Against the backdrop of a general decline in the crypto market, the Hyperliquid protocol has grown against the trend with its unique profit mechanism and high trading volume.

Author: Alvis

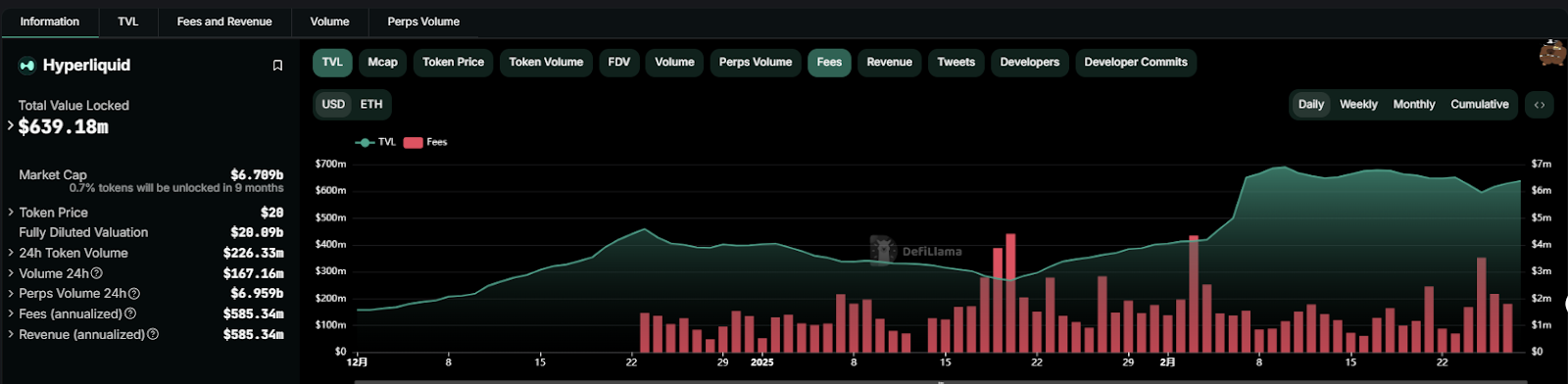

Recently, the crypto market has continued to decline, and the TVL (total locked positions) of major agreements have declined. However, in this downturn, there is one agreement that bucked the trend and increased instead of decreasing: Hyperliquid.

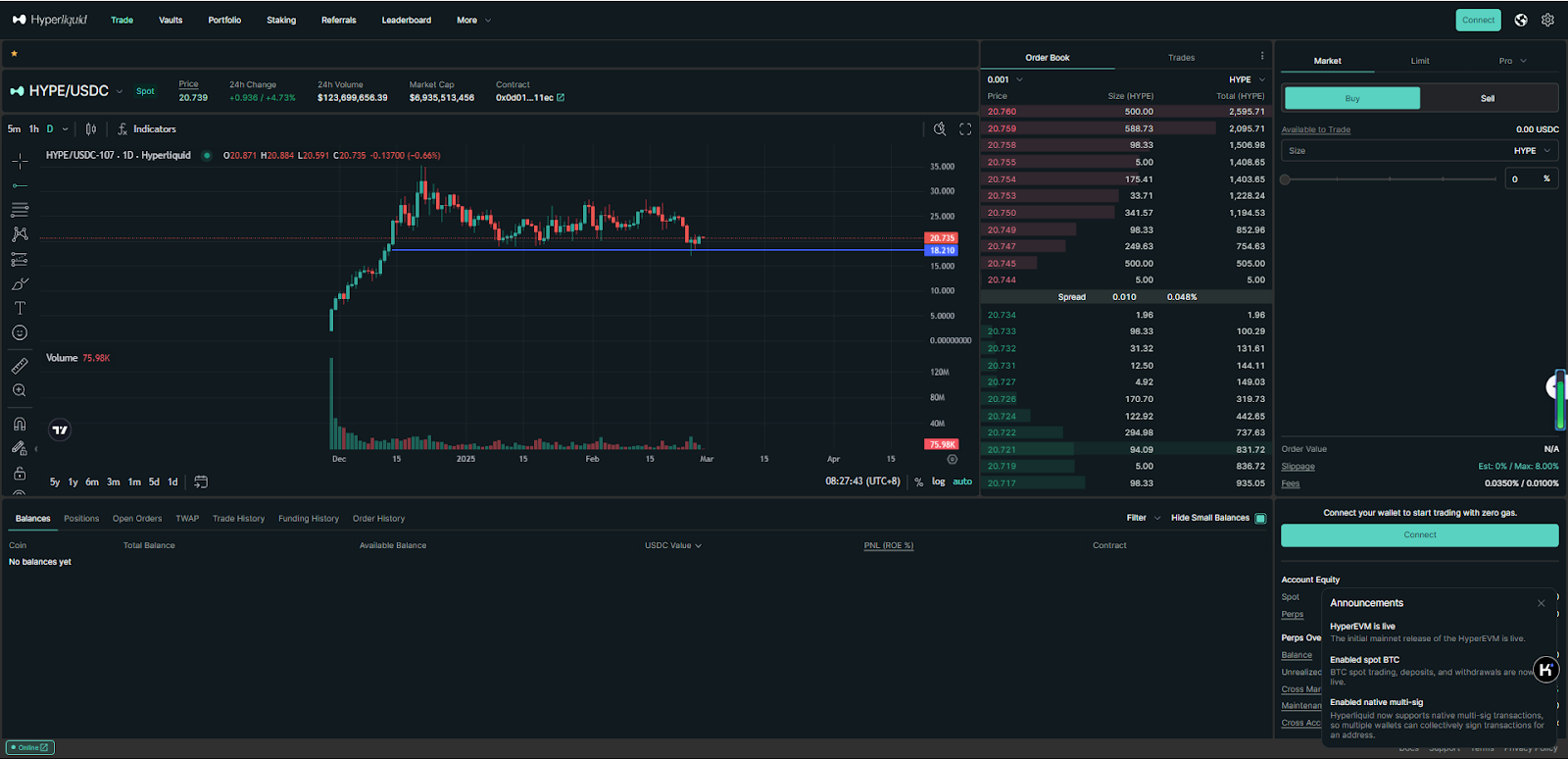

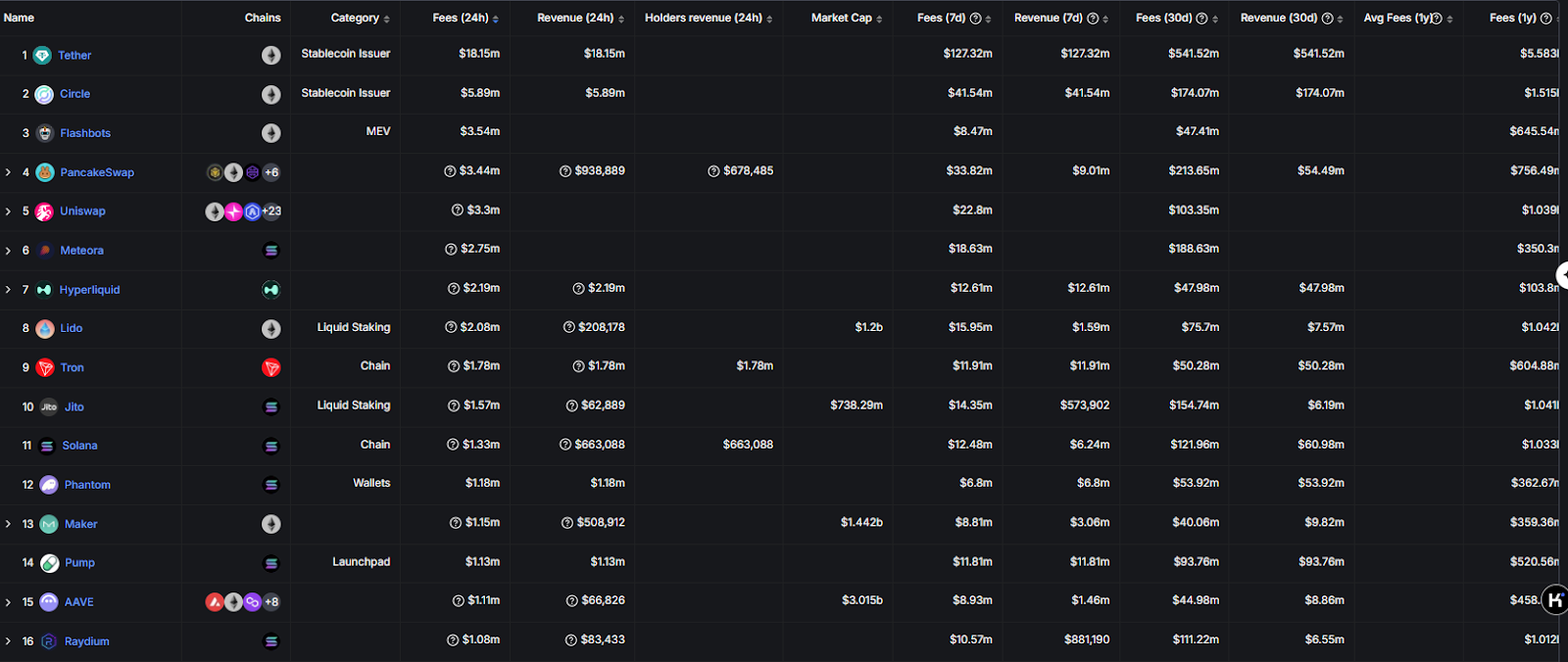

With its unique profit mechanism and strong trading volume, its token HYPE not only remained resilient in the downward market, but also gained US$2.19 million in agreed revenue in just 24 hours. The revenue in 7 days surpassed Pumpfun, ranking seventh in the entire network.

What makes Hyperliquid take the lead in the encryption winter? How does it break the industry curse and achieve dual growth in revenue and market value? Let us explore in depth the driving force behind this phenomenon.

High-performance Layer1-Fully on-chain order book Perpetual exchange Hyperliquid DEX

Hyperliquid’s core product is its perpetual contract DEX, which allows traders to gain up to 50 times leverage on BTC, ETH, SOL and other assets. It has a fully on-chain order book and zero gas fees. Unlike Solana, which supports a wide range of decentralized applications (DApps), Hyperliquid’s layer-1 is built specifically to optimize DeFi transaction efficiency.

As of February 28, 2025, Hyperliquid (HYPE) ranked seventh in the agreement with 24-hour agreement revenue of US$2.19 million and a cumulative performance of US$12.61 million in 7 days. It not only surpassed emerging agreements such as Pumpfun, but also established absolute dominance in decentralized perpetual contract tracks.

Multi-dimensional innovation in income structure

- Derivatives transaction fees (accounting for 70%+ revenue): The tiered rate system of 0.01%-0.035% for perpetual contracts, combined with the average daily trading volume of 10 billion US dollars, constitutes the basic income;

- Spot auction revenue: Through the Dutch auction mechanism of HIP-1 tokens, the cost of putting a single project on the shelves reaches US$300,000 to US$500,000, and the annualized revenue potential exceeds US$140 million;

- Cross-chain bridging and ecological service fees: With the launch of HyperEVM, Gas fees (paid through HYPE) and smart contract service fees will become new growth poles.

Its core data indicators show a completely different growth logic from traditional DEX:

1. Disruptive breakthroughs in transaction scale and efficiency

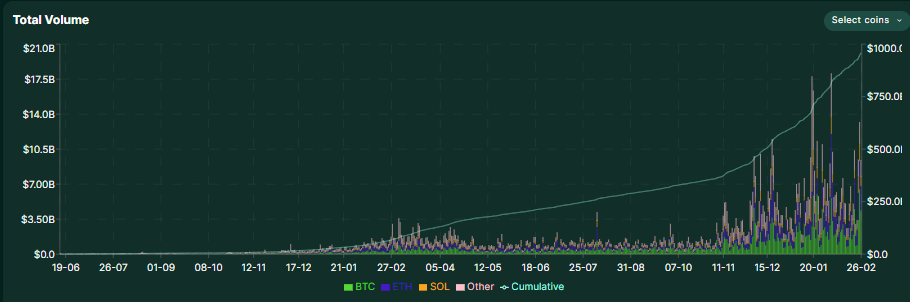

The daily trading volume has stabilized at US$9 billion, with a peak exceeding US$10 billion. This figure has reached 6%-10% of the transaction volume of EY’s renewed contracts, far exceeding similar decentralized platforms (such as dYdX, GMX, etc.).

The TVL/revenue ratio was only 50.6 (TVL of $638 million vs 7-day revenue of $12.61 million), which was significantly better than Uniswap (184.9) and Raydium (12.7). Top DEX Uniswap had revenue of US$22.8 million over the same period, but its higher TVL highlights Hyperliquid’s profit margins, which fully demonstrates that its capital utilization is at the top of the industry.

Token economics: Building a perpetual motion machine for value capture

HYPE’s token model design pioneered the direct link between agreement revenue and token value:

The triple driving force of the deflation engine

- 100% revenue repurchase and destruction: The platform uses more than 70% of derivatives transaction fees and spot auction revenue for market repurchase and destruction of HYPE. Based on current income levels, the annual destruction volume can reach 150 million pieces, accounting for 21.4% of the circulation;

- Pledge deflation mechanism: Verifiers need to pledge HYPE to participate in the consensus. The current pledge APY reaches 18.9%, attracting more than 31% of liquidity lock-in;

- Expansion of token utility scenarios: After HyperEVM was launched, HYPE became a necessary token for cross-chain Gas payments and smart contract deployment, adding dual drivers for developers and users on the demand side.

Time game of token allocation

Unlocking risk controllability: Team tokens (23.8%) are locked until December 2025, and linear release is adopted (24 months), which is more conservative than similar projects (such as the dYdX team unlocking immediately);

Community incentive reserve: 38.9% of the tokens are used for ecological construction, which continues to attract external liquidity through transaction volume mining, developer incentives, etc. Data shows that every dollar of incentive can leverage $5.3 in TVL growth.

Building a valuation model: Value revaluation from a multi-dimensional perspective

1. Relative valuation method (industry comparison)

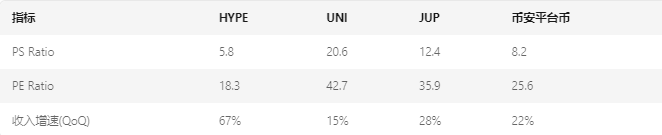

HYPE’s current circulation market value of US$6.7 billion corresponds to PS 5.8 being at an industry low level. Considering that its revenue growth rate is 3-4 times that of its peers, and the PEG ratio is only 0.27, it is indeed underestimated overall.

2. DCF model calculation

Key assumptions:

- Compound revenue growth rate of 55% in the next three years (conservative estimate)

- Pledge yield remains above 15% to attract long-term holders

- HyperEVM ecosystem contributes more than 25% of new revenue

Discounted result:

- Reasonable valuation at the end of 2025:$48.2 (+130%)

- Target price for 2026:$79.5 (PEG returns to industry average of 0.8)

3. On-chain Value Capture Factor (VCC)

Introduce TVL/(MC/TVL) indicator to calculate:

- HYPE VCC=6.38/(69/6.38)=0.59

- Industry average =0.31

The data shows that for every $1 of TVL, the value created in the Hyperliquid ecosystem is 1.9 times the industry average.

Risk factors and market misjudgments

1. Re-examination of “Centralization Doubts”

Hyperliquid’s native token HYPE was launched via airdrop in November 2024 and covers 94,000 unique addresses. The allocation boosted a market value of $2 billion on day one, indicating high community adoption.

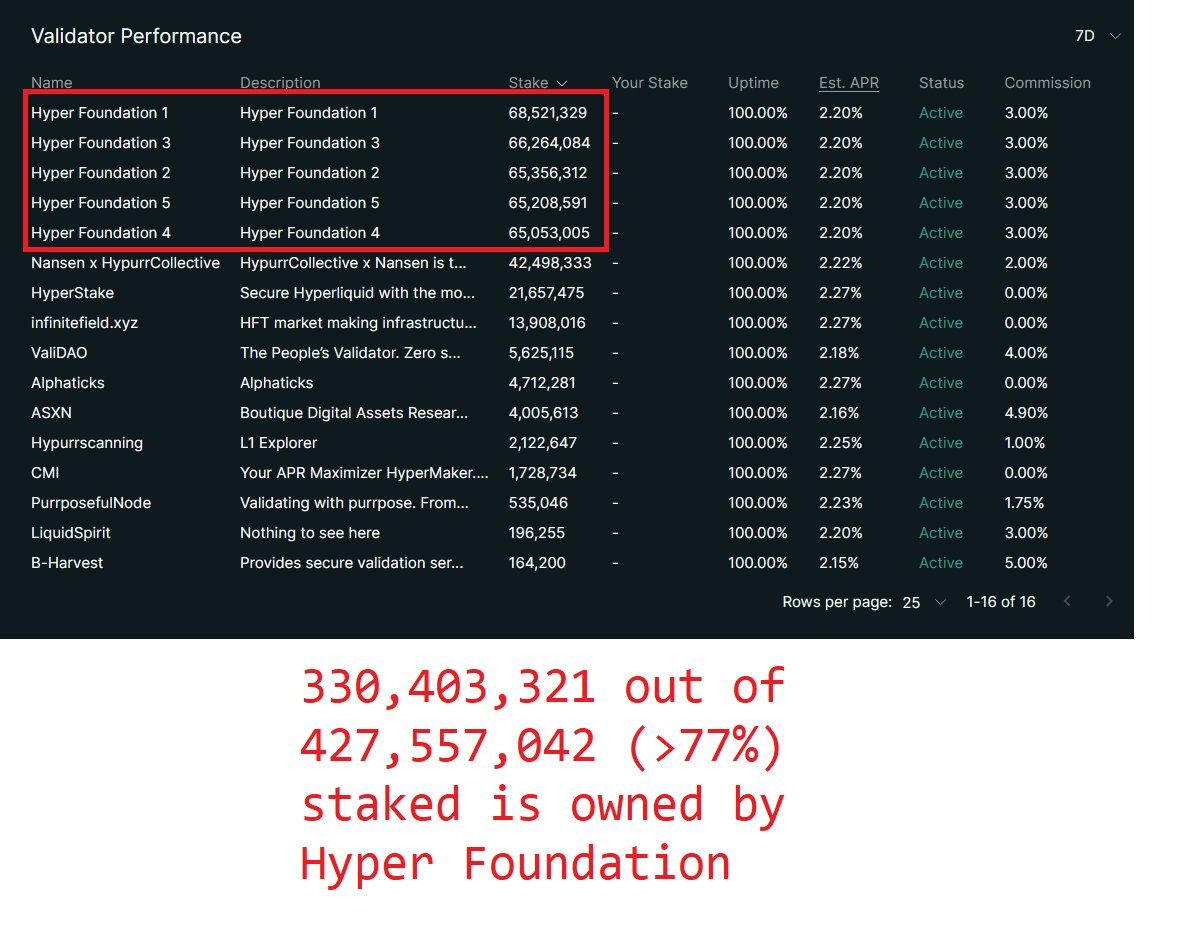

However, online data shows that the team controls 78% of the pledges.

Although node concentration is controversial, it should be noted that:

- The verifier committee adopts a dynamic rotation system and randomly changes 1/3 of the nodes every epoch (about 4 hours);

- The open source process is advancing in stages, and the core code of RustVM has passed CertiK audit.

2. Deep barriers to competition

- Liquidity moat: The network effect formed by a daily transaction volume of US$9 billion requires competitors to invest at least US$1.8 billion in vampire attacks (calculated based on a 0.2% incentive), while HYPE’s repurchase mechanism can instantly offset more than 30% of the impact;

- Developer migration costs: HyperEVM is fully compatible with Solidity, but HyperBFT achieves 10 times the performance of the EVM chain, creating the advantage of “no development threshold and differentiated experience.”

Conclusion: Strategic opportunities in value reconstruction

Hyperliquid reconstructs the rules for the flow of value along the chain through technological paradigm innovation:

- Short-term (0-6 months): Benefiting from the surge in Gas demand caused by the launch of HyperEVM, combined with the peak season of Q2 perpetual contract trading, target price of $35-42;

- Medium term (6-18 months): Ecological expansion will diversify the income structure, and PS is expected to align with the currency and Taiwan dollar (8.2→ market value of US$9.2 billion);

- Long-term (18 months +): If 55% revenue growth is maintained, it is expected to impact the market value of 100 billion US dollars in 2026 and become a core component of Web3 financial infrastructure.

Today, as the boundaries between traditional CEX and DEX become increasingly blurred, Hyperliquid proves the possibility of a new path-to achieve a paradigm revolution in financial efficiency through breakthroughs in blockchain’s native performance. When the market is still using the valuation framework of DEX to view HYPE, its essence is already a new trinity species that integrates CEX efficiency, DEX transparency and L1 scalability. This is the core logic of its value revaluation.