Through the ups and downs of the encryption market, the old public chain Cardano can always bring its own BUFF and open all the way. In this cycle, Cardano’s veteran has revitalized himself and anchored the Bitcoin L2 narrative. Recently, he has frequently used multiple identities such as U.S. crypto reserve assets, ETF application targets, and popular institutional configuration options, and has a full sense of existence.

Author: Nancy, PANews

Through the ups and downs of the encryption market, the old public chain Cardano can always bring its own BUFF and open all the way. In this cycle, Cardano’s veteran has revitalized himself and anchored the Bitcoin L2 narrative. Recently, he has frequently used multiple identities such as U.S. crypto reserve assets, ETF application targets, and popular institutional configuration options, and has a full sense of existence.

Ecological indicators have been crushed, and policy BUFF has been chargedrelationship households

On March 2, Trump issued a document announcing that his executive order on digital assets directed the presidential working group to promote strategic reserves of cryptocurrencies, including BTC, ETH, XRP, SOL and ADA. However, the news was not completely unexpected. At the end of January this year, Ripple CEO Garlinghouse confirmed that he had discussed with Trump the possibility of using XRP as a U.S. strategic reserve asset, and emphasized that the diversification of reserves should be ensured. Now it seems that this game of chess has already begun to be laid out.

Stimulated by this news, the encryption market was “resurrected with blood” overnight. Among them, Cardano’s ADA performance is particularly eye-catching. CoinGecko data shows that its highest increase in 24 hours exceeds 78.1%, directly dominating the hot search list. However, while market sentiment is high, there are also doubts: Cardano’s technical strength and ecological development are slightly inferior to other selected assets. Why was it selected as a U.S. reserve asset?

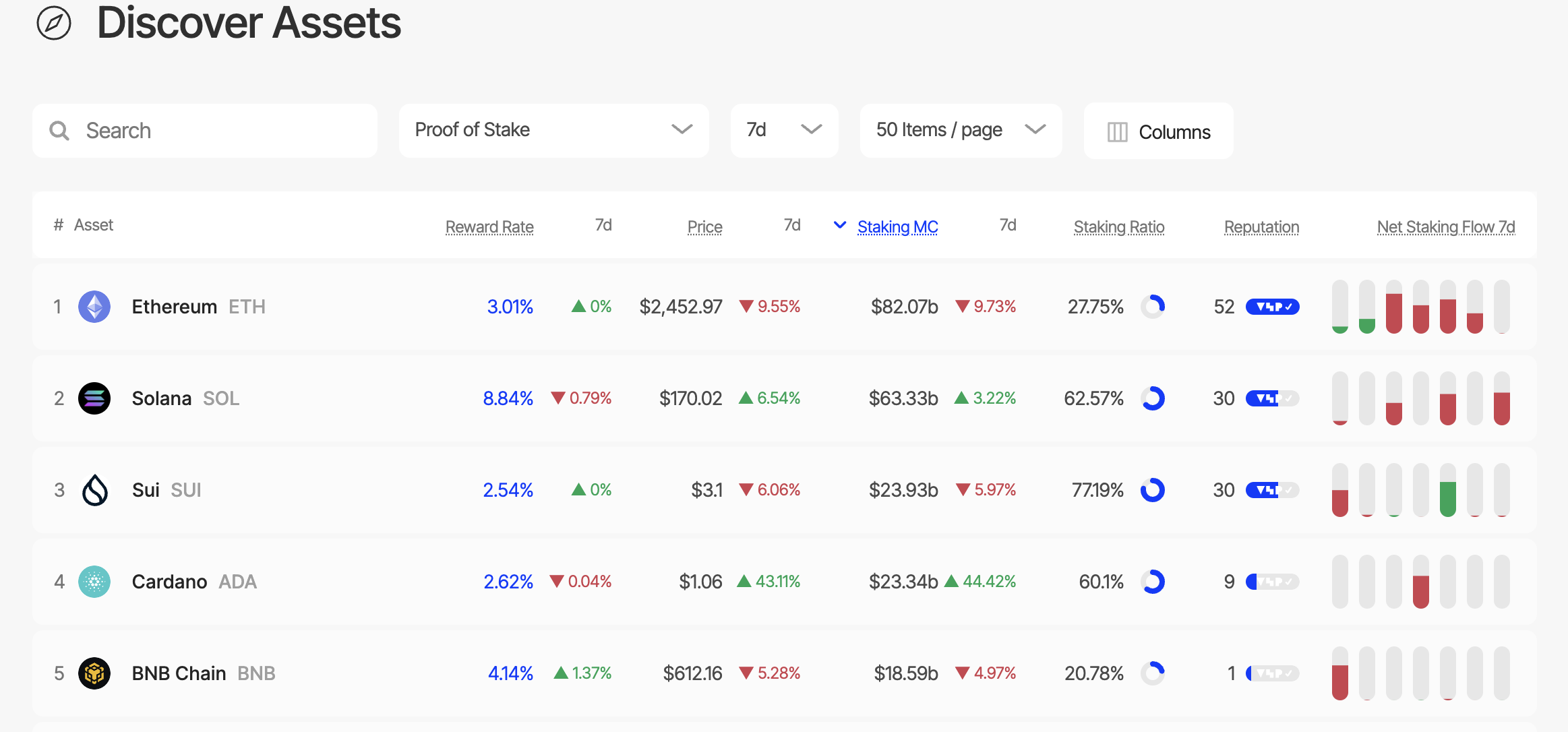

Cardano holders have a high willingness to hold in the long term, and more than 60% choose to lock up positions to support the network, which also increases the health of their network. According to data from pledge data website Staking Rewards, Cardano is the fourth largest POS blockchain network, with a pledge amount of US$23.34 billion and a pledge rate of 60.1%.

However, according to DeFillama data, as of March 3, Cardano’s TVL was nearly US$508 million, the market value of the chain stablecoin was US$22.55 million, and application revenue in the past 24 hours was only US$3024. During the same period, Solana’s TVL reached US$8.38 billion, with daily revenue of approximately US$836,000. Judging from the performance of ecological indicators, Cardano lags behind among the selected assets. Although the pledge scale is astonishing, ADA’s pledge has not been transformed into the actual application of dApp, which means that there are still large gaps in its ecology to be filled.

“So does this mean we have to change the name to ‘American Digital Assets’?” Cardano founder Charles Hoskinson joked in a recent tweet.

In fact, the outside world has always called Cardano a “Japanese public chain”, and Cardano is an American manufacturing project founded by American Charles Hoskinson. He was one of the original eight co-founders of Ethereum. He has invested a lot of money and energy in blockchain, longevity science, and extraterrestrial exploration. In 2014, Hoskinson left due to differences between the development direction of Ethereum and the Vitalik Buterin product, founded the US-based Input Output Global and launched Cardano. The reason why Cardano is so popular in the Japanese market, even called “Japan Ethereum”, is largely related to its early financing model. It is reported that nearly 95% of the buyers in Cardano’s public offering come from Japanese investors, also known as “retirement investment”. The main reason is that the public offering is led by the Japanese company Emurgo. At that time, Japan’s regulatory environment was relatively loose compared to Europe and the United States, which also made Cardano misunderstood as a Japanese project. But as the U.S. encryption policy becomes increasingly open, Cardano is gradually downplaying its impression of Japan.

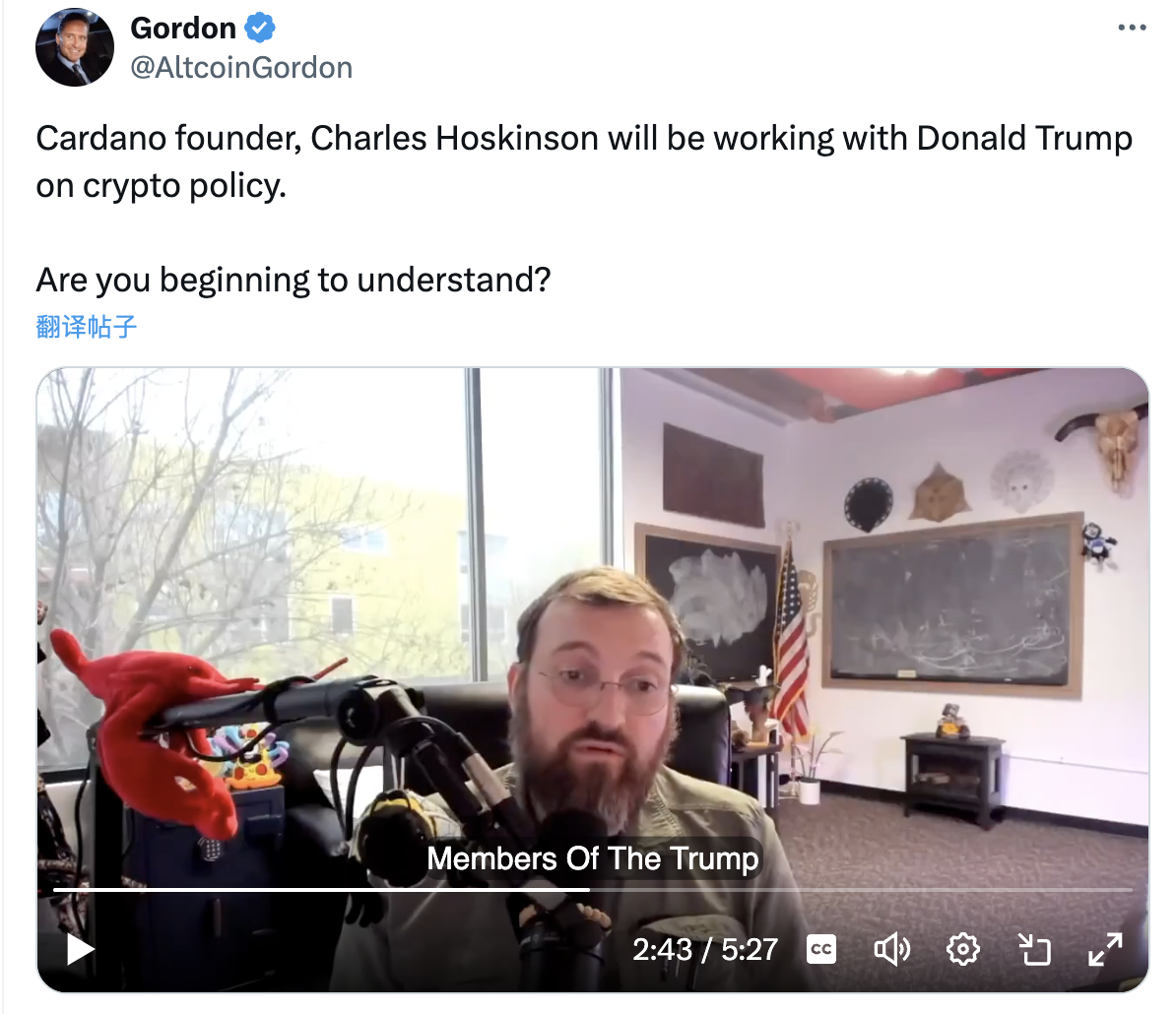

As for Cardano’s inclusion in the strategic asset reserve, many people speculated that it did not rely on technology, but had established close ties with the U.S. government, especially since founder Charles Hoskinson repeatedly hinted. For example, in November 2024, just as Charles Hoskinson was rumored to be considering appointing him as a crypto policy adviser, he revealed in a conversation that he had a close relationship with a member of Trump’s team. He said he would work with lawmakers and the administration to push for passage of a bipartisan bill. Cardano research and development firm Input Output Global will establish an Office of Cryptocurrency Regulatory Policy in early 2025 and plans to engage with “leaders in certain key positions” in the U.S. government to promote a legislative agenda for cryptocurrency-related securities and commodities. However, as of now, the specific progress of this plan has not been made public, and there is no evidence that he has been officially employed by the U.S. government.

Charles Hoskinson also clarified on March 2,”No one has been appointed to a cryptocurrency-related role by the executive branch tonight, and the meeting does not mean recognition or granting of magical new powers, that is the legislative process, and it takes time and effort. I will not comment on this topic again until I have clear and substantive information about the legislative process, which must be relevant to the creation of new laws to allow the industry to survive and prosper in the United States.”

From academic to Bitcoin wingman, CardanoJiwennarrativePost hot spots

The narrative of flowing water, the iron Cardano.

Recently, Cardano’s multiple market developments have made it one of the hot targets of market attention. For example, ADA is the top three assets in the latest positions of gray smart contract funds, with a proportion of 18.23%; the Cardano spot ETF application submitted by gray has been accepted by the US SEC;Cardano plans to integrate Ripple’s RLUSD stablecoins to enhance its DeFi ecosystem and provide wider use opportunities for RLUSD.

Not long ago, Charles Hoskinson also disclosed that Input Output Global (IOG) will focus on developing the Bitcoin DeFi ecosystem in 2025. The team plans to work with Fair Gate Labs, a developer of the multi-party computing protocol, with the goal of launching a demonstration version before the Bitcoin conference in May 2025. The technology developed by Fair Gate Labs will become the foundation of BitcoinOS and will not require the issuance of additional tokens. Cross-chain transactions only require the use of Bitcoin. The project will also cooperate with community projects and wallet service providers to achieve the goal of “awakening sleeping giants.”

The dividends of this strategic reserve policy have undoubtedly further brought additional policy support to Cardano and provided it with new capital flows and attention in the market.

Looking back on Cardano’s development history, in the past few rounds of market baptism, Cardano has always been good at building eye-catching narratives to create a unique market image, and increasing market attention by relying on external events.

From the start of the “research-driven third-generation blockchain”, to the environmental brand of the “Green Ethereum Killer”, to the ecological moment when smart contracts were launched, it has now become a new role of “Bitcoin Layer2”. These narratives are sometimes not entirely based on the technology itself, but are more driven by external events and public opinion. In particular, the bull market cycle often amplifies its potential and quickly becomes the focus of market attention with its strong ability to pull orders.

However, from the original academic school to the current Bitcoin “wingman”, although Cardano has been quite successful in narrative evolution, the practical application problem behind it is still its biggest weakness. With the help of “U.S. policy riding”, it remains to be seen whether Cardano can break the inherent impression of previous bull markets under the illusion of limitations.

Accused or forA dead letter on paper makes the execution path a mystery

However, as for altcoins, including ADA, that were named by Trump as strategic reserve assets, in addition to doubts about the transfer of benefits, their implementation method, timetable, specific scale and funding sources are still unclear, and they are considered by the market to be more at the intention stage, and execution power remains a mystery. (Related reading: Trump announces cryptocurrency reserve plan: 5 assets were selected, but were questioned by “advertising spots” and the implementation method is uncertain)

Udi Wertheimer, founder of Taproot Wizards, believes,”The best view I have seen so far about strategic reserves is that it’s just a typical Trump negotiating strategy. To truly build reserves, Trump must convince Congress that he cannot decide alone. Whenever Trump needs to persuade other stakeholders, he always makes an absurd proposition first and can retract it later. So, in Trump’s chess language, it just means he’s telling Congress that if I don’t agree to Bitcoin reserves, I’m going to make even more outrageous terms.”

Arthur Hayes, co-founder of BitMEX, pointed out,”There’s nothing new here, just talk. Tell me when they get congressional approval to borrow money or raise the price of gold. Without these, they wouldn’t have the money to buy bitcoins and altcoins.”

“Investing in Bitcoin alone may be the best option-the simplest and the logic behind it as a successor to gold is clear; if people want more diverse options, they can build a market-weighted index of crypto-assets to keep it unbiased.” Coinbase co-founder and CEO Brian Armstrong believes.