Wen| Laika think tank, author| Jin Dao, Editor| G3007

In the early morning of February 27, Beijing time, Nvidia, the high-profile global AI leader, announced its fiscal fourth quarter (November 1, 2024 to January 31, 2025) results for the fiscal year 2025.

This data generally exceeded market expectations, among which revenue growth slowed down but still hit a new high.Specifically, NVIDIA Q4 revenue increased by 78% year-on-year to US$39.331 billion, with analysts expecting US$38.05 billion; of which data center revenue was US$35.58 billion, a year-on-year increase of 93.32%. Q4 net profit was US$22.066 billion, up 72% year-on-year, corresponding to net profit per share of US$0.89, and analysts expected it to be US$0.84.

On the day after the earnings report was released, Nvidia’s share price fluctuated slightly and eventually closed red. However, on the second trading day, it experienced its second largest drop in a single day since the DeepSeek impact. The share price finally closed down US$11.13, a drop of 8.48%.

Why does Nvidia’s financial report attract attention?

Although Nvidia is a company founded in the United States and listed on U.S. stocks, Nvidia’s financial report touches the hearts of investors around the world. Why is Nvidia’s financial report so eye-catching? The main reasons are as follows:

1. Nvidia has performed well in the past few years

For an ordinary consumer, Nvidia’s existence may be the preferred graphics card brand when buying a computer. But in fact, Nvidia, as the world’s leading AI company, used to be its core business games, but currently only accounts for a small portion of its revenue. More of its revenue comes from the infinite demand for computing power of global technology companies.

This financial report shows that the data center division is by far Nvidia’s largest source of revenue, with sales of US$35.6 billion. This exceeded the average forecast of $34.1 billion. Game-related sales, once Nvidia’s core business, reached $2.5 billion, with average analysts expecting $3.02 billion. Revenue from the automotive business was US$570 million.

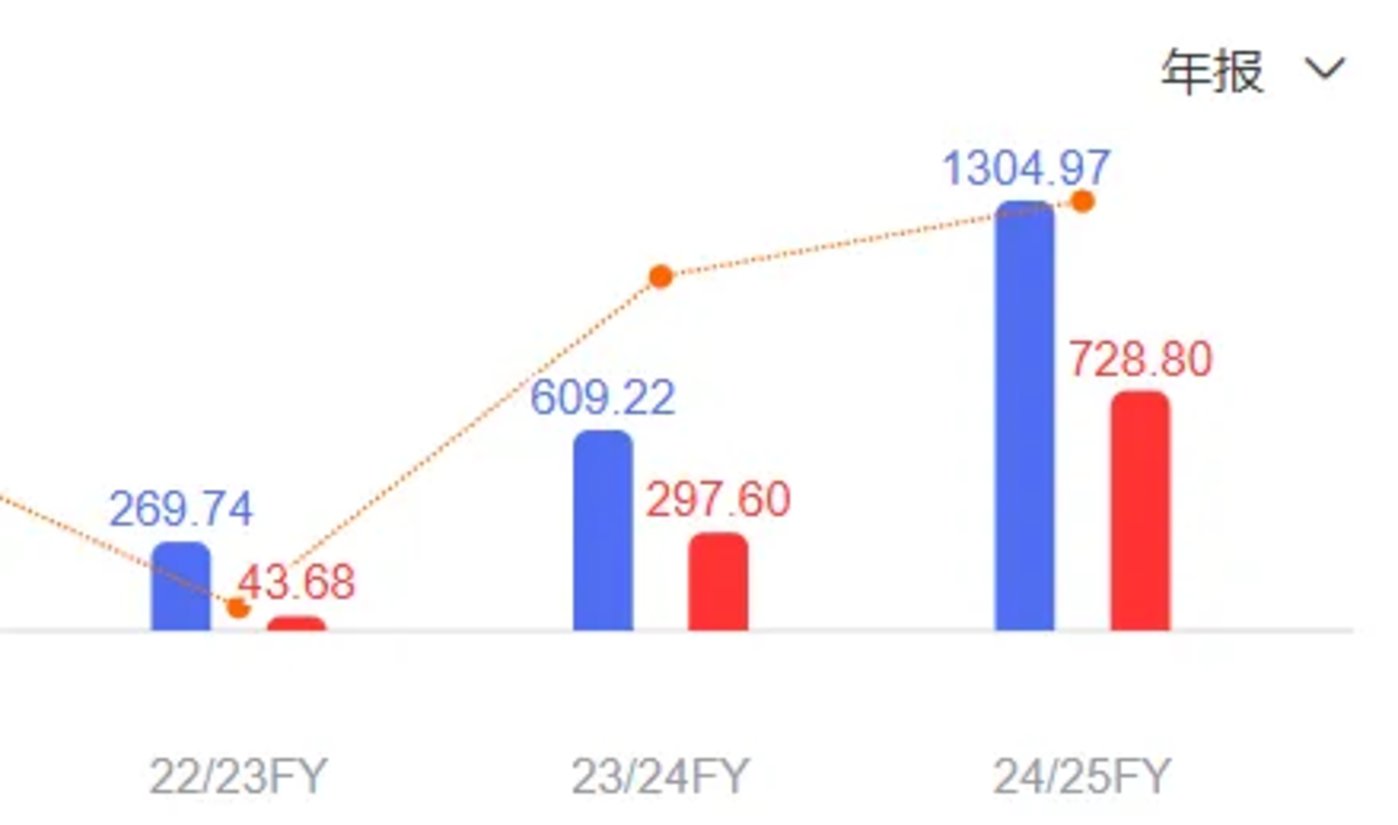

In the past few years, NVIDIA has benefited from the significant increase in demand for GPUs in the development of global AI technology, and its performance has been outstanding. Even the data can be described as horror.To give a simple example, in the natural year 2022, Nvidia’s revenue will be US$26.974 billion, and its profit will be US$4.368 billion; in 2023, its revenue and profit will reach US$60.922 billion and US$29.760 billion respectively. Revenue has more than tripled, but profits have increased more than seven times. With the previous value already so exaggerated, revenue in 2024 will be US$130.497 billion and profit will be US$72.88 billion, both more than twice the previous value.

If viewed on a quarterly basis, Nvidia’s financial report is also very worthy of investors ‘expectations. For example, the Q4 quarterly earnings report released this time has revenue of US$39.331 billion, which is even more than the whole of 2022, highlighting how fast the company is growing.

Investors are expecting that Nvidia’s earnings report will continue the myth of high growth.

2. Nvidia is directly related to the rise and fall of US stocks

Readers familiar with U.S. stocks should understand that in the past two years, the market value of U.S. stocks has been continuously concentrated among several giants, gradually forming Magnificent 7, commonly known as the Seven Sisters of U.S. stocks (also known as the Seven Giants of U.S. stocks). Generally speaking, it refers to Apple (AAPL.US), Microsoft (MSFT.US), Amazon (AMZN.US), Google (GOOGL.US), Meta (META.US), Tesla (TSLA.US), and NVIDIA (NVDA.US). In December 2024, the total market value of the seven sisters in the U.S. stock market was approximately 120 trillion yuan, exceeding the total market value of more than 5,000 companies in the A-share market by approximately 100 trillion yuan.

Behind the prosperity of U.S. stocks in recent years, in fact, it is mainly because these seven companies have been continuously raising their stock prices. It is difficult for other stocks to have a relatively long-term positive performance. Therefore, these seven companies have attracted the attention and attention of investors around the world.

The importance of Nvidia is reflected in two aspects: 1. Its huge valuation (which means that its share price may have a significant impact on the entire market, including the blue-chip Dow Jones Industrial Average);2. Its role in the field of artificial intelligence (this field plays an important role in the overall economic growth of the United States, and some even analyze that the prosperity of U.S. stocks this year is mainly due to the AI bubble).

In the early days of DeepSeek’s emergence, Nvidia’s share price closed down 16.97% on January 27. The Nasdaq index was not spared that day, falling 612 points as of the close, a drop of more than 3%. Nvidia’s market value evaporated by nearly US$590 billion (equivalent to slightly more than 3 AMDs or nearly 18 Cambrians), setting a new record in U.S. financial history. ASIC chip concept stock Broadcom closed down 17.4% on Monday, losing nearly US$200 billion in market value. Chip foundry TSMC closed down 13.3%, losing more than US$150 billion in market value. From this performance, we can see the far-reaching impact of Nvidia as the seven sisters on U.S. stocks.

It is precisely for the above reasons that Wall Street and investors participating in U.S. stocks around the world are paying more attention to Nvidia’s performance after the emergence of Deepseek.People also hope that Nvidia can resist doubts about computing power and respond to different voices in the market with high-growth financial reports.

Although some data in Nvidia’s earnings report continue to hit new highs, analysts believe that Nvidia’s performance is not impressive enough and are worried about future growth.Last night, Nvidia led the decline of seven sisters in U.S. stocks. Under the joint effect of these seven companies, the Nasdaq index, which is mostly technology stocks, once hit its biggest decline since the DeepSeek impact, and finally closed down 2.78%.

As mentioned earlier, DeepSeek once caused Nvidia’s stock to plummet in the early days of its emergence. Compared with Nvidia’s rise of more than 240% and 171% in 2023 and 2024 respectively, the performance of Nvidia’s share price this year is surprising: Nvidia’s share price peaked at US$138.88 in the beginning of 2025, and the latest closing price after the press conference was US$120.15. The stock price fell 13.49% from the highest price on the first day of the year. This performance disappointed many investors.

Regarding why DeepSeek can affect Nvidia, we mentioned it in the article” Sword of Dawn in China’s AI: DeepSeek competes with GPT-4o at low cost, Trump’s Urgent Call.” Some analysts believe that DeepSeek achieves top-notch model performance with limited hardware resources, reducing reliance on high-end GPUs, and low training costs indicate that the demand for computing power investment in large AI models will be significantly reduced.

The reason why Nvidia’s performance has grown rapidly in recent years is due to the growing demand for high-end GPUs by large companies for training AI models. If DeepSeek’s success can prove that computing power is not the most important factor, then it is not a good news for Nvidia.

Although Nvidia’s share price reacted generally on the day of the earnings report, it experienced its second drop in the year on the following trading day, making some investors pessimistic about the future trend.

The secret battle of computing power is still going on

Although Nvidia’s financial report released this time hit new highs in revenue and profits, some people pointed out that the time period for this Q4 quarter financial report is from November 1, 2024 to January 31, 2025. At that time, DeepSeek had not yet entered the public eye, so the impact on Nvidia’s performance has not yet been felt.

Opponents said that although DeepSeek trained in a cheap version, lowering market expectations for Nvidia’s high-end GPUs, even so, the DeepSeek-V3 and DeepSeek-R1 models were still trained on the Nvidia chip cluster represented by the H800. In other words, even if DeepSeek reduces costs and increases efficiency, it is doing it within the framework of Nvidia.

Whether it is for or against, at least what we can see is that Nvidia is also reviewing the new challenges brought by DeepSeek, an Eastern AI product.

In a phone conference after the earnings report, Nvidia founder and CEO Huang Renxun said that the inference model will consume 100 times the computing power, and future inference models will consume more computing power. DeepSeek-R1 has ignited global enthusiasm and is an excellent innovation. More importantly, it open-source a world-class reasoning AI model, and almost every AI developer is applying R1.& rdquo; He also mentioned at the meeting that the NVIDIA Blackwell chip is specially designed for reasoning, and the current demand for this chip is extremely strong.

Colette Kress, Nvidia’s chief financial officer, expects Nvidia’s gross margin to return to around 75% by the end of the year as Blackwell is introduced to the market. In this quarter, the adjusted gross profit margin of this indicator in the fourth quarter was 73.5%, a year-on-year decrease of 3.2 percentage points, in line with analysts ‘expectations.

However, it is unknown whether this high-end chip can participate in China’s AI construction and help Nvidia continue to create new financial reporting myths. On February 24, Alibaba Group CEO Wu Yongming announced that in the next three years, Alibaba will invest more than 380 billion yuan in building cloud and AI hardware infrastructure, totaling more than the total of the past ten years. This also set a record for the largest investment in cloud and AI hardware infrastructure construction by China private companies.

Although Ali is the only one in China that has invested so much in AI, and Tencent, ByteDance, Baidu, etc. are also actively launching their own AI construction plans, in the face of increasingly strengthened export controls, despite the hardware impact on the development of domestic AI It has a certain impact, but also has a negative impact on the sales of Nvidia’s high-end chips.

American giants such as Microsoft and Meta are also vigorously launching ambitious plans to invest heavily in the AI field, but the AI boom on Wall Street is showing signs of cooling down. On the one hand, DeepSeek launched a low-cost AI model, which affected market sentiment; on the other hand, some analysts suggested that Microsoft may cancel the leases of some data centers, which may raise concerns about AI overcapacity.

Under the influence of the dual unfavorable factors of export control + overcapacity, how long Nvidia’s financial report legend can last will only be left to time to test.

Conclusion

In the AI era when computing power is booming, NVIDIA once again confirmed the dominance of its chip empire with its financial report myth. However, DeepSeek’s emergence is like a double-edged sword, which not only pierces the market’s blind belief in relying on computing power, but also ignites the fire of technological innovation.Behind the financial report numbers is not only the carnival of capital, but also the epitome of the global science and technology game. When Eastern algorithms challenge the hegemony of Western hardware with the attitude of reducing costs and increasing efficiency, a revolution on efficiency and cost is quietly brewing.Can NVIDIA’s Blackwell chip continue to write a legend? How will China companies ‘trillion-dollar bets reshape the AI landscape? The answer may be hidden in every collision of computing power in the future, but the only certainty is that this war without smoke will eventually define the winner and loser of the next era.