The financialization of attention is almost inevitable, and the core of the next wave of financial innovation will focus on how to effectively evaluate and trade digital Mindshares.

Author:Marco Manoppo

Compiled by: Shenchao TechFlow

In 2025, attention will become a new currency that is more important than data.

In today’s era, Mindshare has become the key to business success. If you think I’m like the typical venture capitalist and start with an obvious point, you’re right, but keep reading.

Attention has always been the most important currency in the business world. This is also the core logic of commodity sales. Before the birth of the Internet, the golden age of print media and advertising proved this. At that time, cigarette companies increased sales by linking to controversial social issues and movements to attract public attention.

Simply put,Attention brings Mindshare, and Mindshare determines distribution efficiency.

Then, the brand era arrived. Brands such as Nike, Lucky Charms and Nutella have successfully captured consumers ‘Mindshare through emotion-driven marketing strategies, thereby achieving higher profit margins. Consumers are willing to pay a 30% premium for the exact same product simply because of the brand’s image in their minds. I myself have been deeply affected by it. When I was a college student, I crazily collected Supreme’s Box Logo. Now I think about it, it’s a shameful era.

I almost spent $1000 on these things when I should have invested in ETH.

Fast forward to the 2020s, our world is completely digital, and the battle for Mindshare has shifted online.

This trend accelerated significantly during and after the COVID, but its origins can be traced to the rise of YouTuber over the past 15-20 years. Early content creators like Ryan Higa and Smosh initially made interesting little videos just out of interest. However, the rise of social media platforms has changed everything. Platforms such as Facebook, Twitter and Instagram have pushed YouTuber and independent creators higher than most second-tier stars through the compound effect of viral transmission.

For example, Casey Neistat started his daily vlog in 2015. At the time, it was rare for large YouTubers to use their influence to launch commercial projects. Today, however, MrBeast has built a multimillion-dollar business empire through its content distribution channels. Rhett Link successfully acquired and expanded the Mythical Entertainment Network through its YouTube audience.

It is obvious that all companies are competing for Mindshare today.

Mindshare essentially represents a premium. In modern capital markets, this premium is reflected directly in your stock price or token price. Take Tesla as an example. If Elon Musk had not spoken frequently on social media, its market value might not have reached today’s high. I believe this trend will continue to develop in the next five years and will be further financialized. This also laid the foundation for what we call information financialization (InfoFi)today.

If you can understand this joke, we can become friends.

What is InfoFi?

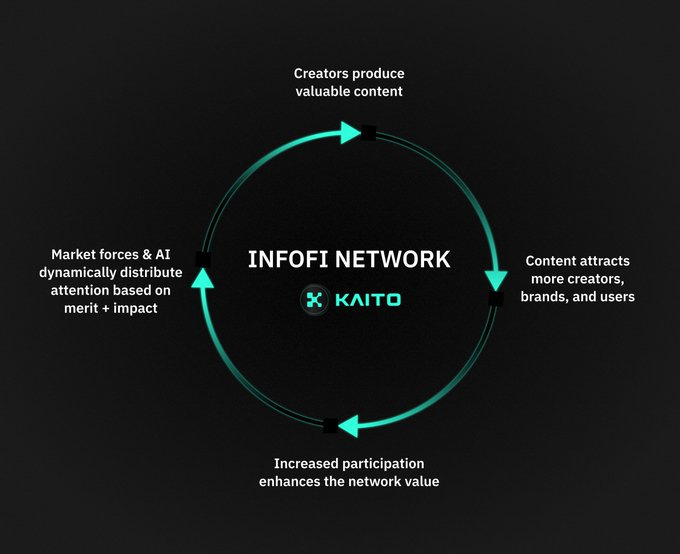

InfoFi is a concept promoted by Kaito, but I think its connotation is far broader and deeper than the original definition.

“An emerging concept that combines financial incentives with the generation, verification and distribution of information is mainly used in decentralized systems. The goal is to solve many problems in the current information economy by introducing market mechanisms, such as unreliable data, algorithmic bias and unfair value distribution, thereby ensuring that information is more accurate and credible, and can be efficiently organized and disseminated. rdquo;

This definition is undoubtedly correct, but I think the core significance of InfoFi is more far-reaching.

→Essentially, the core of InfoFi is to tokenize the information supply chain.

In other words, information is no longer just a free resource, but an asset that can be assigned, traded, and optimized through financial mechanisms.

For a long time, monetization of attention has often relied on creating a stand-alone product and then directing attention to that product. This model has proven to be successful, such as:

-

Food bloggers make money by recommending restaurants or condiments (such as Uncle Roger and David Chang);

-

Fashion bloggers launch their own clothing brands (such as Alexa Chung and Kardashians);

-

Fitness bloggers promote protein powders or energy drinks (such as Christian Guzman);

-

Investors and financial institutions profit from selling financial products (such as ARK Invest or venture capital funds targeting high-net-worth clients);

-

Some fake financial mentors profit from trading signal clusters (you know);

-

Some toxic masculine Internet celebrities profit through pyramid schemes (you know).

However, now we are entering a new era——An era when Mindshare can be traded directly.

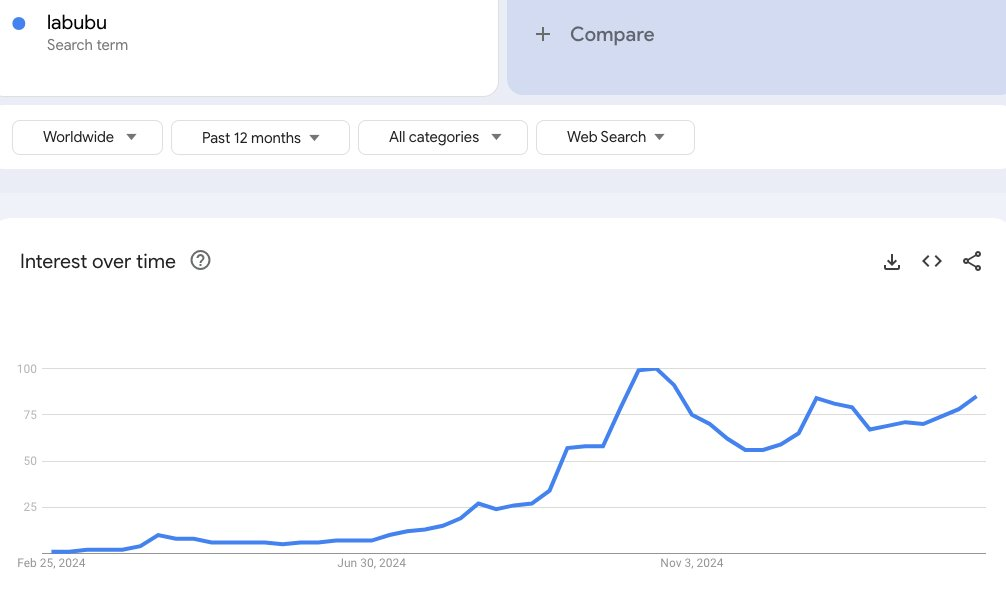

Imagine a scenario where in the future, people no longer need to create derivative businesses to realize attention, but can insteaddirect investmentand trading cultural trends, narratives or attention cycles.For example, when Labubu became a hot topic, there was currently no efficient way in the market for people to bet on its continued popularity. Although a memecoin called $LABUBU appeared briefly, its price trend was more affected by fluctuations in the overall crypto market than by the popularity of Labubu itself or changes in Mindshare.

InfoFi offers an alternative: a more direct and liquid mechanism for speculation and trading attention itself.

The key role of trusted oracle in InfoFi

In order to make InfoFi truly aMature and reliableIn the field of science and technology, the Trusted Oracle (Oracle) is indispensable. The main role of the oracle is to securely introduce offline data (such as market sentiment, social trends, etc.) into the blockchain system and ensure that the data cannot be tampered with. Since the core of InfoFi is the trading of narratives, trends and market sentiment, real-time and accurate data feeds are particularly important.

Currently, oracle solutions such as UMA, Chainlink, Pyth, and API3 have provided important offline data services for decentralized finance (DeFi). These oracles allow DeFi applications to settle bets, verify market trends, and aggregate price information from multiple data sources.

Challenges and limitations of current oracle technology

Although decentralized oracle technology has made some progress, it still faces the following major challenges to fully support the development of InfoFi:

-

lack of real-timesentiment analysisAbility.Currently, most oracle networks focus mainly on providing price data or the results of structured events. However, the development of InfoFi requires oracle machines that can track and quantify social emotions, user engagement trends, and relevant indicators of viral spread in real time, and minimize latency.

-

Issues of verifiability and subjectivity of data.Unlike price data, sentiment analysis often involves subjectivity. For example, how to define positive or negative emotions? How to ensure that these data are objective, credible, and will not be manipulated by humans?

-

Extensibility of data sources.Current oracles often rely on a limited number of verified data sources, such as exchanges or specific news websites. However, InfoFi requires broader data coverage, including news articles, social media updates, market forecasts, and niche forums, to provide more comprehensive and accurate insights.

-

Risks of data manipulation.Since the core of InfoFi is speculation around narratives and trends, someone may deliberately amplify certain narratives or trends through means such as robot farms or false participation. The oracle must have the ability to identify and filter these abnormal behaviors to prevent malicious manipulation of data.

-

Economic incentives for data providers.How to ensure that the data provided by the oracle is reliable? This requires the design of reasonable incentive mechanisms, such as staking, Slashing, and reputation scoring, to encourage data providers to report data honestly and effectively restrict misconduct.

The future direction of Oracle

In order to meet the needs of InfoFi, oracle technology needs to evolve further. Future oracles may incorporate the following key features:

-

AI Driven data aggregation: Through artificial intelligence technology, extract valuable information from massive data, and quickly analyze and integrate it.

-

Reputational mechanisms that encourage alignment: Design reasonable reward and punishment mechanisms to ensure that data providers ‘behaviors are consistent with system goals.

-

Real-time trend verification: Provide faster and more accurate trend analysis and verification capabilities, and support financial products built based on narrative.

Through these improvements, Oracle will be able to better support the development of InfoFi, providing security, scalability, and controllability resistance to narratives and trends based financial products.

Expansion of InfoFi’s market reach

Forecasting markets can be seen as an early attempt at InfoFi (the financialization of information), which allows speculators to make bets on real-world events based on information advantages. For example, platforms such as Polymarket, Kalshi, and Augur have demonstrated the potential of this model, although their user base is still relatively small.

Similarly, there is the concept of a data market. This idea was proposed back in 2017 during the ICO boom (exposing my age) in an attempt to commoditize data sets and allow users to trade. However, due to the vague value proposition of these projects and the inefficiency of the token economy model, they ultimately failed to gain widespread market recognition.

In contrast, InfoFi represents a more mature and extensible version of these concepts. Unlike pure bets or data trading, the core of InfoFi is to transform Mindshare (Mindshare), or people’s attention and interest, into a new tradable asset class.

Here are some possible InfoFi application scenarios:

-

narratives based ETF: Design tokenized asset portfolios to track specific topics of concern. For example, the AI Trend Index can track hot topics related to artificial intelligence, while the Metaverse Craze Basket focuses on the popularity of discussions on metaverse concepts.

-

Financial instruments related to Internet celebrities: Tokenize the creator’s future income so that fans can purchase these tokens, thereby speculating on the creator’s future influence.

-

Memecoin derivatives: Provide more sophisticated ways to allow people to speculate on cultural phenomena without relying on traditional cryptocurrency economic models.

-

Tokenized media channels

However, there is still a key question to be solved for InfoFi’s future: Will there be a killer application that can establish InfoFi as a separate financial domain, rather than just a branch of decentralized finance (DeFi)?

key insights

-

Redefine the value of information.InfoFi challenges the traditional concept that information is free. It proposes that attention, narrative and data themselves have intrinsic value and can be traded and speculated through financialized methods.

-

attention economynatural evolution.As Mindshare (or attention) plays an increasing role in determining financial outcomes, markets will develop more direct ways to capture and monetize these attention cycles.

-

Unlock new financial markets.InfoFi has opened up a whole new market that allows people to speculate directly on cultural phenomena, Internet celebrity growth and popular narratives, rather than just directing attention to traditional business models.

-

The key to success lies in the fit between the product and the market.The challenge for InfoFi is to design financial instruments that are liquid, scalable and attractive enough to become a new financial paradigm, not just another DeFi gimmick.

Final thinking

Although InfoFi is still in its early stages of development, the financialization of attention is almost inevitable. From forecasting markets to financial instruments based on Internet celebrities to the trend of tokenization, the core of the next wave of financial innovation will focus on how to effectively evaluate and trade digital Mindshares.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern