Asia is not only the core area of global hardware manufacturing, but also a natural testing ground for the demand side of the DePIN project.

Written by: Deep Trend TechFlow

introduction

As a media deeply involved in the Asian Web3 market, we have also witnessed DePIN’s explosive growth in the past year.

According to the DePIN 2024 report released by Messari, more than 13 million devices deployed DePIN nodes globally last year.

This track, which deeply binds on-chain governance, incentives and real-life assets, not only brings global real-life application scenarios to Web3, but also creates a new asset collaboration model.

In the Solana ecosystem, the DePIN project has spawned a number of highly representative innovative practices based on its low-cost, high-performance on-chain environment.

However, when we took a closer look at these projects, we discovered an intriguing phenomenon:

Although most of DePIN’s core agreements and projects are led by European and American teams, its development has formed a deep dependence on Asia. This interdependence is mainly reflected in two levels:Production and supply of hardware equipment, as well as large-scale node deployment requirements.

Western agreements may also be inseparable from Made in the East.

Asia or Asia-Pacific actually plays a unique dual role in the development of global DePIN:

On the supply side, Asia has a complete DePIN hardware manufacturing industry chain, efficient production organization capabilities and significant cost advantages;

On the demand side, the huge population base, high-density urban distribution, openness to new technologies, and acceptance of Web3 and the sharing economy provide ideal application scenarios for the DePIN project.

Through in-depth interviews and research with Asian DePIN projects, Shenzhen TechFlow attempts to reveal the market landscape of the Solana DePIN project in Asia.

First, we went deep into Asian hardware manufacturing clusters to analyze how they support the global DePIN hardware supply chain; second, through user behavior analysis in key markets such as Southeast Asia, we showed a demand picture with regional characteristics; third, we interviewed a number of benchmark projects that have been deployed in Asia, summarized their localization experience and strategic adjustments, and paid special attention to the layout logic and investment landscape of local Asian investment institutions on the DePIN track.

Through these first-hand information and case studies, we hope to provide industry participants with practical market insights.

Supply side: Made in Asia, growing overseas

Hardware, the physical fulcrum of the DePIN ecosystem

The core of DePIN is to bind on-chain governance to real-world assets, and hardware devices are an indispensable physical infrastructure in this ecosystem.

For most DePIN projects, whether the project team is located in Europe, America or Asia, and the business covers North America or Africa, only hardware equipment must be physically deployed to the target area to start the network.

In addition to the familiar use of computer equipment to hook up and mine, DePIN’s broader hardware requirements include but are not limited to:

-

Mining machinery: Helium’s LoRaWAN gateway, Starpower’s wireless hotspot equipment.

-

sensor class: Hivemapper’s car camera, DIMO’s vehicle data collector.

-

Edge Computing Class: React Network’s distributed energy monitoring device.

Have you ever wondered where the hardware for these projects came from?

Asia, the globally recognized factory of the world, actually plays a key manufacturer role.

Asia, the global smart device manufacturing center

As we all know, with economic globalization and changes in the world’s production division pattern, China’s Guangdong-Hong Kong-Macao Greater Bay Area, Yangtze River Delta region, and Southeast Asia (Vietnam, Thailand and other places) have become the world’s largest smart device manufacturing base.

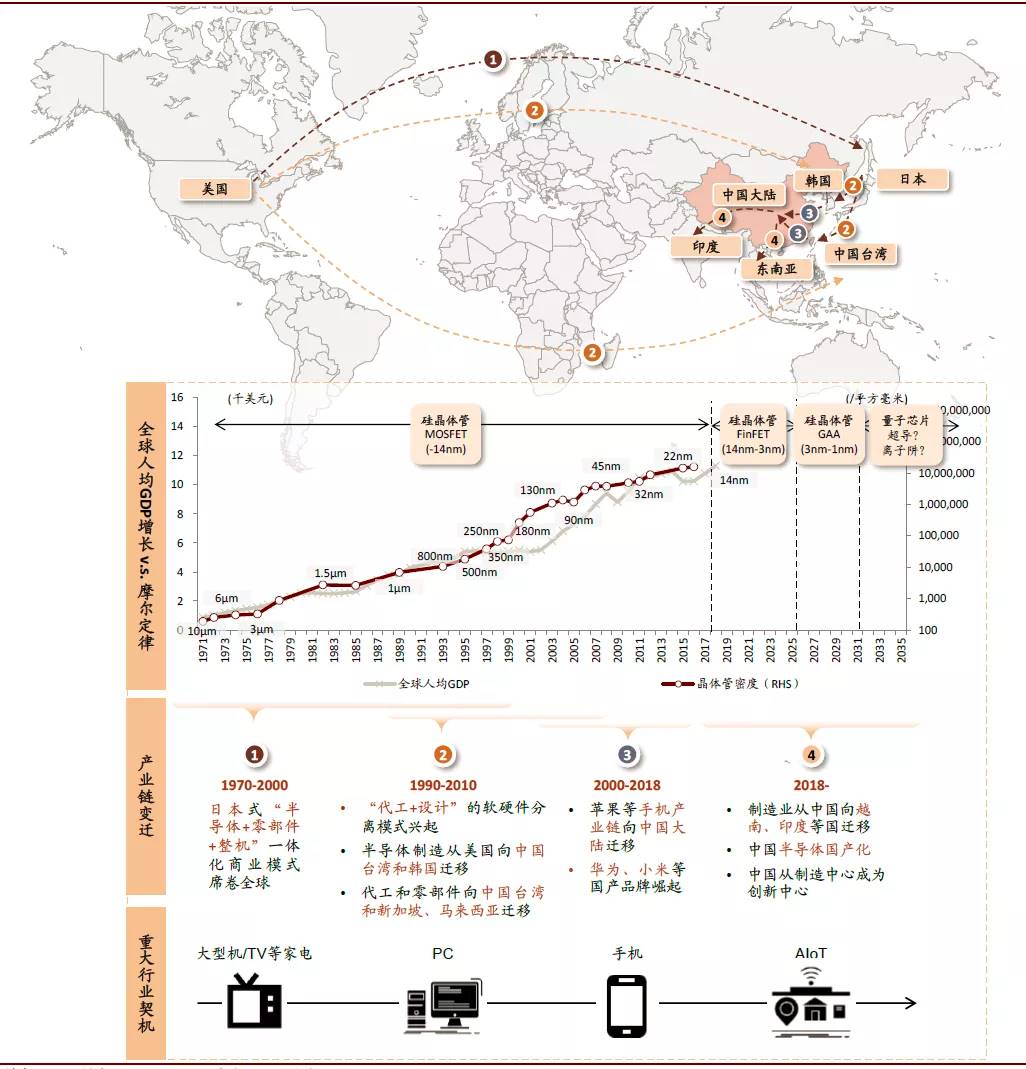

(Source: China International Capital Research: Investment Opportunities for the Migration of the Electronics Industry Chain in the Post-Epidemic Era)

The manufacturing capabilities of this area are attractive to DePIN projects that rely on hardware around the world.

-

complete supply chain:

-

From electronic component production to equipment assembly, Asia has formed highly integrated industrial clusters.

-

Supply chain efficiency: The rapid iteration capabilities of hardware manufacturing meet the DePIN project’s need for equipment updates.

-

-

Production capacity and cost advantages:

-

Public data shows that Asia’s production organization capabilities and relatively cheap labor make hardware manufacturing and assembly costs 30%-50% lower than those in Europe and the United States.

-

Transportation and distribution capabilities: Asian hardware manufacturers are able to quickly ship equipment around the world, supporting the DePIN project to carry out global business.

-

-

Talent and technology accumulation:

-

Decades of hardware manufacturing experience have given Asia a wealth of engineers, skilled workers and supply chain management talents.

-

-

Experience in mining machinery manufacturing:

-

Don’t forget that more than a decade ago, China and surrounding areas were one of the most prosperous regions in Bitcoin mining, and mining machine manufacturing and node deployment were once at the forefront of the world;

-

The technical accumulation and acceptance of these Bitcoin mining machinery industry chains (such as Bitmain, Jianan Yunzhi, etc.) extend to DePIN hardware, which naturally has a smoother inheritance gene.

-

DePIN stores in front and back: Western agreements, Made in the East

“History does not repeat itself, but it always has the same rhyme–Mark. Twain.

Today, when the hardware of the global DePIN project benefits from Asian manufacturing capabilities, this model has actually become popular as early as the last century.

and we’re used to calling it“front shop and back factory”(front shop, back factory)。

This concept originally referred to a business model developed jointly by Guangdong Province in mainland China and Hong Kong in the early days of China’s reform and opening up, that is, using Hong Kong as a transit point to sell goods produced in the mainland to Europe, the United States and other regions.

Interestingly, from traditional Web2 manufacturing to Web3, you can see a clear business evolution that relies on a fixed geography:

-

end of the 20th century: Hong Kong (front store) receives international orders, and the Pearl River Delta (rear factory) completes production.& ldquo; The Four Asian Little Dragons (South Korea, Taiwan, Hong Kong and Singapore) undertake the transfer of Western manufacturing.

-

Bitcoin in ancient times: Before 2017, China was the world’s largest Bitcoin mining machine production and node deployment area. Related mining machines were sold all over the world and were in short supply. Often, the delivery time had to race against the increase in the difficulty of Bitcoin mining across the entire network.

-

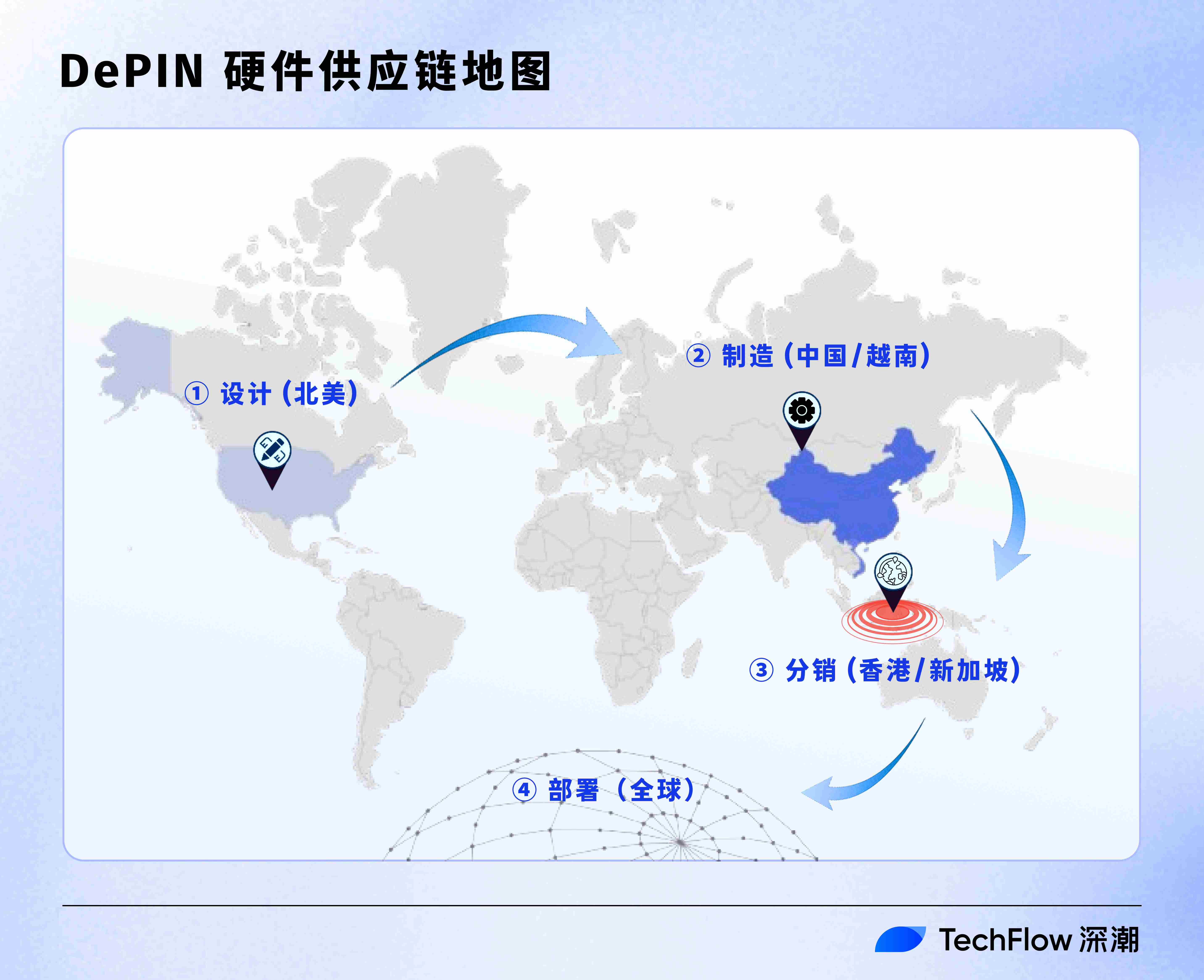

The rise of DePIN:In recent years, the Western/European and American DePIN protocol has been implemented through conceptual narrative, protocol design, marketing and deployment. DePIN hardware equipment made in Asia is sold to European, American and global markets through hubs such as Hong Kong and Singapore.

As Xiao Feng, Chairman and CEO of HashKey Group, once said at last year’s Hong Kong Web3 Carnival event:

"DePIN’s natural advantages lie in the Guangdong-Hong Kong-Macao Greater Bay Area and the Yangtze River Delta region. This is the global manufacturing base for smart devices. Because all Bitcoin mining machines are manufactured in the Greater Bay Area, and the first generation of DePIN is manufactured and distributed in the Greater Bay Area of China. It can be predicted that the future manufacturing and distribution of DePIN equipment should also be in the Greater Bay Area.

At the same time, the DePIN project, the leading DePIN project in the Solana ecosystem, has a considerable reliance on Asian manufacturing in terms of hardware.

FutureMoney, a crypto-asset investment and consulting group with an Asian background, once revealed in public research:

"The DePIN project requires a large amount of hardware production capacity to reduce network operating costs. One of the leading DePIN hardware equipment manufacturers we invested in has supply chains in China and Vietnam, and also supplies hardware for seven DePIN projects, includingDIMO, Hivemapper and React。He is a very dependent strategic partner for these overseas native Web3 projects.& quot;

case studies:Jambo, the Web3 mobile phone sold around the world is produced in Shenzhen

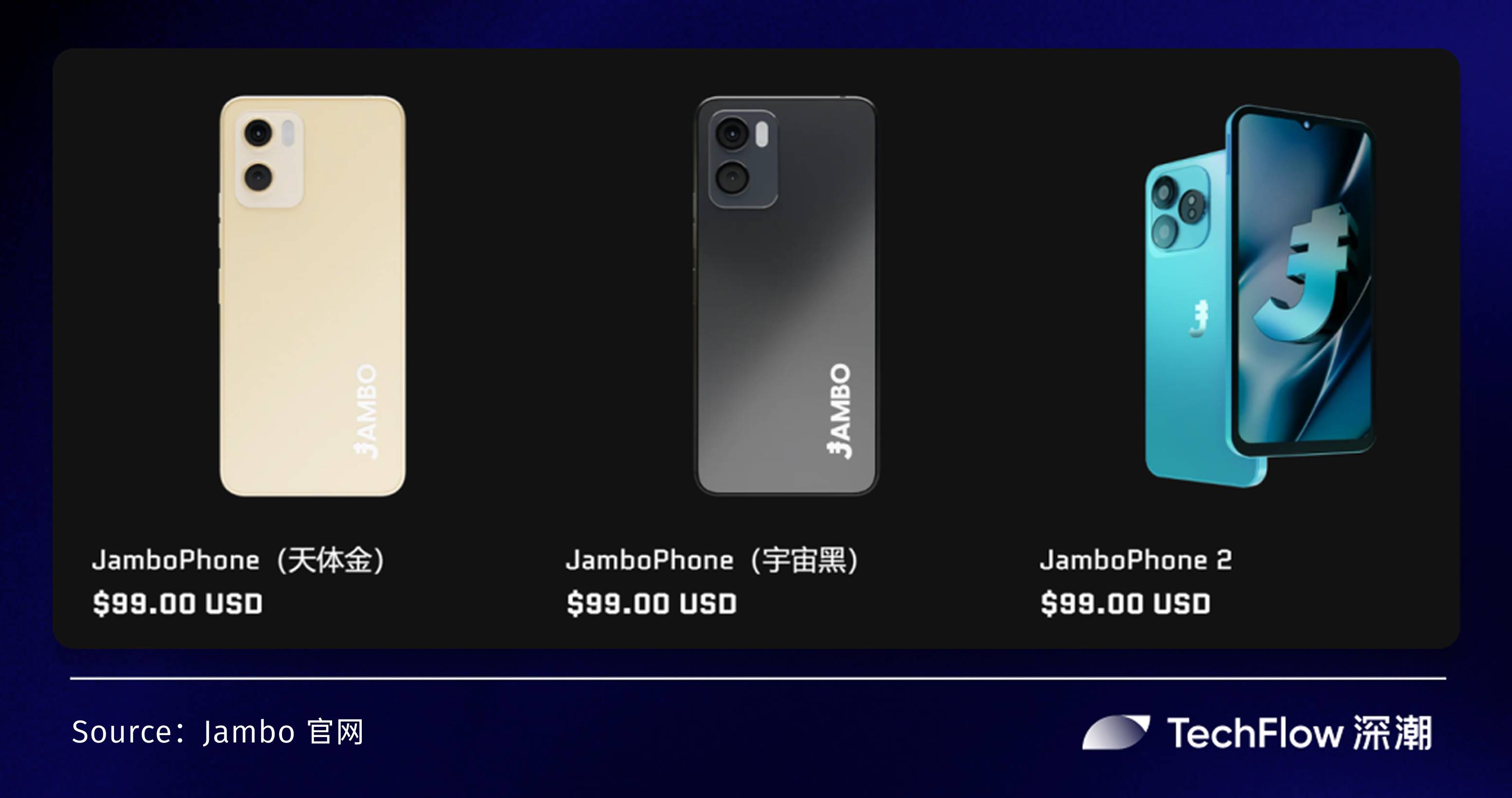

Jambo is one of the representative projects in the Solana ecosystem, focusing on hardware devices in the Web3 ecosystem.

Its core goal is to introduce more users into the DePIN world through cost-effective smartphones.

Jambo’s business scope covers the design, production and sales of smartphones, while also providing support for a range of Web3 applications through its devices, including encrypted wallets, decentralized identity (DID) and distributed storage.

Unlike traditional smartphone manufacturers, Jambo’s hardware strategy is not aimed at profit, but at low-cost hardware devices as the entry point to achieve long-term value through user distribution and ecological growth.

The most discussed point is the $99 pricing of the Jambo phone.

After the original generation product maintained this low-price strategy, the price of the second generation product remained at US$99 based on several times of performance improvement, continuing its hardware-as-entrance strategy.

Such a pricing model is inevitably inseparable from the rightControl of hardware costs。

In a recent podcast by Shenzhen TechFlow, we also invited Jambo founder James to try to explore the mystery behind pricing.

Small Universe Link:

https://www.xiaoyuzhoufm.com/episodes/67c31eccb0167b8db9d306b6

Spotify Link:

https://open.spotify.com/episode/3wRdDh1k2GcxHJnYPJq9gG? si=3WcJz90GRJq5LsP3AsJ07g

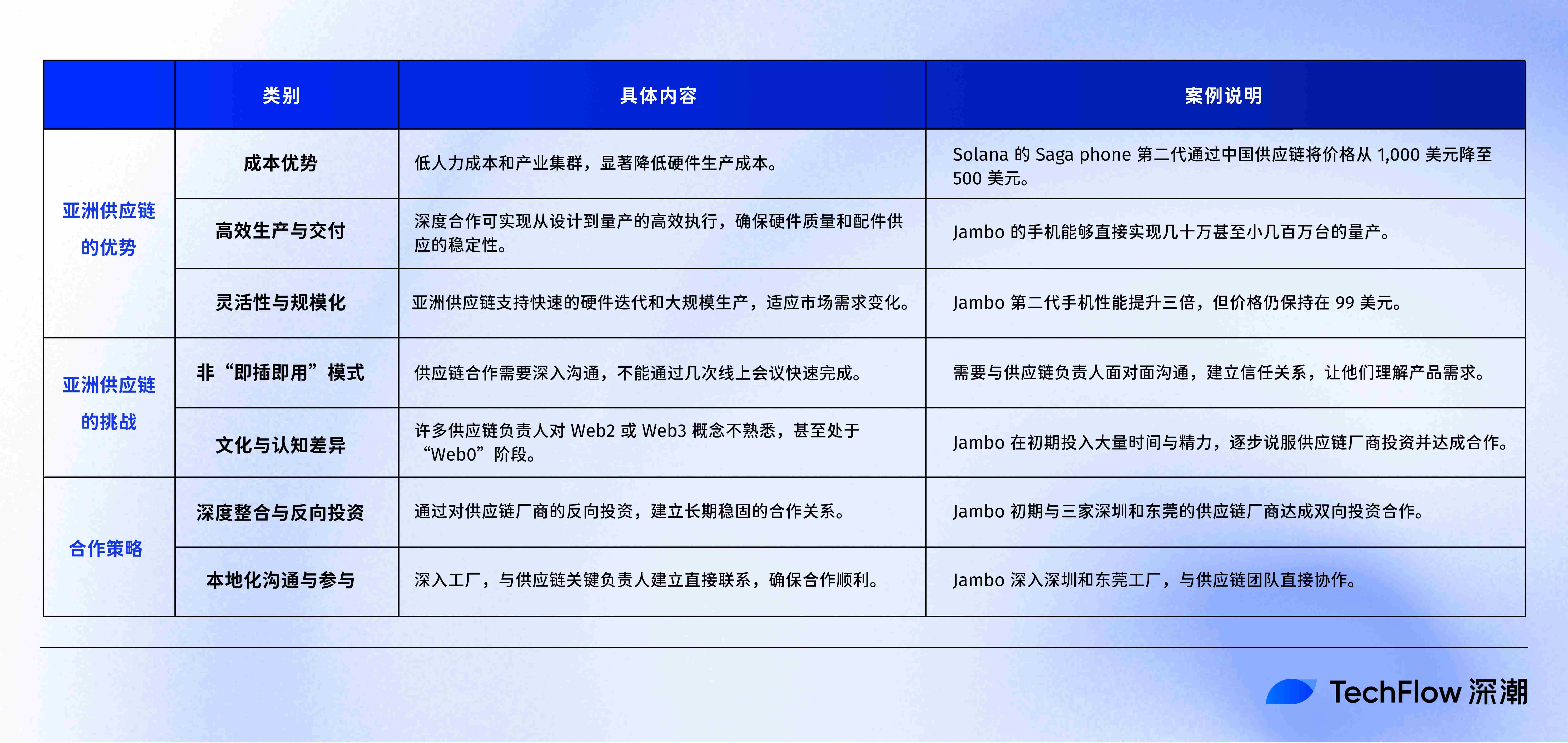

According to James, Jambo relies heavily on China’s manufacturing capabilities in the supply chain to achieve efficient execution from design to mass production and ensure the stability of hardware quality and parts supply.

Obviously, behind the low-cost hardware strategy is the in-depth exploration and integration of Asian supply chain resources.

“Jambo’s operating model is different from many DePIN projects. Many hardware-related DePIN projects usually require pre-sales for up to six months or even a year to raise funds, then find manufacturers to produce, and finally complete shipping.

On the other hand, we can directly mass-produce hundreds of thousands or even millions of mobile phones because we make full use of the advantages of the China team.

we haveWe found three excellent supply chain partners in Shenzhen and Dongguan to ensure efficient hardware production and stable supply of parts. For those teams whose supply chains are not in China, I guess they need to solve supply chain problems through intermediaries and other methods.

In addition to its own production experience, the advantages of Asian supply chains are also favored by other DePIN projects.

For example, Solana’s Saga phone is priced at around US$1,000 for the first generation of Saga phones, while the second generation, which is transferred to China’s supply chain, has dropped to US$500. It can be seen that many Western companies are gradually realizing the importance of Asian supply chains in reducing costs through constant iteration.

Ensuring the hardware production and delivery capabilities of the DePIN project is the last word.

However, James also reminds us thatAsia’s supply chain is not a simple“plug and play”Model— Cooperation with suppliers cannot be completed by placing orders over the phone remotely.

Putting aside the online ridicule that innovative electronic products come from Huaqiangbei, to truly establish a cooperative relationship, we need to go deep into the factory and communicate face-to-face with key leaders in the supply chain.

In particular, many Asian supply chain leaders are not familiar with the concept of Web2 or Web3. It can even be said that their thinking is very traditional manufacturing thinking, and it seems more appropriate to call it Web0.

Therefore, the process of communication and negotiation requires a lot of time and energy.

Taking Jambo as an example, it was a very complicated negotiation process to persuade three supply chain manufacturers to invest in Jambo in the early stage, reverse invest in them, and establish a solid cooperative relationship. This is an off-the-shelf model that needs to be built from scratch.

Overall, this cultural difference may be one reason why Western companies are making slow progress in taking advantage of Asian supply chains.

But there is no doubt that the advantages of Asian supply chains are obvious in terms of cost and efficiency.

Demand side: The characteristics of the crowd create the DePIN natural experimental ground

In the previous chapter, we discussed in detail Asia’s dominant position in DePIN hardware manufacturing.

However, Asia’s contribution to the DePIN ecosystem goes far beyond that.

as the worldmost densely populated、Mobile payment is the most developed、The sharing economy is the most activeAs one of the regions of China, the Asian market naturally has superior conditions to become a DePIN application testing ground.

User behavior and market characteristics in Asia Pacific

-

Adequate acceptance of the sharing economy

The success of the sharing economy model in Southeast Asia and other regions fully demonstrates the openness of users in the Asia-Pacific region to new economic models.

In Thailand and other places, shared travel platforms represented by Grab and Gojek not only successfully occupied the market, but also gradually expanded into multiple fields such as payment, logistics and takeout, forming a diversified ecosystem;

In mainland China, the sharing economy is even more popular.

Data shows that the market size of shared bicycles in China will exceed 30 billion yuan in 2022 and is expected to grow to 42.74 billion yuan in 2025 (Data source: 2024 In-depth Research Report on China’s Shared Bicycle Industry); Similarly, the number of points covered by shared charging treasure in China has reached 4.04 million in 2023, and the penetration rate in first-tier and second-tier cities has reached 44.7%(Data source: 2024 China Shared Charging Treasure Industry Research Report).

We do not intend to discuss too much details about the Web2 industry, but it can be clearly seen from the above data that China and Southeast Asia have a significantly higher acceptance of the sharing economy model, which provides an ideal experimental ground for the DePIN project.

If you delve into the data of Web3, you can also see the natural extension of user behavior in the above context.

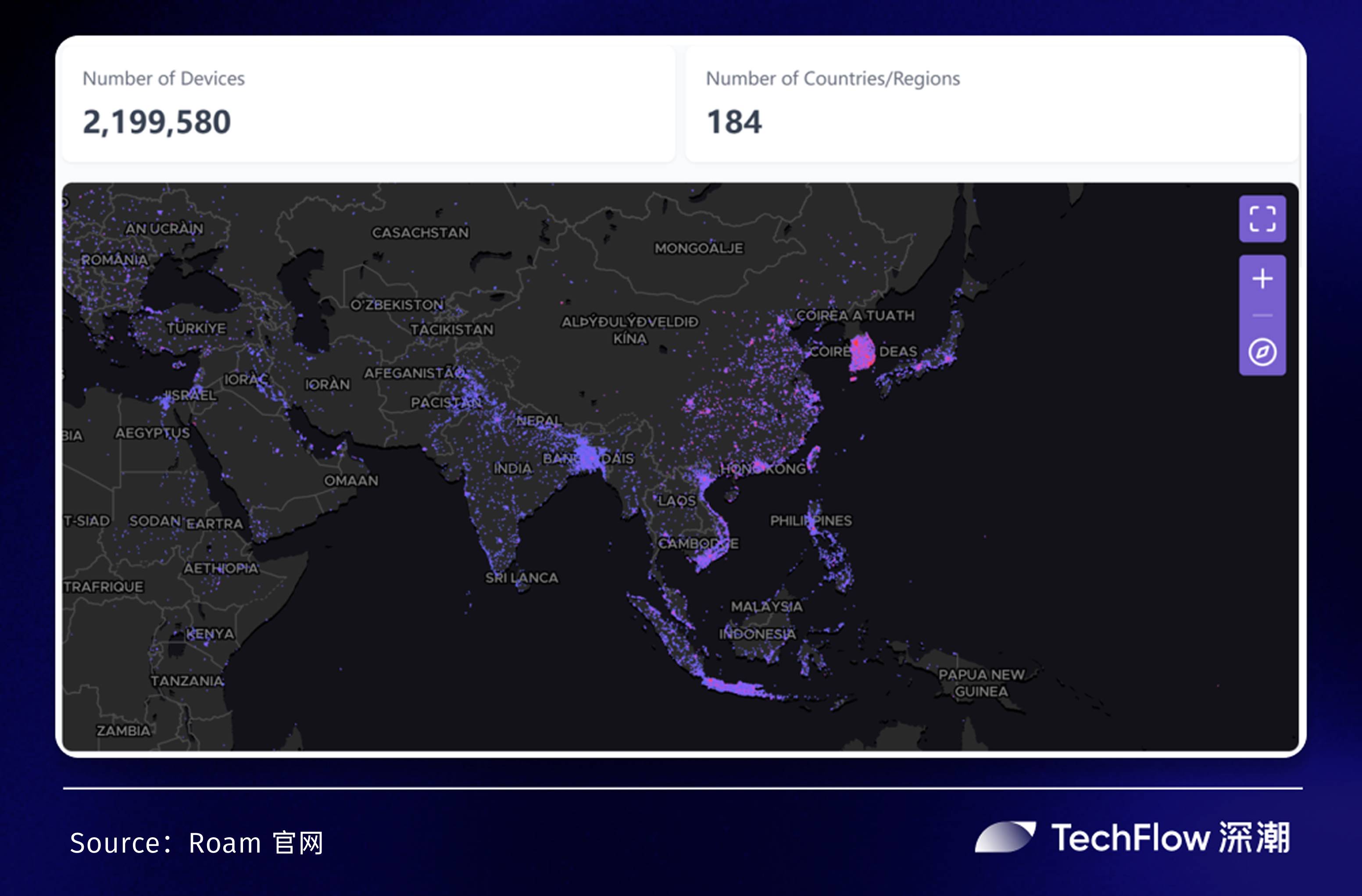

According to depinscan data, in terms of national distribution, China and South Korea are leading the DePIN adoption competition, with 800K + and 790K + devices respectively.

Interestingly, emerging markets such as Indonesia, Vietnam and Nigeria are moving beyond traditional technology hubs, highlighting strong demand outside the West.

Some of the gameplay in the DePIN track are essentially a shared economy model, which earns income from mining or grooming by transferring the rich resources owned by individuals or units; in Southeast Asia, where per capita income is generally low, this model is obviously more promising. Potential to create a trend.

-

The popularity of hanging up mining and hair-cutting economy

The unique user behavior characteristics of the Asian market provide possibilities for the promotion of DePIN projects.

Models such as on-line mining and hair-raising economy (making small profits through low-threshold participation) are particularly popular in Asian markets, especially in China, Vietnam, the Philippines and other places. This user feature can be directly combined with the incentive mechanism of the DePIN project.

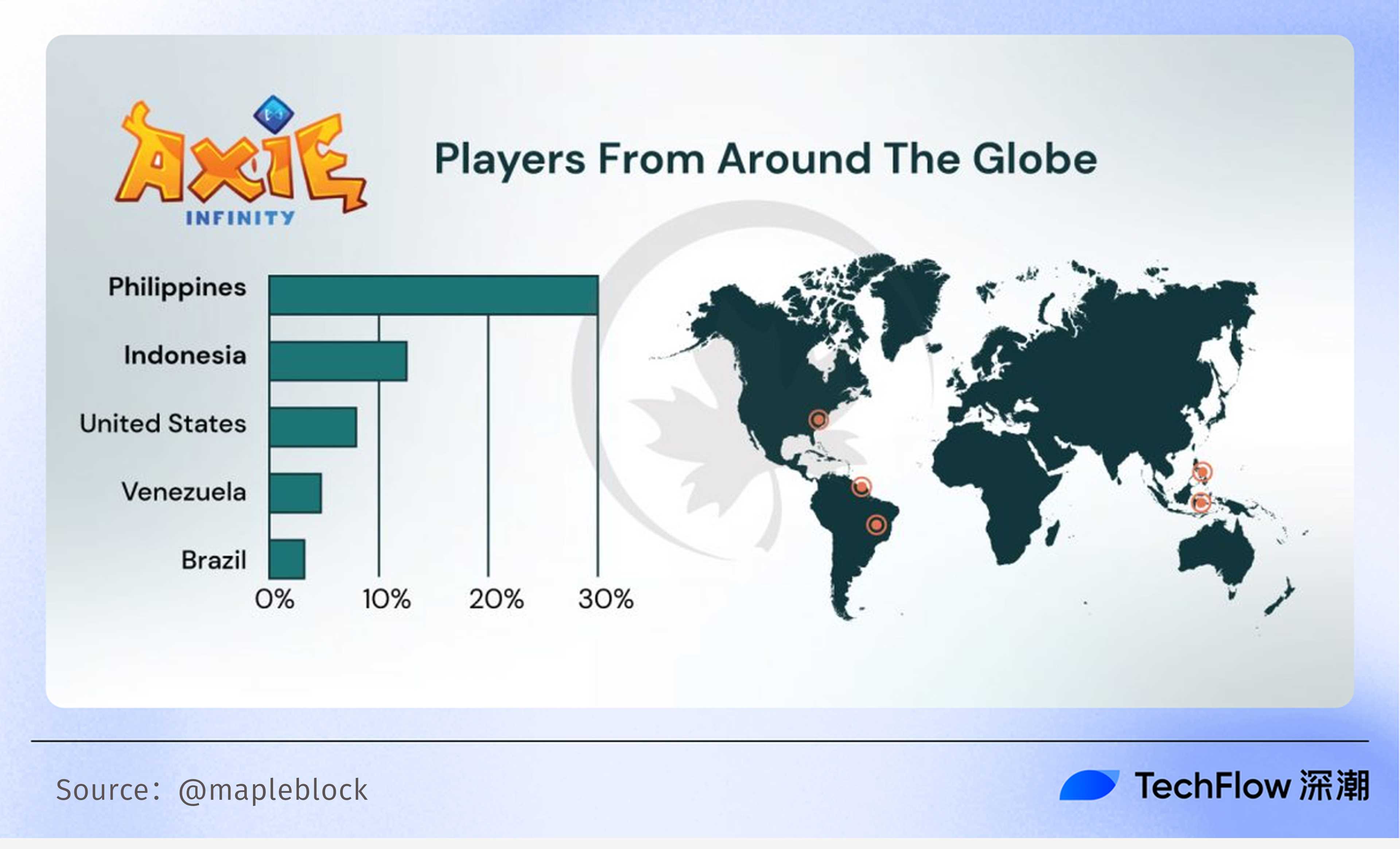

When GameFi became popular last cycle, the region with the highest user participation in the Play to Earn model represented by AXIE was Southeast Asia, especially the Philippines and other regions, accounting for about 30% of the total number of players in the entire project; a similar structure also occurred on StepN.

-

mobile internetPopularization: Smartphones become a promotion tool

Asia has one of the regions with the highest mobile Internet penetration rates in the world and the market with the largest number of smartphone users. According to the GSMA’s “Global Mobile Economy Report 2023”, by 2025, the number of smartphone users in the Asia-Pacific region will reach 3.4 billion, accounting for more than 50% of the global total.

This data is of great significance to the DePIN project:

-

The popularity of smartphones allows users to easily access DePIN applications, such as mobile phone management of decentralized storage, bandwidth sharing and other services.

-

Jambo’s success story shows that low-cost smartphones can serve as an important entry point for DePIN projects. By providing hardware devices pre-installed with DePIN applications, project parties can directly reach users and reduce promotion costs.

-

Crypto Community Foundation

In addition, the Asia-Pacific region has become an important part of the global cryptocurrency market, especially among users in the Chinese-speaking community and Southeast Asia. Among Binance’s user distribution, users in the Asia-Pacific region account for as much as 70%, including China, Hong Kong and Taiwan, as well as Southeast Asian countries.

Many DePIN projects (such as Helium and Filecoin) have large communities and high user activity in the Chinese community.

High participation and community activity also provide important support for the ecological construction of the DePIN project. For example, some DePIN projects have attracted a large number of technical talents and users to participate by holding hackathons, developer conferences and other activities in the Asia-Pacific region.

For any project wishing to enter the DePIN circuit, the Asian market is an important area that cannot be ignored. By deeply understanding the demand-side characteristics of this market, project parties can better design products and incentive mechanisms to achieve rapid growth and large-scale expansion.

Case study: CUDIS, when smart rings spontaneously became popular in the Japanese market

When discussing Asian market demand, CUDIS is a case worthy of attention.

As a smart ring product, CUDIS has shown unexpected popularity in Asian markets, especially Japan. This not only provides inspiration for how the DePIN project can enter the Asian market, but also reflects the consumption potential of Asian users in the health and sports fields.

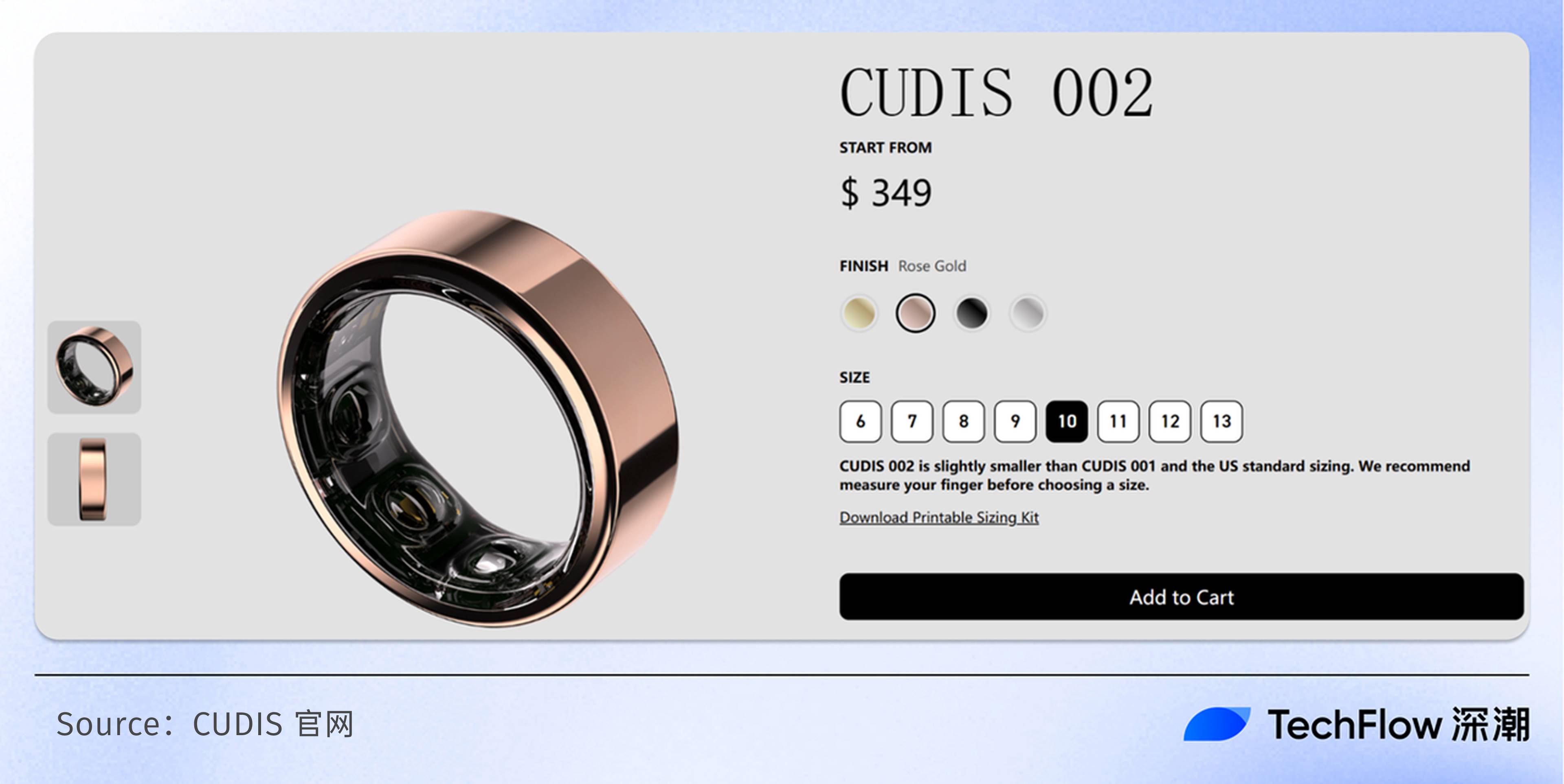

CUDIS’s core product is a smart ring that combines functions such as health monitoring, reward mechanism and decentralized data storage.

By wearing a ring, users can track health data such as heart rate, sleep quality, etc. in real time, while also earning rewards by participating in specific activities such as daily step goals. This model of benefiting while being healthy not only satisfies users ‘concerns about health, but also integrates the incentive mechanism of Web3 into hardware products.

Edison, founder of CUDIS, has been working on ourPodcast interviewsChina revealed:

Currently, the main target markets of the project include the United States, South Korea, Japan, Singapore and the United Kingdom. Among the five countries,Three belong to Asian countries.

At first, Edison didn’t fully realize the importance of the Asian market because of the widespread stereotype that European and American users were more concerned about health and exercise.

However, judging from market performance and internal project data, Asian users are also very concerned about health and sports. In this regard, Edison believes it also benefits from projects like StepN, whose success in the Asian market has educated a large number of users.

In further exchanges, Edison mentioned to us an unexpected pleasure-the Japanese market has shown great enthusiasm for CUDIS products.

The Japanese market was not due to CUDIS’s active promotion and expansion, but naturally formed under the promotion of some influential KOL.

They noticed CUDIS products and took the initiative to forward relevant tweets.

This is also due to CUDIS’s invitation mechanism, where users can invite others to buy and receive rewards after purchasing the ring. This process attracted the participation of some non-Crypto users.

These users ‘understanding of the product is very simple: wearing a ring after purchasing it can not only earn a certain amount of income, but also help your health.

Edison said:

“After the previous WebX event in Japan, we organized a community event with more than 100 local Japanese users participating. Since most users can only speak Japanese, we also specially arranged for translation. This event made us deeply feel the high level of activity of users in the Asian market. Including the previous Social Challenge event on Twitter, we also saw the enthusiasm of Asian users.

At the same time, we also found a user portrait worthy of attention in the conversation: what CUDIS faced,Not all are wool collectors.

“Taken together, Asian users can be divided into two categories. One category is low-frequency users who may participate in some wool collecting behaviors; the other category is users with strong paying propensity and ability.

As long as the product has practical meaning to them, they are willing to pay for it. This is an important phenomenon we have observed in marketing and is also a key direction for our future development in the Asian market.

As a result, this has also led to a change in the marketing language when the DePIN project is promoted in Asia.

That is to say, communication with these users will focus more on the actual use of the product and reduce the content of Web3, such as how data is recorded, why the data belongs to the users themselves, and the value that the data may bring to users in the future.

This may be a significant advantage for hardware products like DePIN,The sense of substitution makes it easier for users to accept products.

Compared with the high communication costs in the past when explaining underlying technologies such as Bitcoin, Ethereum or Solana to users, now with the support of physical products, the threshold for users to understand is greatly reduced.

Inventory of Solana DePIN Project in Asia

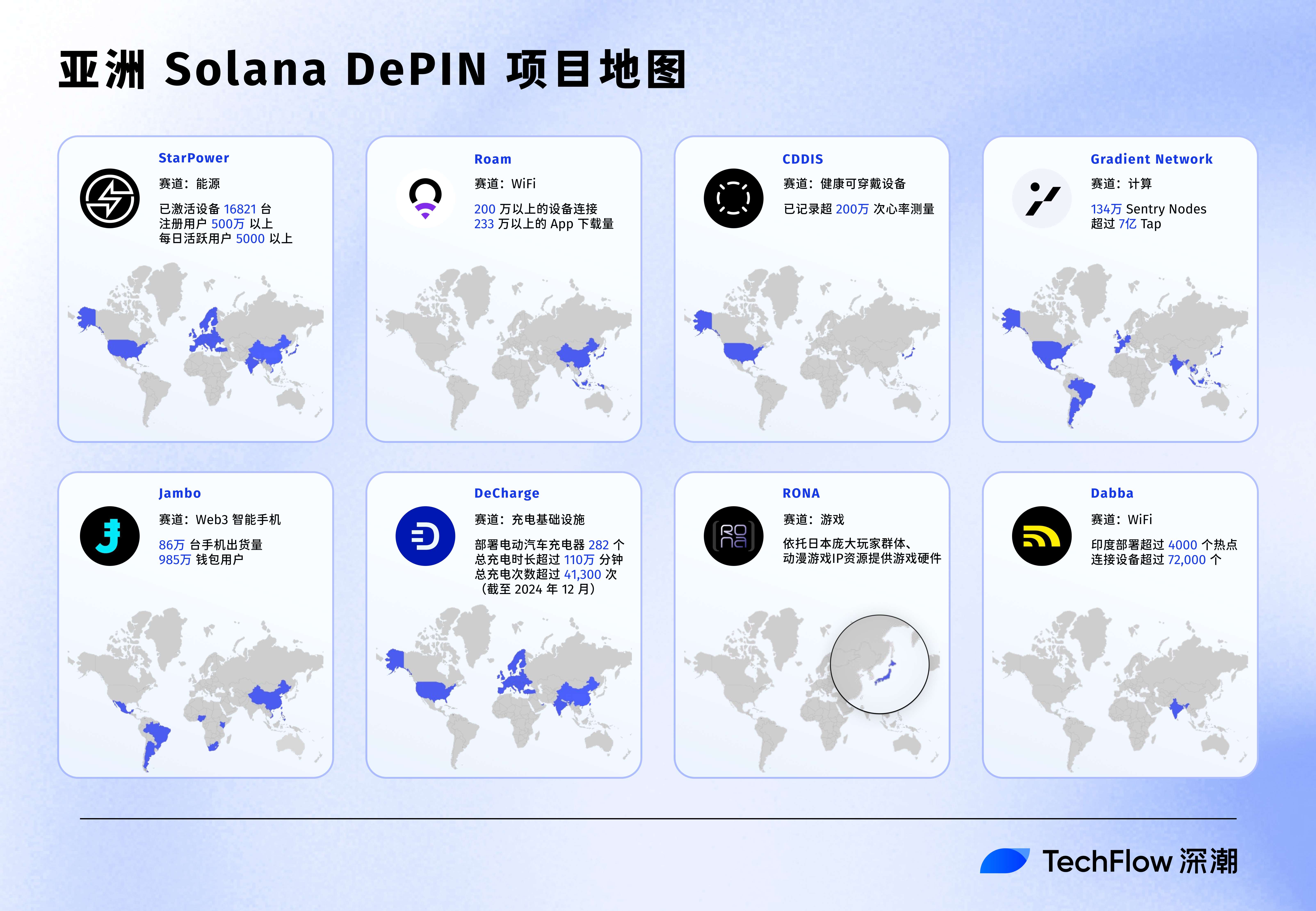

After understanding the supply and demand sides of DePIN in Asia, we also took stock of DePIN projects with teams with Asian backgrounds or products/businesses distributed in Asia. Among them, the more distinctive ones are as follows.

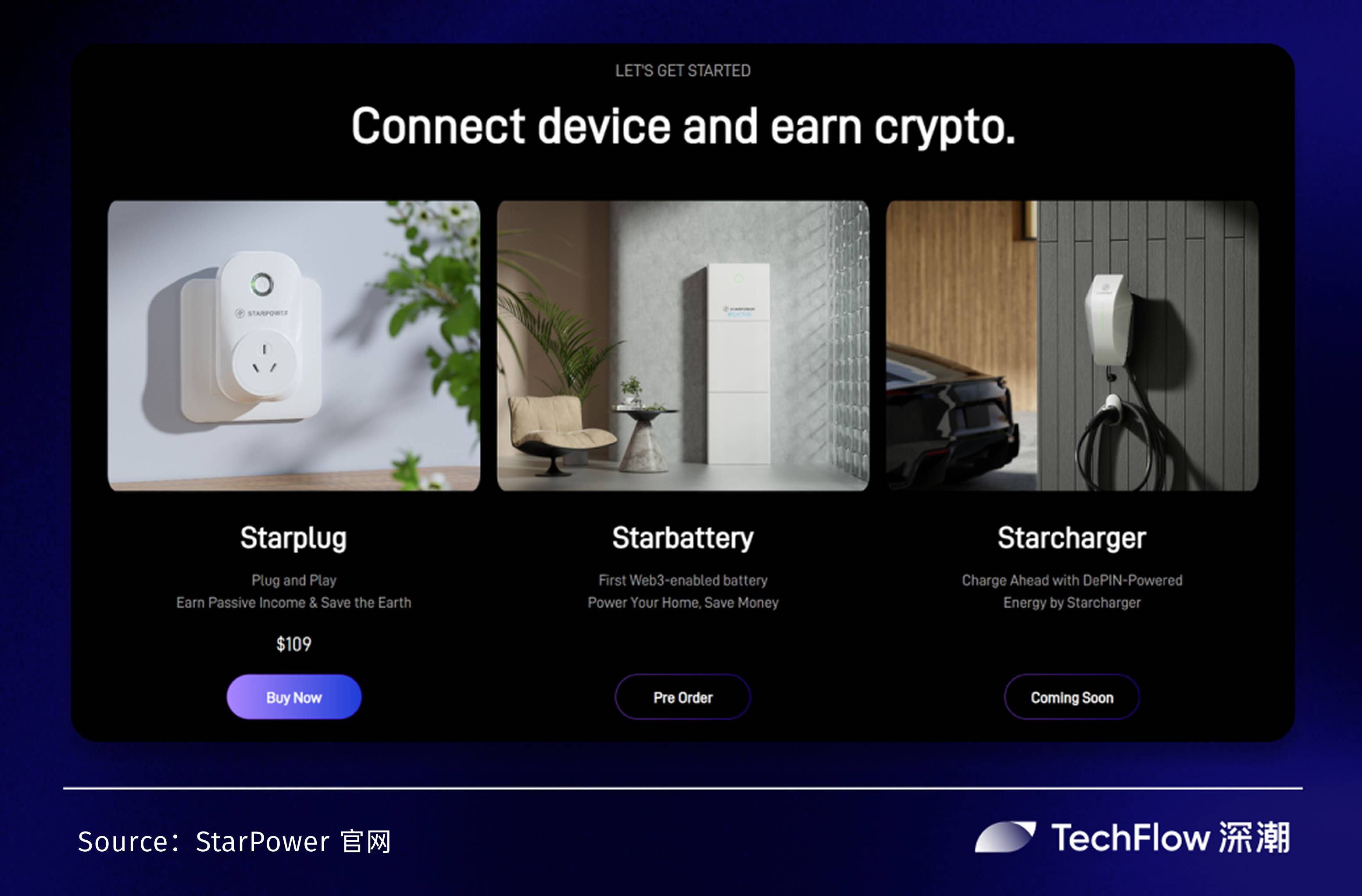

StarPower

As an energy DePIN project, Starpower aims to build a decentralized energy network. Its core concept is “virtual power plant”: a virtual power plant does not produce electricity, but is a scheduling system.

Renewable energy power supply is unstable and energy storage costs are high. Therefore, virtual power plants are needed to efficiently coordinate demand and supply, improve energy efficiency, save electricity bills and reduce carbon emissions by “cutting peak peaks and making up for droughts.” However, due to the low single-household value of ordinary residents ‘electricity and the high access cost, traditional virtual power plants cannot effectively connect to residential electricity.

Starpower aims to combine technologies such as physical devices, blockchain, IoT and AI to fill this gap: on the one hand, it builds smart hardware for the C-side, encourages widespread access through token incentives, and aggregates small energy resources from homes and businesses. Build a decentralized energy network; on the other hand, after obtaining user electricity data under the premise of privacy protection, it provides the best power supply efficiency based on algorithms.

Starpower’s planned hardware products include:

-

Starplug: Smart socket, priced at $109, is currently available through the official website.

-

Starbattery: Smart battery, priced at $4000 to $11500, is currently available for pre-sale through the official website.

-

Starcharger: Smart charger is coming soon.

In addition, Starpower software products also include the Starpower App, which aims to integrate various energy equipment and provide a unified control and management platform.

According to data from Starpower’s official website, Starpower has more than 4 million registered users in 781 cities around the world, more than 16821 activated devices, more than 80,000 App users, and more than 5000+ daily active users. According to the official website equipment distribution map, Europe, Asia, and North America are its main markets, and because Asia’s solar energy and point-to-point energy markets are relatively mature, Starpower is densely distributed in South Korea, Japan, China, India and Southeast Asian countries.

StarPower co-founder Laser revealed in a recent interview:Asian users account for about 33% of StarPower’s total user base, of which South Korean users are more active, accounting for about 25% of Asian users.

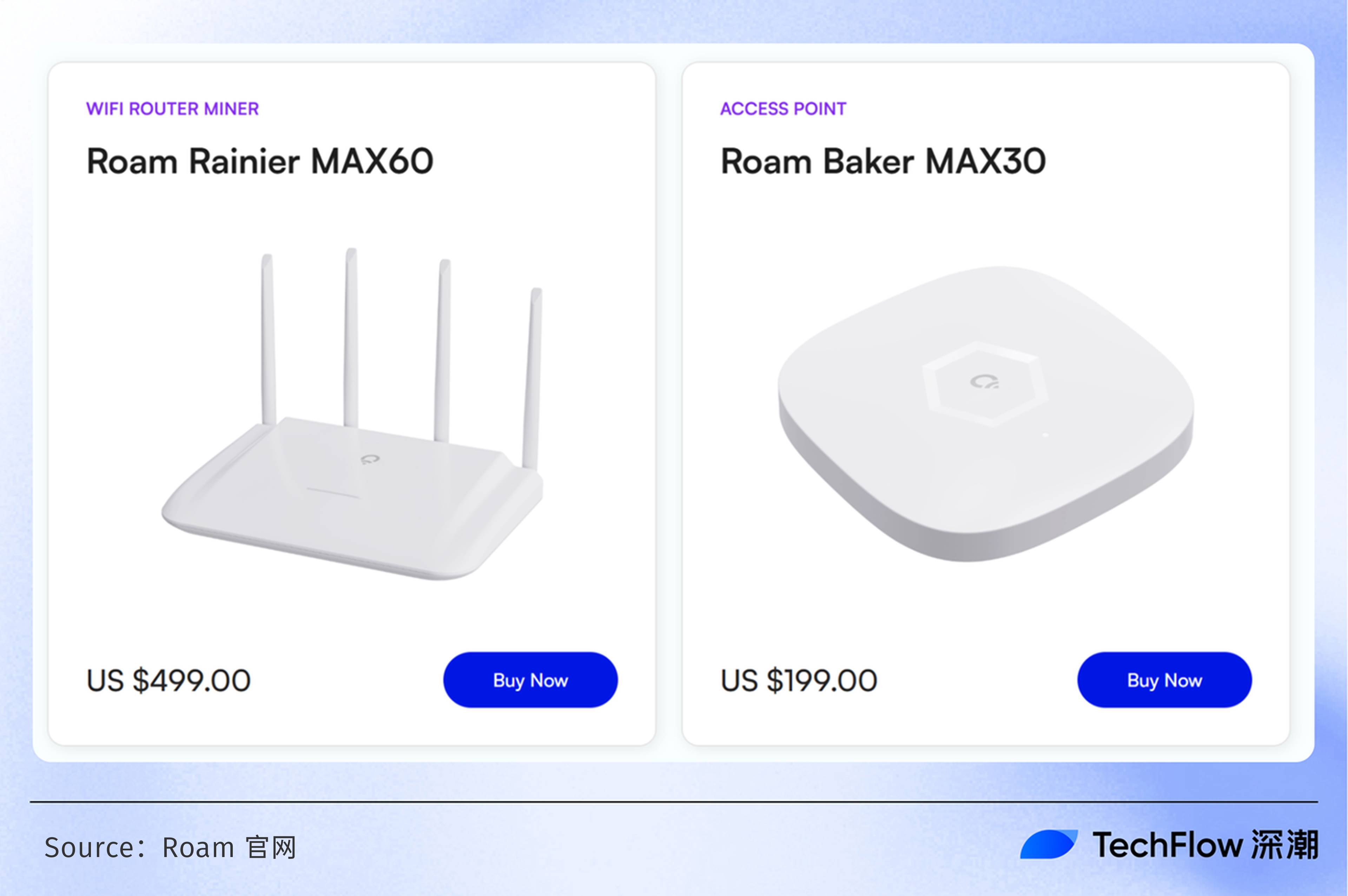

Roam

It is committed to building a decentralized WiFi roaming network around the world, providing enterprise-level WiFi security services, and supporting seamless access to OpenRoaming and self-built WiFi nodes around the world. It is worth mentioning that Roam is the only Web3 IDP project among the 11 enterprise alliances of the WBA (Wireless Broadband Alliance) OpenRoaming program.

Roam’s operating logic is very easy to understand:

Users can join the Roam network by contributing their own WiFi. If other users connect to the WiFi, the contributors will receive corresponding points rewards, and these points can be exchanged for ROAM tokens.

In addition, Roam has also launched an official router. According to the official website, this product is divided into two models:

-

MAX30:$199

-

MAX60:$499

You can earn additional benefits by purchasing an official road router to join the Roam network, including NFT that represents more ecological interests and additional points rewards.

According to official website data, Roam has more than 2 million device connections in more than 140 countries around the world and has achieved more than 2.33 million downloads. It is worth noting that according to DePIN Scan data, Roam’s device distribution shows a clear trend: the more developed the network, the higher the device coverage, with Asia’s coverage being particularly prominent.

Through the DePIN Scan device distribution map, we can see thatMany Asian countries, including South Korea, China (including eastern China, Taiwan and Hong Kong), Japan, Bangladesh, Vietnam, and the Philippines, are equipment-intensive, especially South KoreaIt is also a high-density presence, which reflects Roam’s extensive penetration in the Asian market.

CUDIS

CUDIS is an artificial intelligence-driven wearable DePIN product that aims to promote data ownership back to users while supporting the monetization of personal health data. Based on this decentralized health platform, CUDIS enables developers to build healthcare services and conduct research. In the future, CUDIS is committed to integrating AI Coach, social networking, data confirmation and DePIN to provide users with comprehensive health solutions.

The hardware product form of CUDIS is a ring: the price is US$349 and has been updated to version 002. The software product is the CUDIS App, which has a built-in AI health coach driven by ChatGPT to meet the personalized health needs of different users.

In terms of functionality, the battery life is up to 10 days, it can fully track 9 key body indicators including heart rate, body temperature, and blood oxygen on the App, and supports 30+ exercise modes.

At the same time, CUDIS has also designed a series of daily tasks. Users can receive points rewards when completing check-in, and points will be used as chips to redeem ecological tokens.

In addition, user health data recorded by CUDIS rings will be stored on the chain in a decentralized privacy protection manner, and users will enjoy control over their data. After the CUDIS health data market is launched in the future, users can decide whether to put their data into commercial use. Use it to gain data benefits while promoting the development of the medical and health industry.

Although no relevant data on CUDIS ring sales have been found on social media, according to the “2024 DePIN Status” report released by Messari, CUDIS has recorded more than 2 million user heart rate measurements.

Edison, co-founder of CUDIS, also said in a recent interview: Although it did not initially promote any products for the Asia-Pacific region, it quickly attracted a large number of users from Japan, South Korea and other regions to buy our products after the product was launched.

This phenomenon is also confirmed by the “30-Day Health Challenge” event held by CUDIS: the users participating in the event are mainly from the United States (USA), South Korea (KR) and Japan (JP), and it can also be seen that CUDIS has penetrated into the Asian market, especially the East Asian market.

Gradient network

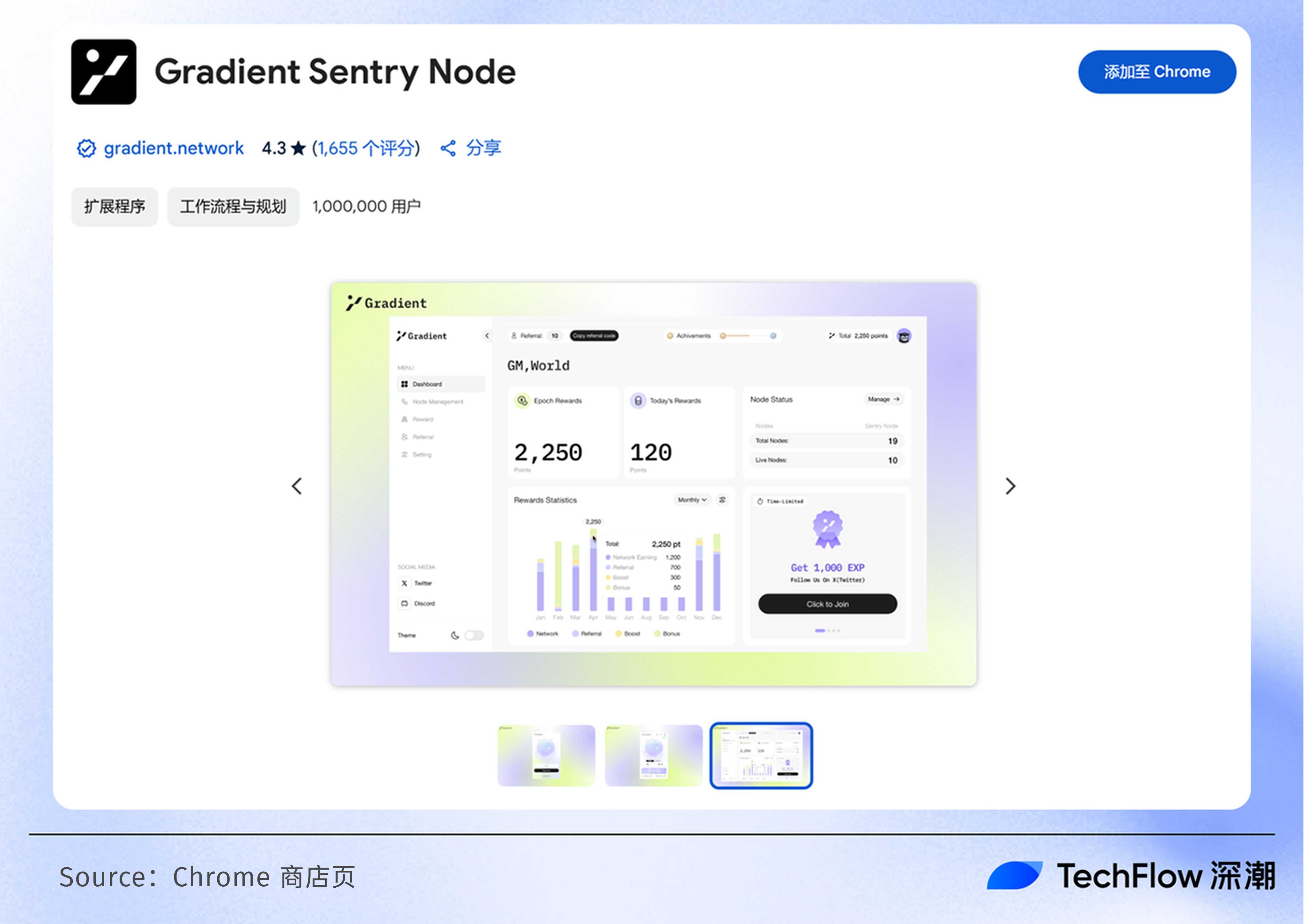

Gradient Network is an open layer of edge computing built on Solana. It aims to connect scattered and idle computing resources around the world, thereby enhancing interoperability between blockchain networks and making computing inclusive and accessible to everyone. and affordability. In September 2024, the project received investment from Pantera Capital, Multicoin Capital, Sequoia Capital and other institutions.

Gradient and DAWN are both IP mining projects. Users can join Gradient’s computing network and download its mining extension program to receive rewards by supporting AI and Web3 applications.

Previously, Gradient Network has launched Sentry Nodes, a lightweight browser extension product. Its core function is Taps, a short P2P connection to confirm Sentry Nodes ‘activity and measure latency. Personal computing devices can easily install Sentry Nodes and be rewarded for becoming part of a globally distributed P2P connectivity infrastructure that requires no license.

According to official website data, 1.34 million Sentry Nodes from 193 regions around the world have joined the community and established more than 700 million taps. Looking at the distribution map of Sentry Nodes on the official website, we can find:

Since the mainland of China IP is not currently supported, the the mainland of China area is blank. But outside of the mainland of China, Sentry Nodes are densely distributed in Asian regions including South Korea, Japan, China Taiwan, China Hong Kong, India, Vietnam, Thailand, and the Philippines.

Outside Asia, Sentry Nodes are also widely distributed in Europe, North America, and South America.

Jambo

Jambo is an on-chain mobile network project with its iconic product JamboPhone at its core and aims to revolutionize the way people contact the encryption industry. It prioritizes scalability, security and user accessibility, simplifying access to digital financial tools, while promoting creativity and community.

As an encrypted native smartphone, JamboPhone was talked about by the DePIN community in 2024 with its price of US$99, 860,000 units shipped, and its outstanding results in connecting 9.85 million wallet users. In terms of functionality, JamboPhone has a built-in multi-chain wallet that supports asset storage and management of various mainstream blockchains, helping users easily control their digital assets. In addition, the mobile phone is also equipped with a DApp store, which brings together various high-quality decentralized applications, covering games, finance, social and other fields to meet the diverse needs of users.

In January 2025, Jambo officially launched the $J token based on Solana and landed on Bitget LaunchX, aiming to promote its satellite launch plan to connect to the global JamboPhone network and expand the coverage of decentralized services.

Many people’s first impression of Jambo is African projects, but Jambo is closely connected to the China market: Jambo co-founder and CEO James grew up in Congo (DRC) since childhood and is a China native of Zhejiang.

In addition, the reason why JamboPhone can achieve million-level mass production in a short period of time is inseparable from the strong manufacturing in China behind it: it is reported that Jambo has established cooperation with three very excellent supply chain partners in Shenzhen and Dongguan to ensure efficient hardware production and stable supply of accessories.

What is worth pondering is that although JamboPhone has the vision of “bringing millions of people in emerging markets such as Latin America, Southeast Asia and Africa to access Web3 technology,” there is still a strong Chinese basics behind the US$99 manufacturing in China.

According to Dune data, the Asian market accounts for more than 35% of the regional distribution of JamboPhones sales, while the China market accounts for as high as 12% of the Asian market.

Decharge

DeCharge is committed to building a community-driven decentralized electric vehicle charging infrastructure. This strategic positioning has formed a natural and close connection with the China and even Asian markets.

According to data from British consulting firm RhoMotion, global electric vehicle sales (excluding hybrid vehicles) will reach approximately 17.1 million units in 2024, a year-on-year increase of 25%. Among them, the China market accounts for 64% of the global share with sales of 11 million vehicles, demonstrating strong market leadership.

At the same time, the electric vehicle market in Asian countries such as India, Thailand and Indonesia has also shown rapid growth. Independent analyst firm Canalys predicts that by 2025, India’s electric vehicle sales will exceed 300,000 units, the new car penetration rate will increase to 6%, and the compound annual growth rate will reach 59%.

The booming development of electric vehicles in Asia has generated strong demand for charging infrastructure. In this context, DeCharge, relying on its decentralized model and community-driven advantages, is expected to expand rapidly in the Asian market and become an important force in promoting industry change.

At the end of 2024, DeCharge has launched The Beast, a 7-kilowatt charger product that uses DePHY technology and sells for $1299. When others use the charging device, its purchaser will be able to gain benefits and transform traditional charging infrastructure into assets that generate passive income.

Currently, The Beast has been put into use in many countries including Asia, the United States and Europe, demonstrating its potential to expand into global markets. According to the officially released market report for the second half of 2024, the number of DeCharge electric vehicle chargers deployed is 282; the total charging time exceeds 1.1 million minutes; and the total number of charges exceeds 41,300. In addition, according to official information disclosure, the team is currently carrying out active promotion strategies in countries such as India (DeCharge headquarters), Southeast Asia and Dubai.

Rona

RONA is a high-performance Web3 gaming ecosystem committed to combining advanced hardware with blockchain technology to provide players with an immersive gaming experience and the opportunity to earn revenue through games. By integrating fun gameplay, token incentives and AI computing power sharing, RONA aims to create a new ecosystem for players that can both enjoy gaming and achieve economic value added.

RONA’s core products include hardware game devices RONA NEXUS and RONA SYNC, as well as the game operating system RONA OS:

Currently, hardware game equipment is in the pre-sale stage. By integrating advanced game handles, equipped with powerful CPUs and GPUs, and equipped with high-resolution LCD screens, RONA hardware game equipment will provide players with immersive game control and a vivid visual experience.

At the same time, Rona also has revenue attributes: on the one hand, players will be able to earn revenue through P2E; on the other hand, whether they are using the idle power of the device to participate in mining tasks, or sharing GPU resources to the Rona platform to empower AI games. With the development of models, players will receive additional revenue. In addition, as game items continue to increase on the Rona platform, players will also receive airdrops for third-party games.

It is worth noting that although the official website and social media have not yet disclosed a large amount of user-level data, Rona is rooted inJapan, and the Japanese market itself has a profound foundation in the game industry,Including a large player base, rich IP resources and the world’s leading game hardware industry (such as Sony, Nintendo, etc.).

In addition, Rona has received support from many top Japanese institutions in the traditional and cryptographic fields, including Sony, NTT docomo, SBI, ACG and Jasmy. Strong institutional endorsement will provide strong support for the project in terms of game development, hardware innovation, animation and game IP resource integration, further consolidating its competitive advantages in the industry.

WiFi Dabba

Many people regard Dabba as India’s version of Helium. Both belong to the Web3 DePIN hotspot project, but Dabba is more focused on consumer WiFi.

Specifically, Dabba has proposed an innovative “managed deployment” model that integrates and authorizes more than 100,000 cable operators to deploy your hotspots where they are needed most across India.

At the same time, every 1 GB of data consumed burns local DBT tokens equal to the price consumers pay for that data. This local DBT token is issued only to hotspot owners, who are the people who buy the actual hardware to provide users with Internet connectivity, and local cable operator companies install the equipment in India.

This approach not only simplifies the hotspot deployment and maintenance process, but also allows hundreds of millions of Indian users eager for WiFi services to obtain affordable products.

Currently, Dabba has also launched its hardware product WiFi Dabba Lite, which sells for $199. Dabba previously planned to launch 100,000 Dabba Lite devices in India to provide Internet services to unconnected users in India. According to explorer.dabba data, Dabba has deployed more than 4000 hotspots across India, with more than 72,000 connected devices.

For a long time, India has had significant deficiencies in the coverage and efficiency of its network infrastructure. According to data from the Internet and Mobile Association of India (IAMAI), India’s overall Internet penetration rate is only 35%, and it is as low as 20% in rural areas. A large number of people still urgently need low-cost Internet access solutions.

On the other hand, India has a vast territory and complex terrain, and the construction and maintenance costs of traditional network infrastructure are high, resulting in a significant gap in urban and rural network coverage. Centralized networks are prone to congestion during peak hours, further affecting the user experience.

Based on this, Dabba’s decentralized WiFi solution can utilize resources more efficiently, which not only improves network stability and speed, but also significantly reduces operating costs. At the same time, the rapid popularization of smartphones in India and the digital transformation vigorously promoted by the government have provided Dabba with strong growth momentum and made its development potential in the Indian market more prominent.

VC inventory of Asian investment in DePIN

In the previous cycle, DePIN participation was mainly dominated by European and American institutions. In the current DePIN cycle, more Asian institutions continue to emerge, demonstrating the growing interest in DePIN in the region.

We also took stock of the layout of Asian investment institutions on DePIN.

Yzi Labs

VClocation: Singapore, United Arab Emirates

the number of investment projects:5

projects are distributed:

-

NYM:Building the next generation privacy infrastructure

-

Ankr:Web3 infrastructure provides node-as-a-service

-

Privasea:Decentralized private computing infrastructure

-

Swan Chain:Decentralized AI infrastructure

-

CoralApp: Web3 Fitness App

Animoca Brands

VClocation: China Hong Kong

the number of investment projects:7

projects are distributed:

-

io.net: Decentralized computing networks

-

GEODNET: Decentralized network for Earth observation

-

peaq:The Web3 network that supports the Internet of Things

-

Aethir:Decentralized real-time rendering network

-

Hivello:Utilize idle computer resources to support various DePIN protocols

-

Domin Network : DePIN Rollup for Business

-

Nodepay: Decentralized bandwidth infrastructure

Waterdrip Capital

VClocation: China

the number of investment projects:15

projects are distributed:

-

IoTeX: DePIN Modular Infrastructure Platform

-

peaq: Web3 network that supports the Internet of Things on Boca

-

Jambo: On-chain mobile network

-

Oort: Web3 data infrastructure

-

Phala Network: Off-chain computing infrastructure

-

Network3: AI trains Layer2 networks

-

Swan Chain: Decentralized AI infrastructure

-

SkyX: Decentralized Weather Network

-

AiGO Network: DePIN Data Network

-

ATT: Digital advertising ecosystem

-

Nubila Network: Data Oracle

-

DePHY: Integrated DePIN framework

-

PowerPod: Sharing electric vehicle charging network

-

Ordz Games: Retro arcade games

-

Parasail: Re-pledge agreement to pledge DePIN assets

IOSG Ventures

VClocation: China Hong Kong/New York

the number of investment projects:6

projects are distributed:

-

IoTeX: DePIN Modular Infrastructure Platform

-

Phala Network: Off-chain computing infrastructure

-

Theta Network: Media and entertainment-centered blockchain

-

Filecoin: Decentralized storage network

-

OpenLayer: Modular real data layer

-

MXC: Smart City IoT Network

FutureMoney

VClocation: China

the number of investment projects:8

projects are distributed:

-

IoTeX: DePIN Modular Infrastructure Platform

-

Natix Network: Decentralized camera network

-

Pocket Network: The blockchain data ecosystem for Web3 applications

-

Nubila Network: Data Oracle

-

DePHY: Integrated DePIN framework

-

PowerPod: Sharing electric vehicle charging network

-

JDI Global: Web3 hardware manufacturer

-

Hotspotty: An all-in-one tool for building and expanding DePIN networks

Foresight Ventures

VClocation: China Hong Kong, Singapore

the number of investment projects:7

projects are distributed:

-

IoTeX: DePIN Modular Infrastructure Platform

-

io.net: Decentralized computing networks

-

Ola: Bitcoin Ecological Benefit Enhancement Network

-

CUDIS: AI-driven wearable DePIN products

-

Glacier Network: Accelerate AI and DePIN data infrastructure

-

DePHY: Integrated DePIN framework

-

Parasail: Re-pledge agreement to pledge DePIN assets

Hashed

VClocation: South Korea

the number of investment projects:2

projects are distributed:

-

IoTeX: DePIN Modular Infrastructure Platform

-

Jambo: DePIN mobile phone

JDI Global

where the company is located: China (JDI is a hardware manufacturing company)

the number of investment projects:9

Project Division:

-

Roam:Decentralized global WiFi network

-

GEODNET:Decentralized network for Earth observation

-

U2U Network: A DAG-based and EVM-compatible blockchain network

-

UXUY:One-stop decentralized exchange

-

MXC:Smart City IoT Network

-

PumpX: Decentralized anonymous communication protocol

-

MetaPhone: TON-based smartphones

-

DeMR:Decentralized privacy live video infrastructure

-

PowerPod:Shared electric vehicle charging network

Conclusion:Asia, the invisible pillar of Solana DePIN

Through observation and research on the Solana DePIN project in the Asian market, we can clearly see that Asia is not only the core area of global hardware manufacturing, but also a natural testing ground for the demand side of the DePIN project.

From supply chains to user behavior, from hardware manufacturing to market penetration, Asia plays an irreplaceable role in the DePIN ecosystem.

On the supply side, Asia provides hardware support for global DePIN projects with its complete manufacturing industry chain and significant cost advantages. The manufacturing capabilities of the Guangdong-Hong Kong-Macao Greater Bay Area, the Yangtze River Delta and Southeast Asia make hardware production efficient and inexpensive, making it the main source of global supply of DePIN hardware. This advantage is not limited to hardware manufacturing, but also reflected in the deep integration of supply chain efficiency and technology accumulation.

On the demand side, the user characteristics of the Asian market naturally match DePIN’s incentive mechanism. The high-density population distribution, acceptance of the sharing economy model, and penetration of the mobile Internet make Asia the best testing ground for DePIN application scenarios.

From Jambo’s smartphones to CIDIS’s smart rings, to the localized layout of multiple benchmark projects, the enthusiasm and participation shown by Asian users provide the DePIN project with the possibility of rapid expansion.

In addition, local Asian investment institutions are also beginning to make their mark on the DePIN track. Different from the pattern dominated by Europe and the United States in the previous cycle, during this cycle, Asian capital is actively deploying DePIN projects, demonstrating strong regional influence. This not only provided more financial support for the DePIN project, but also promoted its further implementation in the Asian market.

For any project looking to gain a place on the DePIN track, a deep understanding of the uniqueness of the Asian market and active integration into this ecosystem will be the key to success.

No matter what the crypto market holds, DePIN’s story continues.

Asia will always be an integral part of this story.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern