“What we need to do is help the industry mature and bring the value that exists in traditional markets into the crypto market.”

Interview: Mensh, ChainCatcher

Guest: Armani Ferrante, CEO of Backpack

Armani gave people a very cordial feeling. Every time he met someone who greeted him warmly on the way to the interview site, he would talk to them very politely. But then he fell into deep thought or replied to the message without a moment’s pause.

The Backpack team stayed at the hotel in the same complex at the Consensus venue, which Armani explained as a way to reduce commuting time. In Japan, his residence is also close to the office. He is a two-point workaholic when he does not have to socialize.

During the conversation, perhaps due to the rigorous nature of an engineer, he would meditate briefly, define and disassemble each question before answering it. Where he has no specific evidence, he will add that you can verify it yourself.

Armani was an engineer at Apple. In 2017, he came into contact with Ethereum and was fascinated by the concept of a world computer. He quit his job at Apple almost immediately and has since devoted himself to the blockchain technology development process.

Backpack Wallet was established in April 2022. After the collapse of FTX in the same year, 88% of the company’s treasury funds were lost. But in the midst of the crisis, Armani also sees opportunities for compliant exchanges. The Backpack Exchange was established in March 2023.

In April 2023, Backpack released the first xNFT series Mad Lads on Solana, which was a great success. The total transaction volume once ranked first in the entire network, even surpassing the old Ethereum blue-chip NFTs such as BAYC. During the bear market, Backpack had to rely on a budget of $1.4 million raised through Mad Lads NFT sales to keep it afloat.

In February 2024, Backpack completed a US$17 million financing, led by Placeholder, with Wintermute, Robot Ventures, Selini Capital, Amber Group and others participating.

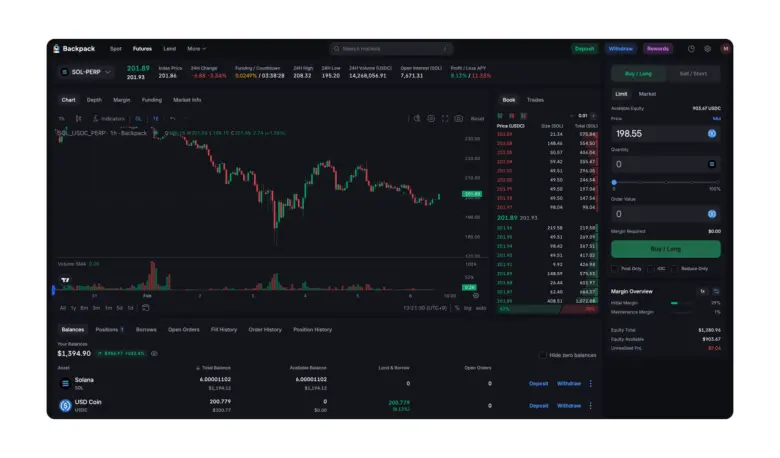

There are currently 57 spot trading pairs, 15 perpetual contracts and 5 mortgage liquidity pools on Backpack. According to Coinmarketcap data, the current total assets of Backpack are US$34.12 million, of which approximately 54% are USDC and 26.22% are SOL. As of press time, trading volume was US$6194018.

Also warned by FTX, Backpack attaches great importance to compliance in various regions and actively obtains licenses. Backpack received a virtual asset service provider (VASP) license issued by the Dubai Virtual Assets Authority (VARA) in October 2023. On December 10, 2024, Backpack was officially registered as a Class II member of the Japan Association of Virtual Currency and Crypto Asset Exchanges (JVCEA). On January 7 this year, Backpack acquired FTX EU, the bankrupt European branch of FTX, for US$32.7 million. FTX EU previously held a MiFID II license issued by the Securities and Exchange Commission of Cyprus (CySEC). Armani said the company plans to become the only regulated perpetual contract provider in Europe and has submitted a MiCA notice and is expected to go online in the first quarter of 2025.

In this interview, we chatted with Amarni about Backpack’s positioning in the market as a young exchange, future product planning and his personal entrepreneurial life.

From Apple engineer to founding an exchange: The bumpy road to faith

ChainCatcher: You were an engineer at Apple. Why did you decide to enter the encrypted world?

Armani:

After you graduate from college, you go to work for a big company, and like any ordinary engineer, you are a cog in this huge machine. In 2017, the prices of Bitcoin and Ethereum continued to rise, and that moment was very magical. I remember very clearly sitting in a coffee shop on Market Street in San Francisco, reading an Ethereum white paper with my laptop, and I thought it was the coolest thing ever. I was completely fascinated. I didn’t know what to do, how to make money, who to work for, but I knew I wanted to be involved. So I quit my job at Apple, and although I didn’t know what I was doing, I decided to give it a try because everything was so motivated at the time.

ChainCatcher: Can you share your entrepreneurial journey from xNFT to Mad Labs to Backpack Wallet?

Armani:

I entered Solana in September 2020, when there was almost no ecology. I joined the ecosystem and did a lot of things, including DeFi-related work, early wallet infrastructure, developer tools and more. These efforts were later very successful, and the network began to grow rapidly in its early stages. It was precisely because of the growth of the network that I decided to start a business. Solana made me feel for the first time that infrastructure problems had been basically solved, so I began to think about what problems to solve next to promote the development of the network and the industry. At the time, I thought many people knew the importance of mobile and knew that building mobile apps in the encryption space was challenging because the two app stores, iOS and Android, had almost a monopoly. So, my team and I were thinking about how to build a decentralized app store. This is the origin of xNFT. We hope to tokenize applications like image tokenization and build a new distribution channel to build decentralized applications. This was the original idea, although we did change it later.

ChainCatcher: Why did you choose NFT as your starting point?

Armani:

NFT is actually a generic form that represents a certain collectibles. We usually associate it with something like 10K avatars, funny JPEGs or cryptopunk, but it’s actually a universal way to own anything. At the same time, these NFT series, especially the 10K-style avatar series, created great communities at the time, and examples like CryptoPunks were very successful. These communities have attracted widespread attention within the industry and become one of the most exciting social events in the crypto space. So this paves the way for Mad Labs ‘story.

We finally decided to build our own NFT series. There are two main reasons: First, if we want to build our own NFT platform and NFT protocol, then we should build our own NFT series and become our own users. Secondly, the popularity of the community at that time was very strong and it made people feel very exciting.

The beginning of Backpack: Regional compliance opportunities

ChainCatcher: You mentioned that when FTX fell, you saw a gap in the exchange market. What was this gap?

Armani:

As the industry matures, especially as the situation about rules and regulations becomes clearer, exchanges should not be classified as decentralization and centralization. A more appropriate classification would be, in one category, you have censory-resistant systems that are widely distributed around the world and there are no region-specific application rules. For example, the Internet is an example, including decentralized exchanges such as Uniswap. The other category is compliance entities that are centralized and can enforce rules and tools in any region where they serve users.

As the industry matures, people are forced into one of these two categories. But the challenge is that there are many people who are very good at products, who can build good exchanges, but are not good at building all the operating infrastructure needed to build a compliant financial institution. At the same time, there are some people who are very good at compliance and operations, perhaps from traditional financial backgrounds, but who are not very good at building products and don’t understand the characteristics of the crypto industry. You’ll see a lot of people struggling between these two categories, and the real big opportunity is to take the middle road and build a financial institution that’s very adaptable to the industry, that can build things on the chain, we also have wallets, and solve the problem of bridging the traditional financial system and the crypto world.

You can see this happening in many places, like a week or two ago in Japan, when a lot of unregulated exchange apps were kicked out of the app market because they didn’t follow Japanese rules. In Europe, all the largest derivatives exchanges were forced to withdraw because they did not abide by European rules. For example, there are five derivatives exchanges, financial derivatives exchanges, OKX derivatives, etc. Currently, there are almost no exchanges providing derivatives in Europe because no one is compliant. So here’s the opportunity to become a compliant, trustworthy player, solving the problem between traditional finance and the crypto world, and bringing all the value of traditional finance into the blockchain.

ChainCatcher: What products does Backpack currently focus on connecting traditional finance and the crypto industry?

Armani:

There are many different levels of products. You can’t say right away, I’m going to build a Robinhood or a Uniswap competitor. We have two divisions, two businesses. One is a wallet and the other is an exchange.

In terms of exchanges, the primary goal is to establish liquidity. Because as a product, the most important thing is liquidity. So the first product we focus on now is building a very attractive trading product. About two and a half weeks ago, we launched our public beta version to test new products. This product we call interest-bearing futures or interest-bearing professional futures, which is different from ordinary perpetual futures. With our futures products, users can earn income on collateral. We have a native cross-chain money market where you can lend out your assets and use those lent assets to trade. In the past two and a half weeks, we have achieved more than $2.4 billion in trading volume during the testing period alone. Therefore, we plan to officially launch it in early March, when we will be out of public beta and fully open to users around the world. This is the first product we have built and provides a very attractive trading experience, including spot, margin, borrowing, and perpetual futures to earn interest. We have invested a lot of energy into building a truly excellent and differentiated product, solving problems that decentralized exchanges cannot solve. This is the first step we take.

The second one is the wallet. You can think of Backpack Wallet as a self-managed Key Management Service. Now we support chains such as Solana, Ethereum, Base, Eclipse, Arbitrum, Optimism, Polygon, etc., and we hope to be able to support every chain, wallets like MetaMask. But there is indeed a very important issue that needs to be solved in the wallet field now. If you go and open Solflare (one of Solana’s wallets) today, they’ll tell you a shocking statistic: $2.4 billion in money is lost every year because people lose access to crypto-wallets, at least last year. Although I forget the exact statistics, this is a huge failure for the entire industry. This figure even exceeds the annual losses of all centralized exchanges.

Self-custody is one solution. If we didn’t self-manage, then you could question a lot of what we were doing. This is another important part of our product, around building wallets and thinking about how to solve these self-custody issues, so that I can safely tell my parents or relatives and friends that you can use cryptocurrency and there is no risk. You don’t need to worry about self-hosting, you don’t need to worry about losing your key, or how to use your password. This is one of the most important issues that needs to be solved today. So this is where we started.

ChainCatcher: Pump.fun, Moonshot, etc. are very popular, and everyone likes GMGN very much. How do you view the current competitive trend between centralized exchanges (CEX) and decentralized exchanges (DEX) in the market?

Armani:

The very important point I made before also applies here: this is not a competition between decentralized exchanges and centralized exchanges, but a competition between censorship resistance and compliance. Depending on which path you choose to take, you will get very different products and features.

One of the lessons we learned during this cycle is that nothing has an advantage over decentralized exchanges in issuing long-tail assets. Pump.fun may be ridiculous, but it is an example of how it cannot be built in the same way on a centralized exchange. And this is where decentralized exchanges are truly superior to centralized exchanges. As for other parts of the product, margin trading, futures, spot margins, and access to stocks, U.S. Treasury bonds, and Fiat are the strengths of centralized exchanges. There are subtle reasons behind every aspect. After all, it’s all about compliance, it’s about direct connections to banks. If you want to enter and exit channels, only a regulated exchange can do the best. So, this is the advantage of a centralized exchange, which will continue to play a role in deeply regulated products. For example, the U.S. stock market is perhaps the best example, which is the appeal of a centralized exchange. But if you look at examples like Robinhood, if they tokenize stocks, they have the ability to do better than anyone else. This is the advantage of a centralized exchange.

When it comes to margin trading, it’s not just about custody. When you trade margin, you have no concept of self-custody. Whether it’s futures or spot margin trading, or options, you don’t own your assets. The system owns your assets, and the liquidator owns your assets. So it’s all about the rules of the system, especially risk management. Therefore, when it comes to margin trading, the boundaries are very blurred. The example of margin trading does have its advantages and disadvantages. For example, if you have decentralized risk management, transparent risk management, projects like Aave do very well. But if you’re talking about highly leveraged and highly volatile assets, that’s usually an area where a few people participate, and that’s the limitations of decentralization. Whether in CEX or DEX, this issue is almost irrelevant. The question is, who is making these decisions? Who is providing financial support for brands? Who is doing risk modeling? This is a very important issue.

ChainCatcher: What are the biggest challenges you face when building on-chain systems and self-managed wallets?

Armani:

These two worlds will continue to merge. So we very deliberately combined centralized exchanges and decentralized exchanges in one application. If you have an exchange, you can build the best wallet; if you have a wallet, you can build the best exchange. There are many synergies between the two.

To give a simple example, you can completely solve the problem of restoring assets. You remember the shocking statistic I just mentioned about the amount of money lost every year due to self-trusteeship. If you apply modern technologies, such as account abstraction, you may solve all the user experience issues that self-hosting currently has. So I think the two will continue to merge. I think the key is to take advantage of each other, they are not zero-sum games.

Concentration and persistence: two points and front line workaholics

ChainCatcher: How do you allocate your time? How do you usually spend your day?

Armani:

I spend my time mainly in two broad categories, and there may be a third. One is recruitment and company building, and the other is product You have to have a great product and innovate in this field, which I am proud to say we have done. The third category is coordination between compliance, products and engineering so that we can truly solve all problems and build a market with high trust and integrity. So so far, we have basically climbed these mountains.

Next, the mountain we have to climb is how to bring it to market. Now it all comes down to liquidity. No matter how great a product you have, no matter how many healthy areas you can serve, nothing makes sense without deep mobility. So this is the next mountain we are going to climb right now.

We have done a great job so far, whether in terms of products, building a great spot and derivatives product, or even in terms of compliance, one of the biggest advantages is our market trust. We can confidently say that we will be one of the most regulated exchanges in the market, and you can go to all the large institutions and they can trust what they trade. That’s why U.S. capital markets are so special. They are the deepest, most liquid, and most regulated capital markets in the world, with trillions of dollars traded here because people trust them. Everyone knows that it is real, not fake, and cannot be manipulated. Bringing this maturity into the cryptocurrency market is the next mountain we will climb and our focus in the next few months.

ChainCatcher: I heard you were so busy that you didn’t even have time to take a shower for a whole week, right?

Armani: Unfortunately, it is.

ChainCatcher: As an exchange CEO, do you think it is better to be a good trader, or is it better to be less familiar with trading?

Armani:

You must understand your users. If you don’t know your users, you can’t build a great product. Your job is to build the product and solve user problems. If you are not a user to begin with, then you’d better become a user. Not just traders. When you talk about futures, you are talking about traders; when you talk about mass market consumer finance, when you talk about a universal application that covers all funds, you talk about different market segments. Whether you are using on-chain apps, DeFi, wallets, DApps, etc., you need to know your user needs.

ChainCatcher: Do you make your own deals?

Armani:

Yes, or you can say no. I do trade, but I see investing as something like Buffett, take your check-in card, 20 investment opportunities, punch one hole every time you invest, you only have 20 opportunities, and then you buy these assets, never sell them, that’s your lifelong investment strategy. This is my way of investing. I think everyone has a different approach, but this is not financial advice. But this is my view of the market.

Advantages and strategies: chew the most difficult bones first

ChainCatcher: What is Backpack’s competitive advantage over other exchanges?

Armani:

The opportunity we see is that few exchanges can truly penetrate and bring cryptocurrencies into the mainstream mass consumer financial market. The reason is that only a small number of exchanges are doing the hard work of integrating them into the framework of society. This comes down to compliance. Going back to our previous discussion, looking at some of the world’s largest markets, looking at Japan, the United States and Europe, who can operate in these markets and who cannot. And there is a huge gap and opportunity to eventually bring these products to these regions, which are the largest markets in the world.

That’s why we chose to go down this difficult path. Although we could have built and launched the exchange a year ago, we didn’t. We took the time to solve problems and get licenses to build around the world. Our company only has 16 engineers on one product, and everything is done by these 16 engineers, but our company has about 90 people in total, and the rest are compliance, legal, operations, customer support personnel, not in one language, but in all languages, meeting the requirements of building a credible financial market, where you can have the deepest liquidity because you have market integrity and regulatory supervision, all participants, players in traditional regulated markets, You can enter the encryption market. This is a huge opportunity. What we need to do is build this thing correctly, help the industry mature, bring the value that exists in traditional markets into the crypto market, so that cryptocurrency is no longer some unregulated fringe thing, but brings cryptocurrency into society. The framework of society. This is a huge opportunity that few people see.

ChainCatcher: Why did Backpack’s headquarters be located in Japan?

Armani:

Japan is one of the largest markets in the world and one of the most difficult markets to enter because of its strict compliance requirements. You can’t just serve Japanese users. Many companies have tried, but those companies have recently been kicked out of the app store. So we think we have the ability and technology to solve these problems and do the right thing in a way that a very few local crypto exchanges can. Japan is also a very suitable place to live.

ChainCatcher: But the Japanese don’t seem to be too keen on trading, and the Japanese market may be more conservative.

Armani:

Every place in the world has a different culture, but I think many people ignore that Japan used to be a center of gravity when it comes to cryptocurrencies. Binance, for example, originally originated in Tokyo. Because of many exchanges hacking incidents, supervision has become very strict, forcing many people to withdraw. But now, Japan is full of radical policies, attitudes and spirit towards cryptocurrencies, which are very exciting. Recently we have seen that Japan’s cryptocurrency tax rate will be reduced from 55% to 20% or 25%. This is a huge change that will bring large capital inflows into Japan’s crypto market. So, I think the trend in Japan is changing and the opportunities for the future are here.

ChainCatcher: Do you have any upgraded data you want to share with us? Such as transaction volume, number of users, or financial data.

Armani:

We did 60 billion in trading volume when we started the exchange. We call it the pre-season because the exchange was not yet fully built and we only provided spot trading on Solana, Bitcoin and Ethereum spot. At that time, especially in the Chinese-speaking market, everyone was very excited to see a new exchange. After the FTX incident, we have done a lot of work from then to now, and finally ready to start in several major markets and be able to access the world. The largest capital market liquidity. The real opportunity is that cryptocurrencies are the capital market native to the global Internet, not only in China, but also in Japan, the United States, Europe and Africa. That is the essence of cryptocurrency, it has no borders.

March is the real beginning for us. Now we have a complete beta testing plan, we have launched new interest-bearing futures products, the margin system is online, and all compliance infrastructure is in place. In the past two and a half weeks, we have completed approximately 2.4 billion in transaction volume in the beta phase alone, and we expect activity to increase significantly as the trading season approaches.

ChainCatcher: What is the decision-making process for Backpack to decide to go to Memecoin?

Armani:

There are a few questions to ask yourself. The basic question is: Do users want this? Users can never be wrong. So there are many key performance indicators (KPIs) to refer to, but from a qualitative perspective, do users really need it?

Next, there is a more important issue, which is the integrity of the market. The question is much more difficult to solve, which is whether the market is safe? It’s not just exciting, it’s decentralized so that it doesn’t become a market controlled by some insider. I think this is one of the huge criticisms meme coin is currently facing.

This is true on centralized exchanges, and it is also true on decentralized exchanges. So this is one of the most important things. Will this market become a market with asymmetric information, in which some parties will cause harm to others? One of the huge benefits of centralized exchanges is that we are a filter, which can be both a good thing and a bad thing. I think a lot of people are dissatisfied with centralized exchanges now because they feel there is a lot of value deprivation in them, and whether everyone is fighting for the next listing opportunity, everyone wants to go online on the first day and go public as quickly as possible, and they don’t really know or care about what the project is, they just see their competitors doing the same thing. So they also want to go online as soon as possible. Normally, market charts will usually look like this: first go up and then go down. This is a very fair criticism and a point we want to refute.

Everyone is in this prisoner’s dilemma, looking at their competitors and asking themselves, will they go public? If they will go public, do I have the choice not to go public? I pride myself on our judgment and always do the right thing, but these are also the thoughts that every exchange does for itself. This is the dilemma behind it.

ChainCatcher: Backpack just completed Series A financing last year. What was the main purpose of the last round of financing?

Armani:

The last round of financing was mainly used to build teams, recruit people, and ensure that we could obtain the necessary licenses globally and ultimately enter the market. Whether it’s engineers, compliance personnel, customer support, operations, legal, etc. Building an exchange is a huge project. Unlike traditional technology companies, traditional technology companies only need to recruit a bunch of very smart engineers and product people to get started. The members of our team have very diverse skill backgrounds and come from different countries. We are an international team.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern