Just as the market was in a downturn, the strategic reserve was revisited and was basically confirmed, but the market still managed to stop its decline.

Trump, here to put out the fire.

The market’s roller coaster rides one after another, and last week was no exception. Under the attack of tariffs and theft, market panic spread rapidly. BTC, which has always been strong, fell below US$80,000, ETH reached around US$2200, and the copycat leaders BNB and SOL were even overwhelmed and returned to last year. The price at the end of the year.

Amid the wailing,”savior” Trump sent another boost in the arm. Perhaps because the currency circle in the second stock market, which represents political achievements, is too depressed and is a slap in the face, Trump issued a document last Sunday, once again putting the crypto strategic reserves on the agenda, saying that he would accelerate the promotion of crypto reserves including five major currencies. In other words, crypto reserves are firmly established, and the market has lived up to expectations and ushered in a rapid rebound.

But making reserves is not as simple as the president’s lips.

After BTC fell below US$80,000 on Friday, the market’s sentiment dropped to freezing point. Discussions from a bull market to a bear market were endless. Yin and volatility became the main theme of many currencies. The market even began to pay attention to the shutdown price of mining machines. The downturn can be seen. But success is Trump, failure is Trump, and the value of this sentence is still rising.

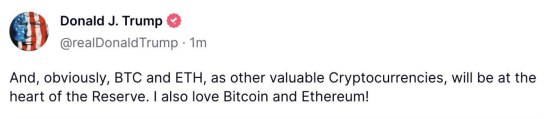

Just yesterday night, Trump, the Bitcoin president of the United States, couldn’t sit still. Trump said in a post to his self-created Truth Social that “the U.S. Crypto Reserve will elevate this critical industry and free it from years of corruption suppression by the Biden administration.” Therefore, my Executive Order on Digital Assets directs the Presidential Working Group to advance the establishment of a Crypto Strategic Reserve, which includes XRP, SOL, and ADA. I will ensure that the United States becomes the global cryptocurrency capital. We are making America great again!”

This is not the first time that crypto strategic reserves have been mentioned in the United States. Since Trump promised to establish reserves at the Bitcoin Conference last October, there has been no end of news about crypto reserves. Whether it’s U.S. Senator Cynthia Lummis

The proposed purchase of 1 million BTC and the subsequent outflow of the so-called crypto reserve construction framework continue to add to the expectations of the United States ‘crypto reserves.

Although the matter was not given a very high priority after the president took office, and encryption was not among the top 100 executive orders, on January 24, Trump handed over this pledge on encryption. It signed a document entitled “Strengthening U.S. Leadership in Digital Financial Technology”, which will establish a presidential working group, clarifying that within 180 days of the issuance of the order, the working group should submit a final report and proposals to the President, including the formulation of a complete federal regulatory framework that regulates the issuance and operation of digital assets (including stablecoins) in the United States. At the same time, the possibility of establishing and maintaining a national reserve of digital assets should be evaluated and criteria should be proposed for establishing such reserves, which may come from cryptocurrencies legally seized by the federal government through law enforcement efforts.

At that time, because the reserves came from legal seizures rather than incremental purchases, and there was still room for operation for a period of time, the market was quite unconvinced and even disappointed. With the liquidity crisis caused by its issuance of coins and subsequent policy propositions, encryption reserves have gradually not been mentioned. Industry people have also expressed extreme dissatisfaction with the president’s reaping of money. The former love of support has gradually evolved into a hatred of wealth.

However, just as the market was in a downturn, the strategic reserve was revisited and was basically confirmed, and the market still managed to stop its decline. In this article, Trump rarely specified the currency and proposed that SOL, ADA, XRP and other altcoins would be included. However, what is quite interesting is that at the beginning of the article, Trump did not even mention BTC and ETH, which made ETH holders very angry, but then he added again,”Obviously, Bitcoin and Ethereum will become the core of the currency reserve.”

This move has a very significant boost to the market. After the news was released, BTC quickly rose from US$85,000 to US$95,000, with the highest increase of more than 10%, and is now reported at US$92,000. ETH also rebounded to US$2550, and the total market value of crypto rebounded by 9% to US$3.254 trillion. The reserve currencies clearly pointed out by Trump were even more blockbuster. The ADA rose by more than 70% in 24 hours, with a market value of more than US$40 billion. It ranked eighth among cryptocurrencies. XRP once hit US$2.99, fully diluted value surpassed ETH., and SOL has also stepped out of the haze of large unlocks and MEMEs and returned to above US$170.

In response, Joseph Lubin, founder of Consensus sys and co-founder of Ethereum, posted a post on social media praising Trump’s “call for orders” behavior, saying,”This is an epic call for orders. President Trump is a Responsive and confident leader, thank him.”

Behind the call for orders, there are not a few doubts from Mouchang. For example, on the eve of Trump’s announcement, a giant whale that leveraged 50 times long BTC and ETH in Hyperliquid used about US$4 million in funds to leverage a position with a total amount of about US$200 million. At that time, the price of Bitcoin and Ethereum was around US$85,000 and US$2210 respectively. At present, the address has been fully closed, making a profit of nearly US$7 million in less than 24 hours. Based on the initial capital of US$4 million, the yield is 175%.

The inside information may not be true, but this is not a rumor. After all, Trump has never mentioned including currencies other than BTC and ETH in reserves before. However, this article is the first to release a list of altcoins, but instead puts the mainstream reserve currencies last. The cart before the horse is obviously put. Looking at the new three currencies SOL, ADA, and XRP that have entered the reserve, they are all currencies that have capital lobbying. They are obviously suspected of “advertising spaces”, and the transfer of benefits is not groundless.

SOL is originally an endorsement of Western capital, while Ripple is experienced. Before the election, it made bets on both sides and donated US$45 million to Fairshake, the Cryptographic Political Action Committee. After Trump was elected, it immediately expressed its loyalty and donated US$5 million in XRP at Trump’s inauguration ceremony, and another US$25 million was donated to Fairshake before the U.S. midterm elections, which has a close relationship with Trump. The entry of ADA was surprising. The currency originated from Cardano and had not been taken seriously by Trump before. However, according to CryptoDoggyCN, in early February, the founder of ADA said that he would go to Florida to meet with big shots. Alex Xu, a research partner at Mint Ventures, also analyzed that SOL, XRP, and ADA went to Mar-a-Lago Manor frequently after Trump took office.

On the other hand, the president’s “choice” is really very arbitrary and even seems to ignore laws and regulations. SOL was previously designated as a securities by the SEC, and its attributes are not clear now. Therefore, the approval of ETFs is not progressing as quickly as LTC. Ripple is not inferior. The lawsuit with the SEC has been in dispute for nearly five years and is not yet over. There is no trace of ADA’s entry. If not for the transfer of benefits, it can only prove that it has randomly chosen among the top 9 currencies in the market value. After all, the president is not a “knowledgeable” person in the field of encryption.

It can be seen that this call has more or less elements of lobbying, and the president’s number one advertising space is likely to be given to the currency with the most lobbying benefits. In this regard, many industry people have also expressed strong dissatisfaction, believing that the president’s move not only weakens the legitimacy of strategic reserves, but is also irresponsible to taxpayers and currency holders. Naval Ravikant, co-founder of AngelList, admitted that “American taxpayers should not take over those nominally decentralized cryptocurrencies.” Aave founder Stani Kulechov also spoke sharply, saying that the addition of XRP, SOL and ADA was ugly news.

Although irony is ironic, the implementation of strategic reserves seems to be far from enough based on the president’s verbal check.

The core question is, where does the money come from? For now, Bitcoin has existing reserves in the United States, but if we want to establish crypto reserves, especially those containing other currencies, we cannot avoid the problem of capital purchases. According to the latest data from the U.S. Congressional Budget Office (CBO), the U.S. federal budget deficit in fiscal year 2025 will reach US$1.865 trillion, accounting for 6.2% of the gross domestic product (GDP). The huge deficit has made Trump use of many strange tricks, either to impose additional tariffs, or to close the internal government, and even announced a new plan to buy an immigrant gold card for US$5 million. The problem directly revealed by various measures is that the landlord’s family really has no food left.

In this context, whether it is for the government or himself, Trump, who has fallen into the money eye, has achieved all current policy implementation paths based on the “empty gloves and white wolf” model, whether it is various tortures in the field of encryption, or building a virtual world, etc., monetization of traffic is Trump’s ultimate goal. It is absolutely impossible for them to put out real money to invest in encryption reserves or pull orders. The greater probability is for encryption companies to provide them first, then maintain their reserves, and withdraw funds from them.

BitMEX co-founder Arthur Hayes bluntly said that the move was nothing new, saying,”When they get congressional approval to borrow money or raise gold prices again, please let me know.” Without these, they would have no money to buy bitcoins and altcoins.” Some industry insiders also said that Trump frequently uses “reserve” and “stockpile” alternately in policy terms, and the specific implementation method is difficult to determine.

From a practical perspective, if strategic reserves at the federal level are to be passed, they must be approved by Congress, rather than decided by the president. Although the president won both houses, it was not an overwhelming advantage, especially in the House of Representatives, where he narrowly won by only 5 votes. The game between the two parties is far from over. Instead, it is becoming increasingly fierce, and the government shutdown is booming. On the other hand, the increase in the reserve composition of many currencies will inevitably increase the difficulty of approval. After all, it is obviously unrealistic for currencies that are already in litigation to be used as strategic reserves, and the road to congressional approval is foreseeable and difficult to go smoothly. It is worth mentioning that in the past week, the U.S. SEC dropped its lawsuit against Coinbase and terminated investigations into projects such as Robinhood Crypto, OpenSea, Uniswap Labs, and Tron, but has not yet ended Ripple’s lawsuit.

If you want to seek to bypass Congress, you can only start with the national sovereign fund. However, the national sovereign fund did not mention crypto assets before, and at the same time, if you want to join the fund. For Trump, a businessman president with interests at its core, it is inevitable to pay more political donations, which is naturally a heavy burden for crypto companies. Perhaps this is the case. Under this kind of good news, although Bitcoin and Ethereum have increased rapidly, they have not exceeded new highs, only hovering on the average line.

However, whether it is the transfer of benefits or the opportunity to call for orders, in the final analysis, Trump’s remarks this time have once again made the market come alive. For the currency circle, which is lingering on the border between the bull-bear and the bull, it is also a sweet rain in the long drought.

On March 7, Trump will hold the first White House Cryptocurrency Summit and deliver a speech. The summit will be chaired by White House encryption director David Sachs and managed by Bo Hines, executive director of the working group. Will Trump surprise or scare the industry at this summit? The market’s nose is ultimately being led by Trump.