for arbitration by Dongguan Bank. This kind of factoring business once again attracted the bank

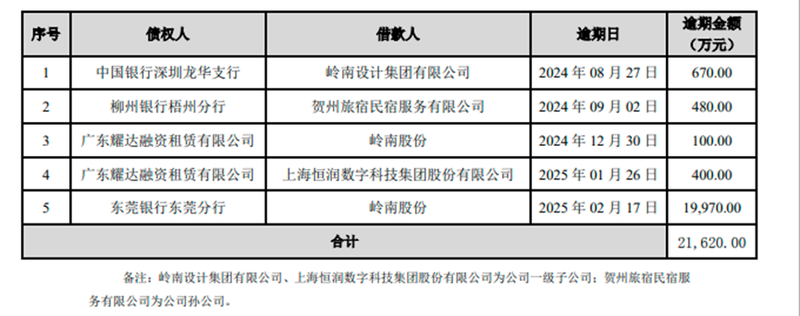

Blue Whale News, February 27 (Reporter Jin Lei)Recently, Lingnan Shares made public a debt overdue announcement. According to the announcement, Lingnan Shares added a total of 216.2 million yuan in overdue debts in banks, financial leasing and other financial institutions from late August 2024 to late February 2025, accounting for 10.27% of its audited net assets in 2023.

Specifically, the above-mentioned overdue debts of Lingnan and its related companies involved 6.7 million yuan from Bank of China Shenzhen Longhua Branch, 4.8 million yuan from Bank of Liuzhou Wuzhou Branch, 2 financial leases from Guangdong Yaoda totaling 5 million yuan, and 199.7 million yuan from Dongguan Bank Dongguan Branch.

At the same time, the company also received the “Notice of Arbitration”, and Dongguan Branch of Bank of Dongguan filed an arbitration application with the Dongguan Branch of the Guangzhou Arbitration Commission due to a financial loan dispute with the company. According to the arbitration announcement, Dongguan Branch of Bank of Dongguan applied to the Guangzhou Arbitration Commission to rule that Lingnan Shares repay the principal of nearly 270 million yuan and the interest, penalty interest, compound interest, etc. payable, totaling approximately 281.8 million yuan.

Banks have previously sued for revolving line factoring business.

Previously, Lingnan shares had issued a partial debt overdue announcement on August 22, 2024, showing that its overdue loan amount to Dongguan Bank was 70 million yuan. In addition, the latest announcement added an additional 199.7 million yuan in overdue debt to Bank of Dongguan Branch, which is exactly the amount of the arbitration principal.

Judging from the reasons for arbitration, there are several key pieces of information, including revolving line loans and pledge of accounts receivable.

During the period from December 31, 2019 to June 13, 2022, the respondent signed 16 “Maximum Rights Pledge Contracts” with the applicant six times in each case, stipulating that the respondent would provide the respondent with a total of 16 engineering projects undertaken by the applicant.

On June 13, 2022, Respondent 1 signed a “Revolving Line Loan Contract” with the applicant, and the applicant provided Respondent 1 with a loan limit of RMB 200 million. The loan limit is valid from June 8, 2022 to June 7, 2023.

Bank of Dongguan issued a loan of 50 million yuan on February 16, 2023, with the loan term from February 16, 2023 to February 15, 2024; it issued a purchase price of 20 million yuan on February 17, 2023, with the loan term from February 17, 2023 to February 16, 2024; After the two loans expired, Lingnan shares applied to the applicant for an eight-month extension of the outstanding balances of the two loans of 44.9 million yuan and 19.9 million yuan.

This also means that Lingnan shares ‘loan had already had problems at the beginning of last year.

On the other hand, as early as the end of last year, Agricultural Bank of China Co., Ltd. Dongguan Dongcheng Branch (hereinafter referred to as Agricultural Bank) filed a lawsuit with the Intermediate People’s Court of Dongguan city, Guangdong Province.

In January 2021, Lingnan signed the “Lianjie Loan Business Cooperation Agreement” with Agricultural Bank of China and Simple Exchange Information Technology (Guangzhou) Co., Ltd., stipulating that the three parties will cooperate to carry out Lianjie loan business, and Agricultural Bank will serve as the factoring institution for this business.“”“” According to the agreement, Agricultural Bank of China will provide online non-recourse domestic factoring financial services for accounts receivable against Lingnan held by suppliers of Lingnan Shares. Lingnan Shares shall unconditionally fulfill the payment obligation of accounts payable under the gold slip on the maturity date recorded in the gold slip.

On January 31, 2024, the three parties continued the above business model. Lingnan Co., Ltd. and Agricultural Bank of China signed a “Maximum Rights Pledge Contract” to provide accounts receivable pledge guarantee for creditor’s rights formed by various businesses handled by Agricultural Bank and Lingnan Co., Ltd. within a certain period of time.

According to the lawsuit, based on the provisions of the” Lianjie Loan Business Cooperation Agreement”, the total principal amount of Jindao debts totaled 297 million yuan (including expired and unexpired). Among them, Lingnan Shares did not fulfill the repayment obligations after 21 Jindao debts matured.

It is not difficult to find that Lingnan shares were sued twice by banks and have many common points, including business model and loan guarantee situation.

Some industry insiders said that when banks or commercial factoring companies grant credit to customers, they usually grant a revolving financing line, which is equivalent to a credit card and uses accounts receivable pledge guarantee. The core point of risk control lies in the payer’s credit status and performance ability. If there are accounts receivable that have already been repaid, you can continue to raise funds from the factoring company within the amount that has already been repaid. However, today, there are also cases of repeated pledges of some businesses or false businesses with idle funds.

Bank of Dongguan’s arbitration request ruling included confirmation that the plaintiff enjoys a pledge right on the accounts receivable for a total of 16 engineering projects undertaken by the Respondent 1 provided by the Respondent 1, and has the right to priority within the scope of the creditor’s rights in this case. Reimbursement.

Bank of Dongguan is rushing for IPO, and litigation and arbitration cases have increased significantly

At present, in addition to tight liquidity, Lingnan Shares is also in trouble in its operating conditions. According to the “2024 Annual Results Forecast”, Lingnan Shares expects its net profit attributable to the parent in 2024 to be-900 million yuan to-1.35 billion yuan, and the net profit attributable to the parent after deducting non-profit is-970 million yuan to-1.42 billion yuan.

Therefore, there is still a large variable whether the loans related to Lingnan Shares will ultimately be recovered.

On the other hand, Dongguan Bank, which has been dragged down this time, is rushing for an A-share IPO. On March 31, 2024, the bank’s IPO was suspended because the financial information had expired. On June 29, the financial information was updated and submitted for IPO restart review. On September 30, the IPO was suspended again due to the same issue. On December 30, the prospectus was updated again. The IPO review status also changed from suspended to accepted.

According to the prospectus, in the first three quarters of 2024, Bank of Dongguan achieved revenue of 7.64 billion yuan, a year-on-year decrease of 164 million yuan, of which net interest income was 5.262 billion yuan, a year-on-year decrease of 693 million yuan; During the period, operating profit was 3.277 billion yuan, a year-on-year decrease of 350 million yuan; net profit was 3.215 billion yuan, a year-on-year decrease of approximately 220 million yuan.

As of the end of June 2024, Bank of Dongguan had a total of 4367 outstanding credit litigation and arbitration cases as plaintiffs or applicants. As of the end of 2023, the data was only 3318 cases, an increase of more than 1000 cases in half a year. It can be seen that the lawsuit with Lingnan is only a small microcosm.

In addition, as of June 30, 2024, there were a total of 14 outstanding litigation cases in which Dongguan Bank and its branches were the plaintiffs and the subject matter of a single dispute was more than 10 million yuan, involving a total principal amount of 1.581 billion yuan.

In terms of assets, as of June 30, 2024, the non-performing loan ratio of Dongguan Bank was 1.04%, an increase of 11 basis points from the end of 2023. The bank’s focused loans have also seen a large increase. As of the end of the reporting period, the scale of focused loans was 5.53 billion yuan, an increase of 51.42% from the beginning of the year, accounting for 1.57% of total loans.