The Office of the Tariff Commission of the State Council issued an announcement stating that starting from March 20, 2025, a 100% tariff will be imposed on rapeseed oil, oil cake, and peas originating in Canada; a 25% tariff will be imposed on aquatic products and pork originating in Canada. China urges Canada to view bilateral economic and trade cooperation rationally, respect objective facts, abide by World Trade Organization rules, and immediately correct erroneous practices.

Financial Union reported on March 8 that the Office of the Tariff Commission of the State Council issued a notice stating that starting from March 20, 2025, a 100% tariff will be imposed on rapeseed oil, oil cake, and peas originating in Canada; a 25% tariff will be imposed on aquatic products and pork originating in Canada.

Announcement of the Tariff Commission of the State Council on imposing additional tariffs on some imported goods originating in Canada

Taxation Committee Announcement No. 3 of 2025

The Canadian government announced that it will impose a 100% tariff on electric vehicles imported from China starting from October 1, 2024; and a 25% tariff will be imposed on steel and aluminum products imported from China starting from October 22, 2024. Canada’s measures seriously violate World Trade Organization rules and are typical protectionist practices that constitute discriminatory measures against China and seriously damage China’s legitimate rights and interests.

In accordance with laws and regulations such as the Tariff Law of the People’s Republic of China, the Customs Law of the People’s Republic of China, the Foreign Trade Law of the People’s Republic of China and the basic principles of international law, with the approval of the State Council, additional tariffs will be imposed on some imported goods originating in Canada starting from March 20, 2025. Relevant matters are as follows:

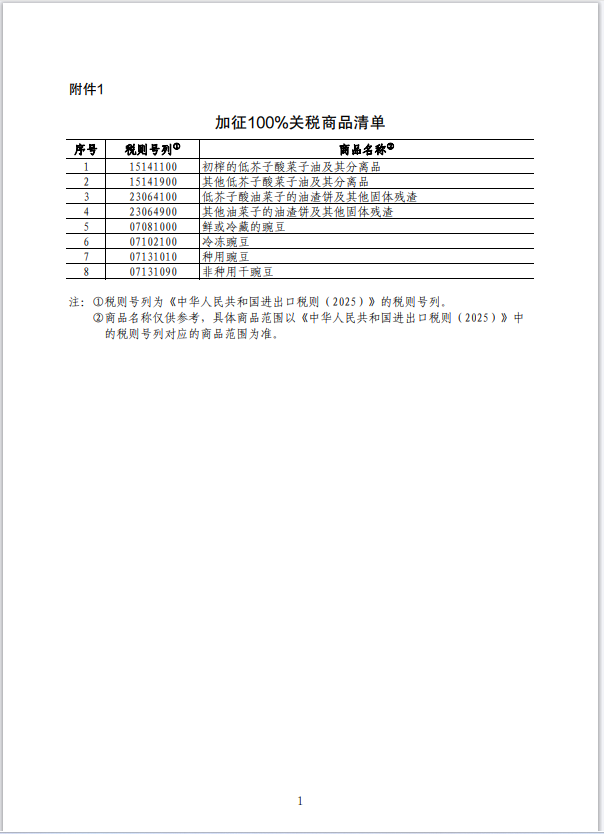

1. A 100% tariff will be imposed on rapeseed oil, oil cake, and peas. See Annex 1 for the specific range of commodities.

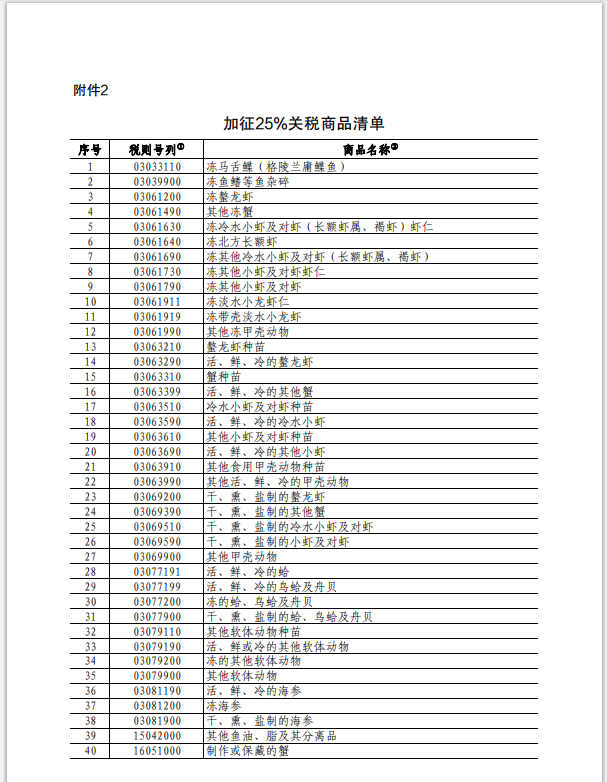

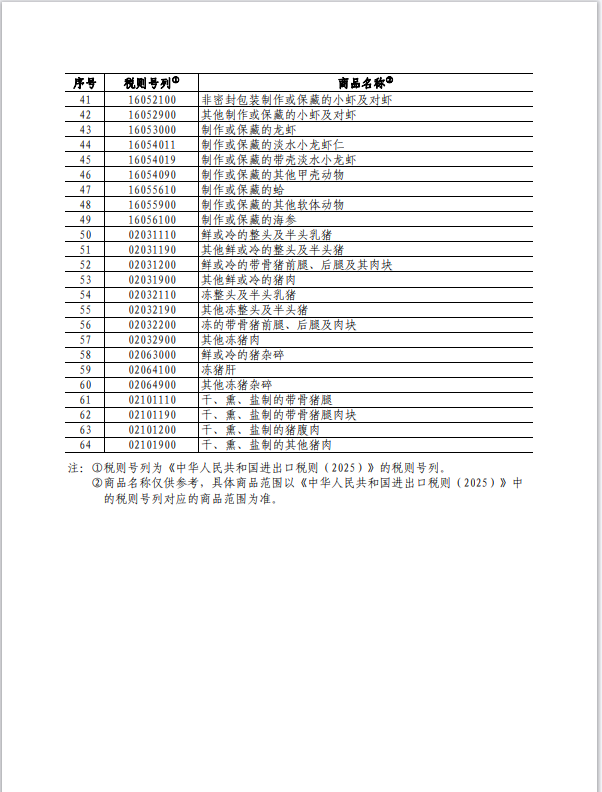

2. A 25% tariff will be imposed on aquatic products and pork. See Annex 2 for the specific range of commodities.

3. For imported goods listed in the Annex originating in Canada, corresponding tariffs will be levied on the basis of the current applicable tariff rate. The current bonded and tax reduction and exemption policies will remain unchanged, and the additional tariffs imposed this time will not be exempted or exempted.

4. Collection of relevant import taxes:

Additional tariff amount = tariff assessable price × additional tariff rate

Tariff = Duty payable based on the current applicable tax rate + Duty Added

Import value-added tax and consumption tax are levied in accordance with relevant laws and regulations.

Customs Tariff Commission of the State Council

March 8, 2025

Annex 1: List of commodities subject to 100% tariff increase

Annex 2: List of commodities subject to a 25% tariff increase