The inevitable government pressure in the coming years will create opportunities for truly decentralized and private stablecoins.

Author: DC

Compiled by: Shenchao TechFlow

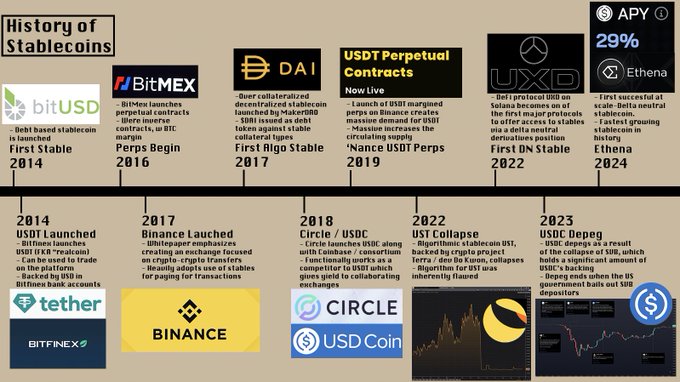

Stable coins account for 2/3 of the transactions on the chain,Whether it’s for redemption, use in DeFi, or purely transfer money. Initially, stablecoins gained attention through Tether’s first widely used stablecoins. Tether was created in response to bank account restrictions faced by Bitfinex crypto users. Bitfinex launched USDTether, which is backed by U.S. dollars on a 1:1 ratio. Since then, Tether has become popular, and traders have used USDT to more easily seize cross-exchange arbitrage opportunities. Tether transactions take only a few blocks (minutes) to complete, while wire transfers take days.

Despite this unique beginnings of encryption, stablecoins have been used far beyond their original application scenarios. They are now a powerful tool for daily money transfers and are increasingly used to earn revenue and facilitate real-world transactions. Stable coins account for about 5% of the total market value of cryptocurrencies. If you add in the companies that manage these stable coins or blockchains like Tron, whose main value comes from the use of stable coins,stablecoins account for nearly 8% of the total market value of cryptocurrencies.

However, despite this astonishing growth, there is still relatively limited content about why stablecoins are so popular and why tens of millions of users around the world have replaced traditional financial systems with stablecoins. There is even less discussion of the numerous platforms and projects that have contributed to this astonishing expansion, and the types of users who interact with them. Therefore, this article will explain why stablecoins are so common, who are the players in the field, and the current main user groups of stablecoins, and explore how stablecoins can becomeThe next important evolution direction of money.

A brief history of the dollar

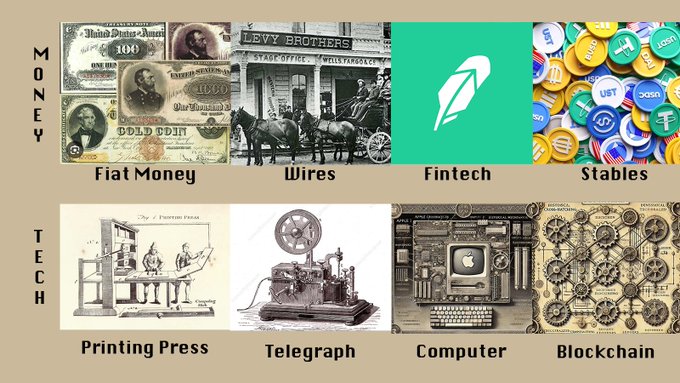

What do you think of when someone talks about money?Cash? Dollar? Supermarket prices? Taxes? In these cases, money is an agreed unit of measurement used to assign value to various, heterogeneous items. Money started with shells and salt, evolved into copper, silver, and gold, and now it is US dollars/fiat tender.

Let’s focus on the dollar. The US dollar/modern fiat currency (currencies issued by governments rather than backed by commodities) has gone through multiple stages. In the United States, paper currency (paper dollars issued by banks) was originally privately owned. Banks can print their own currency at will, similar to the way Hong Kong dollars operate. After this model went wrong, the government stepped in and took over, legally pegging the dollar to gold.

In 1871, using telegraph, the Western Union completed the first wire transfer, allowing funds to be transferred without moving large amounts of paper money. This is a huge breakthrough because it removes physical barriers to the flow of funds and makes the currency and the entire financial system more efficient.

Brief history overview:

-

1913: The Federal Reserve System is established.

-

1971: Nixon ends the gold standard, decoupling the dollar from gold and floating freely.

-

1950: The first credit card was invented.

-

1973: The SWIFT payment network is established to allow faster, more global U.S. dollar transactions.

-

1983: The Stanford Federal Credit Union opens its first digital bank account.

-

1999: PayPal allows pure digital payments without requiring a bank account.

-

2014: Tether launched the first dollar-backed stablecoin, leading us to where we are today.

The most important thing about this little history lesson is to tell us what money is and how we use it is constantly changing. Today, payments of $20 via PayPal, Cash, Zelle or bank transfer are also accepted, although ordinary bank transfers can raise eyebrows. In developing countries and, increasingly, in developed countries, the same is true for stablecoins. Personally, I use stablecoins to pay wages, have used stablecoins to transfer money to get cash, and increasingly use them in place of bank accounts, through accounts such as @HyperliquidX HLP, AAVE, Morpho, and of course @StreamDeFiSuch an agreement to save.

We live in a world where many existing financial systems place excessive burdens on the most vulnerable consumers. Capital controls, monopolistic and established banks, and high fees are the norm. In this environment, stablecoins are an excellent tool for achieving financial freedom. They allow cross-border currency transfers and are increasingly used to directly pay for goods. To understand how this happened in such a short period of time, we must first understand why stablecoins outperform traditional financial products.

stablecoins vs bank transfers: A comparison between the two worlds

The essence of a stablecoin is a token pegged to a fiat currency such as the US dollar or the euro. Many readers of this article may come from developed countries in North America, Europe or Asia, where the financial system is relatively fast, smooth and efficient. There are PayPal and Zelle in the United States, SEPA in Europe, and many financial technology companies in Asia, especially Alipay and Weixin Pay. People in these areas can safely deposit money into bank accounts without worrying about whether the balance will disappear in the morning or hyperinflation. Small transfers can be processed quickly, and large transfers, although they may take longer, are never unmanageable. Most companies force customers to use the local banking system because it is considered safer and easier than alternatives.

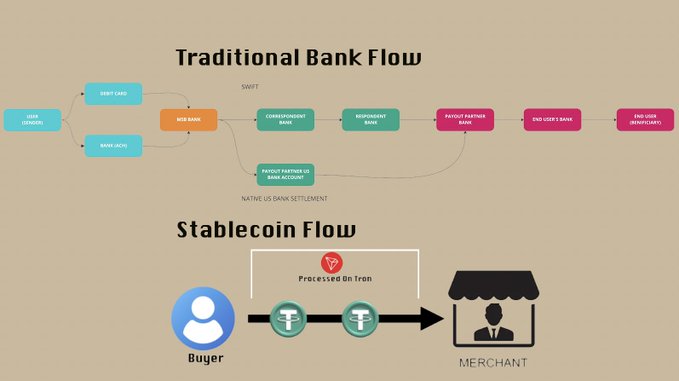

The rest of the world lives in a different reality. In Argentina, bank deposits have been confiscated many times, and the local currency is one of the worst performing currencies in history. In Nigeria, there are official and unofficial exchange rates, and it can be extremely difficult for money to move in and out of the country. Ironically, this also applies to Argentina. In the Middle East, bank account balances can be arbitrarily frozen, resulting in most non-politically connected persons not depositing most of their liquid assets in bank accounts. In addition to the high risk of holding funds, sending funds is often more difficult. SWIFT transfers are expensive and cumbersome, and many people do not have traditional bank accounts (for the reasons mentioned above). Alternatives like the Western Alliance typically charge high fees for international transfers (see its fee calculator) and use official local government exchange rates, resulting in huge hidden costs because the official exchange rate is higher than the actual market exchange rate.

stablecoins allow people to hold funds outside the local financial system because they are essentially global and transferred through blockchain rather than local bank servers. This reflects the difficulty their historical crypto exchanges had in obtaining bank accounts and processing large amounts of deposits, withdrawals and cross-exchange transfers. As we all know, due to Japan’s overly bureaucratic banking system and capital controls, there are arbitrage opportunities between global cryptocurrency prices and Japanese prices.

In 2017, Binance released a white paper,It said it would only support stablecoin-cryptocurrency trading pairs to ensure faster settlements. As a result, most trading volume began to be conducted in stablecoin pairs. In 2019, Binance launched USDT perpetual derivatives contracts, allowing users to use USDT instead of BTC as margin, further consolidating this. stablecoins have been widely accepted as a basic asset by users around the world in the crypto space and now this acceptance is beginning to expand beyond purely crypto use cases.

Let’s take a moment to compare stablecoins and fintech companies:Mainly in terms of their speed, innovative design and focus on solving global financial problems. So far, most fintech companies have only been able to beautify or conceal the obscure and complex payment infrastructure faced by users.

The stablecoin represents the first major change in the global financial system in 50 years.Their speed, reliability, and verifiability make stablecoins ideal for storing value and sending remittances without having to pay ridiculous fees (although, admittedly, this sacrifices the traditional guarantees of existing bureaucratic systems). Stablecoins can be seen as competing with cash and payment processors such as Western Union, while being more durable and safer than cash. They will not be washed away by floods, stolen in burglaries, and can be easily exchanged for local currency. Fees (depending on blockchain) are typically less than $2 and fixed, well below the lower limit for processors such as Western Alliance, which can vary but can range from 0.65% to 4%+.

Once stablecoins become more accepted and mature, they will inevitably be used to fill gaps in the global financial system that have not yet been filled by traditional suppliers. With this steady adoption, there has also been an explosive growth in more services and more complex products.@MountainUSDMBrings RWA revenue to many platforms in Argentina, and@ethena_labsThis allows users to make money through Delta-neutral transactions without having to touch traditional banking systems or exchange custody.

ins are increasingly used to earn revenue and process local payments,Rather than just processing payments, holding value or selling local currency. As this happens, stablecoins are becoming a central part of global financial planning and even corporate balance sheets. Many stablecoin users may not even know they are using cryptocurrency in the background, proving the company has made huge leaps in creating products around stablecoin in recent years.

Companies that are attracting stablecoin users

The main item related to stablecoins is the issuing company itself. USDC @circle, USDT@Tether_to, DAI/USD@SkyEcosystemand PYUSD,@PayPal and @Paxosproduct. There are many others that I haven’t mentioned, but these are the main stablecoins used for payment purposes. Most of these companies have bank accounts that receive traditional wire transfers and convert them into stablecoins and provide them to users.

Stabiloin issuers hold the transferred funds and charge users a very low fee (typically 1-10 basis points). Users can now transfer those assets, and issuers receive floating gains (or gains for DeFi enthusiasts) on assets in their bank accounts. Trading companies are increasingly conducting large-scale dollar-stablecoin transactions, especially as many exchanges crack down on users who only use them for no-fee deposits and withdrawals. Trading companies often offer better large-scale pricing than local exchanges, further improving the efficiency and competitive advantage of stablecoins in a unique environment where all major trading companies compete openly to facilitate these flows. At the same time, stablecoin issuers earn interest on user funds, allowing them to make money through floating earnings rather than charging users high fees.

It is worth mentioning that@SkyEcosystem(Formerly known as Maker) is a little different. Sky uses multiple collateral types as well as collateral reserves in other currencies to support its stablecoin USDS. Users deposit these collateral types and borrow SUSDS from the agreement at a predetermined interest rate. Users can earn income similar to a risk-free interest rate by depositing into the savings rate module, or at the @MorphoLabs and @aave Lend SUSDS on platforms such as platforms, or simply hold it in an account. Such systems provide safer revenue options or riskier options.

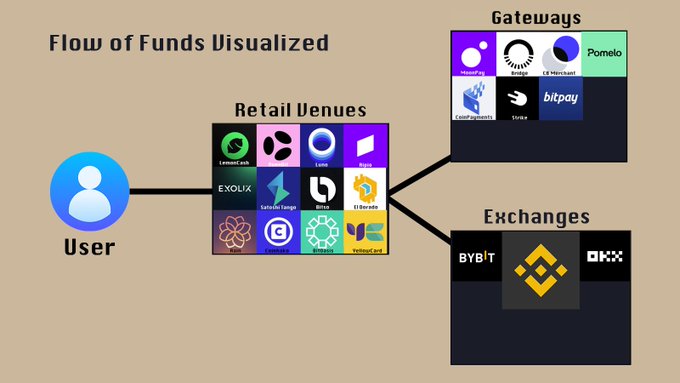

Currently, most major stablecoin issuers are notdirect to consumerof.

Instead, they interact with consumers through a variety of different companies, similar to the way MasterCard works with your bank but not directly with you.

@LemonCash、@Bitso、@buenbit 、@Belo and @Rippio These names are not common on Crypto Twitter. Despite this, the Argentine exchanges mentioned alone have more than 20 million KYC users——This is equivalent to half of Coinbase’s user base, and Argentina’s population is only 1/7 of that of the United States. Last year, Lemon Cash handled approximately $5 billion in total transaction volume, a large portion of which was stablecoin-stablecoin or Argentine peso-stablecoin transactions. Platforms like Lemon are the gateway for most non-P2P stablecoin transactions. These platforms also have large amounts of cryptocurrency trading and stablecoin deposits, although most (except Rippio) do not have their own order book for 90% of the market, but instead operate by routing orders.

This is similar to Robinhood not being an exchange, but managing pricing through market maker routing. I call these platforms retail venues because they focus on retail user experiences and products and do not have their own exchange infrastructure. Just as Robinhood doesn’t let market makers use their apps or APIs (in fact, Robinhood blocks you if you make too many API requests), neither does BuenBit or Lemon; this is not their customer base or target audience at all.

At the same time, we have the actual blockchain stablecoin sending and transaction records. it’s up to @justinsuntronthe@trondao、@binanceBinance Smart Chain,@solanaand@0xPolygonLeading. These chains are used for users to transfer value, not necessarily to interact with DeFi or earn revenue.

Ethereum still maintains a lead in TVL (lock-in total value), but its high cost makes it unattractive for most stablecoin transfers. 92% of USDT transactions occur on Tron, and approximately 96% of Tron transactions are related to stablecoins, compared to 70% of value transfers on Ethereum. In addition, there are various new chains dedicated to processing stablecoins efficiently and cheaply. Notably, LaChain is actually an alliance composed of Ripio, Num Finance, SenseiNode, Cedalio, Buenbit and FoxBit, mainly targeting Latin American users and platforms. This shows how complex and sophisticated the stablecoin field has become as it continues to mature.

As stablecoins become more widely used in remittances, they are increasingly used for local payments. This is where cryptographic payment portals and gateways come in, and I define them as systems that allow the conversion of stablecoins into fiat currencies or realize fiat payments. For example, merchants can accept cryptocurrency, but actually sell it as U.S. dollars and deposit it into a bank account, or directly accept stablecoins.

Given that redemption of stablecoins will always be a bit of friction,Whether time-related or cost-related, there are many companies that simplify this process for users and platforms. These products range from relatively simple but very useful products such as Pomelo (https://www.pomelogroup.com/, which allows processing of encrypted debit card transactions) to a wider range of projects such as@zcabramsThe Bridge. Bridge allows easy transfers between stablecoins, chains and local currencies, greatly reducing friction between platforms and merchants, so that@stripeBridge was acquired to improve the efficiency of its payment system. Systems like Bridge currently exist because merchants do not directly accept USDC or USDT, so the portal/gateway must convert stablecoins for users and will usually prepare working capital in exchange for fees. As stablecoin payments expand, given that many of these platforms have lower fees than credit cards and banking systems, stableco-stablecoin transaction volume (between currency and final product) will increase as merchants accept stablecoins in order to improve unit economics. This is how stablecoins began to shape a post-bank-dominated payments world.

A growing number of companies and projects are focusing on the application of stablecoins and are trying to get current stablecoins users to save online or through some of the aforementioned platforms.

For example, Lemon Cash has an option that allows users to deposit funds@aaveTo earn revenue.@MountainUSDMUSDM earns revenue on stablecoins and is integrated in multiple retail venues and exchanges in Latin America. Many retail venues and exchanges view stablecoin revenue generation and the fees it brings as a potential way to stabilize revenue, smoothing out the fluctuations in revenue caused by reliance on trading fees and bull trading volumes, which can drop significantly (orders of magnitude differences) during bear markets.

What is the next step for stablecoins?

The non-crypto specific use of stablecoins is international transfers and is increasingly used for payments. However, as the infrastructure used by stablecoins continues to improve, they become ubiquitous and savings may also shift to cryptocurrencies, especially in developing countries, a trend that has begun. few weeks ago,@tarunchitraTelling me a story: A grocery store owner in Georgia collects Georgian lari (local currency) from customers, converts it to USDT and earns interest, uses a crude physical ledger to record the balance, and extracts fees from the interest. At the same grocery store, payments can be processed via Trust Wallet’s QR code, which is noteworthy that this occurs in a country with a relatively healthy banking system. In countries like Argentina, citizens are estimated to have more than $200 billion in cash outside the traditional financial system, according to the Financial Times. If half of it goes into chains or cryptocurrencies, it will double the size of DeFi and increase the total market value of stablecoins by about 50%. This is just a relatively small country where other countries such as China, Indonesia, Nigeria, South Africa and India have large informal economies or relative mistrust of banks.

As the use of stablecoins increases, numerous additional use cases are likely to continue to grow. Currently, stablecoins are only used for fully collateralized credit, one of the least common forms of credit in the world. However, with new tools from Coinbase and other companies, KYC information can be used to provide capital to users that, if not repaid, can result in negative credit reports. Increasingly, stablecoin issuers are allowing gains to be passed on to stablecoin holders, such as USDC’s 4.7% gain and Ethena’s USDe’s variable return, which is typically more than 10%. There is also an increasing volume of cross-fiat transactions, starting with one currency, converting into a U.S. dollar stablecoin, and then converting into a third currency. As this situation continues, it becomes more meaningful to convert directly to the fiat stablecoins in the underlying currency to avoid paying twice. As more capital flows into stablecoins, more and more products will be available in crypto and on the chain, which will help drive the daily use of cryptocurrencies to become more mainstream.

future challenges

Finally, I would like to make a few points that I think have not been discussed enough in the dialogue around stablecoins. One is that almost every stablecoin today relies to some extent on bank accounts, and the banking system is not always safe, as we saw with the 2023 USDC decoupling and Silicon Valley bank failures.

In addition, stablecoins are currently used in large quantities for money laundering. If you agree that stablecoins are used to circumvent capital controls and get rid of local currencies, then you unintentionally admit that this use case constitutes money laundering in the local country. This is an open secret with great impact. Currently, neither Circle nor Tether allows reissuance, meaning that if a user’s stablecoin balance is frozen due to legal action or assets are found to be stolen, they cannot be returned to someone with a court order.“”—— This practice is morally questionable at best and unsustainable in the long run. Governments will increasingly require or enforce regulations that make stablecoins available for confiscation. Potentially, this could mean replacing stablecoins with CBDC (Central Bank Digital Currency), although I will discuss this in a subsequent article.

The inevitable government pressure in the next few years will create opportunities for truly decentralized and private stablecoins that can continue to operate in a fully decentralized manner, independent of government actions. I may write a more in-depth article in the future to explore this dark side of stablecoins because it is a fairly broad topic.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern