① Liquor ETF became a major direction of capital inflows in February, while Kechuang 50 was sold the most;

② However, sub-theme ETFs such as artificial intelligence, robots, and innovative drugs are still firmly selected by funds, and many tens of billions of ETFs have been added this month.

Cailian News, February 27 (Reporter Zhou Xiaoya)It is both unexpected and reasonable that today, the technology track has pulled back and the big consumer sector has strengthened.

At the close, pan-consumer-themed ETFs led the rise in the non-goods ETF market. Among them, Yinhua Food ETF and Guangfa Hong Kong Stock Automobile ETF closed up more than 3%; Penghua Hong Kong Consumer ETF, China Merchants Food and Beverage ETF and other products also rose more than 2%.

The long-lost consumer-themed ETF dominates the gainer list, but smart funds have long entered the market. Liquor ETFs became a major direction of capital inflows in February, and were frequently “bought more and more”; while the technology track, which had previously been rising fiercely, was “sold more and more”.

The more you fall, the more you buy liquor ETF

In fact, compared with the Technology Track ETF, consumer-themed ETFs represented by liquor performed weaker in February. Before today’s market, most of the net worth only increased by less than 5%, and some even had net losses. However, funds are “falling more and more buying” on many products.

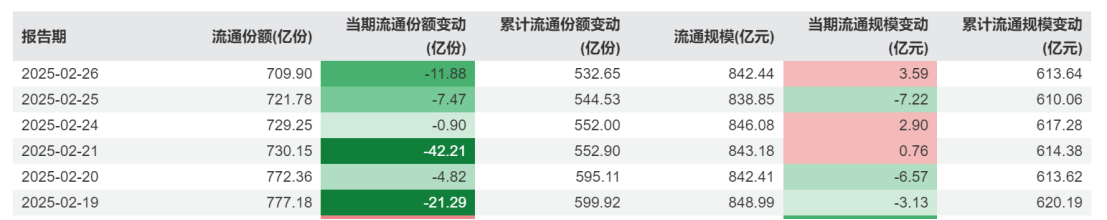

For example, the Penghua Securities Liquor ETF closed up 2.37% today, ranking among the top in the market. Previously, the ETF’s net return this month was only 3.59%, ranking in the bottom third of the non-cargo ETF market. However, since February, it has been Net subscriptions.

Wind data shows that as of February 26, the ETF had a net subscription of 2.14 billion units this month, ranking seventh in the net subscription list of non-goods ETFs during the same period, with a total net inflow exceeding 1.2 billion yuan.

This week, the ETF’s net value fell by more than 1% on February 25, but 970 million units were net subscribed for that day. As of now, the fund’s share has returned to more than 20 billion, reaching 21.597 billion, and the fund size is 12.77 billion yuan.

Similarly, as of February 26, Huitianfu’s main consumer ETF had a net return of 1.42%, but it had a net purchase of 1.238 billion units. In the past four weeks, it has received net purchase of 13.366 billion yuan.

The Science and Technology Innovation 50ETF is rising and selling

At the other end of the list is the correction of the technology track themed ETF. Among them, the Science and Technology Innovation 50 Index closed down 0.05% today after rising in the previous four trading days.

It is worth noting that while the market rose before, the Kechuang 50ETF continued to be sold. The largest Huaxia Science and Technology Innovation 50ETF has recently been net redeemed for six consecutive trading days.

Wind data shows that since February, the cumulative net redemption share of the ETF has reached 18.572 billion, with a net outflow of 20.324 billion yuan, both ranking first in the list of net redemption and net capital outflow of non-goods ETFs this month.

The ETFs linked to the Science and Technology Innovation 50 have been net redeemed a total of 29.74 billion in February, with a net outflow of 31.6 billion yuan. Since the beginning of this month, the Science and Technology Innovation 50ETF has increased by more than 15%.

In addition, the Huaxia Hang Seng Internet Technology ETF is also rising and selling this month. The ETF’s net return as of February 26 exceeded 23%, but it has been net redeemed of 18.496 billion units since February, which is the net redemption since February. The second most non-goods ETF. Today, the ETF closed down 1.31%.

Switch styles or reverse to pick people up?

It is not difficult to see that periodic profit-making exits and low point layouts are one of the important reasons for recent capital changes. And today’s market correction is an opportunity given by the market to “pick up people in reverse”, or is it a hidden signal for a style switch?

Shen Kun, director of the Equity Investment Department of Fu Anda Fund, analyzed that the two sessions are approaching and the market has entered a macro-fundamental test period: first, whether economic fundamentals show signs of stabilizing in the short term, second, the intensity and implementation effect of domestic policies, and third, U.S. tariffs to China and progress in Sino-US negotiations.

“There are currently no obvious optimistic expectations in the market. If the above situation makes positive progress, there may be a valuation repair in value and core assets.” In her view, there are three directions worthy of attention in the follow-up. Among them, in the pro-cyclical sector, the focus is on construction machinery, home appliances, liquor, and new consumption.

In addition, investment opportunities in the artificial intelligence industry chain such as AI end-side and AI application end, and leading companies that have benefited from the improvement of supply and demand pattern are also worthy of attention.

It is worth noting that while funds are on the seesaw stage, ETFs with sub-themes such as artificial intelligence and innovative drugs are still firmly selected by funds.

Wind data shows that as of February 26, the Guangfa China Securities Hong Kong Innovative Drugs ETF received the most net subscriptions this month, with its fund shares increasing by 4.303 billion, and the fund size has successively reached new highs to 12.826 billion yuan; E Fund China Securities Artificial Intelligence ETF is another newly introduced 10 billion ETF this month, with its latest scale of 14.763 billion yuan, and 3.762 billion yuan were net subscriptions this month.

The remaining non-goods ETF, which had net subscriptions of more than 3 billion units this month, the China Securities Robot ETF, also exceeded the 10 billion mark on February 26, reaching 10.241 billion yuan.

“We believe that China’s technology assets are full of opportunities. The core clue is the cloud-to-end AI. Domestic technology giants may lead a new round of technological innovation cycles.” He Mingxiao, manager of Harvest Fund, believes that combined with China’s own manufacturing advantages, there are continuous investment opportunities in domestic computing power around the cloud, autonomous driving and AIOT around terminals, and high-end semiconductor breakthroughs around technological self-improvement.