Wen| Silicon-based laboratory, author| kiki

A China-style innovation storm caused by DeepSeek has plunged Silicon Valley into an innovation panic, but also caused Wall Street to once again question the supergiants ‘”money-spending plans.”

After saving the $500 billion “Stargate” project, OpenAI founder Sam Altman felt that it was not enough. They continued to add additional AI infrastructure. The next goal was to “achieve a 5 trillion computing cluster in the future.”

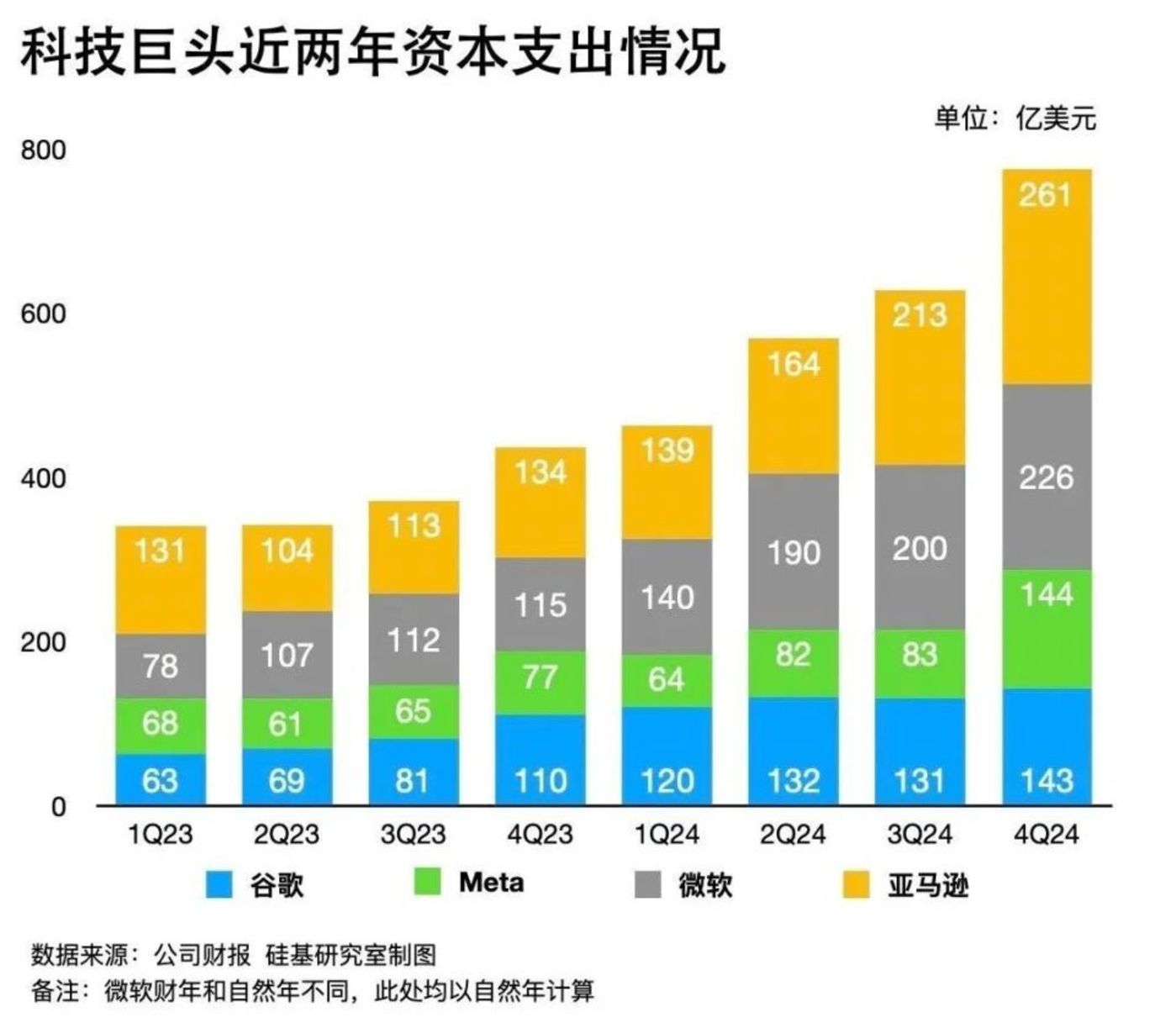

According to statistics from the Silicon-Based Research Laboratory, in 2024, four technology giants Amazon, Microsoft, Google’s parent company Alphabet and Meta spent more than US$240 billion on capital expenditures (CAPEX). According to new guidelines given by executives at the earnings call, this figure is expected to exceed US$320 billion in 2025.

Technology giants continue to issue huge AI-related bills.

Looking at the longer timeline, starting from Q2 of 2023, the capital expenditures of Microsoft, Meta, Amazon and Google have actually shown a significant upward trend. If we look at it according to the indicator of “capital intensity”(capital expenditure as a proportion of revenue),In 2024, Microsoft, Meta, Amazon and Google will account for 17.2% of total revenue in capital expenditures, which is even higher than the previous round of capital expenditures by large energy companies.(Note: Between 2012 and 2016, due to rising oil prices, oil majors spent 10.2% of their revenue on huge capital expenditures to increase production capacity.)

Technology giants have not stopped investing in AI infrastructure, but have entered a new peak. When sorting out the capital expenditures of the four technology companies, we are curious about the following three questions:

1. Where are technology giants spending their capital expenditures?

2. Who is more radical and who is more conservative? How do their capital expenditures differ?

3. Can giants really not stop throwing money?

1. Money flows to more radical AI infrastructure

Back in July 2024, Musk announced on X that he had spent 122 days transforming a home appliance factory into the world’s strongest AI training cluster. This computing power super factory called Colossus (Giant) has collected 100,000 pieces of H100 chips and built such a large-scale super cluster. Even Nvidia founder Huang Renxun couldn’t help but sigh: To complete it in such a short period of time, this is simply a superhuman achievement. nbsp;

Musk’s super-cluster story is a window into understanding the flow of capital expenditures by technology giants. nbsp;

Judging from the concept of “capital expenditure” alone, the majority of which is the expenditure on fixed assets such as land, real estate and equipment purchased by enterprises, which is reflected in technology giants, who need to spend money on AI infrastructure.Continue to invest in AI by purchasing AI chips, servers, networks and storage equipment, and leasing land to build data centers. This is a typical asset-heavy business.

In addition, money will also be spent on upgrading and maintaining the software and content ecosystem. Most large technology companies adopt a “combination of software and hardware” strategy. After accessing AI, giants also need to update and iterate old applications or develop native applications. nbsp;

The total capital expenditures of Microsoft, Amazon, Google and Meta have been rising in the past two years. They spend a large amount of capital expenditures on building larger data centers/clusters. Dylan Patel, founder of Semi Analysis, an organization that has long been tracking the construction of data centers among giants, said in a recent interview:“Wall Street’s estimates of capex are often too low.We track every data center around the world and find that companies such as Microsoft, Meta, and Amazon spend very large amounts on data center capacity. rdquo;

A domestic technical expert engaged in the server industry once analyzed to the “based Research Laboratory” that from a cost perspective,Data center investment costs are mainly divided into hardware equipment, daily operation investment in computer rooms (including rent, cabinet costs, water and electricity energy consumption costs, bandwidth, etc.) and personnel costs, etc., among which the bulk is also hardware equipment procurement including AI chips.

Sung Cho, investment manager at Goldman Sachs Asset Management, pointed out that nearly 50% of cloud vendors ‘capital expenditures are invested in purchasing Nvidia chips. Market research consulting firm Omdia has also released a set of data. The largest buyer of Nvidia’s flagship Hopper chips is still a major technology company. Microsoft purchased 485,000 Hopper chips last year, and Meta bought 224,000. Nvidia Chief Financial Officer Colette Kress revealed at this year’s CES conference that the latest Blackwell GPU chips are being shipped as scheduled, but demand still exceeds supply, and predicts that Nvidia’s data center business is “definitely a year of growth.” nbsp;

However, to understand that major technology companies are competing for AI infrastructure, we cannot just focus on the astonishing numbers. nbsp;

First of all, Microsoft, Meta, Amazon and Google spend money abroad on the premise that they all have high cash flows and solid balance sheets based on their respective business models.

Secondly, big manufacturers are not blindly making big capital expenditures as outsiders say. In fact,Although AI infrastructure cannot be stopped in the short term, the giants are still trying their best to save what can be saved.

They are also using self-developed chips, extended server depreciation cycles, and cooperated with energy companies to plan resources more rationally, improve computing power utilization, and ensure profit margins. nbsp;

Meta executives said during the earnings call that they had raised the estimated useful life of “certain servers and network assets” from 4-5 years to 5.5 years. In addition, major manufacturers that have “suffered from Yingwei for a long time” have also invested in the development of ASIC chips that are “more cost-effective” in specific scenarios, seeking alternative solutions. nbsp;

2. Who is radical and who is conservative?

Although they are all issuing huge expenditure bills, due to differences in strategies and business structures, the giants have their own characteristics in spending money in this wave. nbsp;

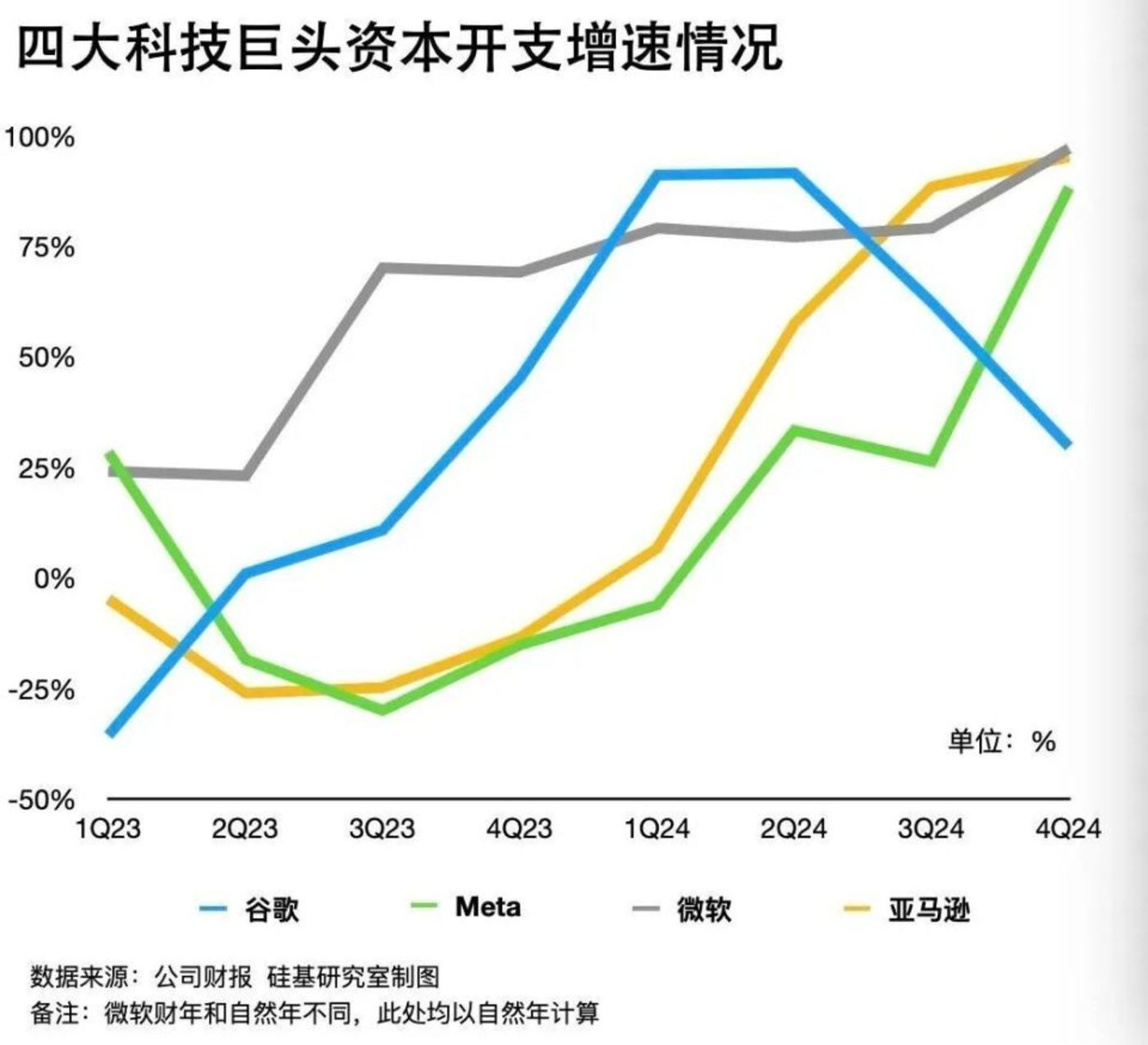

Summary in one sentence:Radical Meta, neutral Microsoft and Google, cautious Amazon.

Compared with ten years ago, Meta’s capital expenditure has increased nearly 20 times, which exceeds that of cloud giants. In 2025, Meta plans to invest US$60 billion to US$65 billion in capital expenditure to promote the development of artificial intelligence. Zuckerberg has also repeatedly shown his determination to gamble heavily on the future of AI. nbsp;

Meta’s aggressive investment in AI is driven by a combination of changes in its business model and strategy.

First of all, Google, Amazon and Microsoft have their own cloud businesses. The logic for investing in AI infrastructure is to use AI to drive the scale of cloud businesses, thereby sharing costs equally and retaining profits. However, the core driving Meta’s revenue growth is the advertising business around social traffic, especially the VR related Reality Labs business is still losing money. nbsp;

Therefore, for Meta, how to use AI to improve quality and efficiency on the user scale and advertiser side is a more critical matter. According to incomplete statistics from the “Silicon Research Laboratory”, Meta has launched tools such as Meta AI and Meta Advantage+ around its own APP family. On the other hand, Meta has cooperated with Nvidia to train more complex artificial intelligence models. Bring more personalized and accurate advertising ranking recommendations, which also rely on greater computing power.& nbsp;

Secondly, due to its previous advocacy of open source, Meta’s personality has also been changing, accelerating the prosperity of its AI ecosystem.

Among the three major cloud giants, despiteIn 2024, the average growth rates of capital expenditures for Microsoft, Google, and Amazon will be 83%, 69% and 62%, respectively, all of which are investment highs.However, looking at the longer timeline, in the past two years, Microsoft and Google have maintained a relatively high growth rate in capital expenditure, but Amazon only started in Q2 2024 when the year-on-year growth rate of capital expenditure increased significantly. nbsp;

There are two reasons for the above differences:First, as the market leader, Amazon AWS has maintained a market share of around 30% in the cloud computing market for a long time. When facing the wave of AI models, it did not quickly seize the first-mover advantage through OpenAI like Microsoft did; Second, considering the stability of its own supply chain, Amazon’s capital expenditure allocation strategy is mainly internal development.

Taking self-developed chips as an example, Amazon has been in a layout for more than ten years. Anthropic, which it has invested in, has previously announced that it will cooperate with AWS’s “computing power cluster” Anthropic will deploy a computing power cluster with hundreds of thousands of Amazon’s self-developed chips in the future. nbsp;

3. The AB side of the “Jevons Paradox”

The massive spending on artificial intelligence by technology giants has split into two voices. nbsp;

There are doubts that the AI arms race of the past two years may turn into a costly gamble, especially since DeepSeek has demonstrated that cheaper methods of training and running models can achieve the same effect. nbsp;

But the other type of voice is from a medium-and long-term perspective. After reproducing DeepSeek, AI still requires new investment in computing power to enter a new exploration. From this point of view, the competition for computing power at the basic layer will continue, scale and efficiency. Walking on two legs, which is why Microsoft CEO Satya Nadella mentioned the “Jevons Paradox” again. nbsp;

Source: X

Technology giants believe that if AI is compared to coal during the Industrial Revolution, the explosion of DeepSeek can promote people’s efficiency in using AI and lead to an explosion at the application level. The “Jevens Paradox” inspires people that when the use of coal increases, people’s demand for coal continues to rise, and innovations in all walks of life will lead to an increase in coal consumption.”AI will become a commodity that can never be satisfied.” Nadella wrote this.& nbsp;

In fact, it is not that the skeptics do not understand this issue. Jesse Cohen, senior analyst at Investing.com, believes that investors are only asking for a “clearer timetable”:“Explain when AI spending translates into earnings and sales growth, not just promises.& rdquo;

But technology giants may really not be able to give a clear time, just as they never expected DeepSeek to emerge. In response to analyst questions, Zuckerberg mentioned that over time, investing heavily in capital expenditures and infrastructure will be a strategic advantage. It is possible that we will have different understandings at some point, but I think it is too early to judge.& rdquo; Chief Financial Officer Susan Li also admitted: We are not sure which stage of the cycle we are at. rdquo;

The contradiction among technology giants has also been highlighted: on the one hand, there are greedy and panicked market expectations, and on the other hand, under FOMO sentiment, in order to stay ahead of the AI table, because past experience tells them that in every early stage of technology competition cycle, companies that dare to expand may be expected to receive “rewards from the brave.” nbsp;

Google CEO ar Pichai has repeatedly emphasized that for Google,“The risk of under-investment in the AI field is far greater than the risk of over-investment.& rdquo;

But what is certain is that this high-intensity capital expenditure will not last forever. On the one hand, continued high capital expenditures will inevitably affect profits, which will adversely affect the high cash flow and balance sheets they have maintained for many years for mature technology companies; on the other hand, technology company executives also gave corresponding signals at the latest earnings call. For example, Amazon management judged that supply chain restrictions including chip supply and electricity will gradually ease in the second half of 2025. nbsp;

As Sam Altman said, in 2025, we are playing an “incredible new computing efficiency game.” From the high-intensity changes in capital expenditures of the giants, we need to see both the complex emotions of the giants and understand the current AI narrative is also moving towards efficiency and rationality. nbsp;

References:

1、The information:Big Tech’s Capex Gusher Tops Last Oil Spree