Original title: Jupiter Crypto Conglomerate

Author: Marco Manoppo, investor at Primitive Ventures

Compiled by: Ashley, BlockBeats

Editor’s note: Jupiter announced a number of major initiatives at the Catstanbul conference, including acquisitions, AI funding, token repurchase and destruction, and the launch of Jupnet, a full-chain interoperability network, demonstrating its ambition for vertical integration. This article analyzes its business strategy and explores how brand, community and user experience determine value capture in a permission-free encryption environment, revealing the inevitable trend of applications eventually moving towards integration.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Last month, Jupiter released a series of blockbuster news at its flagship conference, Catstanbul. To sum up-the amount of information is huge. There is Burning Cat, there is acquisition announcements, and most importantly: Jupiter publicly acknowledges that its ambitions are not limited to the current ecosystem. In today’s article, we’ll break down Jupiter’s latest business strategy and explore why, for a long enough time, every encryption application that grasps users will eventually choose to integrate vertically to maximize value capture. Let’s explore in depth.

TL;DR

acquisition

Jupiter has acquired a majority stake in Moonshot, a popular mobile trading app that generated $35 million in fee revenue after Trump’s Meme coin craze. At the same time, Jupiter also completed the wholly-owned acquisition of Solana DeFi asset management tool Sonar Watch.

financial support

Jupiter is working with ElizaOS’s Shaw to allocate $10 million to support AI developers launched through Jupiter Launchpad.

Token repurchase

50% of the Jupiter transaction agreement fee will be used to repurchase JUP tokens.

Token destruction

Three billion JUP tokens (approximately $3.6 billion) have been destroyed to reduce supply and reduce the fully diluted valuation (FDV) of the agreement.

Jupnet

Jupiter plans to launch Jupnet, a full-chain interoperability network that aims to integrate the entire encryption ecosystem into a single decentralized ledger to maximize and facilitate the user and developer experience.

To be honest, this is one of the strongest product roadmap and new plan announcements I have seen in recent quarters. The Jupiter team’s execution is first-class, demonstrating excellent execution from extremely detailed communication (Meow posts long messages on Twitter basically every day) to the high degree of transparency they maintain to the community.

Give a typical example:

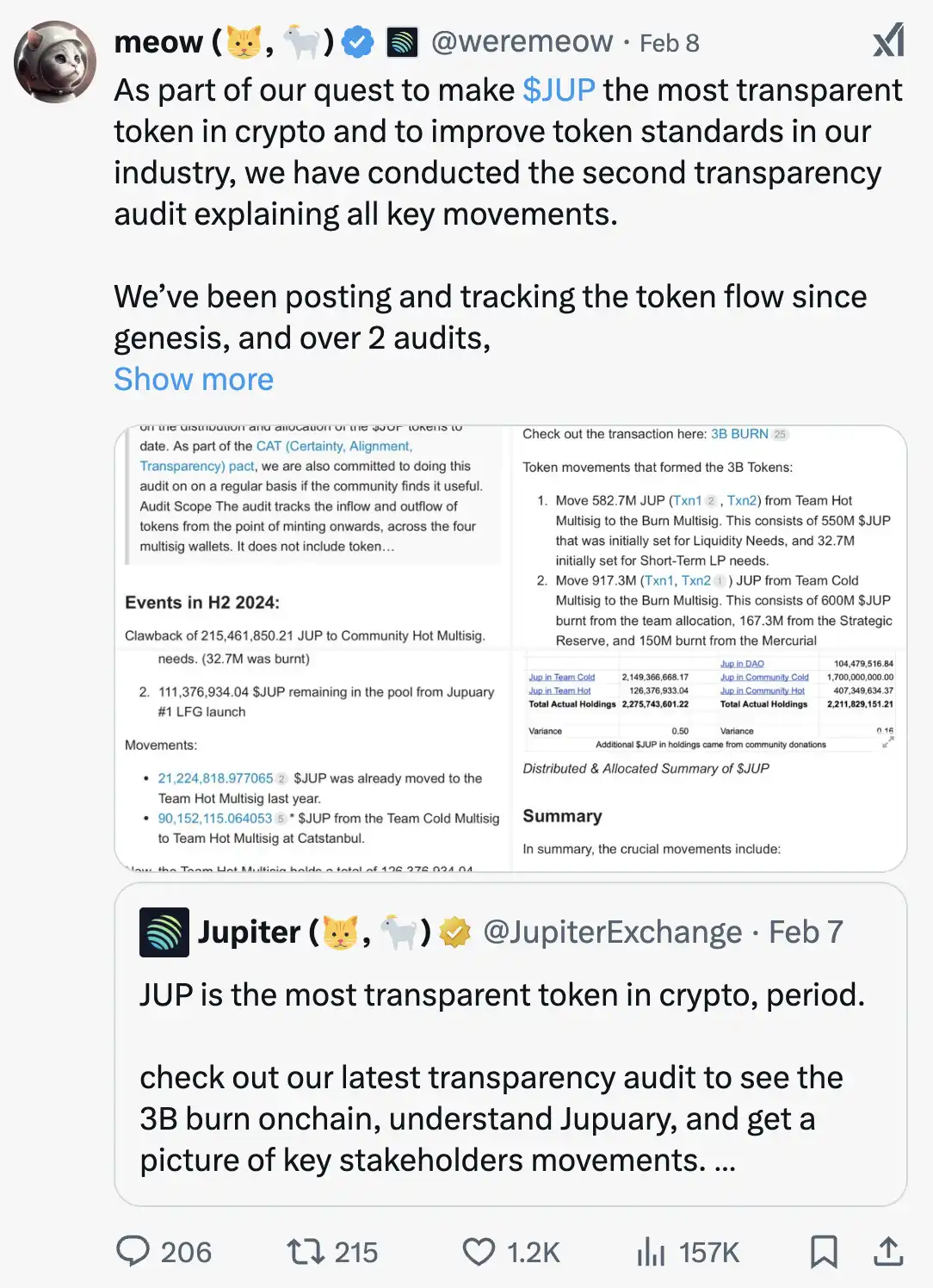

Jupiter recently released a transparency audit report detailing the team’s key financial flows. “We have been publicly tracking the flow of tokens since the creation of the world, and through two audits, we have accounted for all token flows (except one JUP) and integrated tokens into certified wallets.”

Read the last sentence again. For any crypto protocol that has completed TGE, it is crucial to do its best to track the ownership of each token. Similarly, listed companies will clearly document the ownership structure of their stocks. In the crypto space, tracking ownership is relatively more difficult because blockchain is permissionless, but there are still tools that can help teams achieve higher precision tracking.

Meanwhile, Uniswap…

As long as the time is long enough, every application will be vertically integrated

The core point of today’s article is that business strategies in the crypto world are fundamentally different from business models in traditional licensing environments.

Outside the encryption industry, companies often build a “moat” through regulatory barriers, long-term B2B contracts, and proprietary innovation.

However, in the encryption industry, most of this “moat” no longer exists, because the permission-free nature of blockchain allows everyone to build on top of existing products, and users can choose alternatives almost at any time.

So what really matters is the brand, user experience and community, because as the industry matures, we will see more and more experienced entrepreneurs entering the crypto track, building on top of existing infrastructure, and launching blood-sucking attacks on existing giants in the industry.

Ironically, this is exactly what Deepseek is currently doing with OpenAI.

Eventually, in the field of encryption, the “moat” will evolve into the following three points:

·Brand → Users trust you

·Real community → Users want to be part of your organization and have real ownership (through revenue sharing)

·User experience → Users like your product

Aggregation strategies in permissionless environments are smart

Before Jupiter’s success, many people were skeptical of the aggregation model, especially in the EVM ecosystem, where the market performance of the model was not outstanding. For example, 1inch failed to surpass Uniswap’s market cap because most users still prefer to use Uniswap directly (too lazy to change) or opt for other MEV-friendly DEXs such as CoW Swap.

However, at the Solana Ecosystem, Jupiter managed to convince users that it provided the best trading experience, successfully aggregated traffic, and achieved value capture.

To be honest, I’m not sure when this shift occurred. I remember using Orca and Raydium during the 2020-2021 DeFi Summer, and also trying earlier versions of Jupiter. If my memory is correct, by the time DeFi Summer ended, the user experience for Orca and Raydium was already terrible for reasons including:

·Lack of unified token standards (e.g. multiple bridged USDC versions)

· UI running stuck

This poor user experience can still be seen even a year later.

Jupiter used to show the best trading path to prove its best exchange rates. In hindsight, this was a very clever move, as there was no clear DEX market winner in the Solana ecosystem at the time. Even if Raydium holds the highest market share, its market dominance is far less than that of Uniswap on Ethereum.

Excellent business strategy and operations

Simply put, Jupiter performs better in its core business-providing Solana users with the optimal token redemption experience. Many protocols have tried similar strategies in the EVM ecosystem, but few have succeeded. In addition, the Jupiter team was originally formed by Racoon Dev, led by Meow, which meant that during the bear market, they could maintain operations in low-cost emerging markets with a small number of engineers, minimizing capital consumption.

Not all successful startups need a “sexy startup perspective”, and many successful crypto entrepreneurs initially just run development studios. This kind of “traditional service-oriented business” can teach extremely efficient cost management experience and teach founders how to explore market opportunities in a targeted manner.

By 2024, this savvy business operation capability will be fully reflected in the Jupiter team.

In just 12 months, Jupiter acquired 5 teams:

· Moonshot: Acquired this platform that focuses on mobile Meme transactions

· SonarWatch: Asset management tool along the acquisition chain

Ultimate Wallet: Acquisition of self-managed wallet

Coinhall: Acquisition of decentralized trading terminals

SolanaFM: Acquisition of blockchain browser

Forgive my directness, but this was a genius operation. Some acquired projects face fierce competition and market challenges, making them excellent acquisition targets. Also, I don’t have any inside information, but I wouldn’t be surprised if these acquisitions were made mainly through JUP tokens. Considering JUP’s current FDV, the Jupiter team has undoubtedly completed the expansion of the territory at low cost and attracted a group of outstanding developers.

conclusion

This idea is not new. Dan Elitzer of Nascent wrote “The Inevitability of UNIchain” in 2022. The core point is: “When applications reach a certain scale, control over block space becomes increasingly important… The solution is to build a dedicated chain or Rollup, where block space is managed by validators who care about the success of the application.”

My view is similar but more straightforward-this is the embodiment of human nature in capitalist commercial society: optimizing value capture and vertical integration.

The crypto industry is still run by humans, and we still cannot escape our instinctive desire for control of the value chain. Let’s be realistic.

“Original link”