Although Jump still has the strength to make a comeback, it may be difficult for the crypto market to trust it anymore.

Author: Nian Qing, ChainCatcher

In August last year, a rapid and huge sell-off by Jump Trading pushed the crypto market into the abyss, further triggering the “805 plunge.” At that time, rumors that Jump’s “big guy” was about to fall became increasingly intense.

In the six months that followed, almost all the few news articles about Jump focused on its internal and external litigation and lawsuits.

Recently, CoinDesk quoted people familiar with the matter as saying that Jump is currently fully resuming its cryptocurrency business. Jump Trading’s website shows that Jump is recruiting a group of cryptocurrency engineers for its offices in Chicago, Sydney, Singapore and London. In addition, another person familiar with the matter added that Jump plans to start filling U.S. policy and government liaison positions in due course.

Jump was once called the “absolute king” of the trading world. With its ultra-low latency trading system and complex algorithm design, Jump is one of the key liquidity providers in traditional finance. As the scale of the crypto market continues to expand, Jump began to make markets for cryptocurrencies and invest in crypto projects. In 2021, the crypto business unit Jump Crypto was officially established.

However, a gamble that accompanied Jump Crypto’s birth also laid the foundation for its subsequent tragedy at that time.

The Rise and Fall of Jump Trading: The Crypto Gambling of Hidden Giants

In the early days, traders publicly called out bids on the trading floor through shouts, gestures and jumps. This was also the inspiration for Jump Trading’s naming.

Headquartered in Chicago and founded in 1999 by Bill DiSomma and Paul Gurinas, two former Chicago Mercantile Exchange (CME) floor traders, Jump quickly grew into one of the world’s largest high-frequency trading companies, active on futures, options and securities exchanges around the world, and a major trader of U.S. Treasury bonds and cryptocurrencies.

Out of protection of trading strategies, Jump always keeps a low profile. In addition, market makers have always been hidden behind the scenes, and they will always be surrounded by a layer of mystery. Jump rarely releases its financial data, and its founders have been tight-lipped about its operations. Since 2020, perhaps for the purpose of reducing exposure, Jump no longer needs to file 13F documents with the SEC after adjusting its strategies and restructuring its business, but instead continues to file them by its parent company Jump Financial LLC. According to the latest 13F document submitted by the latter, Jump Financial’s asset management scale exceeds US$7.6 billion and the number of employees is approximately 1600. In addition, Jump Trading has offices in the United States, Europe, Australia and Asia.

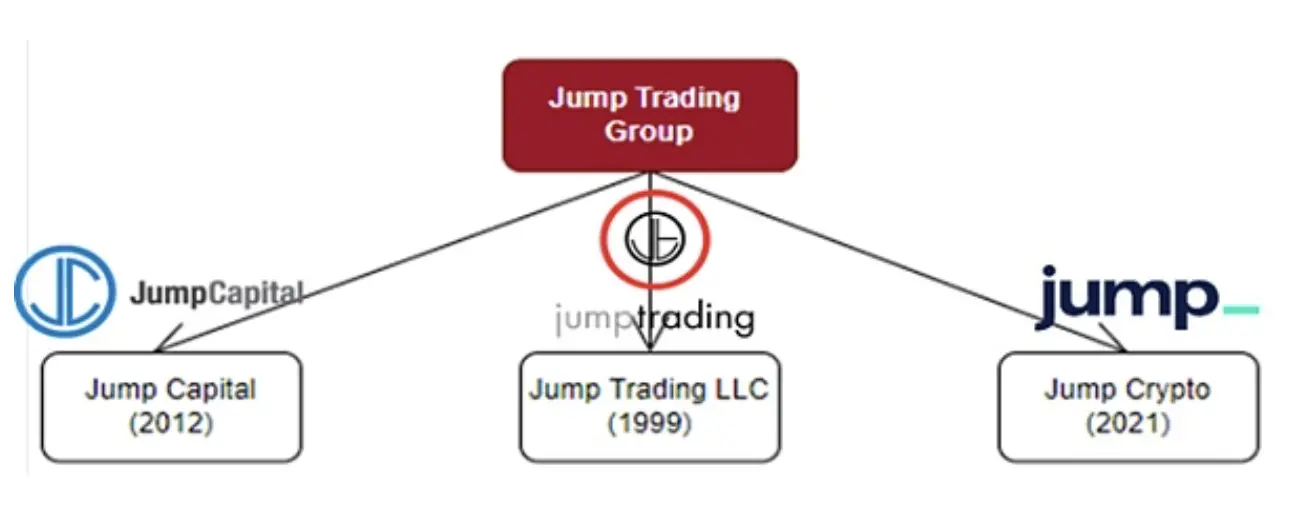

Jump Trading also has two sub-business units, Jump Capital and Jump Crypto.

Jump Capital

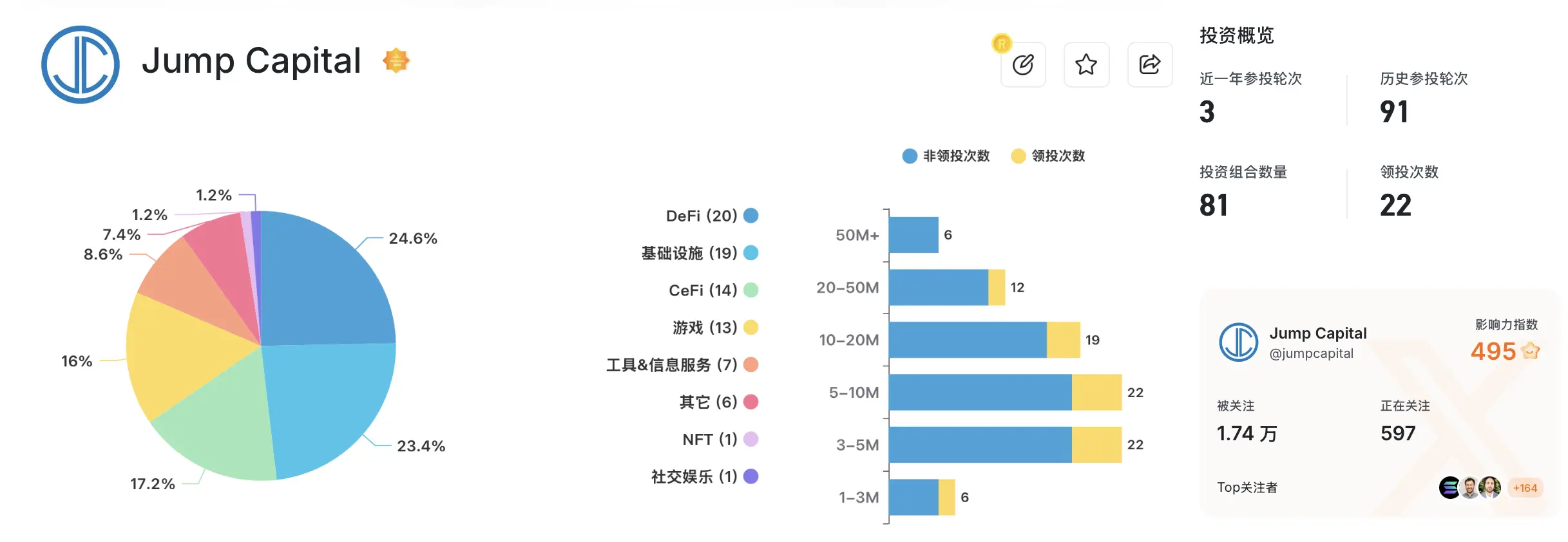

Jump Capital is headquartered in Chicago and was established in 2012. Although Jump’s crypto division was officially established in 2021, Jump Capital has been involved in investing in the crypto field early on. Peter Johnson, one of its partners and one of the heads of encryption strategy, revealed that the company has been secretly deploying encryption strategies for years.

According to the relevant RootData page, Jump Capital has more than 80 crypto investment portfolios, mainly investing in DeFi, infrastructure and CeFi, and has invested in loTeX, Seii, Galxe, Mantle, Phantom and other projects.

In July 2021, Jump launched its largest fund since its establishment, with a total capital commitment of US$350 million and attracting 167 investors. This is Jump Capital’s seventh venture fund.

Jump Crypto

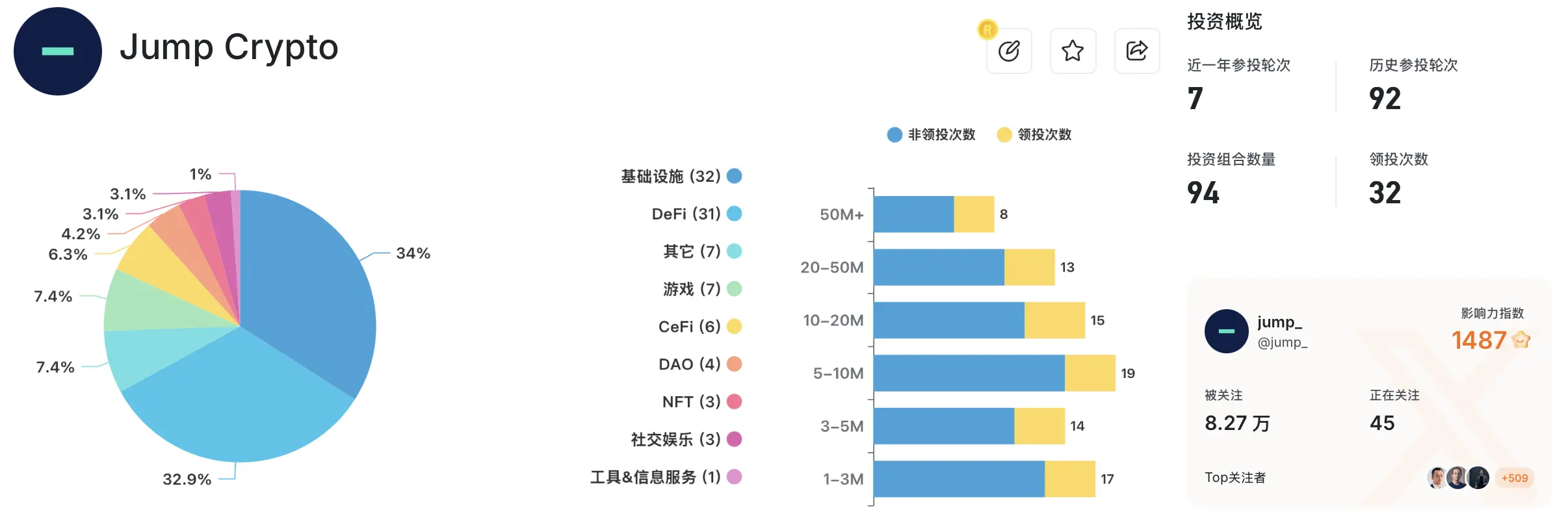

In 2021, while Jump completed the fundraising of its seventh investment fund, it announced the establishment of Jump Crypto, a crypto investment department, and invested 40% of its seventh investment fund in the cryptocurrency field, focusing on DeFi, financial applications, blockchain infrastructure and Web 3.0 stocks and tokens.

Kanav Kariya, only 26 years old, will serve as Jump Crypto’s first president in 2021. Kariya joined Jump Trading as an intern in early 2017, and was assigned by the company to build early cryptocurrency trading infrastructure.

In May 2021, Terra’s algorithmic stablecoin UST became unanchored for the first time. In the following week, Jump secretly purchased a large amount of UST to create the illusion of booming demand and pull the value of UST back to $1. The deal earned Jump $1 billion, and Kariya, the author of the proposal, was quickly promoted to president of Jump Crypto four months later.

But this secret deal also paved the way for Jump to fall from the altar.

With the complete collapse of Terra UST stablecoin in 2022, Jump faces criminal charges for cooperating with Terra to manipulate the price of UST. In the same year, Jump suffered heavy losses in the bankruptcy of FTX due to its deep connection with FTX and Solana ecosystems.

After the FTX incident, the United States tightened its regulation of the crypto market, and it was reported that Jump Trading was being forced to reduce its business and gradually withdraw from the U.S. crypto market. For example, Robinhood terminated its partnership with Jump after the FTX incident. Jump Crypto’s subsidiary Tai Mo Shan was one of Robinhood’s largest market makers and was responsible for handling Robinhood’s billions of dollars in daily trading volume. However, since the fourth quarter of 2022, Robinhood’s financial report has no longer mentioned Tai Mo Shan, and Robinhood has instead cooperated with market makers such as B2C2.

In addition, in order to reduce its cryptocurrency business, Jump Crypto officially split Wormhole in November 2023, and Wormhole CEO and COO resigned from Jump Crypto. The number of Jump Crypto’s team also almost halved during this period.

Jump Crypto’s investment sales after 2023 have also decreased significantly. According to the relevant RootData page, Jump Crypto has more than 90 crypto investment portfolios, mainly investing in infrastructure and DeFi, and has invested in projects such as Aptos, Sui, Celestia, Impressive, NEAR, and Kucoin. However, its “participation rounds in the past year” only have single digits.

On June 20, 2024, Fortune reported that the U.S. Commodity Futures Trading Commission (CFTC) was investigating Jump Crypto. A few days later, Kanav Kariya, who had served at Jump Trading for six years, announced his resignation.

A month later, Jump Crypto launched a massive ETH sell-off. Within 10 days, the cumulative value of ETH sold by Jump Crypto has exceeded US$300 million. The panic directly led to the market decline on August 5, 2024, with Ethereum’s biggest single-day drop exceeding 25%. The community speculated that Jump Crypto’s sell-off of ETH may have been due to pressure from the CFTC investigation and exchanged for stablecoins to exit the cryptocurrency business at any time. Jump Crypto was once rumored that “this big guy is going to fall.”

Related reading: “Accused of bringing down the market, crypto market maker Jump Crypto”

In December 2024, Jump Crypto’s subsidiary Tai Mo Shan agreed to pay approximately US$123 million to settle with the US SEC. According to subsequent SEC charging documents, it was Tai Mo Shan who participated in Terra’s UST market-making. It is reported that Tai Mo Shan is registered in the Cayman Islands and was established to handle specific market market-making and cryptocurrency trading businesses.

The incident between Jump and Terra seems to have finally settled after more than three years of painful entanglement.

Jump fully restores encryption business: The return of the king or the legacy?

Why did Jump choose to fully resume encryption business at this time?

In addition to Jump’s judicial settlement in the Terra incident, a more critical reason is the Trump administration’s friendly attitude towards cryptocurrencies.

Just two days ago, on March 5, Cumberland DRW, the crypto arm of Jump’s old rival DRW in Chicago, signed a joint application with the U.S. Securities and Exchange Commission (SEC) to withdraw the SEC’s lawsuit against him. The agreement was agreed in principle by both parties on February 20 and is currently awaiting approval by the SEC committee. The SEC sued Cumberland DRW in October last year, accusing it of operating as an unregistered securities dealer and selling more than $2 billion in unregistered securities.

The new SEC leadership team has adopted a more tolerant release policy towards crypto companies, and this attitude has given Jump hope for a comeback. In addition, the possibility that Solana and other altcoin spot ETFs will be approved this year makes Jump Crypto, who is deeply involved in the Solana ecosystem, want to get a piece of it.

At the end of 2023, Jump negotiated with BlackRock on “making a market for a Bitcoin spot ETF”, but perhaps due to regulatory issues, Jump Crypto ultimately did not participate in the market making of Bitcoin and even later the Ethereum spot ETF.

Jump still has the strength to make a comeback

A skinny camel is bigger than a horse. Jump Trading still holds approximately US$677 million in chain assets, of which Solana’s token holdings account for nearly half of 47%, and holds 2.175 million SOLs. Secondly, the proportion of stable currencies is about 30%.

Source: ARKHAM

Jump Trading’s on-chain capital holdings are still the largest among several crypto market makers. As of March 8, 2025, the comparison of Jump’s positions with other market makers is ranked from high to low as follows:

- 1. Jump Trading: $677 million

- 2. Wintermute: $594 million

- 3. QCP Capital: US$128 million

- 4. GSR Markets: $96 million

- 5. B2C2 Group: US$82 million

- 6. Cumberland DRW: $65 million

- 7. Amber Group: $20 million

- 8. DWG Labs: $10 million

In addition, in addition to capital volume, Jump also has a series of technical advantages. Taking in-depth participation in the Solana ecosystem as an example, Jump currently participates in the Solana ecosystem through various forms such as technology development (developing Fireancer verification clients and providing technical support for Pyth Network and Wormhole), investment (Jump has invested in multiple Solana ecosystem projects), and market market-making. Jump’s samples for the construction of the Solana ecosystem may bring more cooperation.

But from another perspective, Solana’s decentralization has been weakened by Jump’s dominance.

Dark history is riddled with, Jump is afraid of accumulated problems and difficult to recover

Jump has a halo, but it also has a lot of dark history.

Terra’s UST incident is not difficult to see that Jump Crypto’s market-making style in the crypto market is extremely barbaric. Although market-makers ostensibly account for making differences from transactions, it is not uncommon in the crypto industry to collude with project parties to pull orders in exchange for huge incomes such as options.

In the traditional financial industry, market-making is a strictly controlled business, and supervision needs to ensure that there are no conflicts of interest. Market makers do not work directly with companies issuing shares, but with exchanges under the supervision of regulators. Different businesses such as market making and venture capital are often physically divided to avoid any possibility of insider trading or market manipulation.

Researchers accused Jump of working with Alameda to push up Serum’s fully diluted valuation to cut leeks, but the matter was quickly settled. In addition, in October last year, video game developer FratureLabs filed a lawsuit against Jump Trading in federal court in Chicago, accusing it of fraud and deception by manipulating the price of DIO tokens. FractureLabs originally planned to raise funds by issuing DIO tokens for the first time on the Huobi (now renamed HTX) exchange in 2021. The company hired Jump Trading as a market maker for DIO and lent 10 million tokens to its subsidiaries while sending 6 million tokens to HTX for sale. But Jump Trading systematically liquidates its DIO position, causing the token price to drop to about 0.5 cents and pocketing millions of dollars in proceeds. Subsequently, Jump re-purchased approximately US$53,000 in tokens at a substantial discount and returned them to FractureLabs, and then terminated the market maker agreement. Currently, this lawsuit has not yet been followed.

Although departments such as Jump Crypto and Jump Trading appear independent on the surface, in actual operation, there are obvious interests in the business between these departments. The inability to distinguish the boundaries between market makers ‘venture capital business and trading business is directly related to the lack of clear supervision in the crypto industry. To some extent, this is not the style of a specific market maker, but the style of common market makers in the industry, such as Alameda in the past and today’s SDL. In traditional finance, market-making is strictly controlled. Market makers do not directly cooperate with the company issuing shares, but cooperate with exchanges under the supervision of regulatory agencies. To avoid insider trading or market manipulation, different businesses such as market making and venture capital are often physically divided.

Yesterday, GPS token market makers added unilateral liquidity to the exchange, causing token prices to plummet. The market-making style and moral bottom line of market makers were once again discussed.@ Mirror Tang believes that market makers and project parties together constitute a shadow banking system. The project party usually provides funds to the market maker through an unsecured loan credit line, and the market maker uses the funds and leverage to make the market, thereby enhancing market liquidity. In bull markets, this system can generate huge profits, but in bear markets it can easily trigger liquidity crises.

It is currently uncertain whether Jump will resume market-making business for cryptocurrencies. But if the crypto community still has memories, it may be time to be wary of Jump’s new market-making project.