Image source: Generated by AI

Image source: Generated by AI

When Tencent named its large model C-side application “Yuanbao”, I’m afraid it never thought that one day, the mixed model represented by “Yuan” in this name would become a foil for DeepSeek.

On the evening of March 3, Tencent Yuanbao surpassed DeepSeek’s “ontology” and topped the free App Store list in China. As of press time, DeepSeek overtook Yuanbao to return to the top spot, followed by Doubao in third place.

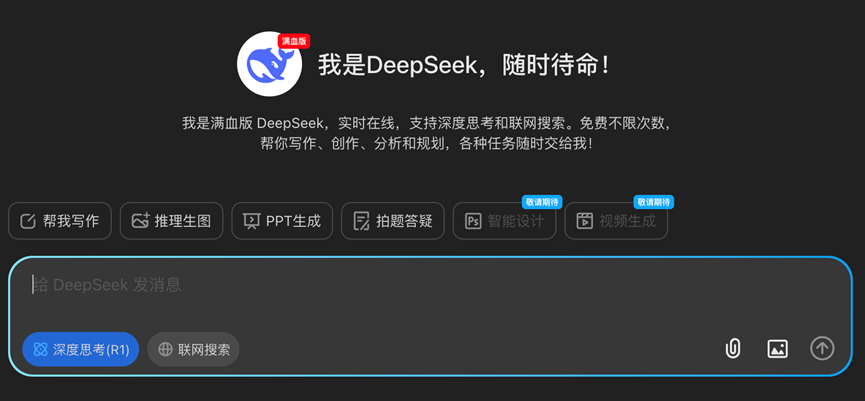

Everyone knows that the rapid speed of light in Yuanbao began on February 13, the day when the DeepSeek-R1 version was connected to the full-blooded version. Although Yuanbao supports switching between the Mixed Origin Model and DeepSeek-R1, Tencent itself knows very well who the “top stream” is. Whether it is the internal promotion of Tencent’s ecosystem or the external streaming, it always puts the “full-blood version of DeepSeek” in a prominent position.

Why did Tencent, which was originally not in a hurry, suddenly speed up? Does Yuan Bao reach the top of the download list just rely on the quantity purchased? Why can’t bean buns follow suit and connect to DeepSeek? This article attempts to observe the different strategies of Tencent and Byte in the AI confrontation from the back of Yuanbao’s “battle” bean buns.

Yuanbao can reach the top, not just by buying quantity

In May 2024, when Tencent officially released Tencent Yuanbao, AI assistant was no longer a new concept. The DAU of Doubao and Wen Xiaoyan had already exceeded one million. Looking back, Doubao and Kimi also stood at the beginning of a steep growth curve at that time.

But at that time, Tencent seemed to be “in no hurry”. Not only was the product released late, but there was not much promotion action after the release, so that it was once considered by the outside world that the layout of AI was not strong enough;

Eight months later, Tencent Yuanbao took less than a month to become the “top brother”, which proved that Tencent was not indifferent, but was waiting for the opportunity.

From being leisurely and slow in the past to suddenly accelerating, Tencent’s attitude has changed because it sees the reason to be anxious.

DeepSeek’s breakthrough made Tencent feel the “entrance threat” from large model products for the first time.In the past, large models were a hot topic in the industry, but now men, women and children are talking about DeepSeek; in the past, large model products needed to be “watered” by traffic, but now DeepSeek brings its own traffic.

Douyin users share DeepSeek conversation videos, and the number of likes has reached nearly one million

Taxi drivers I encounter in taxis will ask me,”Can that Dipp help me write a sequel to the novel?” A 70-year-old man will debate whether DeepSeek’s stock trend can be trusted; whether cars, refrigerators, air conditioners, or local government platforms, all use access to DeepSeek as promotional material.

Since Open AI ignited the fire of big models, the emergence of DeepSeek has aroused national potential for the first time in China. Once this potential energy and attention is transferred into traffic and new traffic portals are created outside Tencent’s ecosystem, it will undoubtedly pose a new threat to Tencent.

Tencent Yuanbao was able to reach the top in a short period of time not only because of the amount of money spent on it, but also because of the combined effect of the following factors.

- Tencent Yuanbao is the first wave of DeepSeek traffic.

On January 27, New Year’s Eve, DeepSeek topped the list of free APP downloads in Apple’s app stores in China and the United States at the same time; on February 13, Tencent Yuanbao officially announced that it would access the full blood version of DeepSeek-R1 and make it available to users. Only 17 days have passed in between, including a full Spring Festival holiday.

Within 17 days, users crowded DeepSeek’s server and tried repeatedly amid anxiety in the reply “The server is busy, please try again later”, even during times when Little Red Book Sharing Teacher D was not too busy at work, such as 3 a.m., or 6 a.m.

17 days later, Tencent Yuanbao appeared with a full-blooded version of DeepSeek-R1 flag, allowing existing users who were tired of waiting to find water to quench their thirst.

- When it was first opened to users, Yuanbao connected to DeepSeek already had a relatively high product completion rate.

Many analyses have mentioned that Tencent Yuanbao caught DeepSeek’s traffic. But the process of “catching traffic” is not just a simple connection to DeepSeek capabilities.

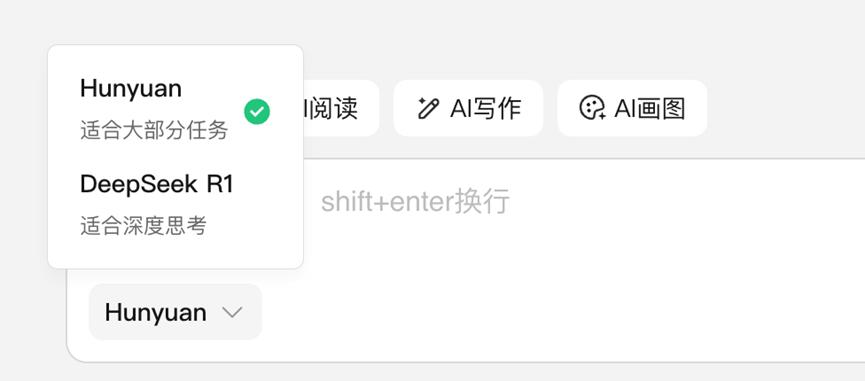

On February 13, when Yuanbao connected to DeepSeek was first available to users, it already had a relatively high product completion rate. Users can directly switch between DeepSeek-R1 and Mixed Origin Model in the model options on the home page.

Because it involves multiple links such as product functions, algorithms, interactive logic, and front-end display, this switch may seem simple, but it will take time to implement the adjustment of the App. Some competing products choose to use other alternatives such as command calls and label recommendations first, and after a period of iteration, they are optimized to a product form similar to Yuanbao.

There are two necessary conditions for improving a product with a high completion rate in 17 days: Tencent’s management makes quick decisions; and the iteration efficiency of the industry and research team is very high.

- Tencent’s entire ecosystem has almost worked together to “support” and no effort is spared.

In the past, there was a joke within Tencent: “Working across groups (business groups) in Tencent is more difficult than working across companies.” However, in the process of “lifting” Yuan Bao, Tencent’s various business groups rarely showed 100% cooperation.

In the early days, Yuanbao was affiliated with Tencent’s Technology Engineering Business Group (TEG) and was transferred to Tencent Cloud and Smart Industry Business Group (CSIG) in early 2025, under the responsibility of Wu Zurong, head of Tencent Meeting. Soon, products originally belonging to the Platform and Content Business Group (PCG), such as QQ browser and Sogou Input Method, were also merged into CSIG.

Tencent’s largest traffic portal, WeChat Business Group (WXG) WeChat, gave Yuanbao an unprecedented “green light”. Not only does the download portal of Yuanbao be displayed on the search page, but Tencent Yuanbao is also directly added to the life service grid. It has a red “new” label and an orange “DeepSeek” comment. The style is radical and is different from WeChat’s consistent low-key and prudent approach.

A product manager who once worked at PCG told Hedgehog Commune: “It was impossible to think about it before. In such a short period of time, let alone asking WeChat to help you online, the plan won’t even be able to attend a PCG meeting.” She speculated that decision-making must be top-down.”Top must be better than Zhang Xiaolong.”

- On the basis of the above three points, the money Tencent spent and invested was successfully transformed into new users.

The amount purchased does not equal the amount that can be purchased, but because the first few points are done well, users have awareness, needs, experiences, and retention. Only the money Tencent Yuanbao spends can it be transformed into new users and support the DAU market. Caijing World mentioned in the report that according to AppGrowing data, as of February 27, Tencent Yuanbao spent a total of 281 million yuan on launch in 27 days, most of which occurred after February 13, that is, after connecting to DeepSeek-R1.

According to data released by the qubit think tank, Tencent Yuanbao added nearly 6 million new users in February, and the highest number of downloads per day exceeded 500,000, a year-on-year increase of more than 10 times. It is the fastest-growing AI intelligent assistant; in February The average monthly DAU has reached 3.6 million, a year-on-year increase of more than 20 times.

If you don’t spend money like Tencent, and don’t have Tencent’s ecosystem, can you gain benefits if you just do the first two points well? Another app that hit the download list in February,”Wen Xiaobai”, may provide an answer.

“Wen Xiaobai” is the entrepreneurial project of Li Yan, former head of the MMU. In July 2024, he received US$32 million in seed round financing. The investors include Red Dot Investment, Jingwei Venture Capital, and Li Yan’s old friend Su Hua. Yuan Xiaobai and Tencent Yuanbao connected to the full-blooded version of DeepSeek-R1 at the same time. On the premise of ensuring the basic product experience, they quickly accepted the first wave of traffic and entered the public eye.

Ask Xiaobai’s web version interface

Tencent’s ecological potential energy and lavish purchasing investment are certainly important guarantees for Yuanbao’s rapid growth over the past half a month, but what hides in the dark is the rapid decision-making of Tencent’s management and the high-intensity iteration of Tencent’s industry and research.

Can bean buns learn from ingot?

Different from large model products that follow the naming rules of the “cultural school” such as Wenxin Yiyan and Tongyi Qianwen, Byte’s bean buns and Tencent’s Yuanbao show the concept of “taking a common name to support them”. Amazing tacit understanding.

In 2024, bean buns will undoubtedly be a star product. According to QuestMobile data, bean buns will start to grow rapidly in the second half of 2024. By the end of the year, DAU has exceeded 12 million, three times that of Kimi’s smart assistant. It was not until the storm of DeepSeek came together with the Lunar New Year. After entering the Year of the Snake, the market was keen to talk about who connected to DeepSeek again. The star product bean buns suddenly became the background bean buns.

They also take a popular name, are also backed by a large factory with traffic entrances, and also have a large self-developed model. Why did Doubao and Yuanbao embark on completely different paths? Isn’t Byte anxious and won’t Byte buy quantity?

The difference in routes between Yuanbao and Doubao reflects the differences in business logic between Tencent and Byte at the current stage.

For AI business, Tencent adheres to investment logic, and the core issue of concern is timing-when to wait and see, when to enter, and when to exit.Previously, Tencent was once questioned that its investment in AI was not as good as other giants. Tang Daosheng, CEO of the Cloud and Smart Industry Business Group (CSIG), once responded in an interview: “When we see clear opportunities, we will not hesitate to increase investment., collaborative operations can be very agile.”

Standing at the current node and looking back, what Tang Daosheng said was not a cliché, but more like a prediction. Tencent, which has an extremely keen sense of investment, clearly knows when to defend and when to attack.

What Byte adheres to is more like entrepreneurial logic. The core issue it focuses on is possibility-whether there is room for this matter, what is it like to be at the top, and whether we can be at the top.

After DeepSeek exploded during the Spring Festival, the expressions and actions of the two companies were also very interesting. Byte’s first reaction was that we did not pay attention to the long-chain thinking model and did not complete the reproduction as soon as possible. If we missed it, we would encourage project members to explore longer-term, uncertain and bold AGI research topics; Tencent quickly realized that a “clear opportunity” was coming and did not hesitate to take it in, spend money, provide resources, invest in flows, and work together to get results.

The company’s cycles and styles are different, which determines that Byte and Tencent will make different choices, take different risks, and harvest different fruits. There is no right or wrong.

In terms of initial investment in general large models and large model applications, bytes are much larger than Tencent’s. Flow, an independent department, has four business lines, focusing on application development of AI models, while the Seed team focuses on basic research on AI models. On the business side, Douyin, Clipping, and TT, there are multiple video generation models in different business teams in horse racing.

If you choose to become the “DeepSeek Launcher”, on the one hand, it will change the original product positioning and user experience of Doubao and affect the morale of the Byte-series large model team; on the other hand, it will also affect external expectations for Byte-series self-developed large model. and brand awareness. Even if you connect to DeepSeek and become another Tencent Yuanbao, Doubao, as a latecomer, will find it difficult to eat this “DeepSeek Starter” cake.

What’s more, although it was surpassed by Yuan Bao in the download list, Doubao’s DAU is still second only to DeepSeek and ranks second among AI assistant products.In addition to dialogue, bean bun’s multimodal recognition, PPT generation, data analysis and other capabilities still maintain differentiated competition with DeepSeek.

What is certain is that DeepSeek-R1 must not be the final form of the big language model, and the big language model is not the only battlefield in the big model competition. If Doubao chooses to follow up and connect to DeepSeek-R1 at this moment, Doubao will need to continue to follow up if other better open source models emerge in the future; if unfortunately, the better models come from closed-source competitors, then Doubao will be placed in a more dilemma.

Choosing different entry methods requires taking different risks. For example, at this moment, Doubao needs to face DeepSeek and Tencent Yuanbao to top the rankings, and get used to being a good “background” in a short period of time.

Doubao can’t learn from Yuanbao, nor can he learn from Yuanbao. Byte must withstand the pressure and use the shortest possible time to elevate its model reputation to the top level in the industry.The self-developed in-depth thinking model that is rumored to be being tested on a small scale will become the first big test he has experienced after the goal of “pursuing the upper limit of intelligence” was released.

If you fall behind, you will be “beaten”, but if you fall behind, you will catch up. This is the path that entrepreneurs should take. The vast China market also accommodates different paths.

References:

1. “DeepSeek has been popular for a month: Tencent Yuanbao has smashed purchases, kimi has plummeted, and bean buns have fallen”, DataEye.

2. Lin Xiaokui: “281 million yuan has been invested in 27 days, Tencent has fought hard”, the world of finance.

3. Huang Qingchun: “Byte refuses to accept DeepSeek, Douyin has other plans”, tiger sniff.

4. Shao Yangang: “Tencent seeks a new” ticket “, Lieyun.com.

5. Chen Meixi: “Do you accept DeepSeek? New Questions for Big Internet Manufacturers “, Hedgehog Commune.